Is It Safe to Send Money Online to India? Complete Security Guide 2025

Last Updated: July 2024

With millions of people sending money to India from across the globe, the safety and security of these transactions has become a critical concern. Whether you're an NRI supporting family back home, a business conducting international operations, or someone helping a friend or relative in India, knowing how to safely transfer money online is essential.

This comprehensive guide explores the safety aspects of online money transfers to India, covering everything from regulatory frameworks and security measures to popular services and best practices that ensure your hard-earned money reaches its intended destination securely.

Key Points Covered in This Article:

- Security features of top money transfer services to India

- RBI regulations and compliance requirements

- KYC procedures and why they matter

- Comparison of popular transfer methods and platforms

- Step-by-step guide to securing your international transfers

- Common scams to watch out for and how to avoid them

- Modern transfer methods like UPI for international transfers

Understanding the Safety of Online Money Transfers to India

The good news is that sending money online to India is generally safe when using reputable services and following proper security protocols. Most established money transfer providers invest heavily in security infrastructure and comply with strict regulations imposed by both Indian and international financial authorities.

According to most users on platforms like Reddit, services such as Remitly, Wise (formerly TransferWise), and Western Union provide reliable and secure money transfer services to India. As one user mentioned, "Remitly is solid, no issues, have been using it for last 5ish years. Their express option gets the money in your Indian bank account in under 5 minutes."

However, the level of safety ultimately depends on several factors:

Service Provider Reputation

Well-established companies with positive reviews and transparent policies typically offer more secure money transfer services.

Security Measures

Look for providers using robust encryption, two-factor authentication, and other advanced security features to protect your transactions.

Regulatory Compliance

Services that comply with both international and Indian regulations offer an additional layer of safety and legal protection.

User Practices

Your own security practices, such as using secure networks and verifying recipient details, play a crucial role in safe transfers.

Regulatory Framework for Money Transfers to India

All international money transfers to India are regulated by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA). Understanding these regulations helps ensure that your transfers comply with legal requirements:

Key Regulatory Points:

- Rupee Drawing Arrangement (RDA): This RBI framework allows authorized dealers to offer cross-border remittance services through tie-ups with overseas entities.

- No Upper Limit for Inward Remittances: There is no cap on the amount that can be transferred to India, but large amounts may require additional documentation.

- Purpose Declaration: Transfers exceeding certain limits require declaration of purpose.

- KYC Requirements: Both senders and recipients must fulfill Know Your Customer (KYC) requirements.

- Tax Implications: Money received in India may have tax implications for recipients based on the purpose of the transfer.

For NRIs sending money to family in India, these transfers are typically straightforward from a regulatory perspective. However, for business-related transfers or large sums, additional documentation might be required.

Pro Tip:

When sending large amounts (typically over $10,000 or equivalent), be prepared to provide documentation about the source of funds and the purpose of the transfer. This is standard procedure and helps prevent money laundering activities.

Common Security Measures Used by Money Transfer Services

Leading money transfer services implement multiple layers of security to protect your money and personal information:

| Security Feature | How It Works | Importance |

|---|---|---|

| Encryption Technology | Uses SSL/TLS protocols to encrypt data during transmission | Prevents hackers from intercepting sensitive information |

| Two-Factor Authentication (2FA) | Requires additional verification step beyond password | Adds an extra layer of security for account access |

| Transaction Monitoring | AI systems detect unusual patterns and flag suspicious activities | Helps identify and prevent fraudulent transactions |

| Secure User Authentication | Implements biometric verification, PINs, or security questions | Ensures only authorized users can access accounts |

| Fraud Detection Systems | Uses advanced algorithms to identify potential fraud | Protects users from scams and unauthorized transfers |

| Secure Data Storage | Information stored in encrypted databases with limited access | Prevents data breaches and unauthorized access to customer information |

When choosing a money transfer service, look for these security features on their website or app. Most reputable providers will prominently display their security credentials to reassure customers.

Important:

No matter how secure the service provider is, always ensure you're using a secure internet connection when making online transfers. Avoid using public Wi-Fi networks for financial transactions, and consider using a VPN for additional security.

Popular Money Transfer Services for India

Several reliable services specialize in money transfers to India, each with its own strengths and features:

Wise (TransferWise)

Security Level: Very High

Key Features:

- Transparent mid-market exchange rates

- Low, upfront fees

- Bank-level data security

- Supports transfers to Indian bank accounts and UPI IDs

Transfer Speed: 1-2 business days typically

Best For: Those looking for the best exchange rates and transparency

Remitly

Security Level: Very High

Key Features:

- Express transfers available (minutes)

- No fee on first transfer (promotional)

- Strong fraud monitoring systems

- 24/7 customer support

Transfer Speed: Minutes (Express) or 3-5 days (Economy)

Best For: Fast transfers and new users (first transfer promotions)

Western Union

Security Level: High

Key Features:

- Extensive global network

- Cash pickup options across India

- Bank deposits to nearly 200 Indian banks

- Mobile app with tracking

Transfer Speed: Minutes to 1-2 business days

Best For: Those who prefer a well-established service with cash pickup options

Xoom (PayPal)

Security Level: High

Key Features:

- PayPal's security infrastructure

- UPI transfers available

- Bank deposits and cash pickup options

- 24/7 fraud monitoring

Transfer Speed: Minutes to 24 hours typically

Best For: PayPal users and those wanting multiple delivery options

ICICI Bank Money2India

Security Level: Very High

Key Features:

- Direct bank-to-bank transfers

- Competitive exchange rates

- Zero transfer fees for certain amounts

- Bank-level security protocols

Transfer Speed: 1-2 business days typically

Best For: ICICI Bank customers and those preferring direct bank services

User experiences on platforms like Reddit indicate that Remitly and Wise are particularly popular among those sending money to India regularly, with many praising their combination of competitive rates, speed, and security.

Pro Tip:

When comparing services, look beyond the advertised exchange rate. Some providers compensate for attractive exchange rates with higher fees. Calculate the total amount that will be received in India to determine the best value.

Potential Risks and How to Avoid Them

While online money transfers to India are generally safe with reputable providers, it's important to be aware of potential risks:

Phishing Scams

Risk: Fake websites or emails that mimic legitimate services to steal your credentials.

Prevention: Always type the URL directly or use bookmarks. Verify email sources and never click suspicious links. Check for HTTPS and security certificates before entering financial information.

Malware and Keyloggers

Risk: Software that records your keystrokes to capture passwords and financial details.

Prevention: Use updated antivirus software, enable two-factor authentication, and consider using a password manager for complex, unique passwords.

Unsecured Networks

Risk: Data interception when using public Wi-Fi for financial transactions.

Prevention: Avoid public Wi-Fi for money transfers. Use mobile data or secure home networks. If necessary, use a VPN for added security.

Transfer Misdirection

Risk: Sending money to incorrect accounts due to typing errors or fraud.

Prevention: Double-check all recipient details before confirming. For first-time transfers, consider sending a small test amount first.

Warning Signs of Potential Fraud:

- Unusually favorable exchange rates that seem too good to be true

- Pressure to act quickly or "limited time" offers

- Requests to use unconventional payment methods

- Poor website design, spelling errors, or unprofessional communication

- Limited or non-existent customer service options

- No clear information about the company's physical address or regulatory compliance

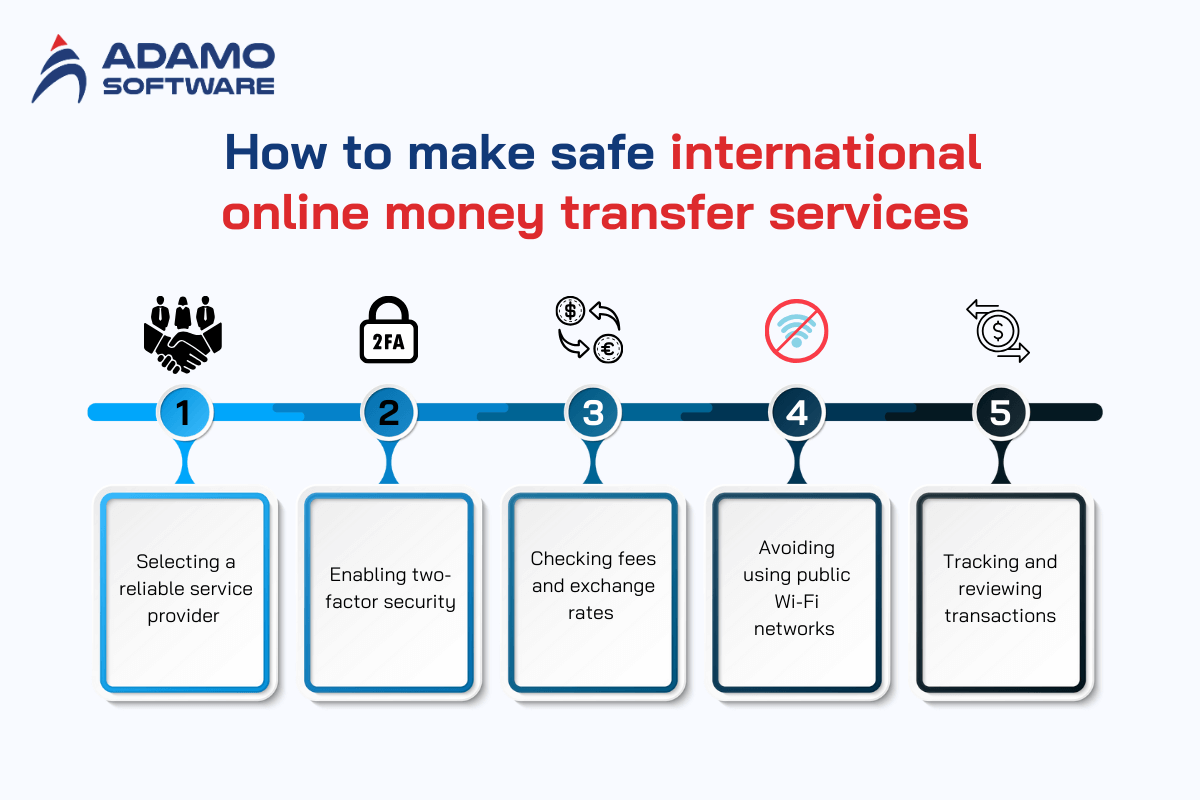

Best Practices for Safe Online Money Transfers to India

Follow these essential practices to ensure your money transfers to India remain secure:

Choose Regulated Providers

Only use money transfer services that are properly licensed and regulated in both your country and India. Look for services that comply with RBI guidelines and international financial regulations.

Use Strong, Unique Passwords

Create complex passwords for your money transfer accounts and never reuse them across different services. Consider using a password manager to help maintain strong, unique passwords.

Enable All Security Features

Activate two-factor authentication, email notifications for transactions, and any other security features offered by your service provider. These additional layers significantly enhance protection.

Verify Recipient Details

Double-check all recipient information before confirming transfers. A simple typo in an account number or UPI ID can result in money being sent to the wrong person and may be difficult to recover.

Keep Software Updated

Ensure your devices have the latest operating system updates and security patches. Keep your banking and money transfer apps updated to protect against known vulnerabilities.

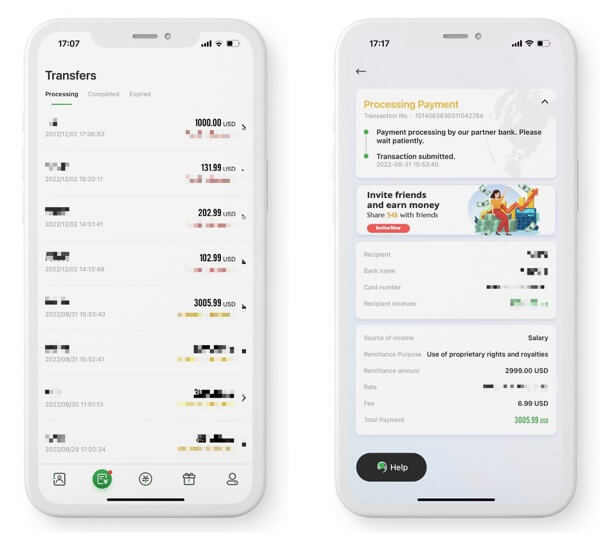

Monitor Transactions

Regularly review your transfer history and statements. Promptly report any unauthorized or suspicious transactions to your service provider and relevant financial authorities.

Pro Tip for Regular Transfers:

If you send money to the same recipients regularly, save their verified details in your account (if the service allows this securely). This reduces the risk of entering incorrect information for future transfers.

KYC Requirements for Sending Money to India

Know Your Customer (KYC) procedures are a critical part of the security framework for international money transfers. These requirements help prevent money laundering, terrorist financing, and other financial crimes:

Typical KYC Documents Required:

For Senders:

- Government-issued photo ID (passport, driver's license, etc.)

- Proof of address (utility bill, bank statement)

- Proof of source of funds (for larger amounts)

For Recipients in India:

- PAN card (for most transactions)

- Aadhaar card or other government-issued ID

- Bank account details that match the name on the ID

The KYC process may vary slightly between different service providers, but the core requirements remain similar. Most reputable services will complete the KYC verification process digitally, allowing you to upload documents through their secure platform.

Important:

Be wary of services that don't require proper KYC verification. While it might seem convenient to skip this step, legitimate services always implement KYC procedures to comply with international regulations and protect their users.

UPI and Modern Transfer Methods to India

India's Unified Payments Interface (UPI) has revolutionized domestic payments, and it's now becoming increasingly accessible for international transfers as well:

Several international money transfer services now support sending money directly to UPI IDs in India, making the process faster and more convenient. Services like Wise, Xoom, and Remitly offer this option.

Benefits of UPI for International Transfers:

Speed: Transfers typically complete within minutes once processed by the sender

Convenience: Recipients only need to share their UPI ID rather than full banking details

Accessibility: Money can be received directly in the recipient's linked bank account

Security: UPI uses multi-factor authentication and encrypted transactions

How to Send Money to UPI:

- Choose a service provider that supports UPI transfers to India

- Enter the amount you wish to send

- Select "UPI" as the delivery method

- Enter the recipient's UPI ID (typically in the format username@upi)

- Verify all details and complete the payment

For NRIs, there are now options to link international mobile numbers to UPI apps through participating banks. This allows direct access to the UPI system, though some limitations may apply compared to resident Indians.

Frequently Asked Questions

Is it safe to send large amounts of money to India online?

Yes, it's generally safe to send large amounts online when using reputable, regulated services. However, larger transfers may require additional verification steps and documentation about the source of funds. Some services also offer better rates for larger amounts, so it's worth comparing options specifically for your transfer size.

Which is the most secure way to transfer money to India?

Direct bank-to-bank transfers and transfers through established services like Wise, Remitly, or Western Union with their full security features enabled are considered the most secure. The "most secure" option often depends on your specific circumstances, including where you're sending from, how quickly the money needs to arrive, and your comfort with different platforms.

How long does it take for money to reach India?

Transfer times vary widely depending on the service and method:

- Express services: Minutes to a few hours

- Standard bank transfers: 1-3 business days

- Economy options: 3-5 business days

Are there any tax implications for sending money to India?

For the sender, money transfers are generally not taxable. For the recipient in India, the tax implications depend on the purpose and relationship:

- Gifts from relatives: Generally not taxable

- Gifts from non-relatives exceeding ₹50,000 in a year: May be taxable

- Business payments or income: Typically taxable

What should I do if my transfer to India gets delayed or goes missing?

- Contact the customer service of your transfer provider immediately

- Have your transaction reference number and details ready

- Ask for the specific status and reason for delay

- Request an estimated resolution timeframe

- If not resolved within the promised timeframe, escalate to supervisors

- For persistent issues, contact relevant financial authorities in your country or file a complaint with the RBI if appropriate

Conclusion: Sending Money Safely to India

Online money transfers to India are generally safe when using reputable services and following proper security practices. The key factors that ensure safety include choosing regulated service providers, implementing strong personal security measures, and staying vigilant against potential scams.

With the advancement of technologies like UPI and the growing competition among money transfer services, sending money to India has become more convenient, faster, and often more affordable than ever before. However, this convenience should never come at the expense of security.

By following the best practices outlined in this guide and staying informed about the latest security measures, you can ensure that your hard-earned money reaches your loved ones or business partners in India safely and efficiently.

Key Takeaways:

- Always use regulated, reputable money transfer services

- Enable all available security features like two-factor authentication

- Verify recipient details carefully before confirming transfers

- Be prepared to complete proper KYC verification

- Consider the trade-offs between speed, cost, and convenience

- Stay vigilant against phishing attempts and scams

- Explore modern options like UPI transfers for greater convenience

Remember that the landscape of international money transfers is continuously evolving, with new services, features, and regulations emerging regularly. Staying informed about these changes will help you make the best decisions for your specific money transfer needs to India.

No comments:

Post a Comment