How to Transfer Large Amounts of Money from USA to India

Ultimate Guide for Secure, Cost-Effective, and Tax-Efficient Transfers in 2025

Introduction: Transferring Money Between the US and India

Whether you're relocating back to India, investing in property, supporting family members, or making business transactions, transferring large amounts of money from the United States to India requires careful planning. With various transfer methods available and compliance requirements to navigate, choosing the right approach is essential for secure and cost-effective transfers.

This comprehensive guide covers everything you need to know about transferring large sums from the USA to India, including the best transfer methods, documentation requirements, tax implications, and strategies to minimize fees and obtain favorable exchange rates.

Best Methods to Transfer Large Amounts of Money to India

When transferring substantial sums of money internationally, the method you choose significantly impacts the cost, speed, and security of your transfer. Here are the most reliable options for sending large amounts from the USA to India:

1. Wire Transfers

Traditional bank-to-bank wire transfers are one of the most secure methods for transferring large amounts of money internationally. These transfers use the SWIFT network, allowing direct movement of funds between financial institutions.

Advantages:

- High security for large transactions

- No upper limit on transfer amounts

- Direct bank-to-bank transfer

- Widely available at most financial institutions

Disadvantages:

- Higher fees ($25-$50 per transfer)

- Less favorable exchange rates

- Takes 1-5 business days

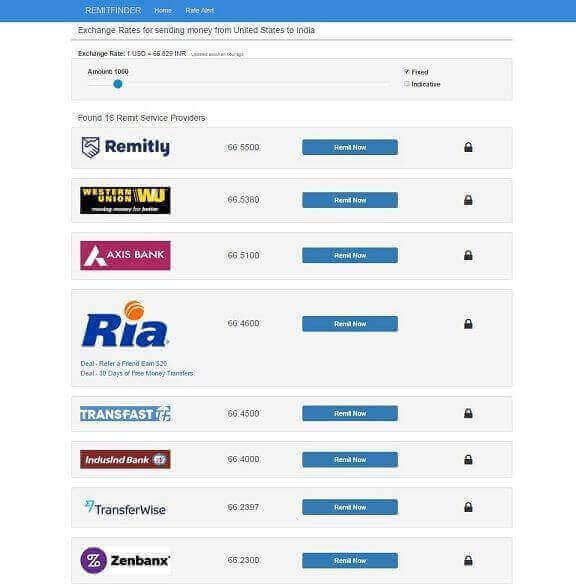

2. Online Money Transfer Services

Digital platforms like Wise, Remitly, and Xoom offer competitive exchange rates and lower fees compared to traditional banks, making them increasingly popular for large transfers.

Advantages:

- Better exchange rates than banks

- Lower fees

- Faster transfers (sometimes within minutes)

- Convenient online platform

Disadvantages:

- May have transfer limits

- Additional verification for large transfers

3. NRE Account Transfers

Non-Resident External (NRE) accounts are specifically designed for NRIs to transfer and manage foreign earnings in India. They offer significant benefits for large transfers.

Advantages:

- Tax-free interest earnings

- Full repatriation of both principal and interest

- No tax implications in India

- Convenient for recurring transfers

Disadvantages:

- Requires account setup in advance

- Only for funds earned outside India

4. ACH Transfers

Automated Clearing House (ACH) transfers provide a cost-effective option for transferring money from a US bank account to an Indian account, though they're generally slower than wire transfers.

Advantages:

- Lower fees than wire transfers

- Can be set up for recurring transfers

- Secure bank-to-bank transfer

Disadvantages:

- Slower processing time (3-5 business days)

- May have lower transfer limits

- Not all banks support international ACH

💡 Pro Tip: For transfers exceeding $50,000, splitting the transfer into multiple smaller transactions might help you avoid additional scrutiny and streamline the process. However, be aware that structuring transactions to avoid reporting requirements is illegal.

Documentation Requirements for Large Money Transfers

When transferring large amounts of money internationally, proper documentation is essential for regulatory compliance and smooth processing. Here's what you'll need when sending substantial sums from the USA to India:

Essential Documentation

| Document Type | Description | Required For |

|---|---|---|

| Identification | Valid government-issued photo ID (passport, driver's license) | All transfers |

| Proof of Address | Recent utility bill, bank statement, or rental agreement | Transfers over $3,000 |

| Source of Funds | Documentation proving the origin of the money (e.g., salary statements, investment proceeds, property sale documents) | Transfers over $10,000 |

| Purpose Declaration | Written statement explaining the purpose of the transfer | All transfers to India |

| Recipient Information | Complete banking details, including SWIFT code and IFSC code | All transfers |

| Tax Forms | IRS Form 8300 (for cash transactions over $10,000) | Cash-funded transfers over $10,000 |

| Supporting Documents | Additional documentation based on transfer purpose (e.g., property purchase agreement, education fees invoice) | Specific purpose transfers |

Special Requirements for Bank Transfers

- SWIFT Code: An 8-11 character code identifying the recipient's bank in the global network

- IFSC Code: Indian Financial System Code, required for transfers to Indian banks

- Account Type: Specification of NRE, NRO, or regular savings account

- Bank Address: Complete address of the recipient's bank branch

Documentation for Different Transfer Purposes

The Reserve Bank of India (RBI) requires specific documentation based on the purpose of your transfer:

For Property Purchase:

- Copy of sale agreement

- Property valuation report

- Seller's bank account details

For Education Fees:

- Admission letter

- Fee structure document

- Student ID verification

For Family Maintenance:

- Proof of relationship

- Declaration of purpose

For Investment Purposes:

- Investment confirmation documents

- Broker or financial institution details

- Investment plan or proposal

⚠️ Important: Under the Bank Secrecy Act, financial institutions are required to report transactions over $10,000 to the Financial Crimes Enforcement Network (FinCEN). This doesn't mean your transaction is illegal, but it does trigger additional scrutiny.

.png)

Tax Implications and Considerations

Understanding the tax implications of large money transfers between the USA and India is crucial to avoid unexpected tax liabilities and ensure compliance with regulations in both countries.

US Tax Considerations

Gift Tax Implications

If you're sending money as a gift to someone in India:

- The annual gift tax exclusion is $17,000 per recipient for 2023

- Gifts exceeding this amount require filing Form 709 (United States Gift Tax Return)

- Gifts to a spouse who is a US citizen are unlimited

- Gifts to a spouse who is not a US citizen are limited to $175,000 annually (2023)

Reporting Requirements

- FBAR filing is required if you have foreign accounts totaling over $10,000 at any point during the year

- FATCA reporting may be necessary depending on your foreign assets

- Currency Transaction Reports (CTRs) are filed by financial institutions for transfers over $10,000

Tax-Free Transfers

- Transfers to your own accounts are not taxable but may require reporting

- Payments for qualified education or medical expenses paid directly to institutions

- Business expense transfers (though subject to business tax rules)

Indian Tax Considerations

NRI Transfers and Taxation

- Money received in NRE accounts is not taxable in India

- Interest earned on NRE accounts is tax-free in India

- Transfers to NRO accounts may have tax implications on interest earned

- Gifts from NRIs to Indian residents exceeding ₹50,000 are taxable for the recipient

Gift Tax in India

- Gifts from close relatives (parents, siblings, spouse) are not taxable

- Gifts received on the occasion of marriage are not taxable

- Gifts from non-relatives exceeding ₹50,000 in a financial year are taxable

Repatriation Restrictions

- Money in NRE accounts can be freely repatriated

- Repatriation from NRO accounts is limited to $1 million per financial year

- Additional documentation may be required for large repatriations

Common Tax Misconceptions

Misconception: All international transfers are taxable

Reality: The taxability depends on the nature of the transfer, not just the fact that it crosses borders.

Misconception: Splitting a large transfer into smaller amounts avoids reporting

Reality: This is called "structuring" and is illegal. Banks are required to report suspicious patterns.

Misconception: Money sent to family in India is always tax-free

Reality: While many gifts to family members are exempt, certain gifts to non-relatives or exceeding thresholds may be taxable.

💡 Tax-Efficient Strategy: For NRIs sending large amounts to India, using an NRE account provides the most tax advantages, as both the principal amount and interest earned are tax-free in India and can be repatriated without restrictions.

NRE Accounts: Benefits for Money Transfers

Non-Resident External (NRE) accounts are specialized bank accounts designed for Non-Resident Indians (NRIs) to manage foreign earnings in India. These accounts offer significant advantages for transferring and managing large amounts of money from the USA to India.

Key Benefits of NRE Accounts

Tax-Free Interest

Interest earned on NRE accounts is completely tax-free in India, making them ideal for long-term savings.

Full Repatriation

Both the principal amount and interest earned can be freely repatriated to your US account without any restrictions.

Foreign Currency Deposits

You can deposit money in foreign currencies, which is then converted to Indian rupees.

Joint Account Options

You can open a joint NRE account with another NRI or an Indian resident (with restrictions).

Multiple Account Types

NRE accounts can be savings accounts, fixed deposits, or recurring deposits to suit different financial goals.

Opening an NRE Account

- Choose an Indian bank that offers NRE accounts

- Complete the account opening form (available online or at bank branches)

- Submit required documentation:

- Passport copy with visa/green card

- Proof of US address

- Passport-sized photographs

- PAN card or Form 60

- Some banks may require in-person verification or notarized documents

- Initial deposit (varies by bank)

Many Indian banks now offer online account opening facilities specifically for NRIs, simplifying the process significantly.

NRE vs. NRO Accounts: Understanding the Difference

| Feature | NRE Account | NRO Account |

|---|---|---|

| Source of Funds | Foreign earnings only | Both foreign and Indian earnings |

| Taxation on Interest | Tax-free in India | Taxable as per Indian tax laws |

| Repatriation | Fully repatriable (both principal and interest) | Limited to $1 million per financial year |

| Currency | Maintained in Indian rupees but pegged to foreign exchange | Maintained in Indian rupees |

| Best Used For | Savings, investments, future repatriation needs | Managing Indian income, local expenses, property rent |

"For NRIs planning to transfer large sums from the US to India, an NRE account is the most tax-efficient solution, especially if there's a possibility of repatriating the funds in the future."

— Financial advisor specializing in NRI finances

Comparison of Transfer Services

When transferring large amounts of money from the USA to India, choosing the right service can save you significant money in fees and exchange rate markups. Here's a detailed comparison of the most popular transfer services:

| Service | Transfer Fee | Exchange Rate Markup | Transfer Speed | Transfer Limit | Best For |

|---|---|---|---|---|---|

| Wise (TransferWise) | 0.4-0.7% of transfer amount | No markup (mid-market rate) | 1-2 business days | $1 million per transfer | Best overall value and transparency |

| Remitly | $0 for economy, $3.99 for express | 1-2% markup | Economy: 3-5 days Express: Minutes to hours |

$30,000 per day | Fast transfers with competitive rates |

| Xoom (PayPal) | $0-$4.99 depending on amount | 2-4% markup | Minutes to 1 business day | $50,000 per transaction | Speed and convenience |

| Bank Wire Transfer | $25-$50 outgoing $15-$30 incoming |

3-5% markup | 3-5 business days | No limit (bank-dependent) | Very large transfers and security |

| Western Union | $0-$45 depending on amount and method | 2-6% markup | Minutes to 5 business days | $50,000 per 30 days | Multiple delivery options |

| OFX | No transfer fee | 0.4-1.5% markup | 1-2 business days | No limit | Large transfers with no fees |

| MoneyGram | $5-$50 depending on amount | 1-3% markup | Minutes to 2 business days | $10,000 per transaction | Cash pickup options |

Cost Comparison Example

Let's compare the cost of transferring $50,000 USD to India using different services:

| Service | Transfer Fee | Exchange Rate (USD to INR) | Amount Received (INR) | Total Cost (USD)* |

|---|---|---|---|---|

| Wise | $250 (0.5%) | 83.50 (mid-market) | 4,153,750 INR | $250 (0.5%) |

| Remitly | $0 | 81.89 (1.9% below mid-market) | 4,094,500 INR | $952 (1.9%) |

| Xoom | $4.99 | 80.56 (3.5% below mid-market) | 4,028,000 INR | $1,754 (3.5%) |

| Bank Wire | $45 | 79.33 (5% below mid-market) | 3,966,500 INR | $2,545 (5%) |

| OFX | $0 | 82.25 (1.5% below mid-market) | 4,112,500 INR | $750 (1.5%) |

*Total cost includes both the explicit fee and the hidden cost in the exchange rate markup.

Factors to Consider When Choosing a Transfer Method

Transfer Amount

For very large transfers ($50,000+), services like Wise or OFX often provide the best value due to their competitive exchange rates, even if they charge a percentage-based fee.

Transfer Speed

If you need money to arrive quickly, Remitly's express service or Xoom may be worth the additional cost. For non-urgent transfers, slower options typically offer better rates.

Recipient's Banking Situation

Consider whether the recipient needs a bank deposit or cash pickup. Most online services offer bank deposits, but for cash pickup, Western Union or MoneyGram may be necessary.

Security and Reliability

For very large transfers, the security and established nature of traditional bank wires might outweigh their higher costs. Consider the trade-off between cost and security.

Step-by-Step Transfer Guide

Follow these detailed steps to successfully transfer large amounts of money from the USA to India, minimizing fees and ensuring compliance with all regulations.

Method 1: Using Online Money Transfer Services (Wise, Remitly, etc.)

Step 1: Preparation

- Gather required documents (identification, proof of address)

- Collect recipient's bank details:

- Full name as it appears on the bank account

- Bank account number

- IFSC code (for Indian bank)

- Bank branch address

- Prepare documentation for the source of funds if transferring over $10,000

Step 2: Account Setup

- Create an account with your chosen transfer service

- Complete the verification process (may include submitting ID, proof of address)

- For large transfers, expect enhanced verification procedures:

- Video verification call

- Documentation for source of funds

- Explanation of transfer purpose

Step 3: Initiate Transfer

- Select "Send Money" or equivalent option

- Enter India as the destination country

- Enter the transfer amount

- Review the exchange rate and fees

- Select your payment method (bank transfer is usually cheapest for large amounts)

- Enter recipient's banking information

- Specify the purpose of the transfer (required for Indian regulations)

Step 4: Fund the Transfer

- For large transfers, ACH bank transfer or wire transfer is recommended

- Follow the platform's instructions to link your bank account

- Authorize the debit from your account

- For very large transfers, you might need to split into multiple transactions

Step 5: Track and Confirm

- Note the transaction reference number

- Use the platform's tracking feature to monitor the transfer status

- Notify the recipient to check for the deposit

- Keep records of the transfer for tax and documentation purposes

Method 2: Bank-to-Bank Wire Transfer

Step 1: Gather Required Information

- Recipient's full name and address

- Recipient's bank account number

- Recipient bank's name, address, and branch

- SWIFT code of the recipient bank

- IFSC code (for Indian banks)

- Purpose of remittance (required for Indian regulations)

Step 2: Contact Your Bank

- Visit your bank branch or log in to online banking

- Navigate to the wire transfer or international transfer section

- For large transfers, some banks require in-person visits

- Prepare documentation for source of funds and transfer purpose

Step 3: Complete Wire Transfer Form

- Fill out the international wire transfer form

- Specify the amount to transfer

- Choose whether the intermediary bank fees are paid by you or the recipient (choosing "OUR" means you pay all fees)

- Provide the reason for transfer (e.g., family maintenance, property purchase)

- Review all details carefully before submission

Step 4: Pay Fees and Authorize Transfer

- Pay the wire transfer fee (typically $25-$50)

- Sign the transfer authorization form

- Receive a receipt and SWIFT confirmation number

- Note: Wire transfers may need to go through correspondent banks, which can add delays and fees

Step 5: Track and Follow Up

- Note the SWIFT reference number for tracking

- International wire transfers typically take 3-5 business days

- Contact your bank for status updates if needed

- Inform the recipient to check for the deposit

- Keep all records for tax purposes

Method 3: NRE Account Transfer

Step 1: Open an NRE Account (if you don't have one)

- Choose an Indian bank with good NRI services

- Complete the NRE account application (can often be done online)

- Submit required documentation:

- Passport with visa pages

- Proof of US address

- Passport-sized photographs

- PAN card or Form 60

- Receive account activation confirmation

Step 2: Transfer Funds to Your NRE Account

- Use one of these methods:

- Wire transfer from your US bank

- Online money transfer services like Wise or Remitly

- Bank-specific NRI transfer services (e.g., ICICI Bank's Money2India)

- Provide your NRE account details as the recipient account

- Specify "Own Account Transfer" as the purpose

Step 3: Internal Transfers (if needed)

- Once funds are in your NRE account, you can:

- Transfer to other Indian accounts

- Set up fixed deposits

- Make investments

- Pay for expenses in India

- Use the bank's online banking platform for convenient management

💡 Pro Tip: For transfers exceeding $50,000, contact the transfer service's customer support before initiating the transaction. They can often provide personalized guidance, potentially offer better rates, and ensure the transfer goes smoothly without unnecessary delays.

Security Tips and Best Practices

When transferring large amounts of money internationally, security should be your top priority. Follow these best practices to protect your funds and ensure a smooth transfer process.

Before Initiating a Transfer

-

Research the Transfer Service

Verify the legitimacy of any money transfer service by checking reviews, confirming regulatory compliance, and ensuring they have proper security protocols in place.

-

Double-Check Account Details

Verify the recipient's bank details multiple times. Even a single digit error can result in funds being sent to the wrong account, which can be difficult to recover.

-

Use Secure Networks

Only initiate transfers on secure, private internet connections. Avoid using public Wi-Fi networks for financial transactions.

-

Enable Strong Authentication

Use two-factor authentication (2FA) for both your bank account and the money transfer service to add an extra layer of security.

During and After the Transfer

-

Monitor the Transaction

Track your transfer using the provided reference number and set up notifications to stay informed about its status.

-

Confirm Receipt

Contact the recipient to verify they received the funds as expected, especially for large transfers.

-

Keep Documentation

Save all receipts, confirmation numbers, and correspondence related to the transfer for tax purposes and as proof of transaction.

-

Check Your Accounts

Review your bank statements after the transfer to ensure no unauthorized transactions occurred.

Red Flags and Warning Signs

Watch Out For:

- Transfer services with rates that seem too good to be true

- Requests to split large transfers into multiple smaller ones to avoid documentation

- Pressure to send money urgently without proper verification

- Services that don't require proper identification or verification

- Unfamiliar fees that appear during the transaction

Common Scams to Avoid:

- Phishing emails claiming issues with your transfer

- Phone calls asking for your financial details to "verify" a transfer

- Fake money transfer websites that mimic legitimate services

- Third-party agents offering special rates for large transfers

- Requests to send test transfers to "verify" accounts

Strategies for Securing Large Transfers

Consider Splitting Large Transfers

For very large amounts, consider breaking up the transfer into smaller transactions over several days. This can reduce risk and may help avoid triggering additional verification requirements.

Test With Smaller Amounts First

When using a new transfer service or sending to a new recipient, test the process with a small amount first to ensure everything works as expected.

Consider Premium Services

For very large transfers, many services offer personalized assistance with dedicated account managers who can guide you through the process and provide enhanced security measures.

Use Forward Contracts for Large Transfers

If you're planning to transfer a large amount but are concerned about exchange rate fluctuations, consider a forward contract that locks in today's exchange rate for a future transfer.

Frequently Asked Questions

Is there a limit on how much money I can transfer from the USA to India?

There is no specific limit imposed by the U.S. government on how much money you can transfer from the USA to India. However, large transfers (typically over $10,000) trigger reporting requirements for financial institutions under the Bank Secrecy Act. Individual transfer services may have their own limits. On the Indian side, there are no restrictions on the amount of foreign currency that can be transferred into India, but the purpose of the remittance must be specified.

Do I have to pay taxes on money transferred from the USA to India?

In the USA, sending money abroad is not itself a taxable event. However, gift tax rules may apply if you're giving money to someone else and exceed the annual exclusion amount (currently $17,000 per recipient). For amounts above this threshold, you may need to file a gift tax return, though you likely won't owe taxes unless you've exceeded your lifetime gift tax exemption.

In India, money received from abroad is generally not taxable for the recipient if it's sent by a relative. However, if the amount exceeds ₹50,000 and is received from a non-relative, it may be taxable as "Income from Other Sources" for the recipient. For NRIs, funds deposited in NRE accounts are tax-free, including the interest earned.

What documentation do I need for large money transfers to India?

For transfers exceeding $10,000, you'll typically need:

- Government-issued photo ID (passport, driver's license)

- Proof of address (utility bill, bank statement)

- Documentation of the source of funds (bank statements, investment proceeds, sale documents)

- Purpose declaration for the transfer

- Complete recipient bank details including IFSC code

- Additional supporting documents based on the purpose (e.g., property purchase agreement, education invoice)

What's the difference between an NRE and NRO account?

NRE (Non-Resident External) accounts are designed for depositing foreign earnings. The interest earned is tax-free in India, and both principal and interest can be freely repatriated abroad.

NRO (Non-Resident Ordinary) accounts are for managing income earned in India (like rent, dividends, or pension). Interest earned is taxable in India, and repatriation is limited to $1 million per financial year after tax payment.

How long does it take to transfer money from the USA to India?

Transfer times vary by method:

- Online money transfer services: Economy transfers take 1-5 business days, while express transfers can be completed within minutes or hours.

- Bank wire transfers: Typically take 3-5 business days.

- ACH transfers: Usually take 3-7 business days for international transfers.

Large transfers may take additional time for verification and compliance checks.

Why are bank exchange rates lower than the rates I see online?

Banks and money transfer services make money by adding a markup to the mid-market exchange rate (the rate you see on Google or financial websites). This markup is often hidden in the exchange rate rather than presented as a separate fee. Online money transfer services typically offer exchange rates closer to the mid-market rate compared to traditional banks, which may have markups of 3-5% or more.

Is it better to send money in USD or INR?

When transferring money to India, you'll typically specify the amount in USD, and the recipient will receive funds in INR after conversion. Some services allow you to lock in an exchange rate at the time of transfer, which can be advantageous if you anticipate currency fluctuations. The most important factor is finding a service that offers a competitive exchange rate with low fees, rather than focusing on the currency denomination of the transfer itself.

What happens if my money doesn't arrive or goes to the wrong account?

If your transfer is delayed or sent to the wrong account:

- Contact your transfer service's customer support immediately with your transaction reference number.

- If using a bank wire, contact your sending bank to initiate a trace on the wire transfer.

- For transfers to incorrect accounts, the recovery process can be complex and may require cooperation from the recipient bank.

- Document all communications and keep records of your original transfer instructions.

This highlights the importance of verifying all account details before confirming a transfer, especially for large amounts.

Conclusion

Transferring large amounts of money from the USA to India requires careful planning, attention to detail, and awareness of regulatory requirements. By choosing the right transfer method, preparing proper documentation, understanding the tax implications, and following security best practices, you can ensure your money reaches its destination safely, efficiently, and cost-effectively.

For NRIs or those sending substantial sums to India, opening an NRE account offers significant tax advantages and simplifies the process for recurring transfers. Online money transfer services like Wise and Remitly provide excellent value for most transfers, while traditional bank wire transfers remain a secure option for very large amounts.

Remember that exchange rates and fees significantly impact the final amount received, especially for large transfers. Taking the time to compare options and potentially negotiating rates for substantial amounts can save you thousands of dollars.

Always keep detailed records of your international transfers for tax compliance and stay informed about any regulatory changes that may affect cross-border money movements between the USA and India.

Key Takeaways

- Compare transfer services to find the best combination of exchange rates and fees

- Prepare all necessary documentation before initiating large transfers

- Understand the tax implications in both countries to avoid unexpected liabilities

- Consider opening an NRE account for tax-efficient transfers and repatriation flexibility

- Prioritize security measures to protect your funds during the transfer process

- Keep records of all transfers for tax reporting and compliance purposes

User Experiences and Reviews

Rahul S., Software Engineer

I moved back to India after 12 years in the US and needed to transfer my life savings. I used Wise for the transfer of around $200,000. Their process was transparent, and I saved over $6,000 compared to my bank's exchange rate. The verification for the large amount took an extra day, but the money was in my NRE account within 3 business days. Highly recommend their service for large transfers.

Priya K., Business Owner

I regularly send money to family in India and tried several services before settling on Remitly. Their Express service gets the money to my parents' account within minutes, which is crucial for emergencies. The exchange rates aren't as good as Wise, but the speed is worth it for me. For larger transfers ($10,000+), I've found their customer service very helpful in expediting verification.

Vikram P., Real Estate Investor

For my property purchase in Mumbai, I transferred $150,000 through my bank's wire service. While the fees were higher ($45), the security and direct bank-to-bank transfer gave me peace of mind. I also appreciated that the bank helped me with all the documentation for such a large transfer. For property purchases, I recommend traditional wire transfers despite the higher cost.

Anita M., Financial Consultant

I've been managing my finances between the US and India for over a decade. Opening an NRE account was the best financial decision I made. I transfer large amounts quarterly using OFX, which has no transfer fees and reasonable exchange rates. The tax benefits of the NRE account are substantial—all interest is tax-free, and I can repatriate funds whenever needed without restrictions.

No comments:

Post a Comment