How to Transfer Large Amounts of Money from USA to India: A Complete Guide (2025)

Learn the most secure, cost-effective, and compliant ways to transfer substantial funds internationally

Table of Contents

- Introduction

- Why People Transfer Large Amounts to India

- Methods for Transferring Large Amounts

- Understanding NRE and NRO Accounts

- Regulatory Requirements and Compliance

- Tax Implications

- Fees and Exchange Rates Comparison

- Security Measures and Fraud Prevention

- Step-by-Step Transfer Guides

- Tips for Getting the Best Rates

- Latest News and Updates

- User Reviews and Experiences

- Frequently Asked Questions

- Conclusion

- Glossary of Terms

Introduction

Transferring large sums of money from the United States to India requires careful planning, understanding of regulations, and awareness of the most cost-effective methods. Whether you're an NRI (Non-Resident Indian) planning to invest in property, supporting family members, repatriating funds, or relocating back to India, this comprehensive guide will walk you through everything you need to know about moving substantial funds across borders.

With increasing global connectivity and digital banking advancements, transferring money internationally has become more accessible. However, when dealing with large amounts, considerations like exchange rates, fees, security, regulatory compliance, and tax implications become significantly more important.

This guide covers all aspects of large money transfers from the USA to India, helping you navigate the complex landscape of international remittances while ensuring your money reaches its destination securely, efficiently, and in compliance with all applicable regulations.

Why People Transfer Large Amounts to India

Understanding the purpose behind your large money transfer is crucial, as it can affect the method you choose, the accounts you'll need, and the tax implications. Common reasons for transferring substantial funds from the USA to India include:

- Property Investment: Many NRIs transfer large sums to purchase real estate in India as an investment or for future retirement plans.

- Family Support: Supporting parents, children's education, or other family financial needs often requires regular or large one-time transfers.

- Relocation: When moving back to India permanently, transferring accumulated savings and investments is necessary.

- Business Investment: Establishing or investing in business ventures in India requires substantial capital transfers.

- Retirement Planning: Building a retirement nest egg in India for eventual return.

- Debt Repayment: Settling outstanding loans, mortgages, or other financial obligations in India.

Each of these scenarios may benefit from different transfer methods and account structures. For instance, if you're investing in property, you might prefer a direct bank-to-bank transfer to a Non-Resident External (NRE) account, while regular family support might be more efficiently handled through specialized remittance services.

Methods for Transferring Large Amounts

When transferring large sums of money from the USA to India, you have several options, each with its own advantages, limitations, and costs. Let's explore the most common and reliable methods:

1. Bank Wire Transfers

Bank wire transfers are one of the most secure ways to move large amounts of money internationally. Most major US banks offer this service.

Pros:

- High security and reliability

- No upper limits for transfers

- Direct bank-to-bank transfer

- Established process with tracking

Cons:

- Higher fees ($30-$50 per transfer)

- Less competitive exchange rates

- Processing time of 1-5 business days

- Complex paperwork for large amounts

Best for: Very large transfers (over $50,000) where security is the primary concern.

2. Online Money Transfer Services

Digital platforms like Wise (formerly TransferWise), Remitly, and Xoom offer more competitive rates than traditional banks.

Pros:

- Better exchange rates

- Lower fees than banks

- User-friendly interfaces

- Fast transfers (1-3 days)

Cons:

- Transfer limits may apply

- May require verification for large amounts

- Some services have daily/monthly caps

- Fewer regulatory protections than banks

Best for: Mid-sized transfers ($5,000-$50,000) where cost-efficiency is important.

3. NRI-Specific Bank Transfers

Many Indian banks have US branches or partnerships specifically designed for NRI transfers.

Pros:

- Specialized for India-bound transfers

- Streamlined processes for NRIs

- Better rates than standard US banks

- Familiar with Indian regulations

Cons:

- Limited branch availability in the US

- May require maintaining accounts

- Still more expensive than digital services

- Processing time varies

Best for: NRIs with existing accounts in Indian banks with US operations.

4. Foreign Exchange Services

Specialized forex services like OFX and XE offer competitive rates for large transfers.

Pros:

- Specialized in currency exchange

- Competitive rates for large amounts

- Higher transfer limits

- Rate locking options

Cons:

- Less known than major banks

- Setup process can be lengthy

- May require substantial documentation

- Limited additional services

Best for: Currency-sensitive large transfers where getting the best exchange rate is critical.

Expert Tip

For very large transfers (over $100,000), consider splitting the amount into multiple transactions over several days or weeks. This can help manage exchange rate fluctuations and reduce the risk exposure to a single transaction day's rate.

| Transfer Method | Transfer Limits | Speed | Fees | Exchange Rate Quality | Security Level |

|---|---|---|---|---|---|

| Bank Wire Transfer | No practical limit | 1-5 business days | $30-50 per transfer | Average to Below Average | Very High |

| Wise | Up to $1,000,000 per wire | 1-3 business days | 0.4-0.5% of transfer amount | Excellent | High |

| Remitly | Up to $30,000 per transfer | 3-5 business days (Economy) | $3.99+ depending on amount | Good | High |

| Xoom (PayPal) | Up to $50,000 per transfer | Minutes to 1-2 business days | $4.99+ depending on amount | Average | High |

| NRI Bank Services | Varies by bank | 1-3 business days | Varies by bank ($10-30) | Good for large amounts | Very High |

Understanding NRE and NRO Accounts

For NRIs transferring large amounts to India, understanding the different types of accounts available is crucial. The two primary account types are NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts.

NRE Account

Non-Resident External Account

Key Features:

- Maintained in Indian Rupees (INR)

- Only foreign earnings can be deposited

- Funds are fully repatriable (can be sent back to the US)

- Interest earned is tax-free in India

- No TDS (Tax Deducted at Source) on interest

- Joint account option with another NRI or resident Indian

Best For:

- Storing funds you may want to return to the US later

- Income earned outside India

- Making investments in India

- Tax-efficient savings

NRO Account

Non-Resident Ordinary Account

Key Features:

- Maintained in Indian Rupees (INR)

- Can receive both foreign and Indian income

- Limited repatriation (up to $1 million per financial year)

- Interest is taxable in India

- TDS applicable on interest (currently 30% plus surcharge)

- Joint account option with another NRI or resident Indian

Best For:

- Managing income generated within India

- Receiving rental income, dividends, or pension in India

- Meeting expenses in India

- Converting resident accounts when moving abroad

Top Banks for NRI Accounts in India

When selecting a bank for your NRE or NRO account, consider factors like interest rates, service quality, digital banking capabilities, and international presence.

HDFC Bank

- Strong digital banking

- Wide NRI services

- Competitive interest rates

ICICI Bank

- Extensive US presence

- Dedicated NRI services

- Good exchange rates

State Bank of India

- Largest banking network

- Government-backed security

- Lower minimum balance requirements

Axis Bank

- Premium banking services

- Good for high-value clients

- Strong digital platform

YES Bank

- Higher interest rates

- Innovative banking solutions

- Responsive customer service

DBS Bank

- International banking expertise

- Seamless digital experience

- Competitive rates for large transfers

Important Consideration

When transferring large amounts to your NRE/NRO account, ensure that proper documentation of the source of funds is maintained. This will be critical for any future repatriation requests and tax compliance.

Regulatory Requirements and Compliance

Large money transfers between countries are subject to strict regulatory oversight to prevent money laundering, terrorist financing, and tax evasion. Understanding these regulations is crucial to ensure your transfer proceeds smoothly.

US Regulations

- FinCEN Reporting: Financial institutions must report transactions over $10,000 to the Financial Crimes Enforcement Network (FinCEN) through Currency Transaction Reports (CTRs). This is not a tax but a reporting requirement.

- FBAR Filing: US persons with foreign financial accounts that exceed $10,000 at any time during the calendar year must file a Foreign Bank Account Report (FBAR).

- Know Your Customer (KYC): Banks and money transfer services are required to verify your identity and may request additional documentation for large transfers.

- Source of Funds: For large transfers, you may be asked to provide documentation proving the legitimate source of the funds.

Indian Regulations

- FEMA Regulations: The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India, including inward remittances.

- Liberalized Remittance Scheme (LRS): While LRS primarily applies to outward remittances from India, understanding these regulations is important for NRIs planning to eventually repatriate funds.

- Purpose Code Requirement: All inward remittances to India require a purpose code that identifies the reason for the transfer.

- RBI Guidelines: The Reserve Bank of India has specific guidelines for NRI accounts and large transfers.

"In India, all inward remittances are regulated by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA). Compliance with these regulations is essential to avoid complications with your transferred funds."

Documentation Requirements

For large transfers, be prepared to provide the following documents:

US Side:

- Valid identification (passport, driver's license)

- Proof of address (utility bill, bank statement)

- Source of funds documentation (tax returns, salary slips, investment statements)

- Recipient's complete bank details

- Purpose of transfer statement

India Side:

- NRI status proof (visa, passport copies)

- PAN card (for tax purposes)

- KYC documents for the receiving bank

- FEMA declaration forms (for certain transfer types)

- Relationship proof (for transfers to family members)

Compliance Alert

Attempting to circumvent reporting requirements by breaking up large transfers into smaller amounts (known as "structuring") is illegal in the US and can lead to severe penalties, including criminal charges.

Tax Implications

Understanding the tax implications of large money transfers between the US and India is crucial for staying compliant with tax authorities in both countries.

US Tax Considerations

- Reporting Requirements: Transferring money abroad is not taxable in itself, but reporting may be required. Transactions over $10,000 are automatically reported by financial institutions to FinCEN.

- Gift Tax: If your transfer is considered a gift to someone in India, gift tax rules may apply. Currently, you can give up to $17,000 per year per recipient without filing a gift tax return. Amounts above this require filing Form 709, though actual tax may not be due until lifetime exemption limits are reached.

- Proposed Remittance Tax: NEW! A proposed bill in the US (as of May 2025) suggests implementing a 5% tax on remittances sent by non-citizens. If passed, this would affect transfers to India starting potentially in July 2025.

- FATCA Reporting: US taxpayers with foreign financial accounts may need to report these accounts under the Foreign Account Tax Compliance Act.

Indian Tax Considerations

- NRE Account Benefits: Money transferred to an NRE account enjoys tax exemption in India. Interest earned on NRE accounts is tax-free, and repatriation is permitted without tax implications.

- NRO Account Taxation: Interest earned on NRO accounts is taxable in India. Banks typically deduct TDS at 30% plus applicable surcharge.

- Repatriation from NRO: When repatriating money from an NRO account, you may need to obtain a CA certificate confirming tax compliance.

- Gift Tax for Recipients: If your transfer is considered a gift to an Indian resident, they may have tax obligations if the amount exceeds ₹50,000, unless the gift is from a relative.

Tax Planning Tip

For large transfers, consider consulting with a cross-border tax specialist who understands both US and Indian tax systems. Strategic timing and structuring of your transfers can lead to significant tax savings.

"As an NRI, you are not subject to taxation on the money you send to India. However, sending money to India from overseas will have tax implications for the recipient who is a resident of India."

- ICICI Bank NRI Services

Fees and Exchange Rates Comparison

When transferring large amounts, even small differences in fees and exchange rates can result in thousands of dollars of variation in the amount received. Understanding the true cost of your transfer is critical.

Understanding the True Cost

The total cost of an international money transfer consists of:

- Upfront Fees: The explicit fee charged for processing the transfer

- Exchange Rate Margin: The difference between the mid-market exchange rate and the rate offered by the service

- Receiving Bank Fees: Additional charges levied by the receiving bank in India

- Correspondent Bank Fees: Intermediary banks may deduct fees during the transfer process

Fee Comparison for $50,000 Transfer (Approximate)

| Service | Upfront Fee | Exchange Rate Margin | Est. Total Cost | Amount Received (₹) |

|---|---|---|---|---|

| Traditional US Bank | $45-$50 | 2-3% ($1,000-$1,500) | $1,045-$1,550 | ₹4,056,000-₹4,092,000 |

| Wise | ~$245 (0.49%) | 0% (mid-market rate) | ~$245 | ~₹4,176,000 |

| Remitly | $3.99 (Economy) | 0.5-1% ($250-$500) | $254-$504 | ₹4,129,000-₹4,156,000 |

| Xoom | $4.99 | 1-2% ($500-$1,000) | $505-$1,005 | ₹4,092,000-₹4,134,000 |

| NRI-Specific Bank | $10-$30 | 1-1.5% ($500-$750) | $510-$780 | ₹4,113,000-₹4,134,000 |

| Forex Specialist (OFX) | $0 | 0.4-1% ($200-$500) | $200-$500 | ₹4,134,000-₹4,156,000 |

*Estimates based on mid-2025 rates with USD/INR at approximately 84. Actual rates and fees may vary.

Money-Saving Tip

For transfers over $50,000, contact money transfer services directly to negotiate better rates. Many services offer preferential pricing for large transfers but don't advertise these rates publicly.

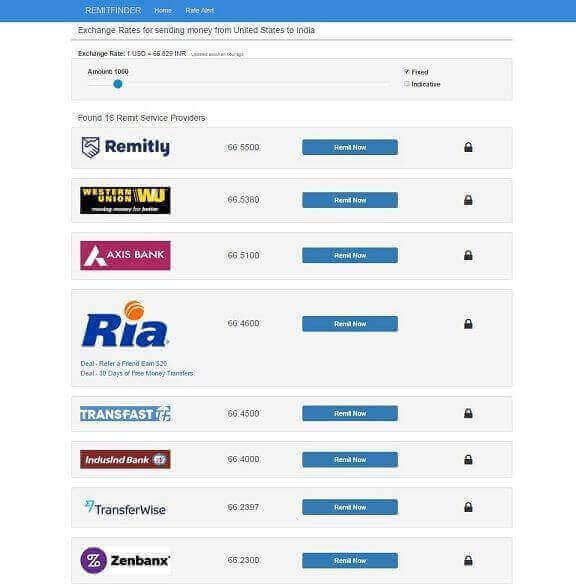

How to Compare Providers

To find the best service for your large transfer:

- Request quotes from multiple providers on the same day (exchange rates fluctuate daily)

- Ask for the total INR amount that will be received in India

- Check if your transfer amount qualifies for fee waivers or preferential rates

- Verify any receiving bank charges that might be deducted

- Consider using comparison sites like RemitFinder or CompareRemit

Security Measures and Fraud Prevention

When transferring large amounts of money internationally, security becomes paramount. Here are essential security measures and fraud prevention strategies to protect your funds.

Common Transfer Fraud Schemes

- Business Email Compromise (BEC): Fraudsters hack or spoof email accounts to send fake transfer instructions.

- Phishing Attacks: Fake websites or emails designed to steal your banking credentials.

- Social Engineering: Manipulative tactics to trick you into transferring money to fraudulent accounts.

- Exchange Rate Scams: Offering unrealistically good exchange rates that never materialize.

- Advance Fee Fraud: Requesting upfront payments for "guaranteed" better rates or special services.

Security Best Practices

- Verify Recipient Details: Triple-check all account numbers and bank details before confirming.

- Use Secure Networks: Never initiate transfers on public Wi-Fi or unsecured networks.

- Enable Multi-Factor Authentication: Add an extra layer of security to your banking accounts.

- Start with Small Test Transfers: Send a small amount first to verify correct delivery.

- Monitor Your Accounts: Check for confirmations and track the progress of your transfer.

- Use Established Providers: Stick with well-known and regulated transfer services.

Verification Procedures

For large transfers, implement these additional verification steps:

Verbal Confirmation

Call the recipient directly (using a previously established phone number) to confirm account details before sending large amounts.

Secondary Authorization

Set up requirements for a second authorized person to approve large transfers, adding an extra layer of protection.

Documentation Trail

Maintain complete records of all communications, confirmations, and receipts related to your transfer.

Staged Transfers

Consider breaking very large transfers into several smaller ones, allowing you to verify each stage before proceeding.

Warning Signs of Fraud

- Pressure to act quickly or claims of "special limited-time rates"

- Requests to change previously established payment instructions

- Unexpected communication about your transfer from unknown sources

- Unrealistic promises about exchange rates or fees

- Requests for additional payments or fees after the process has started

Step-by-Step Transfer Guides

Follow these detailed guides for executing large transfers using different methods:

Bank Wire Transfer Process

Gather Recipient Information

Collect complete details of the receiving bank in India, including:

- Recipient's full name as it appears on the account

- Account number

- IFSC code (Indian Financial System Code)

- Bank name, branch name, and address

- SWIFT code for international transfers

- Purpose of transfer

Contact Your US Bank

Initiate the wire transfer through:

- Online banking (if available for international wires)

- In-person visit to your bank branch (recommended for very large transfers)

- Phone banking (some banks offer this service)

Complete Required Documentation

Prepare and submit:

- Wire transfer request form

- Identification documents (passport, driver's license)

- Source of funds declaration (for large amounts)

- Purpose of transfer declaration

Pay Transfer Fees

Typical wire transfer fees range from $30-$50 for most US banks.

Obtain Confirmation

Request and save:

- Wire transfer reference number

- SWIFT confirmation (MT103 form if available)

- Expected delivery timeframe

Track the Transfer

Monitor the progress through:

- Your bank's online tracking system

- Contacting your bank's wire department

- Checking with the recipient bank in India

Using Wise (formerly TransferWise)

Create and Verify Your Account

Register on Wise and complete the verification process, which typically includes:

- ID verification (passport, driver's license)

- Address verification

- Enhanced verification for large transfers (may include source of funds documentation)

Set Up Your Transfer

Enter transfer details:

- Amount to send

- Select USD to INR

- Enter recipient's Indian bank details (account number, IFSC code)

- Specify transfer purpose

Review and Confirm

Check all details, especially:

- Exchange rate (Wise offers the mid-market rate)

- Transfer fee (typically 0.4-0.5% for large transfers)

- Estimated delivery time

Fund Your Transfer

Options include:

- ACH bank debit (lower fees but slower)

- Wire transfer to Wise (faster for large amounts)

- Debit card (typically limited to smaller amounts)

Track Your Transfer

Follow the progress through Wise's tracking system, which provides real-time updates.

NRI-Specific Bank Transfer

Set Up NRE/NRO Account

If you don't already have one:

- Choose an Indian bank with US operations (ICICI, SBI, HDFC)

- Complete NRI account opening forms

- Provide required KYC documentation

- Submit proof of NRI status

Initiate Transfer Through NRI Services

Options include:

- US branch of Indian bank

- Online NRI portal

- NRI relationship manager assistance

Fund Your Transfer

Methods vary by bank but typically include:

- Direct deposit from US account

- Check deposit at US branch

- Wire transfer from US bank

Complete Purpose Declaration

Specify the reason for your transfer as required by FEMA regulations.

Confirm and Track

Monitor the transfer through:

- NRI online banking portal

- NRI customer service

- Dedicated relationship manager (for premium accounts)

Pro Tip for Large Transfers

For amounts over $100,000, consider making an appointment with a senior banking officer or relationship manager at your bank. They can often provide personalized service, expedited processing, and possibly better rates for very large transfers.

Tips for Getting the Best Rates

When transferring large amounts, even small improvements in exchange rates can result in significant savings. Here are strategies to secure the best possible deals:

Timing Your Transfer

- Monitor Exchange Rate Trends: Use tools like XE.com or OANDA to track USD-INR exchange rate patterns.

- Avoid Month-End Transfers: Rates are often less favorable during high-volume periods at month-end when businesses make international payments.

- Consider Economic Announcements: Major economic news releases (like Federal Reserve decisions or GDP data) can cause rate volatility.

- Set Rate Alerts: Many services allow you to set notifications when rates reach your desired level.

Negotiation Tactics

- Request Preferential Rates: For amounts over $50,000, explicitly ask for better rates than those advertised.

- Mention Competitor Quotes: Let providers know if you've received better offers elsewhere.

- Bundle Transfers: If planning multiple transfers, negotiate a better overall rate for the combined amount.

- Leverage Banking Relationships: Long-term customers with good standing often receive preferential treatment.

- Consider Premium Accounts: Some banks offer better exchange rates for premium or private banking clients.

Strategic Approaches

- Forward Contracts: Lock in today's exchange rate for a future transfer (available through forex specialists and some banks).

- Limit Orders: Set up automatic transfers that execute when exchange rates reach your specified level.

- Split Transfers: Divide very large amounts into multiple transfers over time to average out rate fluctuations.

- Compare Total Received Amount: Focus on the final INR amount that will arrive in India rather than just the exchange rate or fees separately.

Service Selection Tips

- Use Comparison Tools: Sites like CompareRemit and RemitFinder show real-time comparisons between services.

- Check for First-Time User Promotions: Many services offer special rates or fee waivers for first transfers.

- Evaluate the Full Service: Consider speed, customer service, and ease of use alongside rates.

- Direct vs. Indirect Routes: Transfers with fewer intermediary banks often result in fewer fees being deducted.

Rate Comparison Strategy

When comparing rates between providers, request quotes within a short timeframe (ideally within the same hour) as currency markets fluctuate constantly. This ensures you're making valid comparisons between services.

Hidden Costs to Watch For

- Correspondent Bank Fees: Intermediate banks in the transfer chain may deduct their own fees, reducing the final amount.

- Receiving Bank Charges: Some Indian banks charge for processing incoming international transfers.

- "No Fee" Deceptions: Services advertising "no fees" often build their profit into less favorable exchange rates.

- Weekend Processing Fees: Some providers charge extra for transfers processed during weekends.

- Cancellation or Amendment Fees: Changing details after initiating a transfer can be costly.

Latest News and Updates

Staying informed about regulatory changes and market developments is crucial when planning large international transfers. Here are the latest updates affecting money transfers between the USA and India:

BREAKING: Proposed 5% Remittance Tax in the US

A new US legislative proposal called "The One Big Beautiful Bill" includes provisions for a 5% tax on money transfers sent by non-citizens from the United States to foreign countries, including India.

- Implementation Timeline: If passed, the tax could take effect as early as July 2025.

- Who's Affected: Non-US citizens including green card holders, H-1B visa holders, and other non-citizens sending money abroad.

- Potential Impact: For Indian diaspora in the US, this could mean paying an additional $5 for every $100 sent to India.

- Exemptions: The proposal includes provisions for "verified US senders" who would be exempt from the tax.

Source: Economic Times, May 2025

RBI Updates to NRI Account Regulations

The Reserve Bank of India continues to streamline processes for NRIs, with recent updates focusing on digital account management and simplified documentation requirements.

Updated: April 2025

UPI Integration for International Transfers

India's Unified Payments Interface (UPI) is increasingly being integrated with international payment systems, potentially making transfers to Indian accounts faster and more cost-effective.

Updated: March 2025

Exchange Rate Volatility

Recent economic data from both the US and India has led to increased USD-INR exchange rate volatility, making timing considerations more important for large transfers.

Updated: May 2025

Digital Money Transfer Competition

The competitive landscape for US-India money transfers continues to evolve, with more fintech companies entering the space and offering innovative services and competitive rates.

Updated: February 2025

Stay Informed

Regulations regarding international money transfers can change rapidly. Before initiating any large transfer, verify current rules and requirements with both US and Indian financial authorities or consult with a cross-border financial advisor.

User Reviews and Experiences

Learning from the experiences of others can provide valuable insights when planning your own large money transfer. Here are some testimonials from people who have transferred substantial amounts from the USA to India:

"I transferred $200,000 to purchase property in Bangalore. After comparing multiple options, I went with a direct bank wire transfer to my NRE account. While the fees were higher ($45), the peace of mind was worth it. I negotiated with my US bank for a better exchange rate since it was such a large amount, which saved me about $800."

Transferred using: Chase Bank to HDFC NRE Account

"For my $75,000 transfer to support my parents' medical expenses, I used Wise. Their process was smooth, and the mid-market exchange rate saved me nearly $1,500 compared to my bank's offer. The verification process was strict but manageable—I had to provide source of funds documentation and have a video call to verify my identity."

Transferred using: Wise to SBI Account

"I tried to transfer $120,000 through Remitly but hit their transfer limits. Had to split it into four transactions of $30,000 each over two weeks. Their customer service was helpful, but the process was a bit cumbersome. Still, the rates were good, and I saved compared to traditional bank options."

Transferred using: Remitly to ICICI Account

"After moving back to India permanently, I needed to transfer my entire savings of about $250,000. I used ICICI Bank's NRI services since I had accounts on both sides. They offered a slightly preferential rate for such a large amount. The entire process took about 4 business days, and their documentation requirements were thorough but straightforward."

Transferred using: ICICI Bank USA to ICICI NRE Account

"My experience transferring $85,000 through a major US bank was disappointing. Despite being a long-term customer, they gave me a poor exchange rate and charged high fees. I later discovered I could have saved nearly $2,000 by using specialist services like OFX or Wise. Lesson learned for next time!"

Transferred using: Bank of America to Axis Bank

Insight from Reviews

A common thread in these experiences is that negotiation is possible for large transfers, and comparing multiple options almost always leads to significant savings. Also note that splitting very large transfers may be necessary due to service limits.

Frequently Asked Questions

Any transaction of $10,000 or more will be automatically reported to FinCEN by financial institutions in the US through Currency Transaction Reports (CTRs). However, this is merely a reporting requirement and doesn't mean you owe taxes or are doing anything improper. There is no upper limit on how much you can legally transfer.

For the sender in the US, transferring your own money is not typically a taxable event. However, if the transfer is considered a gift to someone else, amounts above $17,000 per recipient per year may require filing a gift tax return. In India, funds received in an NRE account aren't taxable, but interest earned on NRO accounts is subject to tax in India.

For funds earned outside India, an NRE account is generally preferable because it offers:

- Tax-free interest earnings in India

- Full repatriation rights (you can send the money back to the US later)

- No tax deductions on deposits or withdrawals

NRO accounts are better for managing income generated within India.

For very large transfers, bank-to-bank wire transfers generally offer the highest security and reliability. They have established processes for handling large amounts and provide comprehensive tracking. For even greater security, consider splitting the transfer into multiple transactions and verifying receipt of each portion before sending the next.

The timeframe varies by method:

- Bank wire transfers: 1-5 business days

- Online money transfer services: 1-3 business days

- NRI banking services: 1-3 business days

Large transfers may take longer due to additional security checks and compliance procedures. Always factor in this timing when planning time-sensitive transactions like property purchases.

Yes, especially for amounts over $50,000. Banks and money transfer services often have preferential rates for large transfers that aren't advertised. Don't hesitate to ask for a better rate and mention that you're comparing options. For very large amounts, even a slightly improved rate can save thousands of dollars.

For large transfers, be prepared to provide:

- Government-issued ID (passport, driver's license)

- Proof of address

- Source of funds documentation (bank statements, investment statements, property sale documents, salary slips, tax returns)

- Purpose of transfer declaration

- Recipient's complete banking details

- For NRI accounts: NRI status proof

The proposed 5% tax on remittances by non-citizens is still pending legislation. If passed, it would add a 5% cost to money transfers sent by non-US citizens from the United States. For example, sending $50,000 would incur a $2,500 tax. The bill includes provisions for exemptions for verified US citizens. This potential tax makes evaluating the overall cost of transfers even more important. Stay updated on developments if you're planning large transfers in late 2025 or beyond.

Conclusion

Transferring large amounts of money from the USA to India requires careful planning, thorough understanding of available options, and attention to regulatory requirements. By following the strategies outlined in this guide, you can ensure your funds reach their destination securely, efficiently, and with minimal costs.

Remember these key points:

- Compare Multiple Services: Always get quotes from at least 3-4 providers before making a decision.

- Consider the Total Cost: Look beyond upfront fees to exchange rate margins and receiving bank charges.

- Security is Paramount: For very large transfers, prioritize established and regulated services even if they cost slightly more.

- Stay Compliant: Understand and follow reporting requirements in both the US and India.

- Choose the Right Account: Select between NRE and NRO accounts based on your specific needs and future plans.

- Document Everything: Maintain records of all transfers, communications, and confirmations.

- Stay Informed: Keep up with regulatory changes that may affect your transfer strategy.

By taking a strategic approach to international transfers, you can save thousands of dollars while ensuring your money moves safely across borders. Whether you're investing in property, supporting family, or planning your return to India, this guide provides the foundation for making informed decisions about your financial movements.

Glossary of Terms

Non-Resident External account - Maintained in Indian rupees for foreign earnings, with tax-free interest and full repatriation rights.

Non-Resident Ordinary account - Maintained in Indian rupees for income earned within India, with taxable interest and limited repatriation.

Foreign Exchange Management Act - Indian legislation governing foreign exchange transactions and cross-border transfers.

Financial Crimes Enforcement Network - US agency that collects and analyzes financial transaction information.

Society for Worldwide Interbank Financial Telecommunication - Global network for secure financial messaging between banks.

Indian Financial System Code - Unique code identifying bank branches in India for electronic fund transfers.

Tax Deducted at Source - Income tax deducted at the source of income generation in India.

Currency Transaction Report - Form filed by financial institutions for cash transactions over $10,000 in the US.

The midpoint between the buy and sell prices of a currency pair in the global currency markets, considered the "true" exchange rate.

Electronic transfer of funds from one bank account to another, typically used for large or time-sensitive transfers.

Automated Clearing House transfer - Electronic network for financial transactions in the US, typically slower but cheaper than wire transfers.

The difference between the mid-market exchange rate and the rate offered by a financial service provider.

Foreign Account Tax Compliance Act - US law requiring foreign financial institutions to report on assets held by US account holders.

An intermediary bank that facilitates wire transfers between banks that don't have a direct relationship.

Agreement to exchange currency at a fixed rate on a future date, protecting against exchange ratefluctuations.

Money sent by a foreign worker to an individual in their home country, often referring to international money transfers.

No comments:

Post a Comment