Setting Up API-Based Money Transfers to India for Business Owners: The Ultimate Guide (2025)

A comprehensive guide to establishing seamless, cost-effective money transfer operations to India using modern API technology

Published: May 26, 2025

Last Updated: May 26, 2025

Table of Contents

- Introduction to API-Based Money Transfers

- Understanding the India Remittance Market

- Key Benefits for Business Owners

- Regulatory Requirements and Compliance

- Top API-Based Money Transfer Providers

- Technical Implementation Process

- Security Considerations and Best Practices

- Cost Structure and ROI Analysis

- Case Studies and Success Stories

- Common Challenges and Solutions

- Future Trends in Cross-Border Payments

- Conclusion and Next Steps

Introduction to API-Based Money Transfers

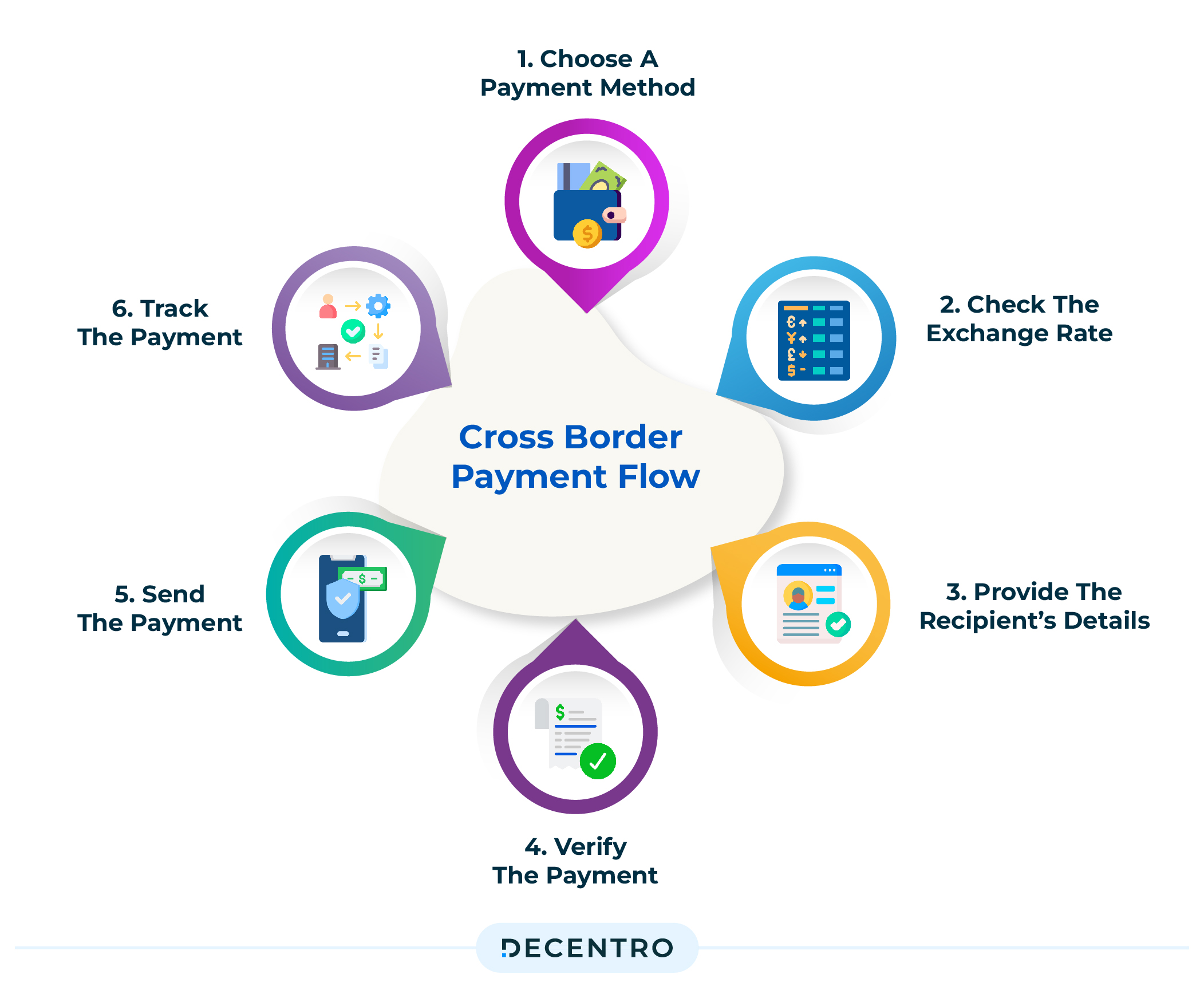

Cross-border payment architecture showing the flow of money transfers

In today's interconnected global economy, efficient money transfer systems are vital for businesses operating across borders. For companies dealing with India—one of the world's largest remittance markets—establishing reliable, cost-effective payment channels is crucial for success.

API-based money transfers represent a technological revolution in the remittance industry, allowing businesses to programmatically send funds to India without the cumbersome processes associated with traditional banking channels. Application Programming Interfaces (APIs) create secure connections between your business systems and financial service providers, enabling seamless integration of payment functionality.

"API-based money transfers are transforming how businesses manage cross-border payments, reducing transaction times from days to minutes while providing unprecedented visibility into the payment lifecycle."

As Indian fintech infrastructure continues to evolve with innovations like the Unified Payments Interface (UPI) and regulatory frameworks that support digital transactions, businesses worldwide have unprecedented opportunities to establish efficient payment corridors to the subcontinent.

This comprehensive guide walks business owners through every aspect of setting up API-based money transfers to India—from understanding regulatory requirements and selecting the right service provider to technical implementation and security best practices. Whether you're managing payroll for remote workers in India, paying suppliers, or enabling customer refunds, this guide will provide the essential information you need for success.

Understanding the India Remittance Market

India consistently ranks as one of the world's top remittance recipients, with annual inbound transfers exceeding $83 billion. This massive market is driven by several factors:

Large Diaspora Population

The Indian diaspora, estimated at over 18 million people worldwide, regularly sends money home to family members.

Business Expansion

Growing international trade relationships with India require efficient payment channels for B2B transactions.

Tech Outsourcing

India's position as a global IT services hub creates regular payroll requirements for international companies.

Digital Transformation

Rapid adoption of digital payment systems in India has created one of the world's most advanced fintech ecosystems.

Typical flow of cross-border payments to India

The traditional banking-based remittance channels to India have been characterized by:

- High fees (often 5-7% of transaction value)

- Long settlement times (2-5 business days)

- Lack of transparency in exchange rates

- Limited integration capabilities with business systems

- Manual reconciliation processes

API-based money transfer solutions address these pain points by providing programmatic access to payment infrastructure, often at a fraction of the cost and time of traditional methods. These solutions leverage India's advanced digital payment infrastructure, including the Immediate Payment Service (IMPS) and Unified Payments Interface (UPI), which enable real-time domestic transfers.

Key Benefits for Business Owners

Why API-Based Money Transfers Make Business Sense

Speed and Efficiency

Real-time or near-real-time transfers to Indian bank accounts, reducing payment cycles from days to minutes.

Cost Reduction

Lower transaction fees compared to traditional wire transfers and bank remittances, often saving 2-4% per transaction.

System Integration

Seamless connection with existing business software (ERP, accounting, payroll systems) for automated payment processing.

Transparency

Clear visibility of fees, exchange rates, and transaction status throughout the payment process.

Enhanced Security

Advanced fraud detection and prevention mechanisms that protect your business and payment recipients.

Scalability

Ability to handle payment volumes from occasional transfers to thousands of monthly transactions without operational overheads.

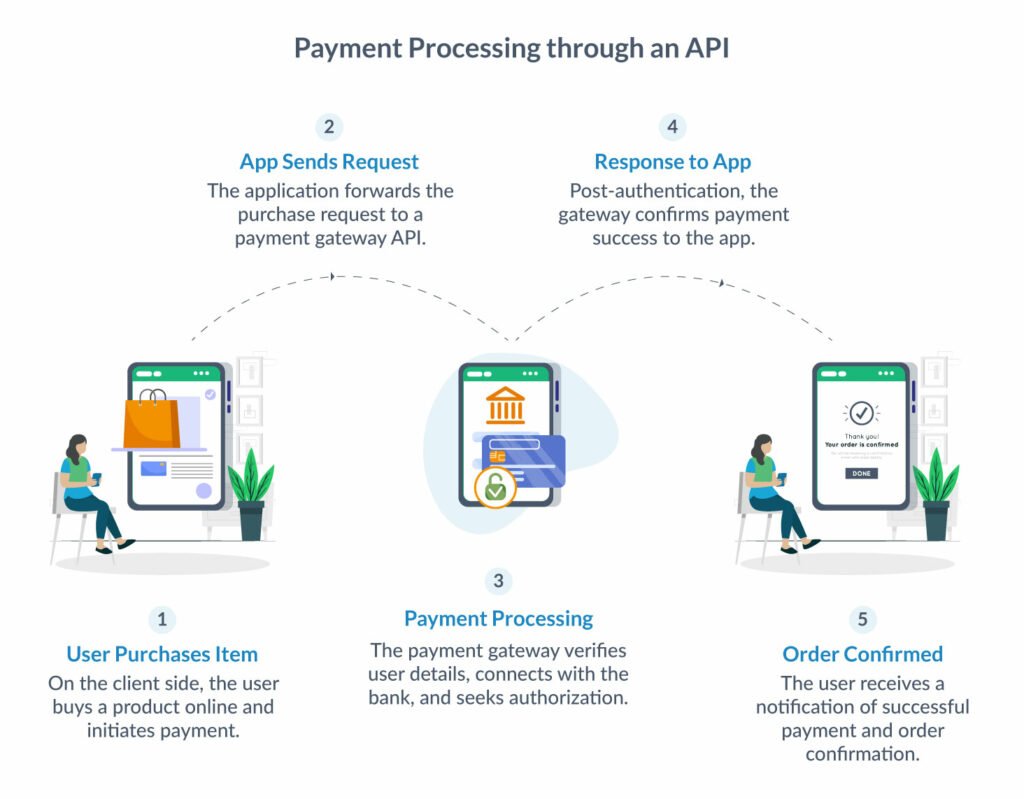

How API-based financial transactions work

For business owners managing regular payments to India, API-based solutions can dramatically transform payment operations. Consider a technology company with 50 contractors in India that previously spent hours processing monthly payments through traditional banking channels:

Before API Implementation:

- Manual data entry into banking portals

- 3-5 business days for payment settlement

- High wire transfer fees ($25-45 per transaction)

- Manual reconciliation against accounting systems

- Limited visibility into payment status

After API Implementation:

- Automated payments triggered directly from payroll system

- Same-day or next-day settlement

- Fees reduced to $2-5 per transaction

- Automatic reconciliation with real-time status updates

- Complete audit trail and compliance documentation

Regulatory Requirements and Compliance

When establishing API-based money transfers to India, compliance with both domestic and Indian regulatory frameworks is essential. The Reserve Bank of India (RBI) maintains strict oversight of international money flows and has established specific requirements that affect cross-border transactions.

Key Regulatory Considerations

Reserve Bank of India (RBI) Guidelines

The RBI regulates all incoming international remittances under the Foreign Exchange Management Act (FEMA). API providers must comply with RBI guidelines on cross-border payments, which include requirements for transaction reporting, KYC verification, and purpose codes for transfers.

Know Your Customer (KYC) Requirements

Both sending and receiving entities must verify customer identities according to the RBI's KYC Direction, 2016. For business payments, this typically includes verifying business registration details, beneficial ownership information, and the purpose of transfers.

Data Localization Requirements

Since April 2018, the RBI has mandated that all payment-related data must be stored exclusively in India. API providers must ensure their infrastructure complies with these data localization requirements, which affect where transaction data is processed and stored.

Anti-Money Laundering (AML) Compliance

API-based transfer systems must incorporate robust AML measures, including transaction monitoring, suspicious activity reporting, and compliance with international standards like those set by the Financial Action Task Force (FATF).

Purpose Code Documentation

All remittances to India must include appropriate purpose codes that categorize the nature of the payment (e.g., services rendered, salary, dividend payment). Your API solution should facilitate the assignment of these codes to ensure compliance.

"Compliance isn't just about meeting requirements—it's about building a sustainable, risk-managed payment operation that protects your business and customers while enabling efficient money movement."

Working with an established API provider can significantly simplify compliance management, as reputable providers have already built the necessary frameworks to handle these requirements. However, business owners should still understand their obligations and ensure their chosen solution adequately addresses all regulatory considerations.

Top API-Based Money Transfer Providers

Selecting the right API provider is crucial for establishing reliable money transfers to India. Here's a comparison of leading providers specializing in the India corridor:

| Provider | Settlement Time | Fee Structure | Coverage in India | API Features | Best For |

|---|---|---|---|---|---|

| Nium | Real-time to same-day | Transaction fee + FX margin | All major banks, 100+ real-time markets | Comprehensive API suite, account verification, multi-currency accounts | Enterprise businesses with high transaction volumes |

| Cashfree Payments | Instant to 24 hours | Pay-per-transaction model | All Indian banks, UPI integration | Banking APIs, verification suite, integrated payouts | Indian businesses making domestic and international transfers |

| Wise for Business | 1-2 business days | Transparent fee structure, mid-market exchange rates | All major Indianbanks | Batch payments API, multi-currency accounts | SMEs with regular payment requirements |

| Stripe | 2-3 business days | Percentage + fixed fee | Major Indian banks | Unified API for global payments | Online businesses already using Stripe for payments |

| PayPal for Business | Instant to 24 hours | Percentage-based, variable by volume | Limited bank coverage | Well-documented REST APIs | Businesses with existing PayPal integration |

Key Factors to Consider When Selecting a Provider

Technical Capabilities

- API documentation quality

- SDK availability

- Webhook support

- Testing environment

- Error handling

Operational Factors

- Settlement speeds

- Support quality

- Compliance assistance

- Reporting capabilities

- Scalability

Commercial Terms

- Fee transparency

- FX rates

- Volume discounts

- Contract flexibility

- Implementation costs

"The right provider isn't necessarily the cheapest—it's the one that offers the right balance of features, reliability, and support for your specific business requirements."

Many businesses find that working with speciality providers focused on the India corridor delivers better results than generic global payment solutions. These specialized providers often have deeper relationships with Indian banking networks and greater expertise in navigating the specific regulatory environment.

Technical Implementation Process

Banking API architecture overview showing integration points

Implementing an API-based money transfer system to India involves several technical steps. Here's a structured approach to guide your technical team through the process:

Requirements Definition

Begin by documenting your specific transfer requirements, including:

- Expected transfer volumes and frequency

- Average transaction values

- Recipient types (businesses vs. individuals)

- Integration needs with existing systems (ERP, accounting software)

- Compliance and reporting requirements

Provider Selection and Onboarding

Once you've selected a provider, you'll need to complete their onboarding process:

- Business verification and KYC documentation

- Signing service agreements

- Setting up access credentials for API testing

- Establishing support channels

API Integration Planning

Develop an integration architecture that outlines:

- Authentication mechanism (OAuth 2.0, API keys)

- Error handling and retry logic

- Webhook configuration for status updates

- Data mapping between your systems and the API

Sandbox Testing

Most providers offer a sandbox environment to test integrations:

- Implement API calls for core functions (beneficiary creation, payment initiation)

- Test error scenarios and edge cases

- Validate webhook receipt and processing

- Conduct end-to-end payment simulations

Production Implementation

After successful testing, move to production implementation:

- Secure production API credentials

- Implement additional security measures

- Configure monitoring and alerting

- Enable proper logging for audit purposes

User Acceptance Testing

Before full rollout:

- Conduct limited production transfers

- Verify receipt by beneficiaries

- Confirm settlement times and fees

- Test reconciliation processes

Deployment and Monitoring

Once fully implemented:

- Establish ongoing monitoring procedures

- Create operational playbooks for common scenarios

- Set up regular reconciliation processes

- Implement continuous improvement practices

// Sample Code: Initiating a payment to India with Node.js

const axios = require('axios');

async function initiateTransfer() {

try {

const response = await axios({

method: 'post',

url: 'https://api.provider.com/transfers',

headers: {

'Authorization': 'Bearer YOUR_API_KEY',

'Content-Type': 'application/json'

},

data: {

amount: 50000,

currency: 'INR',

beneficiary_id: 'ben_12345',

purpose_code: 'SERVICES',

reference: 'INV-2025-05'

}

});

console.log('Transfer initiated:', response.data);

return response.data;

} catch (error) {

console.error('Transfer failed:', error.response.data);

throw error;

}

}

The time required for implementation varies based on complexity but typically ranges from 2-12 weeks. Working with providers that offer robust documentation, SDKs, and implementation support can significantly accelerate this timeline.

Security Considerations and Best Practices

Security is paramount when implementing API-based money transfers. A breach could lead to financial loss, regulatory penalties, and reputational damage. Here are critical security measures to implement:

Essential Security Measures

Authentication & Authorization

- Implement OAuth 2.0 or similar protocols

- Use strong API key management

- Enforce principle of least privilege

- Implement IP whitelisting where possible

- Use multi-factor authentication for admin functions

Data Protection

- Encrypt data in transit (TLS 1.2+)

- Encrypt sensitive data at rest

- Implement proper key management

- Apply data minimization principles

Fraud Prevention

- Implement transaction limits

- Use velocity checks to detect unusual patterns

- Apply beneficiary verification procedures

- Consider geo-fencing and time-based restrictions

- Implement behavior analysis

Monitoring & Auditing

- Implement comprehensive logging

- Set up real-time alerting for suspicious activities

- Conduct regular security audits

- Perform periodic penetration testing

- Establish an incident response plan

"Security isn't just a technical concern—it's an ongoing operational discipline that requires vigilance, training, and continuous improvement."

Security Best Practices for API Integration

- Never hardcode API credentials in application code – Use environment variables or secure vaults.

- Implement IP restrictions – Limit API access to specific IP addresses when possible.

- Validate all input – Prevent injection attacks by validating and sanitizing all input data.

- Set up transaction thresholds – Create alerts for transfers exceeding normal patterns.

- Implement dual controls – Require two-person approval for transfers above certain thresholds.

- Regular security reviews – Schedule periodic reviews of your security measures and access controls.

- Choose PCI-DSS compliant providers – Ensure your provider meets industry security standards.

- Secure webhooks – Verify webhook signatures to ensure authenticity of incoming notifications.

- Implement proper error handling – Avoid exposing sensitive information in error messages.

- Keep dependencies updated – Regularly update libraries and dependencies to patch security vulnerabilities.

Additionally, ensure your team is trained on security best practices and establish clear protocols for handling sensitive payment information. Regular security awareness training can help prevent social engineering attacks that might compromise your payment infrastructure.

Cost Structure and ROI Analysis

Understanding the true cost of implementing and maintaining an API-based money transfer solution is crucial for calculating your return on investment (ROI). Here's a breakdown of the primary cost components:

Implementation Costs

Integration Development

- Developer time: $2,000-$10,000

- Testing resources: $1,000-$3,000

- Documentation: $500-$1,500

Provider Onboarding

- Setup fees: $0-$5,000 (varies widely)

- Compliance documentation: $500-$2,000

- Legal review: $1,000-$3,000

Internal System Updates

- Accounting system integration: $1,000-$5,000

- Training: $500-$2,000

- Process documentation: $500-$1,500

Ongoing Operational Costs

Transaction Fees

The most visible cost component, typically structured as:

- Percentage fee: 0.5-2% of transfer amount

- Fixed fee: $1-5 per transaction

- FX margin: 0.2-1% above mid-market rate

- Monthly/annual subscription: $0-500/month

Maintenance Costs

- API updates and maintenance: $1,000-5,000/year

- Security reviews: $2,000-10,000/year

- Compliance updates: $1,000-3,000/year

- Monitoring and support: $500-2,000/year

ROI Calculation Framework

To calculate the ROI of your API-based money transfer implementation, consider both quantitative and qualitative benefits:

Quantitative Benefits

- Reduced transaction fees compared to traditional methods

- Staff time savings from automation

- Improved cash flow from faster settlements

- Reduced error correction costs

- Lower FX costs from better rates

Qualitative Benefits

- Enhanced recipient satisfaction

- Better visibility and control over payments

- Improved compliance and risk management

- Greater scalability for business growth

- Competitive advantage from payment efficiency

// Sample ROI Calculation

// Assumptions for a business making 100 monthly transfers to India

// Traditional Method Costs

const oldMethodCostsPerMonth = {

averageTransferFee: 100 * 30, // $30 per transfer

fxCosts: 100 * 50000 * 0.03, // 3% FX margin on $50,000 avg

staffTime: 40 * 25, // 40 hours at $25/hour

reconciliationCosts: 20 * 25, // 20 hours at $25/hour

errorCorrectionCosts: 10 * 25 // 10 hours at $25/hour

};

// API Method Costs

const apiMethodCostsPerMonth = {

averageTransferFee: 100 * 5, // $5 per transfer

fxCosts: 100 * 50000 * 0.008, // 0.8% FX margin

staffTime: 5 * 25, // 5 hours at $25/hour

reconciliationCosts: 2 * 25, // 2 hours at $25/hour

errorCorrectionCosts: 2 * 25, // 2 hours at $25/hour

subscriptionFee: 200, // Monthly API subscription

maintenanceCosts: 1000 / 12 // Annual maintenance spread monthly

};

// Calculate total costs

const oldTotal = Object.values(oldMethodCostsPerMonth).reduce((a, b) => a + b, 0);

const apiTotal = Object.values(apiMethodCostsPerMonth).reduce((a, b) => a + b, 0);

// Monthly savings

const monthlySavings = oldTotal - apiTotal;

// Initial investment

const initialInvestment = 15000; // $15,000 for implementation

// Payback period (months)

const paybackPeriod = initialInvestment / monthlySavings;

For most businesses, the payback period for implementing API-based money transfers ranges from 3-12 months, depending on transfer volumes and the complexity of the implementation. Higher volume businesses typically see faster returns on their investment.

Case Studies and Success Stories

Real-world examples demonstrate how businesses have successfully implemented API-based money transfers to India:

Tech Services Company

A North American technology firm with over 200 developers in India implemented an API-based payment solution to replace their manual wire transfer process.

Results:

- Reduced payment processing time from 3 days to same-day

- Decreased transaction costs by 78%

- Automated reconciliation saving 45 hours monthly

- Eliminated payment errors previously affecting 3% of transfers

"The API integration transformed our payroll operations. We've eliminated payment delays that used to cause frustration among our India team, while dramatically reducing our finance team's workload."

— Finance Director

E-commerce Marketplace

An e-commerce platform connecting global buyers with Indian artisans implemented API-based disbursements to pay thousands of small merchants across India.

Results:

- Scaled payment operations from 500 to 5,000 monthly transfers

- Reduced payment settlement time from 7 days to next-day

- Saved $15,000 monthly in transaction fees

- Improved merchant satisfaction scores by 47%

"Our ability to pay artisans quickly and reliably has become a key competitive advantage. Many of our sellers now choose us specifically because of our superior payment experience."

— Operations Manager

Investment Fund

A European investment fund with significant investments in Indian startups implemented an API-based solution to streamline capital deployments and operational expense payments.

Implementation Approach:

- Selected a provider specializing in high-value transfers with strong compliance features

- Integrated the API with their fund management platform

- Implemented enhanced security with multi-signature approval workflows

- Created automated compliance documentation for regulatory reporting

Results:

- Reduced FX costs by accessing near-midmarket rates, saving approximately 1.2% on all transfers

- Decreased settlement time from 3-5 days to next-day

- Improved tracking and visibility of fund deployments

- Enhanced compliance documentation and audit readiness

"The transparency and control we've gained have been transformative. We now have complete visibility into every stage of our capital deployment process, with significant cost savings on our international transfers."

— Fund Manager

These case studies demonstrate that businesses across various industries and sizes can realize significant benefits from API-based money transfer implementations. The key success factors consistently include thorough planning, selection of the right provider for specific business needs, and attention to both technical integration and operational processes.

Common Challenges and Solutions

While implementing API-based money transfers to India offers numerous benefits, businesses often encounter challenges during the process. Understanding these common obstacles and their solutions can help you navigate the implementation more smoothly:

| Challenge | Impact | Solution |

|---|---|---|

| Complex Regulatory Compliance | Transfers may be delayed or rejected due to insufficient compliance documentation or incorrect purpose codes. | Partner with providers offering pre-built compliance frameworks. Establish clear internal processes for collecting and validating all required compliance information. |

| Beneficiary Data Accuracy | Incorrect bank details can lead to failed transfers, delays, and additional fees for investigations. | Implement beneficiary verification APIs to validate bank details before initiating transfers. Create standardized formats for collecting beneficiary information. |

| Technical Integration Complexity | Development teams may struggle with API integration, particularly if they lack experience with financial APIs. | Select providers with comprehensive documentation, SDKs, and responsive support. Consider using consultants with specific experience in payment API integrations. |

| Exchange Rate Volatility | Fluctuating exchange rates can create budgeting challenges and affect payment recipients when amounts convert to less than expected. | Use guaranteed rate features offered by some providers or implement forward contracts for large, planned transfers. Consider local currency pricing where appropriate. |

| System Downtime and Reliability | API outages or banking system maintenance can interrupt payment operations. | Implement robust error handling with retry mechanisms. Develop contingency processes for critical payments during outages. Monitor provider status pages and schedule critical transfers accordingly. |

| Reconciliation Challenges | Matching transfers with internal systems can be difficult, especially for high-volume operations. | Use unique reference codes for each transaction. Implement automated reconciliation using webhook notifications. Consider implementing a payment operations dashboard. |

Tips for Overcoming Challenges

Staged Implementation

Begin with a small subset of transfers to validate your integration and processes before scaling up. This allows you to identify and address issues with minimal impact.

Cross-functional Teams

Form implementation teams that include finance, technical, and compliance stakeholders to ensure all perspectives are considered during setup and testing.

Comprehensive Documentation

Create detailed internal documentation covering integration points, operational procedures, and troubleshooting guides to support ongoing operations.

Provider Relationship

Establish strong relationships with your provider's technical and account management teams. Direct access to expertise can dramatically accelerate problem resolution.

"The most successful implementations aren't those without challenges—they're those where challenges are anticipated and met with prepared, thoughtful responses."

Future Trends in Cross-Border Payments to India

The landscape of international payments to India continues to evolve rapidly. Staying informed about emerging trends can help businesses make strategic decisions about their payment infrastructure:

Central Bank Digital Currency (CBDC)

The Reserve Bank of India is developing the digital rupee, which could revolutionize cross-border payments by enabling near-instant settlement at minimal cost.

When deployed at scale, API providers will likely integrate with the digital rupee infrastructure, potentially reducing costs and settlement times further.

UPI International Expansion

India's Unified Payments Interface is expanding internationally, with bilateral arrangements already in place with several countries.

This expansion may enable direct, real-time payment corridors that bypass traditional correspondent banking networks, potentially reducing costs and increasing speed.

AI-Powered Compliance

Artificial intelligence is increasingly being deployed to streamline compliance processes for cross-border payments.

These systems can automate sanctions screening, detect unusual patterns, and reduce false positives in AML monitoring, making compliance more efficient while reducing risk.

Preparing for Future Developments

To position your business to benefit from future innovations in the India payment corridor:

- Build flexible infrastructure – Design your payment systems with adaptability in mind, allowing you to incorporate new payment rails and methods as they emerge.

- Monitor regulatory developments – Stay informed about changes to India's financial regulations that may impact cross-border payments. The RBI regularly updates guidelines related to international remittances.

- Evaluate provider innovation – When selecting and reviewing API providers, consider their track record of incorporating new technologies and payment methods. Providers investing in innovation will likely deliver more long-term value.

- Participate in industry forums – Engagement with payment industry groups can provide early insights into emerging trends and opportunities in the India corridor.

The future of India-bound payments is likely to be characterized by greater speed, lower costs, and enhanced transparency. Businesses that establish API-based infrastructure now will be well-positioned to benefit from these improvements as they materialize.

Conclusion and Next Steps

Implementing API-based money transfers to India represents a significant opportunity for businesses to improve their payment operations, reduce costs, and enhance the experience for payment recipients. The journey from traditional banking channels to API-powered transfers requires careful planning and execution but delivers substantial returns on investment.

By following the guidance in this article—from understanding regulatory requirements and selecting the right provider to addressing security considerations and navigating technical implementation—you can establish an efficient, reliable payment infrastructure that scales with your business needs.

Assess Your Current Process

Begin by documenting your existing payment workflows, volumes, costs, and pain points. Identify specific metrics you can use to measure improvement after implementation.

Define Requirements

Develop detailed requirements for your API-based solution, considering integration needs, security requirements, compliance considerations, and operational workflows.

Research and Select Providers

Evaluate potential providers based on the criteria outlined in this guide. Request demos, review documentation, and speak with reference customers before making your decision.

Develop Implementation Plan

Create a detailed project plan that includes technical integration, testing, operational process development, and training. Identify key stakeholders and establish clear responsibilities.

Execute in Phases

Implement your solution incrementally, beginning with a limited pilot before full-scale deployment. This approach minimizes risk and allows for adjustments based on early experience.

"The shift to API-based payments isn't just a technical upgrade—it's a strategic business decision that can enhance your operational efficiency, reduce costs, and improve the experience for everyone involved in the payment process."

As you embark on this journey, remember that successful implementation is about more than just technical integration—it requires attention to process, people, and ongoing operations. The investment you make today in establishing robust API-based payment infrastructure will continue to deliver returns as your business grows and as the technology continues to evolve.

Ready to Get Started?

Begin your journey toward more efficient India payments by assessing your current processes and researching potential providers today.

For personalized guidance on implementing API-based money transfers for your specific business needs, consider consulting with a payment integration specialist.

What Businesses Say About API-Based Transfers to India

"After shifting to API-based transfers, our payments have been accepted at major merchants and have been well received by clients. The implementation team was incredibly helpful in solving certain integration challenges for us."

"This partnership with our API provider is an important milestone for us. It means we can now deliver even more value to our customers, helping them navigate the complexities of international payments effortlessly."

"We went from kickoff to having a live product in about 3 months. We've gone from zero to processing millions of transactions together. The technical documentation was excellent and support responsive."

"We had many criteria: the network connectivity, good commercial terms, good after-sales service. Our API provider fulfills every criterion that we have. The transparency in the transaction process has been transformative for our business."

About the Author

A financial technology expert with over 12 years of experience in global payment systems and API integrations. Specializing in cross-border payment infrastructure, the author has helped numerous businesses implement efficient payment corridors to emerging markets, with particular expertise in the India payment ecosystem.

This article was researched and compiled using the latest information from regulatory sources, payment provider documentation, and real-world implementation case studies.

References and Further Reading

- Reserve Bank of India - Know Your Customer (KYC) Direction, 2016

- Forbes - How To Pick The Right Remittance API Provider For Your Business

- Nium - Global Real-Time Payments

- Cashfree Payments - API Banking for Fast-Growing Businesses in India

- Cyrus Technoedge Solutions - Money Transfer API

- Open Banking API Security: Best Practices for Fintechs

- API Banking Security Whitepaper - Aujas Cybersecurity

- World Bank - Case Study: India Fast Payments Toolkit

- API Cost Calculator: How Much Does it Cost to Build an API?

- The Real Cost of API Integration: Numbers Your Developer Won't Tell You

No comments:

Post a Comment