Xoom vs Remitly vs Western Union: 2025 Comparison

Xoom vs Remitly vs Western Union: The Ultimate 2025 Comparison Guide

Find out which international money transfer service offers the best value, speed, and features for your needs

Looking to send money internationally in 2025? With so many options available, choosing the right money transfer service can be overwhelming. This comprehensive comparison guide examines three major players: Xoom (a PayPal service), Remitly, and Western Union. We'll analyze their fees, exchange rates, transfer speeds, and usability to help you make an informed decision.

International money transfer services have evolved significantly in recent years, with digital options becoming increasingly popular. Whether you're supporting family back home, paying for services abroad, or managing international finances, selecting the right provider can save you significant money and time.

Table of Contents

- Quick Comparison: At a Glance

- Fees & Exchange Rates Analysis

- Transfer Speeds Comparison

- Global Reach & Availability

- User Experience & App Features

- Security & Reliability

- Customer Service Comparison

- Special Features & Benefits

- User Reviews & Ratings

- Best For: Ideal Use Cases

- Conclusion & Recommendations

Xoom

PayPal Service

Xoom is PayPal's international money transfer service, offering transfers to 130+ countries with multiple delivery options including bank deposits, cash pickup, and bill payments.

Remitly

Digital Remittance Service

Remitly specializes in immigrant-focused money transfers from 17 developed countries to 50+ developing nations, with competitive rates and fast delivery options.

Western Union

Traditional Transfer Giant

Western Union is one of the oldest and largest money transfer services, with over 200 countries served and 500,000+ agent locations worldwide for both digital and in-person transfers.

Quick Comparison: At a Glance

| Features | Xoom | Remitly | Western Union |

|---|---|---|---|

| Send From | US, Canada, UK, Eurozone | 17 countries (US, UK, Canada, Australia, Singapore, etc.) | 200+ countries |

| Send To | 130+ countries | 50+ countries (focus on developing nations) | 200+ countries |

| Typical Fees | $0-$4.99 fixed fee + 0.4-3% exchange rate markup | $1.99-$3.99 fixed fee + 0.5-3.5% exchange rate markup | $0-$35 fixed fee + 1-3% exchange rate markup |

| Fast Transfer Speed | Minutes to hours | Minutes (Express) | Minutes (Money in Minutes) |

| Economy Transfer Speed | 3-5 business days | 3-5 business days | 2-5 business days |

| Payment Methods | Bank account, Credit/Debit card, PayPal balance | Bank account, Credit/Debit card | Bank account, Credit/Debit card, Cash (in-person) |

| Delivery Methods | Bank deposit, Cash pickup, Home delivery, Mobile wallet, Bill payment | Bank deposit, Cash pickup, Mobile wallet | Bank deposit, Cash pickup, Mobile wallet |

| Trustpilot Rating | 1.6/5 (23,000+ reviews) | 4.6/5 (70,000+ reviews) | 3.9/5 (25,000+ reviews) |

| Maximum Transfer Limit | $50,000 USD/transaction (varies by country) | $30,000 USD/transaction (varies by country) | $50,000 USD/transaction (varies by country) |

Source: Project Untethered Comparison Chart

Fees & Exchange Rates Analysis

When comparing money transfer services, both upfront fees and hidden costs in exchange rates significantly impact the total cost. Here's a detailed analysis of how Xoom, Remitly, and Western Union stack up in 2025:

Xoom Fee Structure

- Fixed Fees: Typically range from $0 to $4.99 depending on amount sent, destination country, and payment method.

- Exchange Rate Markup: Xoom adds a 0.4% to 3% margin on the mid-market exchange rate, with higher markups on less common currency pairs.

- Payment Method Impact: Using a credit/debit card typically costs more than funding from a bank account or PayPal balance.

- Special Promotion: $0 transfer fee on first transaction for new customers in 2025.

"Xoom, which is owned by PayPal, charges a fee of 1% on all transactions up to $999, and $10 on transactions of $1,000 or more when sending from a bank account."

Remitly Fee Structure

- Fixed Fees: Standard service fees range from $1.99 to $3.99 for transfers under $1,000.

- Exchange Rate Markup: Typically between 0.5% to 3.5%, varying by currency pair and transfer amount.

- Express vs. Economy: Express transfers (minutes) cost more than Economy transfers (3-5 days).

- Credit Card Fee: Additional 3% fee for transfers funded by credit cards.

- Fee Waiver: Service fees may be waived for transfers over $1,000 or based on specific currency corridors.

"For example, for a $1,000 transfer using a credit card as a new customer from the U.S. to Mexico on March 18, 2025, the fee was $1.99 ($3.99 for subsequent transfers), but was subtracted as a new customer discount. An additional credit card fee of $31.99 was also charged."

Western Union Fee Structure

- Fixed Fees: Highly variable, ranging from $0 to $35 depending on transfer amount, destination, and delivery method.

- Exchange Rate Markup: Typically 1% to 3% above mid-market rate, with higher markups for less common corridors.

- In-Person vs. Online: In-person transfers at WU locations typically cost more than online transfers.

- Cash Pickup Premium: Sending for cash pickup usually costs more than bank deposits.

- Domestic Transfers: $20-$35 for domestic transfers within the US.

"Transfer fees typically start at GBP 0 or USD 0.99, with higher fees ranging from GBP 5 to 50 or more. Western Union fees vary by country, amount, and delivery method."

Real-World Cost Example (2025)

Let's compare the costs of sending $500 USD to a bank account in the Philippines:

| Provider | Upfront Fee | Exchange Rate (USD/PHP) | PHP Received | Effective Total Cost |

|---|---|---|---|---|

| Xoom | $2.99 | 55.21 | 27,328.95 | $11.23 (2.25%) |

| Remitly | $3.99 | 55.87 | 27,656.65 | $7.44 (1.49%) |

| Western Union | $0.00 | 54.95 | 27,475.00 | $9.12 (1.82%) |

| Mid-market rate | - | 56.71 | 28,355.00 | - |

* Rates are illustrative and may vary. The mid-market rate represents the true exchange rate without markups.

Key Findings: Fees and Rates (2025)

- Best for Small Transfers ($0-$300): Remitly typically offers better overall value when factoring in both fees and exchange rates.

- Best for Medium Transfers ($300-$1000): Western Union can be competitive when sending to major corridors with their $0 fee promotions.

- Best for Large Transfers ($1000+): None of these three are ideal for large transfers; specialized forex services would be better.

- Hidden Costs: All three providers make a significant portion of their revenue from exchange rate markups rather than upfront fees.

Transfer Speeds Comparison

Speed can be critical when sending money internationally. Here's how the three services compare in terms of transfer times in 2025:

Xoom Transfer Speeds

- Fast Option: As quick as minutes for cash pickups and mobile wallet transfers

- Bank Deposits: Usually within hours, but can take 1-2 business days depending on the receiving bank

- Economy Option: 3-5 business days for bank-to-bank transfers

- Bill Payments: Usually processed within 24 hours

Remitly Transfer Speeds

- Express Service: Within minutes for cash pickups and select bank deposits

- Economy Service: 3-5 business days for bank-to-bank transfers

- Mobile Wallets: Usually within minutes to a few hours

- Satisfaction Guarantee: Refund of transfer fee if money doesn't arrive as scheduled

Western Union Transfer Speeds

- Money in Minutes: Available for pickup at agent locations within minutes

- Next Day Service: Available for pickup next business day

- Direct to Bank: 2-5 business days for bank deposits

- Mobile Money Transfer: Within minutes to supported mobile wallets

Factors Affecting Transfer Speed

Service-Specific Factors

- Selected delivery method (cash vs. bank deposit)

- Payment method (card payments are faster than bank transfers)

- First-time vs. repeat transfers (first transfers may include verification)

- Transfer amount (larger amounts may require additional verification)

- Service level selected (express vs. economy)

External Factors

- Banking hours and weekends in destination country

- Local holidays in sending or receiving countries

- Recipient bank processing times

- Compliance and security checks

- Destination country's financial infrastructure

| Transfer Type | Xoom | Remitly | Western Union |

|---|---|---|---|

| Cash Pickup (Fastest) | Minutes | Minutes | Minutes |

| Bank Deposit (Card Funded) | Within hours to 1 day | Minutes to hours (Express) | 1-2 days |

| Bank Deposit (Bank Funded) | 3-5 days | 3-5 days (Economy) | 2-5 days |

| Mobile Wallet | Minutes to hours | Minutes to hours | Minutes |

Speed Verdict (2025)

All three services offer comparable speeds for their fastest options, with transfers available within minutes for cash pickups. For bank deposits, Remitly's Express service tends to be the fastest, often crediting accounts within hours, while Xoom and Western Union typically take longer for bank-to-bank transfers. However, actual speeds vary significantly by corridor and can change based on numerous factors.

Global Reach & Availability

The geographic coverage of each service can be a deciding factor, especially if you're sending to less common destinations.

Xoom Coverage

Send from:

- United States

- Canada

- United Kingdom

- Eurozone countries

Send to:

- 130+ countries worldwide

- Strong coverage in Latin America

- Good coverage in Asia

- Expanding presence in Africa

Special Features:

- Bill payment services in select countries

- Mobile top-ups in many countries

- Cash delivery to home in select locations

Remitly Coverage

Send from:

- 17 developed countries including:

- United States, United Kingdom

- Australia, Canada, Singapore

- European countries: Germany, France, Italy, etc.

Send to:

- 50+ developing countries

- Strong focus on immigrant corridors

- Excellent coverage in Philippines, India, Mexico

- Growing presence in Africa

Special Features:

- Specialized in immigrant remittance corridors

- Over 140,000 cash pickup locations

- Mobile wallet integration in select markets

Western Union Coverage

Send from:

- 200+ countries and territories

- Both online and agent locations

- 57,000+ sending locations in US alone

- Broadest sending network globally

Send to:

- 200+ countries and territories

- 500,000+ agent locations worldwide

- Unmatched global network

- Coverage in remote and developing areas

Special Features:

- Most extensive cash pickup network

- Physical locations available worldwide

- Service available in rural and remote areas

Key Geographic Strengths (2025)

| Region | Best Overall Coverage | Best Value | Special Notes |

|---|---|---|---|

| Latin America | Western Union | Xoom | Xoom has specialized services for Mexico, Brazil, and Colombia |

| Southeast Asia | Western Union | Remitly | Remitly offers excellent rates to Philippines and Vietnam |

| South Asia | Western Union | Remitly | Remitly shines with India transfers; Xoom added UPI payments |

| Africa | Western Union | Western Union | Western Union has unmatched network in Africa |

| Europe | Western Union | Xoom | All three have good coverage in major European countries |

| Middle East | Western Union | Western Union | Western Union offers the most reliable service in this region |

Coverage Verdict (2025)

Western Union remains the undisputed leader in global coverage with its presence in over 200 countries and extensive agent network. For specialized corridors, especially from developed to developing nations, Remitly offers competitive rates and excellent service. Xoom provides good coverage from its limited sending countries to 130+ receiving countries, with particularly strong service in Latin America.

User Experience & App Features

The convenience and ease of use can significantly impact your money transfer experience. Here's how the three services compare in terms of user experience in 2025:

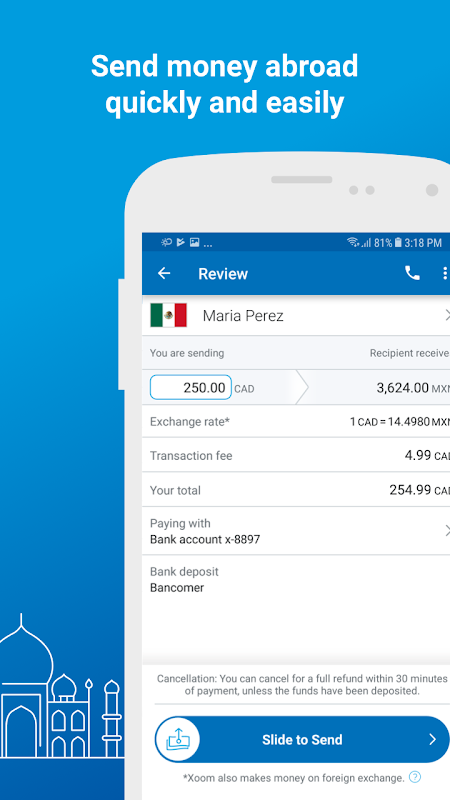

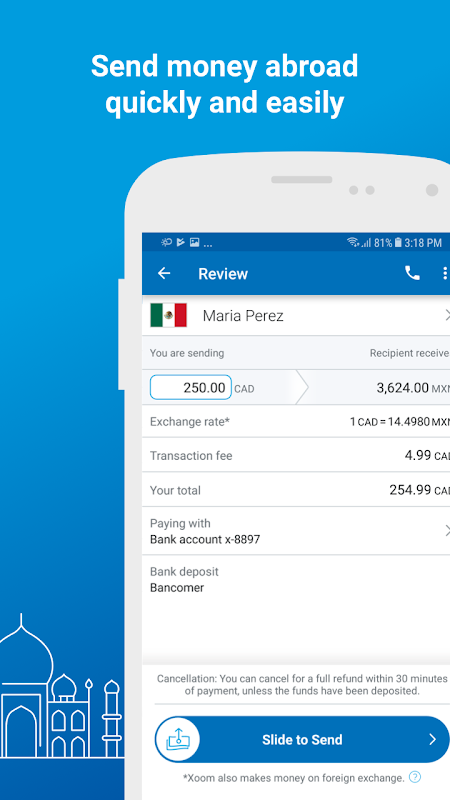

Xoom User Experience

Mobile App

Clean and intuitive PayPal-integrated interface

Language Support

Available in 15 languages

Recurring Transfers

Easy setup for regular payments

Recipient Management

Simple recipient addition and management

PayPal Integration

Seamless connection with PayPal accounts

Pros

- Clean, intuitive interface

- Quick transfer setup

- PayPal integration

- Bill payment options

- Multilingual support

Cons

- Some users report account freezes

- Verification process can be cumbersome

- Limited sending countries

- Customer service response time

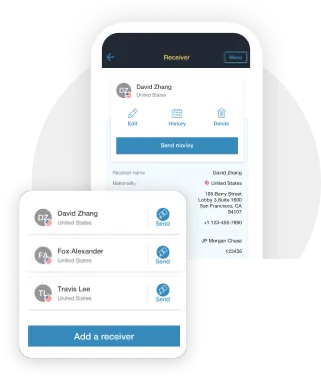

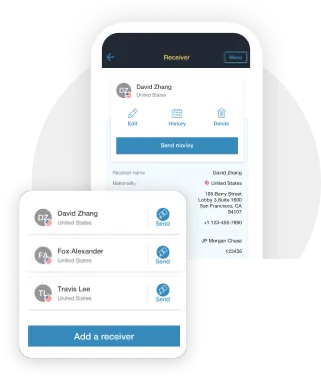

Remitly User Experience

Mobile App

Highly rated app with simple, focused design

Language Support

Available in 11 languages

Transfer Notifications

Real-time alerts and status updates

Customer Support

24/7 multilingual support

WhatsApp Integration

Send money directly through WhatsApp

Pros

- Streamlined, purpose-built interface

- Excellent tracking and notifications

- 24/7 customer support

- Clear distinction between Express and Economy

- WhatsApp integration for transfers

Cons

- Limited to specific country corridors

- Occasional transfer delays during high volume

- Verification can be strict for large transfers

- No transfers between sending countries

Western Union User Experience

Mobile App

Feature-rich app with global functionality

Location Finder

Easy to locate nearest agent

Digital Options

QR code transfer capability

Hybrid Experience

Start online, complete in-person

Payment Options

Supports Apple/Google Pay

Pros

- Powerful agent location finder

- Multiple delivery and payment options

- Streamlined repeat transfers

- Digital/physical hybrid capabilities

- Reliable tracking system

Cons

- Interface can feel dated compared to competitors

- Occasional app performance issues

- Less intuitive fee structure

- Customer service quality varies by region

2025 UX Innovations

Xoom Innovations

- PayPal stablecoin (PYUSD) integration for zero-fee transfers

- Enhanced bill payment options in more countries

- Voice-assistant compatibility for quick transfers

- Advanced fraud detection with AI monitoring

Remitly Innovations

- Virtual Assistant via WhatsApp for transfers

- Circle App for no-fee global spending

- Enhanced biometric verification

- Interac e-Transfer integration in Canada

Western Union Innovations

- Digital Banking platform in select markets

- Cross-border payments via Google Pay

- Zero-fee humanitarian corridors

- Enhanced cross-border payment tracking

Security & Reliability

Security is paramount when sending money internationally. Here's how these three services protect your funds and information:

Xoom Security Features

- Encryption: 128-bit data security encryption

- Authentication: 2-factor authentication for account access

- Monitoring: 24/7 fraud monitoring systems

- Regulation: Licensed as a money transmitter in the US

- Guarantees: Money-back guarantee if funds don't arrive

- Corporate Backing: PayPal subsidiary with strong financial stability

- ID Verification: Recipients must provide ID for cash pickup

- Privacy: Strict data protection policies

Remitly Security Features

- Encryption: 256-bit SSL encryption

- Authentication: Two-factor authentication

- Monitoring: Automated and manual fraud detection

- Regulation: Licensed money transmitter in US, regulated by FCA (UK), Central Bank of Ireland (Europe)

- Guarantees: 100% satisfaction guarantee with refunds for delayed transfers

- Transaction Verification: Multiple verification steps for larger transfers

- ID Verification: Required ID for both sender verification and cash pickup

- Recognition: Named "Most Secure International Transfer App 2025"

Western Union Security Features

- Encryption: Advanced encryption for all data transmission

- Authentication: Multi-factor authentication options

- Monitoring: Extensive fraud monitoring and anti-money laundering systems

- Regulation: Regulated in all operating jurisdictions worldwide

- History: 170+ years of money transfer experience

- Compliance: Rigorous compliance practices and partnerships with law enforcement

- ID Verification: Strict ID requirements for both sending and receiving

- Fraud Protection: Dedicated fraud prevention teams worldwide

Security Comparison

| Security Aspect | Xoom | Remitly | Western Union |

|---|---|---|---|

| Data Encryption | 128-bit | 256-bit | Advanced Encryption |

| Regulatory Compliance | Strong | Very Strong | Extremely Strong |

| Account Verification | Good | Very Good | Excellent |

| Money-Back Guarantee | Yes | Yes, with refund of fees | Yes, with conditions |

| Fraud Prevention System | Advanced | Advanced | Industry-leading |

Security Verdict (2025)

All three services maintain high security standards, with Western Union setting the industry benchmark due to its long history and extensive compliance infrastructure. Remitly has been recognized for its secure app and strong verification processes, while Xoom benefits from PayPal's established security protocols. For the average user, all three provide adequate protection, though Western Union's experience gives it a slight edge for high-value transfers.

Customer Service Comparison

Quality customer support can be crucial, especially when dealing with issues related to international transfers. Here's how these three services compare in customer service:

User Reviews: What People Are Saying

Xoom User Reviews

"Xoom is one of the best ways that I have found to quickly and easily send money to anyone anywhere, you can deposit it right into their account by just following their easy steps."

— Kurt Edward B.

"I have made two international transfers to myself (USA to Europe) and both gave a good rate and the latest this morning was completed bank to bank in 3 hours. That is frankly unbelievable."

— Alan O.

"Worst experience ever. My transfer has been stuck for days with no explanation. Customer service is unreachable."

— Maria S.

Remitly User Reviews

"I've used several other companies throughout the years to send money and Remitly is by far the best. Their customer service is great. You can actually speak to a live person when you need them."

— Maggie M.

"Efficient, easy to use and low cost. That's all one really wants in a service like this."

— Rob K.

"My account was unexpectedly locked after several transfers. Took three days to resolve despite their 24/7 support claim."

— Jamal T.

Western Union User Reviews

"Western Union has been my go-to for sending money to my family in rural Colombia for years. No other service reaches their village."

— Carlos M.

"The app has improved significantly in 2025. Much faster and easier to use than before. Transfers to India are consistently reliable."

— Priya J.

"The fees are just too high compared to other services, especially for small amounts. Been a customer for years but considering switching."

— David L.

Customer Service Verdict (2025)

Remitly clearly leads in customer service with its 24/7 availability, short wait times, and consistently high ratings. Western Union benefits from its extensive network and multilingual support but suffers from longer response times. Xoom's customer service appears to be the most problematic area, with mixed reviews and longer wait times, despite offering support in many languages.

Special Features & Benefits

Beyond the basics of sending money, these services offer unique features that might make one a better fit for your needs:

Xoom Special Features

-

Bill Payments

Pay utility bills directly in select countries including Mexico, Guatemala, El Salvador, Colombia, and the Philippines.

-

Mobile Reloads

Top up prepaid mobile phones internationally with competitive rates.

-

PayPal Integration

Seamless transfers from PayPal balances and easy account management for PayPal users.

-

Home Delivery

Cash delivered directly to recipient's home in select countries like the Philippines and Dominican Republic.

-

PYUSD Support

Send using PayPal's stablecoin with zero transfer fees.

Remitly Special Features

-

Price Promise Guarantee

Your recipient gets the exact amount promised or Remitly refunds your fees.

-

Delivery Promise

Money arrives by the promised time or you get your transfer fee back.

-

WhatsApp Integration

Send money and manage transfers directly through WhatsApp with virtual assistant.

-

Remitly Circle App

Multi-currency account allowing sending, storing, and spending with no fees globally.

-

Simplified Verification

Quick account verification process for immigrant communities.

Western Union Special Features

-

Global Network

Unmatched network of 500,000+ agent locations in 200+ countries and territories.

-

Digital Banking

Multi-currency digital banking platform in select markets with international account features.

-

WU+ Membership

Premium membership program offering discounted fees and exclusive exchange rates.

-

Hybrid Transfers

Start transfers online and complete them at agent locations, or vice versa.

-

Humanitarian Initiatives

Zero-fee transfers to crisis regions and disaster areas.

Unique Value Propositions

Each service has carved out unique strengths in the international money transfer market. Xoom excels with utility bill payments and PayPal integration, Remitly stands out for its strong focus on immigrant communities and guaranteed delivery times, while Western Union's unparalleled global network and physical presence remain its greatest advantage, particularly for cash transfers to remote areas.

Best For: Ideal Use Cases

Based on our comprehensive comparison, here are the scenarios where each service shines:

Xoom is Best For:

- PayPal Users: The seamless integration with PayPal accounts makes Xoom the obvious choice for existing PayPal customers.

- Bill Payments: If you need to pay utilities or other bills in countries like Mexico, Philippines, or Colombia, Xoom's direct bill payment service is unmatched.

- Mobile Top-ups: For sending small amounts to reload mobile phones internationally, Xoom offers competitive rates.

- Latin America Transfers: Xoom has particularly strong service and competitive rates for transfers to Latin American countries.

- Urgent Small Transfers: For sending smaller amounts quickly with a credit card, Xoom provides fast service with reasonable fees.

Remitly is Best For:

- Immigrants Supporting Family: Specifically designed for immigrants in developed countries sending money back home.

- Philippines, India & Mexico Transfers: Particularly competitive rates and service for these major corridors.

- First-time Users: Simple, intuitive interface and dedicated customer support make it ideal for first-time senders.

- Delivery Guarantees: If you need reliability and guaranteed delivery times, Remitly's satisfaction guarantees provide peace of mind.

- WhatsApp Users: The integration with WhatsApp makes transfers convenient for regular users of the messaging app.

Western Union is Best For:

- Remote Location Transfers: Unmatched for sending money to remote or rural areas with limited banking infrastructure.

- Cash Pickups: The extensive agent network makes it ideal when recipients need physical cash.

- African Transfers: Superior coverage and reliability for transfers to African nations.

- High-Value Transfers: Better infrastructure and security for handling larger amounts (though specialized forex services may offer better rates).

- In-Person Service: For those who prefer face-to-face transactions and assistance with the transfer process.

Conclusion & Recommendations

Final Verdict: Xoom vs Remitly vs Western Union in 2025

After thoroughly analyzing Xoom, Remitly, and Western Union across multiple factors, we can conclude that there's no single "best" service for everyone. The right choice depends heavily on your specific needs, transfer corridor, and preferences.

Xoom

Rating: 3.5/5

Xoom's strengths lie in its PayPal integration, utility bill payment options, and competitive rates to Latin America. It's an excellent choice for PayPal users and those needing to make bill payments overseas. However, customer service issues and limited sending countries restrict its versatility.

Remitly

Rating: 4.7/5

Remitly stands out with exceptional customer service, competitive rates, and a user-friendly experience specifically designed for immigrants sending money to developing nations. Its delivery guarantees and rapid transfers make it a top choice for reliability and value, especially for transfers to popular corridors.

Western Union

Rating: 4.0/5

Western Union's unmatched global network remains its greatest strength. While often not the cheapest option, its extensive reach, reliability for cash transfers, and ability to serve remote locations make it indispensable for certain transfer needs, especially to underbanked regions.

Our Recommendations:

- For immigrant remittances to major corridors: Remitly offers the best value and service.

- For PayPal users or bill payments: Xoom provides seamless integration and unique utilities.

- For cash pickups in remote locations: Western Union's global network is unbeatable.

- For first-time users: Remitly's straightforward approach and excellent support.

- For high-value transfers: Consider specialized forex services instead of these three.

For most users in 2025, we recommend starting with Remitly due to its excellent balance of competitive rates, user experience, and customer service. For specific use cases like bill payments or transfers to extremely remote locations, Xoom and Western Union respectively offer compelling alternatives.

Remember that exchange rates and fees can vary significantly based on specific transfer details, so it's always worth comparing the actual costs for your specific transfer before making a decision.

Reader Questions

Is Xoom, Remitly or Western Union safest for sending money internationally?

All three services are safe and regulated money transfer providers. Western Union has the longest track record and most extensive security infrastructure, but Remitly and Xoom also maintain strong security standards. For large transfers, Western Union's established protocols might provide additional peace of mind.

How can I avoid fees when sending money internationally?

While it's difficult to avoid fees entirely, you can minimize costs by: comparing services for your specific corridor, funding transfers from bank accounts rather than credit cards, choosing slower economy delivery options, sending larger amounts less frequently, and watching for promotional offers like Xoom's first free transfer or Remitly's discounted first transfer.

Can I send large amounts with these services?

All three services have maximum transfer limits, typically around $10,000-$50,000 per transaction depending on your verification level and the corridor. However, for large transfers, you'd likely get better rates using specialized forex services rather than these consumer-focused remittance platforms.

Post a Comment