From Rs. 18,000 Salary to CROREPATI: Complete PLAN! | Money Matters | INVESTMENT

From Rs. 18,000 Salary to Crorepati

Complete Financial Planning Guide for Young Professionals: Transform Your Modest Income into ₹3.5 Crores

The Journey from Struggle to Financial Freedom

Meet Gourab, a 23-year-old UI/UX designer from Kolkata, earning just Rs. 18,000 per month. Like many young professionals, he faced financial challenges but discovered a proven strategy to build substantial wealth over time.

This comprehensive guide reveals the exact financial planning strategy that can transform a modest salary into Rs. 3.5 crores by age 53, based on real-world insights from Ankur Warikoo's Money Matters series.

Understanding Your Financial Foundation

Monthly Income

₹18,000

In-hand salary after PF & ESI deductions

Monthly Expenses

₹8,500

Travel, groceries, subscriptions & EMI

Available for Investment

₹9,500

After all essential expenses

Monthly Expense Breakdown

The Complete ₹9,500 Allocation Strategy

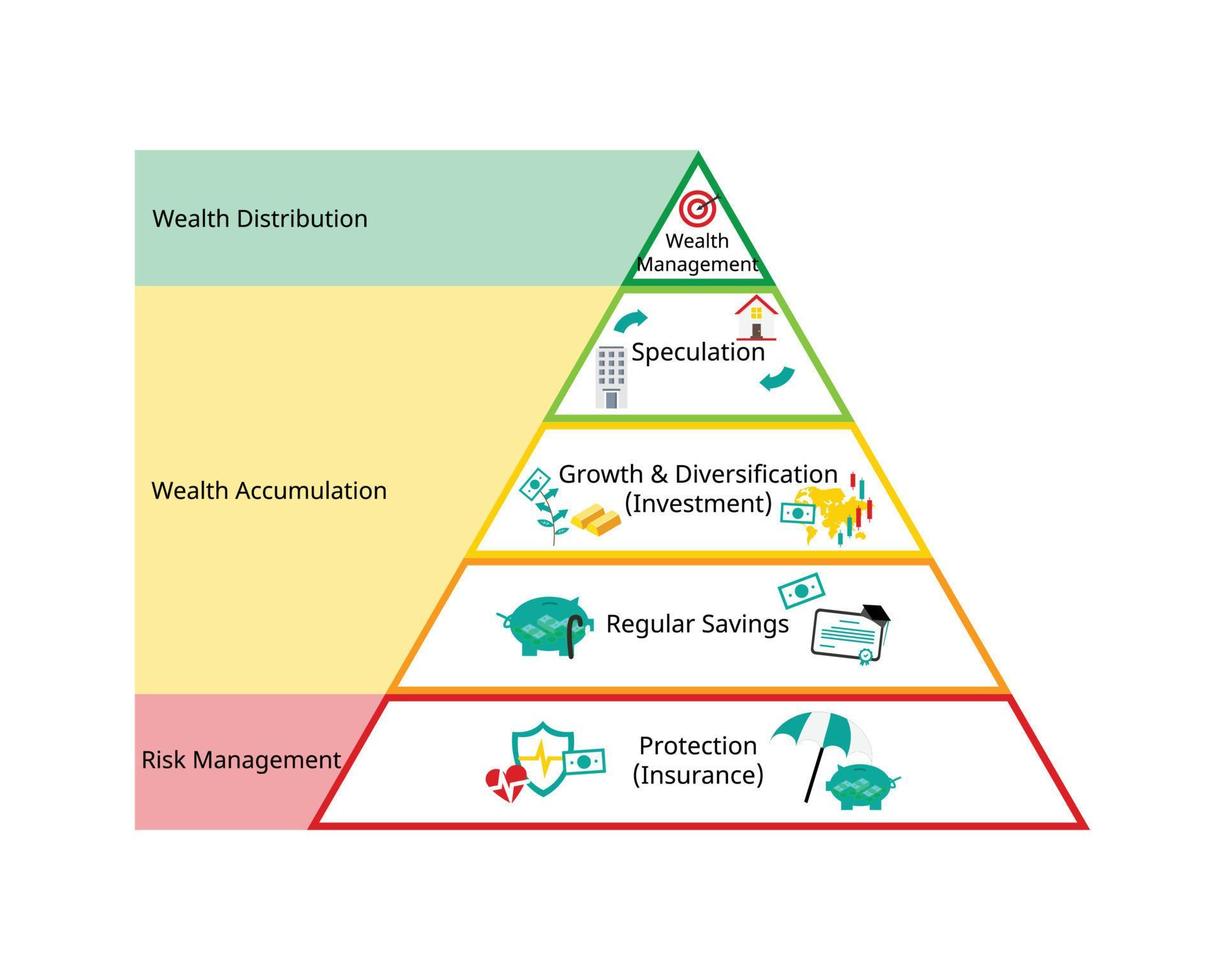

Building Your Financial Pyramid

The key to successful wealth building lies in creating a solid financial foundation. This pyramid approach ensures you're protected while maximizing growth potential.

Foundation Layer: Protection

Emergency fund and health insurance form your safety net

Growth Layer: Investments

Strategic SIP allocation across different risk categories

Flexibility Layer: Personal Fund

Additional savings for life goals and opportunities

Smart Money Allocation Strategy

Emergency Fund

₹2,000

Liquid Mutual Funds

7-7.5% Returns

Health Insurance

₹1,500

Family Coverage

₹4-5 Lakhs

Investment SIP

₹5,000

Equity Mutual Funds

12%+ Returns

Personal Fund

₹1,000

Lifestyle & Goals

Flexible Use

Building Your Emergency Safety Net

Your emergency fund is your financial lifeline. With monthly essential expenses of ₹5,000, you need at least ₹30,000 (6 months) as a safety buffer.

Why Liquid Mutual Funds?

Unlike fixed deposits, liquid funds offer better returns with instant liquidity. Your money grows at 7%+ while remaining accessible for emergencies.

Strategic ₹5,000 SIP Allocation

Large Cap Funds

₹1,500

Low RiskInvests in India's top 50 companies. Provides stable, consistent returns with lower volatility.

Flexi Cap Funds

₹1,500

Medium RiskDiversified across large, mid, and small caps with some international exposure for balanced growth.

Small Cap Funds

₹2,000

High RiskHigh growth potential from small companies. Higher volatility but excellent long-term returns.

Annual SIP Step-Up Strategy

Why Step-Up Your SIP?

- Matches your salary increments

- Protects against inflation

- Accelerates wealth creation

- Helps achieve financial goals faster

Your Wealth Growth Journey

The Power of Compounding

Starting with just ₹5,000 monthly SIP with 5% annual step-up, your disciplined investment approach will compound into substantial wealth over 30 years.

Inflation Adjusted Value

After accounting for 6% inflation and 15% tax, your ₹3.5 crores will have the purchasing power of ₹52 lakhs in today's terms.

Step-by-Step Implementation Guide

Open Your Demat Account

Start your investment journey by opening a demat account. Ensure your Aadhaar is linked to your mobile number for seamless online account opening in just 30 minutes.

Required Documents:

- • Aadhaar Card (linked to mobile)

- • Bank Account Details

- • Income Proof

Secure Health Insurance

Protect your family with a comprehensive health insurance policy covering ₹4-5 lakhs for you, your parents, and grandmother.

Coverage Details:

- • Family Floater Policy: ₹4-5 Lakhs

- • Monthly Premium: ~₹1,500

- • Coverage: You + Parents + Grandmother

Start Emergency Fund SIP

Begin with ₹2,000 monthly SIP in liquid mutual funds to build your emergency corpus of ₹30,000 within 15 months.

Recommended Funds:

- • Liquid Mutual Funds

- • Expected Return: 7-7.5%

- • Redemption: Within 24 hours

Launch Your Investment SIPs

Start your wealth-building journey with diversified SIP allocation across different risk categories for optimal growth.

SIP Allocation:

- • Large Cap: ₹1,500 (Nifty 50 Index)

- • Flexi Cap: ₹1,500 (Parag Parikh)

- • Small Cap: ₹2,000 (Nippon India)

Key Success Factors

Consistency is King

Never skip your monthly SIP. Set up auto-debit to ensure consistent investments regardless of market conditions.

Annual Step-Up

Increase your SIP amount by 5-10% annually to match salary increments and accelerate wealth creation.

Long-Term Vision

Stay invested for the full 30-year journey. Time in the market beats timing the market.

Diversification

Maintain the risk balance across large cap, flexi cap, and small cap funds for optimal returns.

Stay Educated

Keep learning about personal finance and review your portfolio annually with adjustments as needed.

Risk Management

Maintain adequate insurance coverage and emergency fund to protect your investments from life's uncertainties.

Frequently Asked Questions

What if I can't invest the full ₹5,000 initially?

Start with whatever amount you can manage, even ₹1,000. The key is to begin your investment journey. You can gradually increase the amount as your income grows. Remember, consistency matters more than the initial amount.

Should I continue SIP during market downturns?

Absolutely! Market downturns are actually the best time to continue your SIP. When markets are down, you get more units for the same amount, which leads to better long-term returns through rupee cost averaging.

Can I change my fund allocation later?

Yes, you can review and rebalance your portfolio annually. However, avoid frequent changes based on short-term market movements. Stick to your long-term strategy and make changes only when your financial goals or risk profile changes.

What about tax implications on these investments?

Equity mutual fund investments held for more than 1 year qualify for long-term capital gains tax of 10% on gains above ₹1 lakh per year. The calculations in this guide already factor in approximately 15% tax impact on your final corpus.

How often should I review my investment portfolio?

Review your portfolio annually or when major life events occur (marriage, job change, etc.). Avoid checking daily performance as it can lead to emotional decisions. Focus on your long-term goals and stay disciplined.

Ready to Start Your Wealth Journey?

The path from ₹18,000 salary to ₹3.5 crores is clear. Every day you delay is a day lost in the power of compounding. Your future self will thank you for starting today.

Start Small

Begin with any amount you can invest consistently

Stay Consistent

Set up auto-debit for disciplined investing

Think Long-Term

Trust the process and let compounding work

Remember: This is not financial advice but a shared experience from the Money Matters series.

Always consult with SEBI-registered financial advisors for personalized guidance.

Post a Comment