Remitly vs Wise: Best App for Sending Money to India

Remitly vs Wise: Which is the Best App for Sending Money to India in 2025?

A comprehensive comparison to help you choose the right money transfer service

Want to Send Money to India? Here's What You Need to Know

If you're looking to send money to India from abroad, you've probably come across both Remitly and Wise (formerly TransferWise) as popular options. But which one offers better value, faster transfers, and more convenient features?

Both services have their strengths and weaknesses, and the right choice depends on your specific needs, transfer amount, and priorities. This comprehensive comparison examines everything from fees and exchange rates to transfer speeds and user experience to help you make an informed decision.

Article Contents:

Overview of Remitly and Wise

Remitly

Remitly is a digital remittance service founded in 2011, specifically designed for sending money internationally, with a strong focus on immigrant communities. The platform has established itself as a reliable option for those who regularly send money back home to family members in countries like India.

Remitly operates in over 30 countries, allowing users to send money to more than 100 countries worldwide. For sending to India specifically, Remitly offers multiple delivery methods, including bank deposits, cash pickup options, and UPI transfers, making it convenient regardless of the recipient's preferences.

One of Remitly's standout features is its dual transfer options: Economy (slower but cheaper) and Express (faster but with higher fees). The company also frequently offers promotional exchange rates for new customers.

Wise

Wise (formerly TransferWise) was founded in 2011 with a mission to make international money transfers transparent, fair, and accessible. Unlike traditional banks that often hide fees in exchange rate markups, Wise prides itself on using the real mid-market exchange rate.

Wise operates in more than 160 countries and supports 40+ currencies. For India, Wise allows transfers to Indian bank accounts and is authorized by the Reserve Bank of India (RBI) as an Authorised Dealer Category II entity.

A key differentiator for Wise is its multi-currency account feature, which allows users to hold and manage multiple currencies in one account. Wise also supports both incoming and outgoing transfers for Indian users, whereas Remitly only supports sending money to India, not from India to other countries.

Key Features Comparison

| Feature | Remitly | Wise |

|---|---|---|

| Sending from | 30+ countries worldwide | Most countries globally (160+ countries) |

| Sending to India from | 30+ countries including US, UK, Australia, Canada | Most countries globally |

| Sending from India | Not supported | Supported to 50+ countries for education, travel, or medical expenses |

| Delivery methods | Bank deposit, cash pickup, UPI | Bank deposit, UPI |

| Transfer limits | Variable (e.g., 25,000 GBP from UK, 30,000 USD from US) | Up to 100 million INR per transfer for personal transfers; Up to 1.5 million INR per working day for business transfers |

| Multi-currency account | No | Yes, hold and manage 40+ currencies |

| Transfer tracking | Yes, with SMS updates | Yes, with real-time notifications |

| Special features | Promotional rates for new users, remittance insurance | Mid-market exchange rate, borderless account, Wise debit card |

| Business transfers | Not supported (personal transfers only) | Supported with business accounts |

Fees and Exchange Rates

When sending money internationally, the total cost includes both the upfront fee and any markup on the exchange rate. Let's examine how Remitly and Wise structure their fees and rates.

Remitly's Fee Structure

- Variable transfer fee based on amount, payment method, and delivery speed

- Economy transfers typically have lower fees than Express transfers

- Credit card payments often incur higher fees than bank transfers

- Exchange rate includes a markup (typically 0.5% to 3.0% over mid-market rate)

- Often offers promotional rates for first-time users (better exchange rates)

Note: Remitly sometimes advertises "no fee" transfers, but this usually means the fee is built into the exchange rate markup.

Wise's Fee Structure

- Uses the mid-market exchange rate (the one you see on Google)

- Transparent fee structure with upfront fees (no hidden charges)

- Fees typically range from 0.29% to 1.78% of the transfer amount

- Additional small fixed fee that varies by currency

- No special promotional rates - same fair pricing for all customers

Note: While Wise's fees are transparent, they're not always the lowest for small transfers. For larger amounts, Wise often becomes more cost-effective.

Real-World Cost Comparison Example

For sending $1,000 USD to India:

- Remitly: The recipient might receive approximately ₹83,500 with Economy option (3-5 business days) or ₹83,200 with Express option (minutes to hours) after accounting for fees and exchange rate markup.

- Wise: The recipient might receive approximately ₹84,100 after Wise's transparent fee, using the mid-market exchange rate (typically 1-3 business days for delivery).

Note: Actual rates and fees vary based on current exchange rates, payment methods, and ongoing promotions.

The Verdict on Fees and Exchange Rates:

For most transfers to India, especially larger amounts, Wise tends to offer better overall value due to its use of the mid-market exchange rate. However, Remitly's promotional rates for new users and occasional special offers can sometimes make it more cost-effective for specific situations or first-time transfers.

Transfer Speed

How quickly your money reaches India is often a critical factor in choosing a service. Let's compare the transfer speeds of Remitly and Wise:

Remitly Transfer Speed

Remitly offers two delivery speed options:

- Express: Minutes to a few hours (typically under 4 hours)

- Economy: 3-5 business days

The Express option is particularly useful for emergency situations when money needs to reach India quickly. Many users report that Express transfers to Indian banks, especially to major banks, often arrive within minutes.

Note: Express transfers typically have higher fees or less favorable exchange rates compared to Economy transfers.

Wise Transfer Speed

Wise generally offers a single transfer speed option to India:

- Typically 1-3 business days for transfers to India

- Some transfers may complete faster (within 24 hours)

Wise provides an estimated delivery time before you confirm your transfer, allowing you to plan accordingly. While not as fast as Remitly's Express option, Wise transfers are generally reliable and arrive within the estimated timeframe.

Note: Wise doesn't offer an express or instant transfer option specifically for India.

Factors That Affect Transfer Speed:

- Payment method: Credit/debit card payments typically process faster than bank transfers

- Verification requirements: First-time or large transfers may require additional verification

- Banking hours: Transfers may be delayed over weekends or Indian holidays

- Receiving bank: Some Indian banks process incoming transfers faster than others

The Verdict on Transfer Speed:

If speed is your top priority, Remitly's Express option is the clear winner, offering transfers that can complete in minutes. However, if you're not in a rush and prefer getting the best exchange rate, Wise's slightly longer transfer time might be a worthwhile trade-off for the cost savings.

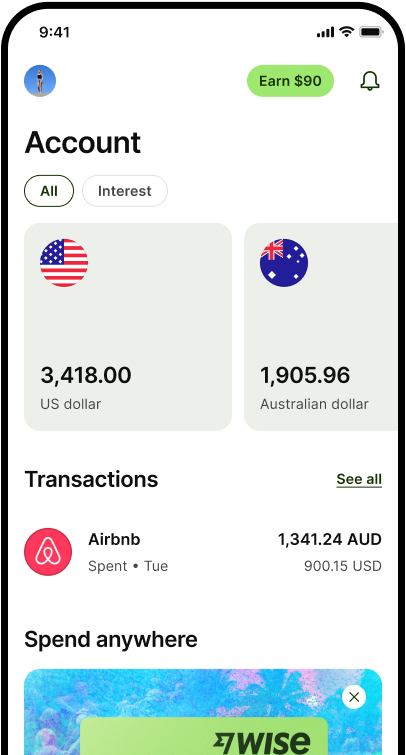

Mobile App Experience

Both Remitly and Wise offer mobile apps for iOS and Android that allow you to send money to India on the go. Let's compare their features and user experience:

Remitly Mobile App

Key App Features:

- Simple, intuitive interface designed for quick transfers

- Easy recipient management with address book integration

- Real-time transfer tracking with SMS notifications

- Option to save payment methods for faster future transfers

- 24/7 in-app customer support with multilingual options

- Ability to schedule recurring transfers

App Store Rating: 4.8/5 (200,000+ reviews)

Google Play Rating: 4.7/5 (300,000+ reviews)

Wise Mobile App

Key App Features:

- Clean, modern interface with comprehensive functionality

- Multi-currency account management in one place

- Detailed fee breakdowns and exchange rate information

- Real-time rate alerts and notifications

- Integration with Wise debit card for spending abroad

- Ability to receive money from abroad (not just send)

App Store Rating: 4.7/5 (150,000+ reviews)

Google Play Rating: 4.5/5 (190,000+ reviews)

App Experience Comparison

| Feature | Remitly App | Wise App |

|---|---|---|

| User Interface | Simple, focused on remittances | More complex, multi-function |

| Ease of First Transfer | Very easy, minimal steps | Slightly more steps for verification |

| Transfer Tracking | Detailed status updates | Basic tracking information |

| Multi-Currency Support | Limited | Extensive |

| Security Features | PIN, biometric, 2FA | PIN, biometric, 2FA |

| Offline Functionality | Limited | Better |

The Verdict on Mobile Apps:

Both apps are well-designed and highly rated, but they serve slightly different purposes. Remitly's app is streamlined specifically for sending money quickly and easily, making it ideal for regular remittances to family in India. Wise's app offers more comprehensive financial management features beyond just transfers, making it better for users who need a complete international money solution.

Pros and Cons of Each Service

Remitly: Pros and Cons

Pros:

- Express transfers can arrive in minutes

- Multiple delivery options including cash pickup and UPI

- Great promotional rates for new customers

- Simpler verification process for smaller transfers

- Excellent SMS tracking and notifications

- Dedicated to serving immigrant communities

- No fees for some transfers (fee built into exchange rate)

Cons:

- Cannot send money from India (only to India)

- Exchange rates include hidden markups

- Higher fees for credit card payments

- Limited business transfer options

- Verification can be stricter for larger amounts

- No multi-currency account features

Wise: Pros and Cons

Pros:

- Uses the real mid-market exchange rate

- Complete transparency in fee structure

- Can send money both to and from India

- Multi-currency account with 40+ currencies

- Higher transfer limits for most countries

- Supports business transfers

- Better for regular international travelers

Cons:

- No instant or express transfer option to India

- No cash pickup option (bank deposits only)

- Can be more expensive for smaller transfers

- More complex verification for first-time users

- Limited customer support options compared to Remitly

- App has more features but steeper learning curve

Key Differentiation Points

- Speed vs. Cost: Remitly offers faster transfers but at a higher cost, while Wise provides better rates but slower transfers

- Transparency: Wise is completely transparent with rates and fees, while Remitly may hide some fees in the exchange rate

- Direction: Wise allows transfers both to and from India, while Remitly only supports sending to India

- Delivery Options: Remitly offers more flexibility with cash pickup options that Wise doesn't provide

- Additional Services: Wise offers a broader financial ecosystem with multi-currency accounts and cards

User Reviews and Experiences

What do real users say about their experiences with Remitly and Wise when sending money to India? Here's a summary of user feedback from various review platforms:

Remitly User Reviews

"Remitly is solid, no issues, have been using it for last 5ish years. Their express option gets the money in your Indian bank account in under 5 minutes." - Reddit user, October 2024

"Remitly is much better when it comes to sending more than $500 and gets money quickly to your Indian account, I am a regular user." - Reddit user, September 2024

"Transactions seem to take way longer than advertised, and the 'guaranteed delivery times' are unreliable. My transfer was delayed by days without clear updates." - Capterra India reviewer

Overall Sentiment:

- Most users praise the speed of Express transfers

- Many appreciate the convenience of mobile app

- Some report issues with customer service

- Occasional complaints about verification process

- High ratings on app stores (4.7+ out of 5)

Wise User Reviews

"Wise works incredibly well. Such an easy platform and app to use. It's clear and straightforward, no hidden stuff or information. It's quick and reliable." - Trustpilot reviewer

"I think it is a good option to transfer money internationally, it works with a wide variety of currencies and handles very low commissions and a favorable conversion rate, transferring money from one country to another quite simple and practical." - Capterra India reviewer

"Wise does not allow personal accounts to receive money internationally i.e., you can't create a balance account in the currency you are receiving." - Reddit user, October 2024

Overall Sentiment:

- Most users appreciate the transparent fees and rates

- Many praise the multi-currency account features

- Some complaints about account verification

- Occasional issues with customer service response times

- Strong Trustpilot rating (4.3 out of 5 from 255,000+ reviews)

What Users Say About Specific Aspects

Customer Service

Remitly: Mixed reviews, but praised for offering multiple language support and 24/7 availability.

Wise: Generally positive but some complaints about slow response times for complex issues.

User Experience

Remitly: Praised for simplicity and focus on making the sending process easy.

Wise: Appreciated for transparency and comprehensive features, though slightly more complex.

Value for Money

Remitly: Good value for express transfers and smaller amounts with promotional rates.

Wise: Better value for larger transfers and users who appreciate the mid-market rate.

Which Service is Right for You?

Based on our comprehensive comparison, here's a guide to help you choose between Remitly and Wise for your specific situation:

Choose Remitly if:

- You need money to arrive in India as quickly as possible

- Your recipient prefers cash pickup options

- You're sending money specifically to family members in India

- You're a first-time user (to take advantage of promotional rates)

- You prefer a simpler interface focused solely on sending money

- You need UPI payment options in India

- You want the option for phone/SMS notifications for your recipient

Choose Wise if:

- You want the best exchange rate (mid-market rate)

- You need complete transparency in fees

- You want to send money from India to other countries

- You regularly deal with multiple currencies

- You need to make business transfers

- You're transferring larger amounts where rate differences matter more

- You want additional features like multi-currency accounts

Specific Scenarios

| If you need to... | Better Option | Why? |

|---|---|---|

| Send emergency money to family | Remitly | Express transfers can arrive in minutes |

| Get the best exchange rate | Wise | Uses the true mid-market rate with transparent fees |

| Send to someone without a bank account | Remitly | Offers cash pickup options throughout India |

| Send money from India abroad | Wise | Remitly doesn't support sending from India |

| Send large amounts (₹1,000,000+) | Wise | Higher limits and better rates for large amounts |

| Make regular monthly transfers | Both work well | Depends on whether you prioritize speed or cost |

| Send money for business purposes | Wise | Offers business accounts with additional features |

Conclusion

Both Remitly and Wise offer excellent services for sending money to India, but they excel in different areas:

Remitly shines when it comes to speed and convenience, particularly with its Express transfer option that can deliver funds to India in minutes. Its multiple delivery methods, including cash pickup, make it versatile for various recipient situations. The service is especially valuable for people sending money to family members who might need quick access to funds.

Wise stands out for its transparency and value, using the real mid-market exchange rate and clearly disclosing all fees upfront. Its multi-currency account features and ability to send money both to and from India make it a more comprehensive international money solution. For larger transfers where exchange rate differences significantly impact the amount received, Wise often provides better value.

Ultimately, the best choice between Remitly and Wise depends on your specific priorities: if you value speed and flexible delivery options, Remitly may be your best bet; if you prioritize getting the best exchange rate and transparency, Wise might be more suitable.

Our Recommendation:

Consider using both services based on your specific needs at different times. Many users maintain accounts with both Remitly and Wise, using Remitly when speed is critical and Wise when getting the best rate is the priority. This approach gives you the flexibility to always choose the optimal service for each specific transfer to India.

Remember to compare the actual rates and fees for your specific transfer amount, payment method, and destination in India before making a decision, as these can vary over time and with promotions.

Post a Comment