How to Send Money from USA to India Without Fees (2025 Guide)

How to Send Money from USA to India Without Fees: Complete 2025 Guide

Discover the smartest ways to transfer money without paying unnecessary charges

Source: Vance

Sending money from the United States to India is common for millions of people, but the fees associated with international transfers can significantly reduce the amount your recipients actually receive. Fortunately, there are several legitimate ways to avoid these fees entirely or minimize them to nearly zero.

In this comprehensive guide, we'll explore all the available options for fee-free money transfers from USA to India, explain hidden charges to watch out for, and provide practical steps to ensure your hard-earned money reaches your loved ones without unnecessary deductions.

Table of Contents

- Understanding Money Transfer Fees

- Beware of Hidden Charges

- 6 Methods to Send Money Without Fees

- Comparison of Top Money Transfer Services

- Using NRE Accounts for Fee-Free Transfers

- Digital Wallet Solutions

- First-Time Transfer Promotions

- Cryptocurrency Transfers: Benefits and Risks

- Getting the Best Exchange Rates

- Tax Implications to Consider

- Frequently Asked Questions

Understanding Money Transfer Fees

Before diving into methods to avoid fees, it's important to understand the different types of charges typically associated with international money transfers:

Transfer Fees

These are straightforward charges that providers levy for processing your transaction. They can be flat fees (e.g., $5 per transaction) or percentage-based (e.g., 1% of the transfer amount). Some services advertise "no transfer fees" but make up for it with unfavorable exchange rates.

Exchange Rate Markups

This is where most providers make their profit. Instead of charging the mid-market rate (the real exchange rate you see on Google), they offer a less favorable rate, typically 2-5% worse than the actual rate. This hidden markup can cost you more than explicit fees.

Intermediary Bank Fees

For traditional wire transfers, multiple banks may be involved in routing your money. Each intermediary bank can deduct a fee from your transfer amount, typically ranging from $10-$50 per intermediary.

Receiving Bank Fees

Some Indian banks charge a fee for receiving international transfers, which can range from ₹100-₹300 per transaction. This is usually deducted from the transferred amount before it reaches the recipient.

Source: Prime Wealth

6 Methods to Send Money Without Fees

NRE Account Transfers

Non-Resident External (NRE) accounts allow for fee-free transfers from the US to India for NRIs. These accounts are specifically designed for this purpose and often come with zero inward remittance charges.

First-Time User Promotions

Many services like Remitly, Western Union, and Xoom offer zero-fee first transfers with good exchange rates. By strategically using these promotions, you can avoid fees on multiple transfers.

Digital Wallet Options

Services like Wise, Revolut and Instarem offer competitive exchange rates with minimal or no fees for digital wallet transfers. They're often cheaper than traditional bank transfers.

P2P Transfer Networks

Peer-to-peer services match people sending money in opposite directions, eliminating international transfer fees. This can result in better rates and lower fees.

High-Value Transfer Waivers

Many services waive fees for transfers above certain amounts (usually $1,000 or more). Consider consolidating smaller transfers into larger ones to qualify for these waivers.

Cryptocurrency Transfers

While requiring more technical knowledge, crypto transfers can bypass traditional banking fees. However, consider exchange fees and tax implications in both countries.

Comparison of Top Money Transfer Services

| Service | Transfer Fee | Exchange Rate Markup | Free Transfer Option | Transfer Speed | Best For |

|---|---|---|---|---|---|

| Wise | $1.99 - $5 (varies by amount) | 0% (mid-market rate) | No free option | 1-2 business days | Transparent pricing, best overall exchange rates |

| Remitly | $0 - $3.99 | 1-2% | First transfer free | 3-5 days (Economy), Minutes (Express) | Fast transfers, first-time users |

| Xoom (PayPal) | $0 - $4.99 | 2-3% | Free for transfers over $500 | Minutes - 1 business day | Fast transfers, PayPal users |

| Western Union | $0 - $5 | 2-4% | First digital transfer free | 0-6 business days | Cash pickup options, widespread availability |

| ICICI Money2India | $0 for transfers above $1,000 | 1-2% | Free for high-value transfers | 1-2 business days | NRIs with ICICI accounts |

| Instarem | $0 - $3 | 0.5-1% | First transfer free | 1-2 business days | Good balance of fees and exchange rates |

| Revolut | $0 between Revolut users | 0-1% (depends on plan) | Free Revolut-to-Revolut transfers | Instant to 3 days | Transfers between Revolut users |

| Bank Wire Transfer | $25-$50 | 3-5% | No free option | 3-5 business days | Large transfers (over $10,000) |

Recommendation

For the best overall value when sending money to India, Wise typically offers the most transparent pricing with the mid-market exchange rate, though they do charge an upfront fee. For completely fee-free transfers, look for first-time promotions from Remitly or Western Union, or use ICICI Money2India for transfers over $1,000.

Using NRE Accounts for Fee-Free Transfers

Non-Resident External (NRE) accounts are special accounts designed for Indians residing abroad who earn in foreign currency. These accounts offer significant advantages for sending money to India without fees:

- No inward remittance fees: Most banks don't charge for receiving money into NRE accounts from abroad.

- Tax benefits: Interest earned in NRE accounts is tax-free in India.

- Full repatriability: Money in NRE accounts can be freely transferred back to the US without restrictions.

- No limit on transfers: There are no upper limits on how much money you can send to your NRE account.

Steps to set up and use an NRE account:

- Choose an Indian bank that offers NRE accounts (HDFC, ICICI, SBI, and Axis Bank are popular options).

- Complete the account application with required documentation (passport, visa, proof of address in the US, PAN card).

- Set up online banking access for your NRE account.

- Initiate a transfer from your US bank to your NRE account using the SWIFT code and account details.

- For regular transfers, set up automatic transfers through your bank's online system.

Major Banks Offering NRE Accounts

- HDFC Bank: Zero inward remittance fees, competitive exchange rates

- ICICI Bank: Free transfers with Money2India service for amounts above $1,000

- State Bank of India: Extensive branch network, good for cash withdrawals in India

- Axis Bank: No charges on inward remittances, good online banking interface

- Kotak Mahindra Bank: Premium banking services for high-value NRI accounts

Digital Wallet Solutions

Digital wallets and fintech platforms have revolutionized international money transfers by cutting out traditional banking intermediaries, resulting in lower fees and better exchange rates. Here are some top digital wallet options for USA to India transfers:

- Wise: Formerly TransferWise, offers mid-market exchange rates with transparent upfront fees.

- Revolut: Free transfers between Revolut users; competitive rates for bank transfers.

- Instarem: Offers loyalty points (InstaPoints) that can be redeemed for future transfers.

- Remitly Circle: Newer service offering no-fee transfers with good exchange rates.

- Unplex: Send money globally through WhatsApp with zero fees and live exchange rates.

Source: Native Teams

Important Note on Digital Wallets

While digital wallets often offer better rates than traditional banks, not all of them provide true "zero fee" transfers. Some make money on exchange rate markups instead. Always compare the total amount that will be received in INR rather than just looking at the fee structure.

Most digital wallets work through mobile apps and require verification of your identity before you can start sending money. The typical process involves:

- Download the app and create an account

- Complete identity verification (usually with a photo ID and proof of address)

- Link your US bank account or debit card

- Add your recipient's bank details in India

- Initiate the transfer and track it through the app

Pro Tip: Direct to UPI

Some digital wallets now support direct transfers to UPI IDs in India, which can be faster and more convenient than traditional bank transfers. Services like Wise allow you to send money directly to any UPI ID in India.

First-Time Transfer Promotions

Many money transfer services offer special promotions to attract new customers. These typically include zero transfer fees and sometimes even promotional exchange rates. Here's how you can take advantage of these offers:

Current First-Time Offers (2025)

- Remitly: No fees on your first transfer + promotional exchange rate

- Western Union: No transfer fees on your first digital transfer up to $5,500

- Xoom: $0 fee on your first transfer when sending $500+

- Instarem: First transfer with zero fees

- MoneyGram: 20% off fees for new users who join MoneyGram Plus Rewards

Maximizing First-Time Offers

If you need to make multiple transfers, consider these strategies:

- Use different services for each transfer to take advantage of multiple "first-time" promotions

- If you have a spouse or partner, they can sign up for separate accounts with the same services

- Use different payment methods (bank account vs. debit card) when available

- Look for seasonal promotions during Diwali, Holi, or other major Indian festivals

Watch for Recurring Requirements

Some services offer "first free transfer" promotions but may require you to maintain regular activity or meet certain conditions to continue getting preferential rates. Always read the terms and conditions of promotional offers.

Cryptocurrency Transfers: Benefits and Risks

Cryptocurrency transfers offer an alternative method to send money internationally with potentially lower fees. However, they come with their own complexities and considerations, especially given India's evolving regulations on crypto assets.

How Crypto Transfers Work

- Purchase cryptocurrency (like Bitcoin, Ethereum, or stablecoins like USDC) on a US exchange

- Transfer the crypto to the recipient's wallet or directly to an Indian crypto exchange

- The recipient converts the cryptocurrency to INR and withdraws to their Indian bank account

Advantages

- Low transfer fees: Many crypto networks have lower fees than traditional bank transfers

- Speed: Transfers can be completed in minutes rather than days

- No intermediaries: Direct peer-to-peer transfers without banks

- 24/7 availability: No restrictions based on banking hours or holidays

Risks and Considerations

- Tax implications: 30% tax on crypto income in India, plus 1% TDS on transactions above ₹50,000

- Price volatility: Value can fluctuate during the transfer process (stablecoins reduce this risk)

- Technical complexity: Requires understanding of wallets and exchanges

- Regulatory uncertainty: India's crypto regulations continue to evolve

Best Practices for Crypto Transfers

- Use stablecoins: Coins like USDC or USDT maintain their value relative to USD

- Choose low-fee networks: Networks like Stellar, Solana, or Polygon have lower fees than Bitcoin or Ethereum

- Verify exchange availability: Ensure the recipient can access a reliable exchange in India

- Consider tax documentation: Keep records of all transactions for tax compliance

- Start with small amounts: Test the process before sending large sums

Legal Considerations

Always ensure compliance with both US and Indian regulations regarding cryptocurrency transfers. Report transactions as required by tax authorities in both countries.

Getting the Best Exchange Rates

Even when you find a fee-free transfer option, getting a poor exchange rate can cost you significantly. Here's how to ensure you're getting the best possible USD to INR exchange rate:

- Check the mid-market rate: Use sites like XE.com or Google to see the current mid-market exchange rate before making a transfer.

- Compare total amounts received: Focus on how many rupees will actually arrive in India, not just the advertised rate.

- Avoid weekend transfers: Exchange rates are often worse on weekends when markets are closed.

- Consider rate locks: Some services allow you to lock in an exchange rate for future transfers.

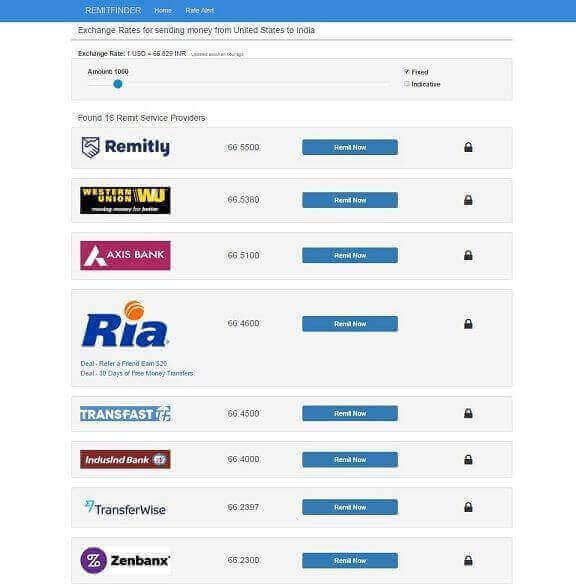

- Use comparison tools: Sites like CompareRemit or RemitFinder show real-time comparisons of different services.

- Transfer larger amounts: Better rates are often available for larger transfer amounts.

Source: RemitFinder

Calculate the True Exchange Rate

To determine the actual exchange rate you're getting, divide the INR amount received by the USD amount sent. Compare this to the mid-market rate to see the true markup.

Example: If you send $1,000 and your recipient gets ₹84,000, your effective exchange rate is 84.0. If the mid-market rate is 85.2, you're losing about 1.4% on the exchange rate.

Tax Implications to Consider

When sending money from the USA to India without fees, it's important to consider the tax implications in both countries:

Tax Implications in the USA

- Gift Tax: If you send more than $17,000 (2025 limit) to any one person in a year, you may need to file a gift tax return, though you likely won't owe tax unless you exceed the lifetime exemption.

- FBAR Reporting: If you have financial accounts in India that exceed $10,000 in aggregate at any time during the year, you must file an FBAR (FinCEN Form 114).

- FATCA Reporting: Foreign accounts may need to be reported on Form 8938 if they exceed certain thresholds.

- Source of Funds: Large transfers may trigger questions about the source of funds from financial institutions.

Tax Implications in India

- Gift Tax: Money received from relatives is not taxable in India. However, gifts from non-relatives exceeding ₹50,000 in a year are taxable as "Income from Other Sources."

- NRE Account Benefits: Funds in NRE accounts and the interest earned are exempt from tax in India.

- NRO Account Considerations: Interest earned in NRO accounts is taxable in India.

- Cryptocurrency Tax: If using crypto for transfers, India imposes a 30% tax on income from virtual digital assets plus a 1% TDS on transactions above ₹50,000.

Consult a Tax Professional

Tax laws are complex and subject to change. It's recommended to consult with a tax professional familiar with both US and Indian tax regulations, especially for large or regular transfers.

Frequently Asked Questions

How much money can I send from USA to India without paying taxes?

In the US, you can send up to $17,000 per recipient per year without filing a gift tax return. Amounts over this require filing a return but you won't owe taxes unless you exceed your lifetime exemption. In India, recipients don't pay tax on gifts from relatives, but gifts from non-relatives exceeding ₹50,000 are taxable.

Is there a limit on how much money I can transfer from USA to India?

There's no legal limit on how much you can send from the USA to India. However, transfers over $10,000 may trigger reporting requirements, and individual services may have their own limits. For large transfers, it's advisable to use services specifically designed for high-value transfers or traditional bank wires.

Can I use Zelle or Venmo to send money to India?

No, Zelle and Venmo only work within the United States and cannot be used for international transfers to India. You'll need to use international money transfer services or banks that specifically offer remittance services to India.

How long do transfers from USA to India typically take?

Transfer times vary by service: Digital wallets and specialized remittance services typically deliver funds within 0-2 business days. Bank wires usually take 3-5 business days. Some services offer instant or same-day transfers for an additional fee. Cryptocurrency transfers can be completed in minutes but may take longer to convert to INR and withdraw to a bank account.

Are there any special considerations for sending large amounts (over $10,000)?

For large transfers, consider: 1) Financial institutions are required to report transfers over $10,000 to regulatory authorities, 2) You may need to provide documentation about the source of funds, 3) Traditional bank wires may be more suitable than online services for very large amounts, and 4) Consider splitting very large transfers into smaller amounts to get better exchange rates, but avoid structuring transactions to evade reporting requirements.

What documentation do I need to send money to India?

Most services require: Valid government-issued ID (passport, driver's license), Your US address and contact information, Recipient's full name and banking details (account number, IFSC code), and Purpose of the transfer. For larger amounts, you may need to provide additional documentation about the source of funds.

Conclusion

Sending money from USA to India without fees is absolutely possible with the right approach. By understanding the true costs of international transfers, taking advantage of promotional offers, using NRE accounts, or leveraging digital wallet solutions, you can ensure more of your money reaches your recipients in India.

Remember these key points:

- Always check the actual exchange rate you're getting, not just the advertised "no fee" claims

- Consider opening an NRE account for regular, fee-free transfers

- Take advantage of first-time user promotions from multiple services

- For larger transfers ($1,000+), look for services that waive fees

- Be aware of tax implications in both countries, especially for large or frequent transfers

- Use comparison tools to find the best service for your specific transfer amount

By following the strategies outlined in this guide, you can save hundreds or even thousands of dollars in fees and exchange rate markups when sending money to India. Your recipients will receive more rupees, and you'll have the satisfaction of knowing you've optimized your international money transfers.

Final Tip

Exchange rates and promotional offers change frequently. Before making any transfer, take a few minutes to compare current options using a comparison site or by checking several services directly. The small time investment can yield significant savings.

Post a Comment