COMPLETE FINANCIAL PLANNING for Rs. 25,000 SALARY! | Money Matters Ep. 10 | Ankur Warikoo Hindi

Complete Financial Planning for Rs. 25,000 Salary

Transform Your Financial Future with Smart Investment Strategies

Introduction to Smart Financial Planning

Financial planning with a Rs. 25,000 salary might seem challenging, but with the right strategy and consistency, you can build substantial wealth over time. This comprehensive guide will show you exactly how to allocate your income for maximum growth.

Whether you're 23 years old starting your career or looking to optimize your current financial strategy, this step-by-step approach will help you create a solid foundation for long-term wealth creation.

Key Takeaways:

- • Protection before investment

- • Systematic investment approach

- • Long-term wealth creation focus

- • Risk management strategies

Understanding Your Rs. 25,000 Salary

In-hand Salary

₹25,000

PF Contribution

₹3,600

Investment Potential

₹20,000

Recommended Allocation Strategy:

Monthly Expenses (₹5,000)

- • Personal expenses: ₹3,500

- • Travel: ₹1,500

- • Music/Content creation: Variable

Available for Investment (₹20,000)

- • Family contribution: ₹10,000

- • Personal investment: ₹10,000

- • Emergency situations: Flexible

Protection First: Insurance Strategy

Why Insurance Comes First?

Before investing in wealth creation, it's crucial to protect your family from financial emergencies. Medical expenses can wipe out years of savings in days, making insurance your first priority.

Priority Order:

- 1. Health Insurance for Family

- 2. Term Life Insurance

- 3. Then start investments

Health Insurance Plan

Coverage Amount

₹5 Lakhs

Per family

Annual Premium

₹25,000

Or ₹2,100/month

Family Coverage

Parents + You

Optional: Sister

Key Features to Look For:

- No room rent limit

- 99%+ claim settlement ratio

- Cashless facility at nearby hospitals

- No waiting period for accidents

Term Life Insurance Plan

Coverage Amount

₹50 Lakhs

For father first

Annual Premium

₹25,000

Or ₹2,100/month

Policy Term

10 Years

Premium locked

Why Term Insurance?

Term insurance provides maximum coverage at the lowest cost. It's pure protection without any investment component, making it the most efficient way to secure your family's financial future.

Strategic Investment Allocation

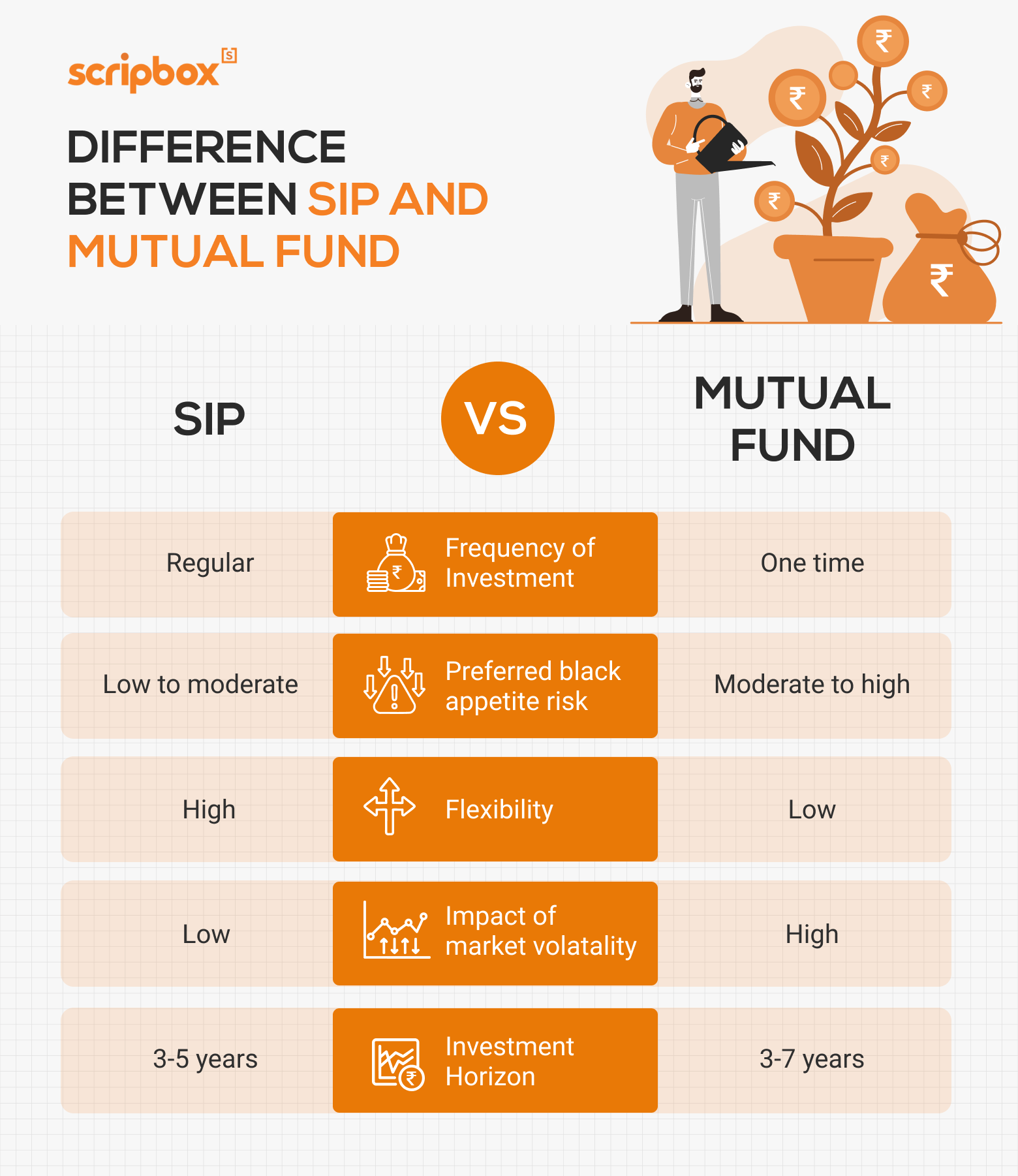

Two-Tier Investment Approach

After securing insurance protection, divide your ₹20,000 monthly investment into two strategic buckets: family contribution and personal wealth creation.

Family Investment (₹10,000)

Conservative, safe investments for family needs

Personal Investment (₹10,000)

Growth-oriented investments for wealth creation

Family Investment Portfolio (₹10,000/month)

Debt Mutual Funds

Low risk, steady returns, better than FD

Nifty 50 Index Fund

Top 50 companies, moderate risk

Family Portfolio Benefits:

- Sister's marriage fund

- Home renovation needs

- Family emergencies

- Parental support

Personal Wealth Portfolio (₹10,000/month)

Large Cap (40%)

₹4,000

Nifty 50 Index

Stable Growth

Mid Cap (30%)

₹3,000

Mid Cap Funds

Higher Growth

Small Cap (30%)

₹3,000

Small Cap Funds

Maximum Growth

Portfolio Characteristics:

- Expected Return: 18% p.a.

- Investment Horizon: 10+ years

- Risk Level: Moderate to High

- Rebalancing: Annual review

Wealth Creation Projections

The Power of Compounding

With consistent SIP investments and annual step-ups, your wealth can grow exponentially. Here's what your ₹20,000 monthly investment can achieve over different time periods.

Key Success Factors:

- • Consistency is crucial

- • Annual 10% step-up in SIP

- • Long-term investment horizon

- • Discipline to stay invested

Investment Growth Timeline

10 Years

₹46 Lakhs

Starting phase

20 Years

₹4 Crores

Substantial growth

30 Years

₹27 Crores

Retirement corpus

Portfolio Comparison

| Time Period | Family Portfolio (₹10,000) | Personal Portfolio (₹10,000) | Total Wealth |

|---|---|---|---|

| 10 Years | ₹17 Lakhs | ₹29 Lakhs | ₹46 Lakhs |

| 15 Years | ₹35 Lakhs | ₹75 Lakhs | ₹1.1 Crores |

| 20 Years | ₹75 Lakhs | ₹3.25 Crores | ₹4 Crores |

| 30 Years | ₹4 Crores | ₹23 Crores | ₹27 Crores |

Your Step-by-Step Action Plan

Implementation Timeline

Follow this systematic approach to implement your financial plan. Start with protection, then move to investments. Each step builds upon the previous one for maximum financial security.

Months 1-3: Health Insurance Setup

Save ₹30,000 over 3 months from your ₹10,000 family allocation

- Research health insurance providers

- Compare claim settlement ratios

- Purchase ₹5 lakh family floater policy

- Ensure cashless facility at nearby hospitals

Months 4-5: Term Life Insurance

Save ₹25,000 over 2 months for term insurance

- Purchase ₹50 lakh term insurance for father

- Choose 10-year policy term

- Ensure premium is locked for entire term

- Nominate family members properly

Month 6 Onwards: Start SIP Investments

Begin systematic investment plan with full ₹20,000 allocation

Family Portfolio SIPs:

- • Debt Fund: ₹2,500/month

- • Nifty 50: ₹2,500/month

- • Insurance: ₹4,200/month

- • Buffer: ₹800/month

Personal Portfolio SIPs:

- • Large Cap: ₹4,000/month

- • Mid Cap: ₹3,000/month

- • Small Cap: ₹3,000/month

Annual Review & Step-up

Every year, increase your SIP by 10% and review performance

- Increase SIP amounts by 10% annually

- Review portfolio performance

- Rebalance if necessary

- Increase insurance coverage as income grows

Pro Tips for Success

- Automate all SIP investments

- Never stop SIP during market downturns

- Keep emergency fund separate

- Track expenses regularly

- Increase investment as salary grows

- Stay disciplined for long-term

Important Disclaimers

Investment Risk Warning: All investments in mutual funds and market-linked instruments are subject to market risks. Past performance does not guarantee future results. Please read all scheme-related documents carefully before investing.

Insurance Guidance: Insurance recommendations are for general guidance only. Please consult with certified insurance advisors and compare multiple policies before making decisions. Premium amounts may vary based on age, health conditions, and policy features.

Financial Planning: This article provides educational content for financial planning awareness. It is not personalized financial advice. Please consult with qualified financial advisors for investment decisions suited to your specific circumstances.

Market Projections: All return projections are illustrative and based on historical market performance. Actual returns may vary significantly due to market volatility, economic conditions, and other factors.

Regulatory Compliance: Ensure all investments comply with current regulatory guidelines. Tax implications may apply to investments and insurance products. Consult tax advisors for specific guidance.

Your Financial Success Journey Starts Now

Key Takeaways

- Protection before investment always

- Consistency beats timing the market

- Start early, benefit from compounding

- Diversification reduces risk

Remember

Building wealth is a marathon, not a sprint. With disciplined investing and the right strategy, your ₹25,000 salary can create substantial wealth over time. Stay consistent, stay invested, and watch your money grow!

Post a Comment