Step-by-Step Guide to Sending Money via Western Union

Step-by-Step Guide to Sending Money via Western Union

A comprehensive guide for safely and efficiently transferring money both domestically and internationally

Last Updated: May 2025

Table of Contents

- Introduction to Western Union

- Money Transfer Methods

- Sending Money In-Person

- Sending Money Online

- Using the Western Union Mobile App

- Understanding Fees and Exchange Rates

- Safety Tips and Fraud Prevention

- Tracking Your Money Transfer

- Frequently Asked Questions

- Customer Reviews and Experiences

- Conclusion

Introduction to Western Union

Western Union is one of the world's largest money transfer companies, operating in over 200 countries and territories with more than 500,000 agent locations worldwide. Founded in 1851, Western Union has evolved from a telegraph company to a global leader in cross-border, cross-currency money movement and payments.

Whether you need to send money to family abroad, pay for international services, or support loved ones in emergency situations, Western Union offers multiple ways to transfer funds quickly and securely. This comprehensive guide will walk you through everything you need to know about sending money via Western Union.

Global Reach

Access to over 500,000 agent locations across 200+ countries and territories.

Fast Transfers

Money can be available for pickup in minutes for many destinations.

Secure Service

Advanced security measures to protect your money and information.

Money Transfer Methods

Western Union offers multiple ways to send money, catering to different needs and preferences. Understanding these options will help you choose the most convenient method for your situation.

In-Person

Visit any Western Union agent location to send money with cash or debit/credit card.

- No account needed

- Cash payment option

- Immediate processing

- Face-to-face assistance

Best for: Those who prefer cash transactions or don't have internet access.

Online

Send money through Western Union's website using your bank account, credit, or debit card.

- 24/7 availability

- Account creation required

- Digital payment methods

- Multiple destination options

Best for: Those comfortable with online banking and digital transactions.

Mobile App

Send money on the go using Western Union's mobile application.

- Convenient mobile interface

- Save recipient information

- Track transfers in real-time

- QR code for in-store payment

Best for: Tech-savvy users who need flexibility and convenience.

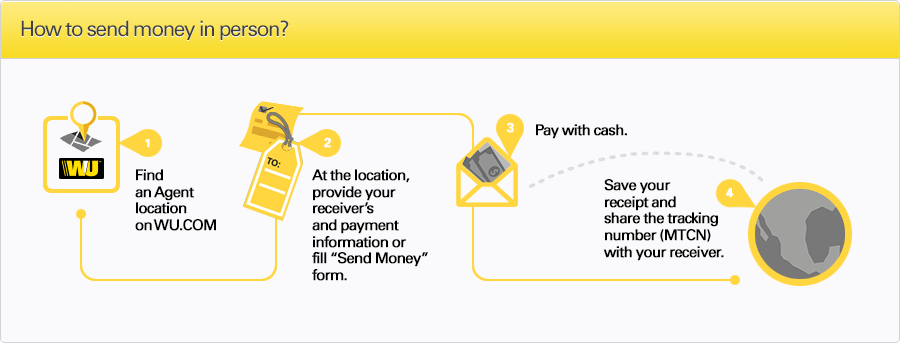

Sending Money In-Person

Sending money in-person at a Western Union agent location is straightforward and requires no prior account setup. This method is ideal for those who prefer face-to-face transactions or need to pay with cash.

A typical Western Union agent location where you can send money in-person

Required Information and Documents

- Valid government-issued photo ID (passport, driver's license, state ID)

- Receiver's full name (exactly as it appears on their ID)

- Destination country and sometimes specific city

- Payment method (cash, debit/credit card)

- Transfer amount and currency

Step-by-Step Process

1 Find a Western Union Agent Location

Use Western Union's website or mobile app to find the nearest agent location. Western Union services are often available at banks, grocery stores, pharmacies, and dedicated money transfer offices.

Tip: Call ahead to confirm business hours, especially if you plan to visit during weekends or holidays.

2 Fill Out the Send Money Form

At the agent location, you'll need to complete a money transfer form. Provide all required information about yourself (the sender) and your recipient.

Note: Be sure to double-check all spelling of names and addresses, as errors can delay your transfer.

3 Show Your ID and Pay for the Transfer

Present your government-issued photo ID to the agent. Pay the amount you want to send plus the transfer fee, which varies based on the destination country, amount, and payout method.

4 Receive Your Receipt and MTCN

After completing the transaction, you'll receive a receipt with a unique 10-digit Money Transfer Control Number (MTCN). This number is crucial for tracking the transfer and for the recipient to pick up the money.

Sample Western Union receipt showing MTCN number

5 Inform Your Recipient

Contact your recipient to provide them with the following information:

- The MTCN (Money Transfer Control Number)

- Your full name and address (as you provided on the form)

- The transfer amount

- A test question answer (if you set one up)

Important Note:

The recipient will need to show a valid ID that exactly matches the name you provided when sending. Any discrepancies can cause delays or prevent the recipient from receiving the funds.

Sending Money Online

Western Union's online service provides a convenient way to send money from the comfort of your home or office. This method requirescreating an account on their website but offers greater flexibility in payment options and destination methods.

Step-by-Step Process for Online Transfers

1 Create a Western Union Account

Visit the Western Union website and click on "Register" or "Sign Up" to create an account. You'll need to provide:

- Full name

- Email address

- Physical address

- Phone number

- Create a secure password

Note: Create a strong, unique password that combines letters, numbers, and special characters.

2 Verify Your Identity

Western Union requires identity verification to comply with financial regulations. This typically involves providing:

- Government-issued ID information

- Social Security Number or Tax ID (in the US)

- Date of birth

This verification process helps prevent fraud and money laundering.

3 Start a New Transfer

Log in to your account and select "Send Money" to begin a new transfer. You'll need to:

- Select the destination country

- Enter the transfer amount

- Choose the payout method (bank deposit, cash pickup, mobile wallet, etc.)

Western Union online transfer interface

4 Enter Recipient Details

Provide accurate information about your recipient:

- Full legal name (as it appears on their ID)

- If sending to a bank account: bank name, account number, branch details

- If sending for cash pickup: recipient's address

- If sending to a mobile wallet: recipient's phone number

Double-check all information as errors can delay or prevent the recipient from receiving funds.

5 Review Transfer Details and Fees

Before completing your transfer, you'll see:

- The transfer amount

- The fee for your transaction

- The exchange rate (if applicable)

- The estimated delivery time

- The total amount to be charged to your payment method

Western Union makes money from both transfer fees and currency exchange rate markups.

6 Pay for the Transfer

Choose your payment method:

- Bank account: Usually has lower fees but takes longer (2-5 business days)

- Debit/credit card: Higher fees but faster processing (minutes to hours)

Enter your payment details and confirm the transaction.

7 Receive Confirmation and MTCN

After successful payment, you'll receive a confirmation with your Money Transfer Control Number (MTCN). Share this number along with your name and the transfer amount with your recipient.

Pro Tip:

For repeated transfers to the same recipient, save their information in your Western Union profile. This will make future transfers faster and reduce the chance of data entry errors.

Using the Western Union Mobile App

The Western Union mobile app offers all the functionality of the website with the added convenience of mobile access. It's particularly useful for people who need to send money while on the go.

Western Union mobile app interface showing money transfer process

Key Features of the Mobile App

- 24/7 Access: Send money anytime, anywhere

- Biometric Login: Secure access via fingerprint or face recognition

- Transaction History: View and manage past transfers

- Real-time Tracking: Monitor the status of your transfer

- Saved Recipients: Quickly send money to previous recipients

- Location Finder: Find nearby agent locations with opening hours

- Exchange Rate Calculator: Check real-time rates before sending

- Price Estimator: Calculate fees before initiating a transfer

- Digital Wallet Integration: Pay using Apple Pay or Google Pay

Step-by-Step Guide to Using the Mobile App

1 Download and Install the App

Download the Western Union app from the Apple App Store or Google Play Store. The app is free and available for iOS and Android devices.

2 Create an Account or Login

If you already have a Western Union account, log in with your credentials. New users will need to create an account and verify their identity, similar to the online process.

The app will guide you through the verification process, which may require taking photos of your ID.

3 Start a New Transfer

Tap on "Send Money" on the home screen and follow these steps:

- Select the destination country

- Enter the amount you wish to send

- Choose how the recipient will receive the money (bank account, cash pickup, mobile wallet)

Western Union app send money interface

4 Enter Recipient Information

Add your recipient's information. If you've sent money to this person before, you can select them from your saved contacts.

5 Review and Pay

Review all details including fees, exchange rates, and estimated delivery time. Select your payment method (bank account, debit/credit card, or digital wallet) and complete the payment.

6 Track Your Transfer

After sending, you can track your transfer directly in the app. The status will update as the transfer progresses, and you'll receive notifications when the money is available for pickup or deposited into the recipient's account.

Transfer tracking interface in the Western Union app

App-Specific Features:

The Western Union mobile app offers some unique features not available on their website:

- Start Online, Pay in Cash: Initiate a transfer in the app but pay at a physical location

- QR Code Payment: Generate a QR code to expedite the payment process at agent locations

- Touch ID/Face ID: Use biometric authentication for faster, more secure login

- Widget Support: Quick access to exchange rates from your device's home screen

Understanding Fees and Exchange Rates

Western Union charges vary based on several factors. Understanding the fee structure can help you make informed decisions and potentially save money on your transfers.

Factors Affecting Transfer Costs

Primary Cost Factors

- Transfer amount - Larger transfers often have higher fees

- Destination country - Fees vary by location

- Transfer method (online, in-person, mobile app)

- Payment method (bank account, credit/debit card, cash)

- Delivery method (bank deposit, cash pickup, mobile wallet)

- Transfer speed - Faster transfers typically cost more

Hidden Cost Factors

- Exchange rate markup - Western Union adds a margin to the mid-market rate

- Receiving bank fees - Some recipient banks charge additional fees

- Promotional rates - First-time users may receive discounted rates

- Loyalty programs - Regular users may qualify for better rates

- Special offers - Temporary promotions for specific corridors

Fee Comparison by Transfer Method

| Transfer Method | Typical Fee Range | Processing Time | Best For |

|---|---|---|---|

| In-person/Cash | $5-$95 | Minutes (cash pickup) | Urgent transfers, recipients without bank accounts |

| Online/Bank Account | $0-$45 | 1-5 business days | Cost-conscious senders, non-urgent transfers |

| Online/Credit Card | $5-$60 | Minutes to hours | Fast transfers with digital convenience |

| Mobile App/Bank Account | $0-$45 | 1-5 business days | On-the-go transfers, tech-savvy users |

| Mobile App/Credit Card | $5-$60 | Minutes to hours | Immediate transfers while mobile |

Exchange Rate Explained

When sending money internationally, Western Union applies its own exchange rate, which includes a markup from the mid-market rate (the rate you see on Google or financial news sites). This markup is typically between 1-4% but can be higher for some currencies.

Understanding Exchange Rate Markup:

For example, if the mid-market rate is 1 USD = 20 MXN, Western Union might offer 1 USD = 19.4 MXN. This 3% difference represents additional revenue for Western Union beyond the stated transfer fee.

Tips to Save on Fees

Compare Payment Options

Paying with a bank account instead of a credit/debit card typically results in lower fees, though transfers take longer.

Send Larger Amounts Less Frequently

Instead of multiple small transfers, combine them into one larger transfer to reduce the total fee amount.

Check for Promotions

Western Union often runs promotions for specific transfer corridors or for first-time users.

Use Price Estimator Tool

Before sending, use Western Union's price estimator tool to compare fees across different payment and delivery methods.

Safety Tips and Fraud Prevention

Western Union transfers are generally secure, but money transfer services can be targets for scammers. Protecting yourself requires awareness and caution.

Red Flags: When NOT to Send Money

Western Union recommends never sending money in these situations:

- To someone you've never met in person (particularly online romantic interests)

- For an emergency situation you haven't confirmed with the supposed person in need

- To claim lottery or prize winnings

- For online purchases from unverified sellers

- To pay taxes or fees to receive funds

- In response to a job offer that requires you to transfer money

- To someone pressuring you to send money immediately or secretly

Common Scams to Avoid

Lottery and Prize Scams

Scammers claim you've won a lottery or prize but need to pay "fees" or "taxes" to receive your winnings.

Remember: Legitimate lotteries never require payment to claim winnings.

Emergency/Family Scams

Someone impersonates your friend or family member claiming to be in an emergency situation requiring immediate funds.

Verify: Always call your family member directly using a known number to confirm.

Online Purchase Scams

Sellers ask for payment via Western Union for online purchases, but never deliver the goods.

Note: Western Union is not meant for purchasing goods online.

Romance Scams

Someone you've met online develops a romantic relationship and eventually asks for money for various "emergencies."

Be wary: If you've never met in person, be extremely cautious about sending money.

Best Practices for Safe Transfers

Protect Your Information

Never share your MTCN or receipt details on social media or with anyone other than your intended recipient.

Use Strong Passwords

Create unique passwords for your Western Union account and enable two-factor authentication if available.

Verify Websites

Only access Western Union through official websites (www.westernunion.com) or the official mobile app.

Verify Emergencies

Always confirm emergency situations through trusted channels before sending money.

Ask Questions

If someone is pressuring you to send money, ask detailed questions that only the real person would know.

Use Purchase Protection

For online purchases, use payment methods with buyer protection rather than money transfers.

What to Do If You're a Victim of Fraud

- Act quickly - Contact Western Union's fraud hotline at 1-800-448-1492.

- Report to authorities - File a report with your local police and the FBI's Internet Crime Complaint Center (IC3).

- Document everything - Keep copies of all correspondence and transaction details.

- Contact your bank - If you paid using a bank account or card, notify your financial institution immediately.

- Forward suspicious emails to spoof@westernunion.com.

Important:

Once a money transfer has been picked up by the recipient, it is very difficult to recover the funds. This is why prevention and awareness are crucial.

Tracking Your Money Transfer

Western Union provides several methods to track the status of your money transfer. Tracking allows you to confirm when your money is available for pickup or has been delivered to the recipient.

Western Union Money Transfer Control Number (MTCN) used for tracking

What You Need for Tracking

To track your transfer, you'll need:

- MTCN (Money Transfer Control Number) - The 10-digit number on your receipt

- Sender's Information - Your full name as provided on the transfer form

- Transfer Amount - The exact amount sent (not including fees)

Tracking Methods

- Online: Visit Western Union's website and use the "Track Transfer" feature

- Mobile App: Access the tracking feature in the Western Union app

- Phone: Call Western Union customer service at 1-800-325-6000

- In-Person: Visit any Western Union agent location with your MTCN and ID

- Email/SMS: Opt for notifications when setting up your transfer

Understanding Transfer Statuses

| Status | Description | Next Steps |

|---|---|---|

| In Progress | Your transfer has been initiated but is still being processed | Wait for processing to complete |

| Available for Pickup | Funds are ready to be collected at a Western Union location | Inform recipient they can collect the money |

| Delivered | Funds have been collected by the recipient or deposited in their account | No action needed; transfer complete |

| On Hold | Transfer requires additional verification or information | Contact Western Union customer service |

| Cancelled | The transfer has been cancelled | Check for refund or contact customer service |

| Expired | Funds weren't collected within the pickup timeframe (usually 90 days) | Contact Western Union for refund information |

Step-by-Step Online Tracking Process

1 Visit Western Union's Website

Go to westernunion.com and locate the "Track Transfer" option in the main menu.

2 Enter Your Tracking Information

Provide the required details:

- MTCN (10-digit tracking number)

- Sender's last name

- Transfer amount

3 Review Status Details

The system will display information including:

- Current status of the transfer

- Estimated delivery time (if not yet delivered)

- Recipient information

- Payment details

Example of a Western Union tracking interface

Tracking Timeframes:

Different transfer methods have different processing times:

- Cash pickups: Usually available within minutes

- Bank account deposits: 1-5 business days

- Mobile wallet transfers: Typically within 24 hours

Status updates may not be immediate, especially for bank transfers which depend on processing times of both Western Union and the receiving bank.

Frequently Asked Questions

Here are answers to some of the most common questions about Western Union money transfers.

How long does it take for a recipient to receive money from Western Union?

The time varies based on the transfer method:

- Cash pickup: Available within minutes in most cases

- Bank account deposit: 1-5 business days

- Mobile wallet: Usually within 24 hours

Transfers to certain countries or during weekends/holidays may take longer.

What identification does a recipient need to collect money?

Recipients typically need:

- Government-issued photo ID (passport, driver's license, national ID card)

- The Money Transfer Control Number (MTCN)

- The sender's name and address

- The transfer amount

- Answer to the test question (if one was set)

ID requirements may vary by country and transfer amount.

Are there limits to how much money I can send through Western Union?

Yes, Western Union applies various limits:

- Online/Mobile: Typically $5,000 USD per transfer

- In-person: Limits vary by location, but are generally higher

- Daily/Monthly limits: May apply based on your sending history and verification level

For large transfers, you may need to visit an agent location and provide additional identification. Limits also vary by country and are subject to change based on regulatory requirements.

Can I cancel a Western Union money transfer?

Yes, but only if the money hasn't been picked up or deposited yet. To cancel:

- Online: Log into your account and look for the option to cancel the transfer

- By phone: Call Western Union customer service at 1-800-325-6000

- In-person: Visit a Western Union agent location with your ID and receipt

Once a transfer has been collected or deposited, it cannot be cancelled. Refund processing typically takes 7-10 business days.

Is it safe to use Western Union for international money transfers?

Western Union employs strong security measures including:

- Encryption technology for online and mobile transfers

- Fraud monitoring systems

- ID verification for both senders and receivers

- Compliance with international financial regulations

While the service itself is secure, users should follow safety guidelines to avoid scams that use Western Union as a payment method.

How do Western Union's fees compare to other money transfer services?

Western Union fees are generally higher than digital-only services like Wise or Remitly, especially for:

- Credit/debit card payments

- Cash pickup options

- Same-day transfers

However, Western Union offers advantages including:

- Wider global coverage (200+ countries)

- Cash payment and pickup options

- No bank account required for sender or recipient

- Established track record and reliability

Customer Reviews and Experiences

Here's what actual users have to say about their experiences sending money through Western Union.

Maria J.

Sends money to Mexico monthly

"I've been using Western Union for over 5 years to send money to my parents in Mexico. The app makes it so convenient - I can send money from my phone and my mom can pick it up in cash within 10 minutes. The fees are a bit high compared to other services, but the reliability and speed are worth it for me."

David T.

First-time user sending to the Philippines

"I needed to send money urgently to a family member in the Philippines during an emergency. The Western Union agent walked me through the entire process, and the money was available for pickup within minutes. The recipient had no issues collecting it, and the online tracking feature gave me peace of mind."

Ahmed K.

Regular sender to India

"Western Union is convenient with so many locations, but I find the fees and exchange rates less competitive than newer online services. The bank deposit option takes 2-3 days to reach my family in India, which is longer than some alternatives. That said, their customer service is excellent whenever I've had questions."

Elena R.

Uses mobile app to send money to Colombia

"The Western Union app has made sending money to my grandmother in Colombia so much easier. I love that I can set up recurring transfers and she can receive the money directly into her bank account. The notification system keeps me updated throughout the process.Worth every penny of the transfer fee!"

Conclusion

Western Union remains one of the most reliable and widespread money transfer services in the world. While digital competitors offer lower fees in some cases, Western Union's combination of physical locations, multiple transfer options, and global reach continues to make it a preferred choice for many customers.

Best For

- Sending money to remote locations

- Cash-to-cash transfers

- Recipients without bank accounts

- Urgent transfers needed within minutes

- Services in countries with limited banking infrastructure

Advantages

- Extensive global network

- Multiple sending and receiving options

- No bank account required

- Established reputation and reliability

- Fast cash pickup availability

- User-friendly mobile app

Considerations

- Higher fees than some online-only competitors

- Exchange rate markups affect total cost

- Bank deposits can take several business days

- ID requirements may be stringent in some locations

- Potential for scams targeting users

By understanding the process, fees, and safety considerations outlined in this guide, you can make informed decisions about using Western Union for your money transfer needs. Always prioritize security and be vigilant against potential scams to ensure your hard-earned money reaches its intended recipient.

Remember that the best money transfer service depends on your specific needs, including transfer amount, destination country, speed requirements, and how the recipient prefers to receive funds. Western Union's flexibility across these dimensions makes it a versatile option worth considering for your international money transfer needs.

Ready to Send Money?

Visit Western Union's official website to start your transfer or download the mobile app from your device's app store. Remember to have your recipient's information and payment method ready before beginning the process.

Post a Comment