Cheapest Way to Send Money to India from New York

Cheapest Ways to Send Money from New York to India

A complete guide to finding affordable, fast, and secure money transfer options in 2025

Current USD to INR: ₹84.94

Updated: May 2025

Sending money from New York to India shouldn't cost you a fortune in fees and poor exchange rates. With millions of Indian expats, students, and professionals living in the United States, finding an affordable way to transfer money back home is essential. Whether you're supporting family, paying for property, or investing in India, this comprehensive guide will help you discover the most cost-effective options for sending money from New York to India in 2025.

We've researched and compared the most popular money transfer services to bring you a detailed analysis of fees, exchange rates, transfer speeds, and overall value. Our aim is to help you save money on every transfer while ensuring your funds reach India quickly and securely.

Table of Contents

- Comparison of Popular Money Transfer Services

- Understanding Fees and Exchange Rates

- Top 5 Cheapest Money Transfer Services

- Best Options for Different Transfer Amounts

- Transfer Speed Comparison

- Tips to Save Money on Transfers

- Tax Considerations for Money Transfers

- Security and Reliability Factors

- Step-by-Step Guide for Using the Cheapest Options

- Customer Reviews and Experiences

- Conclusion and Final Recommendations

Comparison of Popular Money Transfer Services

When sending money from New York to India, you have numerous services to choose from. Here's a quick overview of the main players:

| Service | Fees | Exchange Rate Markup | Transfer Speed | Transfer Options | Overall Value |

|---|---|---|---|---|---|

| Wise (TransferWise) | 0.57% - 1% + small fixed fee | 0% (Mid-market rate) | 1-2 business days | Bank transfer, UPI | Excellent |

| Remitly | $3.99 (< $1,000), $0 (≥ $1,000) | 0.5% - 1.5% | Economy: 3-5 days Express: Same day |

Bank deposit, cash pickup | Very Good |

| Xoom (PayPal) | $0 (bank transfer), $4-$8 (card) | 1% - 3% | Minutes to 2 days | Bank deposit, cash pickup, UPI | Good |

| XE Money Transfer | $0 for transfers above $500 | 0.5% - 2% | 1-3 business days | Bank deposit | Good |

| Western Union | $0 - $5 (online), $5 - $25 (in-person) | 1% - 4% | Minutes to 5 days | Bank deposit, cash pickup, UPI | Average |

| MoneyGram | $0 (< $10,000), $49.99 ($10,001-$15,000) | 1% - 3% | Minutes to 3 days | Bank deposit, cash pickup | Average |

| Bank Wire Transfer | $25 - $50 | 2% - 5% | 3-5 business days | Bank deposit only | Poor |

Pro Tip

While fees are important, the exchange rate markup often has a bigger impact on the total cost. Services advertising "zero fees" often hide their profit in less favorable exchange rates.

Understanding Fees and Exchange Rates

To truly find the cheapest way to send money to India, you need to understand the two main components that determine the total cost:

Transfer Fees

- Fixed fees: A set amount regardless of how much you send (e.g., $3.99 per transfer)

- Percentage fees: Calculated as a percentage of the transfer amount (e.g., 0.5% of $1,000 = $5)

- Tiered fees: Different fees for different transfer amounts

- Payment method fees: Additional charges based on how you fund the transfer (credit card payments usually cost more)

Exchange Rates

- Mid-market rate: The "real" exchange rate used when banks trade with each other

- Rate markup: The difference between the mid-market rate and the rate offered to you

- Hidden profits: Many services advertise "no fees" but profit from poor exchange rates

- Exchange rate guarantees: Some services lock in rates for a period of time (useful when rates are volatile)

The Real Cost Example

Let's look at an example of sending $1,000 from New York to India using different services (as of May 2025):

| Service | Advertised Fee | Exchange Rate (USD/INR) | INR Received | Real Cost* |

|---|---|---|---|---|

| Wise | $7.33 | 84.94 (mid-market) | ₹84,155 | $7.33 (0.73%) |

| Remitly | $0.00 | 84.21 | ₹84,210 | $8.60 (0.86%) |

| Xoom | $0.00 | 83.69 | ₹83,690 | $14.72 (1.47%) |

| Western Union | $0.00 | 83.21 | ₹83,210 | $20.37 (2.04%) |

| Bank Wire | $35.00 | 82.50 | ₹79,613 | $64.00 (6.40%) |

*Real cost includes both the fee and the exchange rate markup compared to the mid-market rate.

Important Note

Money transfer services may change their fees and rates without notice. Always compare the total amount your recipient will receive at the time of your transfer, not just the advertised fees.

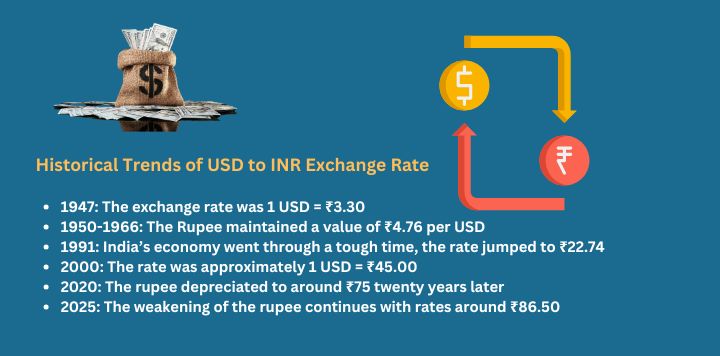

Exchange Rate Comparison Visualization

Historical USD to INR exchange rates show significant fluctuations that affect transfer value

Top 5 Cheapest Money Transfer Services

Based on our comprehensive analysis of fees, exchange rates, and overall value, here are the top 5 cheapest services for sending money from New York to India:

1. Wise (TransferWise)

Best OverallWise consistently offers the best combination of low fees and excellent exchange rates by using the real mid-market rate.

- Fees: 0.57% - 1% + small fixed fee

- Exchange Rate: Mid-market rate (no markup)

- Speed: 1-2 business days

- Transfer Options: Bank transfer, UPI

- Transfer Limits: Up to $1 million

Best for: Medium to large transfers where exchange rate matters most.

2. Remitly

Best for Large TransfersRemitly offers free transfers for amounts over $1,000 with competitive exchange rates and multiple delivery options.

- Fees: $3.99 (< $1,000), $0 (≥ $1,000)

- Exchange Rate: 0.5% - 1.5% markup

- Speed: Economy (3-5 days) or Express (same day)

- Transfer Options: Bank deposit, cash pickup

- Transfer Limits: Up to $30,000 per day

Best for: Transfers over $1,000 when you need flexible delivery options.

3. XE Money Transfer

Best for Fee-FreeXE offers no transfer fees for amounts over $500, making it a good option for medium-sized transfers.

- Fees: $0 for transfers above $500

- Exchange Rate: 0.5% - 2% markup

- Speed: 1-3 business days

- Transfer Options: Bank deposit

- Transfer Limits: Up to $500,000

Best for: Medium-sized transfers when you prefer no upfront fees.

4. Xoom (PayPal)

Best for SpeedXoom offers fast transfers with no fees for bank transfers and supports UPI for quick delivery.

- Fees: $0 (bank transfer), $7.24 (debit), $37.99 (credit)

- Exchange Rate: 1% - 3% markup

- Speed: Minutes to 2 days

- Transfer Options: Bank deposit, cash pickup, UPI

- Transfer Limits: Up to $50,000 per transaction

Best for: Fast transfers when you're willing to pay a bit more in exchange rate markup.

5. MoneyGram

Best for Cash PickupMoneyGram offers an extensive cash pickup network in India with no fees for large transfers.

- Fees: $0 (< $10,000), $49.99 ($10,001-$15,000)

- Exchange Rate: 1% - 3% markup

- Speed: Minutes to 3 days

- Transfer Options: Bank deposit, cash pickup

- Transfer Limits: Up to $10,000 per transaction

Best for: When your recipient needs cash quickly in India.

Popular Money Transfer Apps

Most money transfer services offer mobile apps for convenient transfers on the go:

Popular money transfer apps used for India remittances

Best Options for Different Transfer Amounts

The cheapest service varies depending on how much you're sending. Here's our breakdown:

Small Transfers (Under $500)

For small amounts, fixed fees have the biggest impact on the total cost.

Best Options:

- Wise - Despite small fees, the mid-market rate saves money

- Xoom - When using bank transfer funding

- Remitly Economy - Good for non-urgent transfers

Avoid: Western Union and bank wire transfers, which have higher minimum fees.

Medium Transfers ($500-$2,000)

For medium amounts, balance between fees and exchange rates becomes crucial.

Best Options:

- Remitly ($1,000+) - No fees for transfers over $1,000

- XE Money Transfer - No fees over $500

- Wise - Consistent value with transparent pricing

Avoid: Credit card funding, which adds additional fees to most services.

Large Transfers (Over $2,000)

For large amounts, even small differences in exchange rates make a big impact.

Best Options:

- Wise - The mid-market rate saves significant money

- Remitly - Free transfers with competitive rates

- XE Money Transfer - Good for very large amounts

Avoid: Services with percentage-based fees that increase with transfer amount.

"When sending larger amounts, even a 0.5% difference in exchange rates can mean saving or losing $10 on a $2,000 transfer. Always compare the total amount received, not just the fees."

Transfer Speed Comparison

Sometimes you need to balance cost with speed. Here's how the services compare:

| Transfer Speed | Services | Cost Premium | Best For |

|---|---|---|---|

| Instant/Minutes (Within 1 hour) |

- Western Union (cash pickup) - MoneyGram (cash pickup) - Xoom (UPI transfers) - Remitly Express |

Higher fees or worse exchange rates (2-4% total cost) | Emergencies when recipient needs money immediately |

| Same Day (Within 24 hours) |

- Xoom (bank deposit) - Remitly Express - Western Union (online to bank) |

Moderate premium (1-2% total cost) | Urgent transfers that don't require immediate delivery |

| Standard (1-3 business days) |

- Wise - XE Money Transfer - Remitly Economy |

Best rates (0.5-1% total cost) | Regular transfers when timing isn't critical |

| Economy (3-5 business days) |

- Bank wire transfers - Some Remitly Economy options |

Variable (banks are usually most expensive) | Planned transfers when time is not a factor |

Speed Tip

For the best balance of speed and cost, consider Xoom's UPI transfers or Remitly Express. Both offer relatively quick delivery times without extreme markups on exchange rates.

Tips to Save Money on Transfers

Smart Transfer Strategies

-

Watch exchange rate trends

Monitor USD/INR rates using currency apps or websites. Try to send money when rates are favorable.

-

Combine transfers

Instead of sending multiple small transfers, combine them into one larger transfer to reduce fee impact.

-

Use bank transfers to fund

Avoid credit card fees, which typically add 2.5-3% to your transfer cost.

-

Compare total amounts

Always compare the final rupee amount your recipient will receive, not just the advertised fees or rates.

-

Use promotional offers

Many services offer fee-free first transfers or better rates for new customers.

Avoiding Hidden Costs

-

Beware of "0% commission" claims

Services advertising zero fees usually make money on poor exchange rates.

-

Check for receiving fees

Some Indian banks charge incoming wire fees. Confirm with your recipient's bank.

-

Avoid unnecessary conversions

Send money directly in INR rather than letting the receiving bank convert from USD.

-

Set up rate alerts

Services like XE offer alerts when exchange rates reach your desired level.

-

Consider annual plans

If you send money regularly, some services offer subscription plans with reduced fees.

Transfer Methods to Consider

UPI Transfers

Unified Payments Interface (UPI) is becoming a popular way to send money to India due to its speed and convenience.

- Xoom, Western Union, and Wise now support UPI transfers

- Money arrives almost instantly to UPI-linked bank accounts

- Recipients need an active UPI ID

- Lower transfer limits than traditional bank transfers

Multi-Currency Accounts

Services like Wise offer multi-currency accounts that let you hold both USD and INR.

- Convert money when rates are favorable

- Transfer to Indian accounts with minimal fees

- Provides flexibility for timing your transfers

- Can be combined with other financial strategies

Tax Considerations for Money Transfers

Understanding the tax implications of sending money to India can help you avoid unexpected costs:

US Tax Considerations

-

Gift Tax

The annual exclusion is $19,000 per recipient (2025). Amounts above this may require filing a gift tax return, though no tax is typically due until you exceed your lifetime exemption.

-

Bank Reporting

Banks and money transfer services report transactions over $10,000 to comply with anti-money laundering regulations. This is just reporting, not taxation.

-

Source of Funds

If you're sending business income or investment proceeds, ensure you've properly reported and paid taxes on this income before transferring.

Indian Tax Considerations

-

Gift Taxation in India

Gifts from relatives (includes parents, siblings, spouse) are tax-free in India. Gifts from non-relatives above ₹50,000 may be taxable for the recipient.

-

FEMA Regulations

Foreign Exchange Management Act regulations apply to money coming into India. Most personal transfers don't require special reporting.

-

Documentation

Recipients should maintain records of transfers, especially for large amounts, to explain the source of funds if questioned by tax authorities.

Tax Disclaimer

Tax laws change frequently and vary by individual situation. Consult with a tax professional for advice specific to your circumstances, especially for large transfers or complex situations.

Security and Reliability Factors

When sending money to India, security is just as important as cost. Here's what to look for:

Regulatory Compliance

- Check if the service is registered with FinCEN in the US

- Verify RBI approval for receiving money in India

- Look for compliance with anti-money laundering regulations

- Confirm data privacy practices meet standards

All major services mentioned in this guide meet regulatory requirements in both the US and India.

Transfer Protection

- Look for services offering transfer tracking

- Check for transfer guarantees or money-back policies

- Verify if they provide transfer confirmation documents

- Research customer service quality for issues

Wise, Remitly and Xoom offer comprehensive tracking and solid customer support for transfer issues.

Technical Security

- Check for encryption standards (look for HTTPS)

- Verify two-factor authentication options

- Research the company's data breach history

- Check for security certifications (e.g., PCI DSS)

Major providers invest heavily in security. Enable all available security features when setting up accounts.

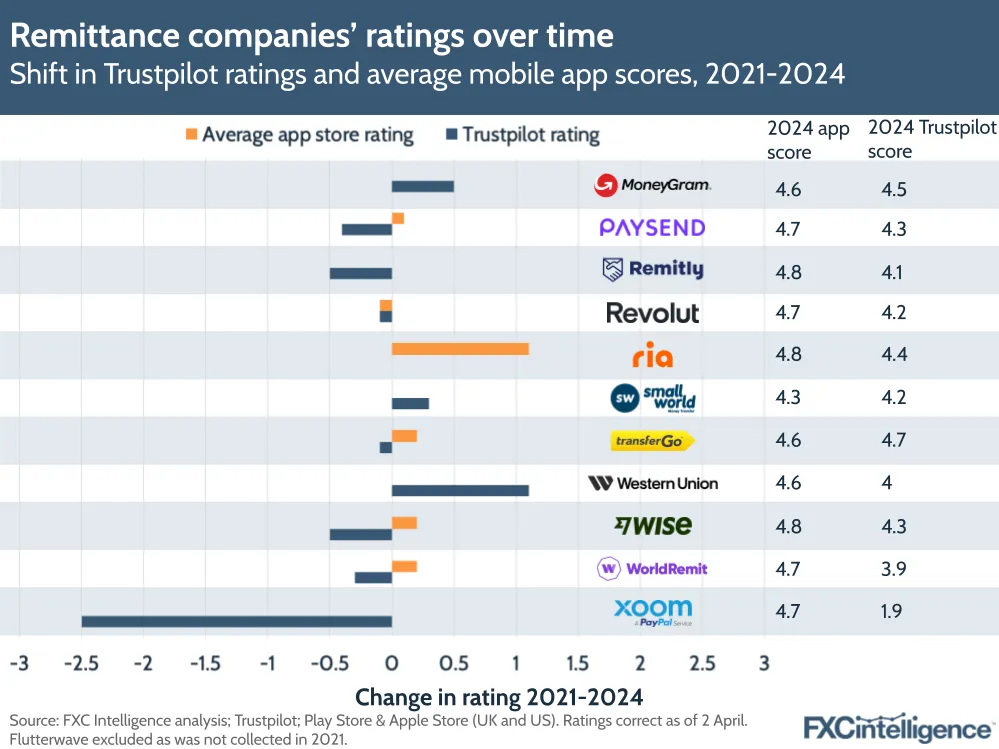

Reliability Ratings

Based on customer reviews and reliability data, here's how these services rank for US-to-India transfers:

| Service | Customer Rating | Service Reliability | Customer Support | Notable Strengths/Weaknesses |

|---|---|---|---|---|

| Wise | 4.6/5 | Excellent | Good | Strong transparency; occasional verification delays |

| Remitly | 4.5/5 | Very Good | Good | Fast transfers; occasional account hold issues |

| XE Transfer | 4.2/5 | Very Good | Good | Reliable for large transfers; less intuitive interface |

| Xoom | 4.0/5 | Good | Average | Fast UPI transfers; occasional payment processing issues |

| Western Union | 3.8/5 | Good | Average | Extensive network; higher fees and stricter verification |

| MoneyGram | 3.7/5 | Good | Average | Wide cash pickup network; occasional transfer delays |

Source: Ratings aggregated from Trustpilot, Google reviews, and industry reports as of May 2025.

Customer satisfaction ratings for major money transfer services

Step-by-Step Guide for Using the Cheapest Options

Here's how to set up and use our top recommended services:

Using Wise (Best Overall)

-

Create an account

Visit wise.com or download the app. Sign up with your email, then verify your identity with a government ID and proof of address.

-

Set up your transfer

Enter the amount you want to send in USD or the amount you want your recipient to receive in INR. You'll see the exact exchange rate and fee immediately.

-

Enter recipient details

Add your recipient's information, including their full name (exactly as it appears on their bank account), bank account number, IFSC code, and sometimes their address.

-

Choose payment method

ACH bank transfer is cheapest, but takes 1-2 business days. Debit card is faster but has additional fees. Avoid credit cards which have the highest fees.

-

Review and confirm

Double-check all details, especially the recipient's bank information. Confirm the transfer and pay.

-

Track your transfer

Use the Wise app or website to track your transfer. You'll receive email notifications as the transfer progresses.

Using Remitly (Best for Transfers over $1,000)

-

Set up your account

Sign up at remitly.com or via their app. Verify your identity with ID and contact information.

-

Enter transfer amount

Choose to send USD to India. Enter the amount (remember: sending $1,000 or more qualifies for free transfers).

-

Choose delivery method

Select either Economy (3-5 business days, better rate) or Express (same day, slightly worse rate).

-

Add recipient details

Enter your recipient's full name, bank details, and IFSC code. For some banks, you'll need to include their address.

-

Select payment method

Use bank transfer for the best rates. Debit cards work for faster funding but add fees.

-

Review and send

Check all details, especially the recipient information and expected delivery time.

Using Xoom (Best for UPI and Fast Transfers)

-

Create a Xoom account

Sign up at xoom.com or with the Xoom app. You can also use your PayPal login if you have one.

-

Start a transfer to India

Enter the amount you want to send and select India as the destination.

-

Choose UPI or bank deposit

For fastest delivery, select UPI transfer and enter your recipient's UPI ID. For larger amounts, bank deposit might be better.

-

Enter recipient information

Add your recipient's details as required for your chosen delivery method.

-

Select funding source

Use bank account (no fee) for the best value. PayPal balance is fast with low fees. Avoid credit cards which have high fees.

-

Review and send

Confirm all details and complete your transfer. With UPI, funds often arrive within minutes.

Setup Tip

For all services, completing full verification during account setup speeds up future transfers. Have your ID, proof of address, and bank details ready when registering to avoid delays later.

Customer Reviews and Experiences

Here's what real users are saying about the top money transfer services for sending to India:

"I've been using Wise for two years to send money to my parents in Mumbai. The transparent fees and excellent exchange rates save me about $25-30 on each $1,000 transfer compared to my bank. Transfers typically take 36-48 hours, which is acceptable for regular support."

— Rahul S., New York

"Remitly's free transfers for amounts over $1,000 is a great deal. I send money to my family in Delhi every month, and their Express service delivers the money the same day with decent rates. Their app makes it very easy to set up recurring transfers."

— Priya K., Brooklyn

"Xoom's UPI transfers are lightning fast! When my sister needed emergency funds, the money arrived in her account in under 10 minutes. The exchange rate isn't the absolute best, but the speed makes it worth it for urgent situations. Their integration with PayPal also makes funding transfers very convenient."

— Amit P., Queens

"I use XE for larger transfers since they don't charge a fee for amounts over $500. Their rates aren't quite as good as Wise, but still much better than my bank. Their customer service helped me when there was an issue with my recipient's bank details, which I appreciated."

— Vikram M., Manhattan

Common Issues to Watch For

- Verification delays - Have your documents ready to avoid holds on your account

- Bank detail errors - Double-check recipient information to avoid transfer rejections

- Unexpected holds - Large or unusual transfers may trigger security reviews

- Weekend delays - Transfers initiated on weekends often process on the next business day

Conclusion and Final Recommendations

After thorough research and comparison of all major money transfer services from New York to India, here are our final recommendations:

-

Best Overall Option: Wise (TransferWise)

Wise offers the best combination of transparent fees and excellent exchange rates. Their mid-market exchange rate policy means you'll consistently get more rupees for your dollars compared to most alternatives, especially for transfers of $500 or more.

-

Best for Large Transfers: Remitly

For transfers of $1,000 or more, Remitly's free transfer policy and competitive exchange rates make it an excellent choice. Their Express service provides same-day delivery when speed is important.

-

Best for Speed: Xoom (PayPal)

When urgency matters most, Xoom's UPI transfers can deliver money to India within minutes. While their exchange rate isn't the absolute best, their speed and integration with PayPal make them valuable for emergency situations.

-

Best for New Users: XE Money Transfer

With no fees for transfers over $500 and a user-friendly platform, XE is an excellent option for those new to international money transfers. Their exchange rates are reasonable, though not as good as Wise.

Remember that exchange rates fluctuate daily, so the cheapest provider today might not be the cheapest tomorrow. Always compare the total amount your recipient will receive at the time of your transfer to get the best deal.

By choosing the right service for your specific needs and following the money-saving tips in this guide, you can save hundreds of dollars per year on your transfers to India. This means more money reaching your loved ones and investments back home, without excessive fees eating away at your hard-earned money.

Whether you're supporting family, paying for property, investing, or sending remittances for any other reason, we hope this comprehensive guide helps you find the most affordable and efficient way to send money from New York to India.

Final Checklist Before Sending Money

- Compare the total INR amount your recipient will receive, not just fees

- Verify all recipient details to avoid transfer rejections

- Consider timing for both exchange rates and processing times

- Choose the appropriate service based on amount, speed, and delivery method

- Keep records of all transfers for tax and tracking purposes

- Check for promotions or first-time user bonuses

Frequently Asked Questions

What is the absolute cheapest way to send money to India?

For most amounts, Wise typically offers the best overall value due to their mid-market exchange rate policy and transparent fee structure. For transfers over $1,000, Remitly is also highly competitive with their zero-fee transfers.

How long does it take for money to reach India?

Transfer times vary by service and method: UPI transfers through Xoom can arrive within minutes, Remitly Express typically delivers same-day, Wise takes 1-2 business days, and traditional bank transfers can take 3-5 business days.

Are there any limits on how much I can send to India?

Most services have daily and monthly limits. Wise allows transfers up to $1 million, Remitly has a $30,000 daily limit, and XE allows up to $500,000. For very large transfers, contact the provider directly as they may offer personalized service and better rates.

Do I need to pay taxes on money sent to India?

In the US, you generally don't pay taxes on money you transfer, but gifts over $19,000 per year to one person require filing a gift tax return. In India, recipients don't pay taxes on gifts from relatives, but gifts over ₹50,000 from non-relatives may be taxable income.

Which service has the best exchange rate for USD to INR?

Wise consistently offers the best exchange rates by using the mid-market rate without markup. Other services like XE and Remitly typically add a markup of 0.5% to 2%, while banks often have markups of 2% to 5%.

Can I use cryptocurrency to send money to India?

Cryptocurrency can be used to transfer value to India, but the regulatory environment is complex. Recipients would need to convert crypto to INR through an exchange, which involves additional fees and potential regulatory challenges. Traditional money transfer services remain simpler and more reliable for most users.

About the Author

Ananya Sharma is a financial writer specializing in international money transfers and cross-border financial services. With over 8 years of experience in the fintech industry, she has helped thousands of NRIs find the most cost-effective ways to move money between the US and India.

Last updated: May 15, 2025

Related Articles

Best Ways to Invest in India from the US

Explore investment opportunities in India's growing economy, including stocks, real estate, and mutual funds.

Read More →Tax Guide for NRIs: US-India Money Transfers

Understand the tax implications of sending money between the US and India as a non-resident Indian.

Read More →How to Open an NRE Account from the US

Step-by-step guide to opening and managing Non-Resident External accounts while living in the United States.

Read More →

Post a Comment