Western Union App Review 2025: Pros, Cons, Fees

Western Union App Review 2025: Pros, Cons, Fees & Comprehensive Analysis

A detailed look at Western Union's mobile app performance, features, and value proposition in 2025

Last Updated: May 12, 2025

Table of Contents

- Introduction

- Key Features of Western Union App in 2025

- User Interface and Experience

- Fee Structure and Pricing

- Security Features and Protection

- Pros of Western Union App

- Cons of Western Union App

- Competitor Comparison

- User Reviews and Feedback

- 2025 Updates and New Features

- Conclusion: Is Western Union App Worth It in 2025?

Introduction

In the ever-evolving landscape of digital financial services, the Western Union app continues to be a significant player in 2025 for international and domestic money transfers. As one of the world's oldest money transfer services, Western Union has successfully transitioned into the digital age, offering a mobile application that allows users to send money to more than 200 countries and territories worldwide.

With the global remittance market expected to reach $930 billion in 2025, mobile money transfer apps have become essential tools for millions of people sending money across borders. Western Union, with its extensive network of physical locations alongside its digital services, presents a unique value proposition in this competitive market.

This comprehensive review examines the Western Union app as it stands in 2025, analyzing its features, fee structure, user experience, security aspects, and how it compares to key competitors like Wise, Remitly, and others. Whether you're a frequent money sender or considering using Western Union for the first time, this guide will help you make an informed decision.

Western Union App 2025 Interface

Key Features of Western Union App in 2025

Global Money Transfer

Send funds internationally to over 200 countries and territories, with options for bank deposits, cash pickup, or mobile wallet delivery.

Multiple Payment Methods

Fund transfers using bank accounts, credit or debit cards, Apple Pay, or start a transfer on the app and pay in cash at an agent location.

Real-Time Tracking

Monitor your money transfers with a unique tracking number (MTCN) and receive notifications when funds are delivered.

Bill Payment

Pay bills anytime, anywhere through the app, including car payments, mortgages, and utilities.

Biometric Authentication

Secure login through Touch ID or Face ID for quick and convenient access to your account.

Exchange Rate Calculator

View and compare the latest international exchange rates instantly using the in-app widget.

Quick Resend Options

Save recipient details to your resend list for faster repeat transfers to family and friends.

Card Scanning

Scan credit or debit cards using your device's camera for faster payment setup and to avoid entry errors.

2025 Feature Highlight: Enhanced Verification Process

Western Union has streamlined its verification process in 2025, allowing new users to verify their identity with various forms of government-issued ID including driver's license, passport, or photo ID. This verification can be completed quickly within the app, enabling users to start sending money within minutes.

Card Scanning Feature in Western Union App

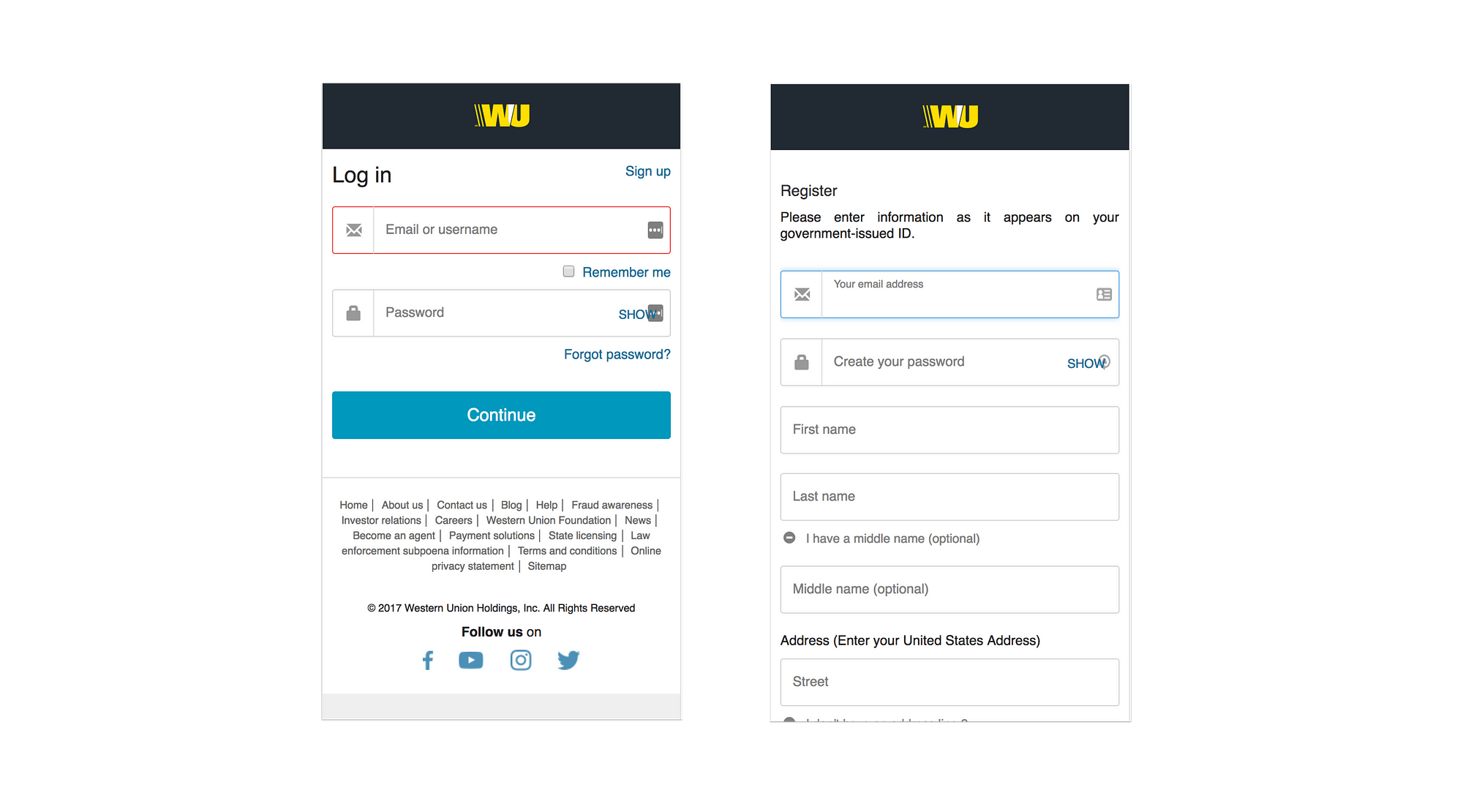

User Interface and Experience

The Western Union app's interface has undergone several refinements in 2025, focusing on creating a more intuitive user experience while maintaining its signature blue and yellow brand identity.

App Navigation and Design

The 2025 version features a streamlined dashboard that presents key actions prominently: Send Money, Track Transfer, Pay Bills, and Find Locations. The bottom navigation bar provides quick access to Home, Activity, Profile, and Support sections.

Western Union App Navigation Interface

Send Money Process

The money transfer process has been simplified to a 5-step flow:

- Select destination country and amount

- Choose payout method (bank account, cash pickup, or mobile wallet)

- Enter receiver details

- Select payment method

- Review and confirm transfer details

Personalization Options

The app now offers more personalization features, including:

- Customizable dashboard with frequently used services

- Dark mode option for reduced eye strain

- Saved recipient lists with contact photos

- Preferred currency settings

- Notification preferences with granular control

Accessibility Features

Western Union has improved accessibility in its 2025 app version with:

- Support for screen readers

- Voice-guided navigation

- Adjustable text sizes

- High contrast mode

- Multiple language support (25+ languages)

Interface Limitations

Some users report that the app's interface can occasionally become slow and unstable, particularly when processing larger transfers or during high-traffic periods. Western Union has acknowledged these issues and states they are working on performance optimizations for future updates.

Fee Structure and Pricing

Western Union's fee structure remains variable in 2025, with costs depending on several factors including transfer amount, destination country, payment method, and delivery option. Here's a breakdown of the typical fees you can expect:

Domestic Transfer Fees

| Transfer Type | Payment Method | Fee Range (USD) |

|---|---|---|

| Domestic Bank Transfer | Bank Account | $0.99 - $10 |

| Domestic Bank Transfer | Credit/Debit Card | $3.99 - $25 |

| Domestic Cash Pickup | Bank Account | $3.99 - $20 |

| Domestic Cash Pickup | Credit/Debit Card | $5.99 - $35 |

International Transfer Fees

| Transfer Type | Payment Method | Fee Range (USD) |

|---|---|---|

| International Bank Transfer | Bank Account | $2.99 - $45 |

| International Bank Transfer | Credit/Debit Card | $5.99 - $50 |

| International Cash Pickup | Bank Account | $3.99 - $45 |

| International Cash Pickup | Credit/Debit Card | $7.99 - $50 |

| Mobile Wallet Delivery | Bank Account | $2.99 - $35 |

| Mobile Wallet Delivery | Credit/Debit Card | $4.99 - $40 |

Additional Fee Considerations

- Exchange Rate Markup: Western Union typically applies a markup to the mid-market exchange rate, which can range from 1-4% depending on the currency pair and transfer amount.

- Card Issuer Fees: When using credit cards, your card issuer may charge additional cash advance fees and interest.

- Intermediary Bank Fees: For some international transfers, intermediary banks may deduct additional fees from the transfer amount.

Promotions and Discounts

Western Union offers several fee-saving opportunities in 2025:

- First Transfer Free: New users typically get their first transfer fee waived (up to a certain amount)

- Referral Program: Refer friends and both parties receive $20 Amazon.com e-gift codes

- Loyalty Program: Frequent users can earn points toward reduced fees

- Promotional Codes: Occasional promotional codes for reduced or waived fees on specific transfer corridors

Fee Estimator Tool

Western Union's app includes a built-in fee estimator tool that allows you to calculate the exact cost of your transfer before committing to it. This tool takes into account all relevant factors including amount, destination, payment method, and delivery option to provide a transparent fee breakdown.

Security Features and Protection

Security remains a top priority for Western Union in 2025, with significant investments in protecting user data and transfer integrity. The app incorporates multiple layers of security:

End-to-End Encryption

All data transmitted through the app is protected with advanced encryption protocols, keeping your personal and financial information secure.

Multi-Factor Authentication

Beyond passwords, the app uses additional verification methods including biometrics (fingerprint/facial recognition) and one-time verification codes.

PCI DSS Compliance

Western Union maintains Payment Card Industry Data Security Standard compliance, ensuring that card data is processed according to rigorous security standards.

Fraud Detection Systems

Advanced AI-driven algorithms monitor for suspicious activities and potential fraud attempts, with real-time alerts for unusual transactions.

Secure Authentication Protocols

TLS (Transport Layer Security) and SSL (Secure Sockets Layer) certification protect data integrity during transmission.

Automatic Session Timeouts

Inactive sessions automatically log out after a period of inactivity to prevent unauthorized access if your device is left unattended.

2025 Security Enhancements

Western Union has implemented several new security features in 2025:

- Enhanced Identity Verification: Improved KYC (Know Your Customer) processes with AI-powered document verification

- Behavioral Biometrics: Analysis of user interaction patterns to detect potential account takeovers

- Transaction Verification Notifications: Real-time alerts for all account activities

- Security Health Check: Regular prompts to review and update security settings

- Geo-Location Verification: Additional security for transfers initiated from new or unusual locations

Security Best Practices

Despite robust security measures, Western Union emphasizes user responsibility in protecting accounts:

- Never share your MTCN (Money Transfer Control Number) except with your intended recipient

- Be wary of transfer requests from unknown persons

- Enable all available security features in your app settings

- Regularly update your mobile device and the Western Union app

- Use unique, strong passwords and change them periodically

Western Union App Security Interface

Pros of Western Union App

Extensive Global Reach

With service to over 200 countries and territories, Western Union offers one of the most comprehensive global networks for money transfers. This extensive reach makes it particularly valuable for sending money to regions where other financial services may have limited presence.

Multiple Delivery Options

The app provides flexibility with various payout methods including bank deposits, cash pickup at over 500,000 agent locations worldwide, and mobile wallet transfers. This versatility accommodates recipients regardless of their banking status or preferences.

Hybrid Digital/Physical Model

Western Union's unique combination of digital services and physical locations creates a hybrid model that allows users to initiate transfers online and pay in cash, or send money entirely digitally. This flexibility is particularly beneficial for users who prefer or need cash options.

Fast Transfer Speed

For urgent transfers, Western Union offers near-instant delivery options (within minutes) to many destinations worldwide. While these expedited services typically cost more, they provide critical speed when needed.

Robust Security Framework

With decades of experience in the money transfer industry, Western Union has developed sophisticated security protocols and fraud prevention systems that provide reliable protection for sensitive financial transactions.

User-Friendly Interface

The 2025 app version features an intuitive design with streamlined transfer processes, clear fee information, and helpful tools like exchange rate calculators and saved recipient lists that enhance the user experience.

Reliable Tracking System

The MTCN tracking system provides transparent status updates on transfers, with push notifications at key points in the transfer process, giving users peace of mind about their transactions.

Established Reputation

With over 170 years in business, Western Union brings unparalleled experience and established regulatory compliance to the digital money transfer space, creating trust and stability that newer fintech companies may lack.

Cons of Western Union App

Higher Fees Compared to Some Competitors

Western Union's fee structure tends to be higher than some digital-first competitors, particularly for bank-to-bank transfers. These higher costs can significantly impact the value of smaller transfers.

Exchange Rate Markups

The company typically applies a markup to the mid-market exchange rate (ranging from 1-4%), which represents an additional hidden cost beyond the stated transfer fee. This can make transfers more expensive than advertised.

Variable Fee Structure

The complex and variable fee structure makes it difficult to predict costs without using the fee estimator for each specific transfer. This lack of standardized pricing can create confusion and surprises for users.

App Performance Issues

Some users report occasional slowdowns, crashes, and interface instability, particularly during high-volume periods or when handling complex transactions. This can lead to frustration when trying to complete time-sensitive transfers.

Limited Multi-Currency Support

Unlike some competitors, Western Union does not offer multi-currency accounts or the ability to hold balances in different currencies. Users must complete a new conversion with each transfer, incurring exchange fees each time.

Verification Delays for Some Users

New users or those sending to certain regions may experience delays in the verification process, which can require additional documentation and review before transfers are approved.

Credit Card Use Concerns

When using credit cards for funding transfers, users may incur additional cash advance fees and interest charges from their card issuers, substantially increasing the total cost of transfers.

Inconsistent Customer Service

Customer service quality can vary significantly, with some users reporting difficulty resolving issues or receiving timely support for complex problems or disputed transfers.

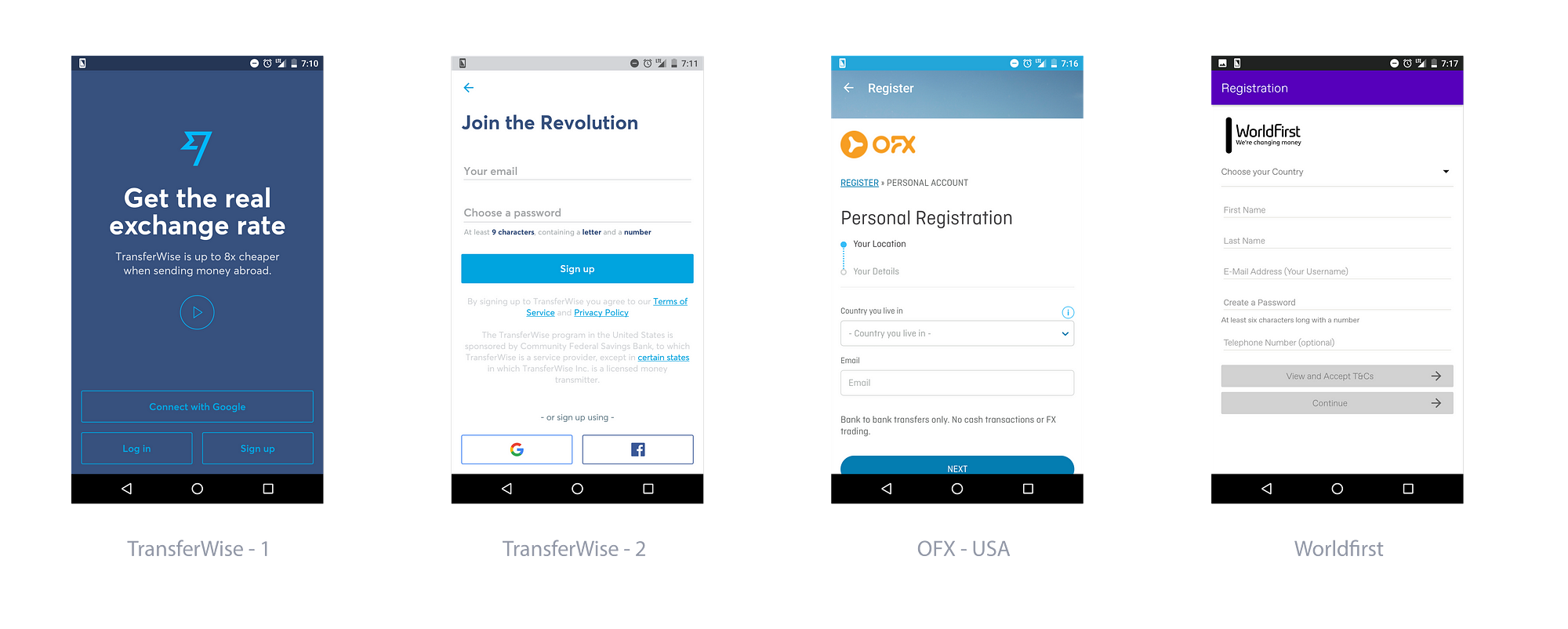

Competitor Comparison

How does Western Union's app stack up against major competitors in 2025? Let's examine the key differentiators:

Western Union vs. Wise

| Feature | Western Union | Wise |

|---|---|---|

| Fee Structure | Variable fees ($0.99-$50+) depending on destination, amount, and delivery method | Transparent fees (typically 0.4-1.5% of transfer amount) |

| Exchange Rates | Markup of 1-4% above mid-market rate | Mid-market exchange rate with no markup |

| Delivery Options | Bank deposits, cash pickup, mobile wallets | Primarily bank deposits, some cash pickup options |

| Transfer Speed | Minutes to 5+ business days | 1-2 business days typical |

| Global Reach | 200+ countries and territories | 80+ countries |

| Multi-Currency Accounts | Not available | Available with account details in 10+ currencies |

| Physical Locations | 500,000+ agent locations worldwide | Online-only with limited physical presence |

Wise offers better exchange rates and more transparent fees, particularly benefiting those making bank-to-bank transfers in supported regions. Western Union excels in global reach, delivery options, and the ability to serve the unbanked through its cash services.

Western Union vs. Remitly

| Feature | Western Union | Remitly |

|---|---|---|

| Fee Structure | Variable fees ($0.99-$50+) | Economy ($3.99+) or Express ($6.99+) options |

| Exchange Rates | 1-4% markup | 0.5-2% markup typical |

| Delivery Options | Bank deposits, cash pickup, mobile wallets | Bank deposits, cash pickup, home delivery in select markets |

| Transfer Speed | Minutes to 5+ business days | Economy: 3-5 days, Express: minutes to hours |

| Global Reach | 200+ countries and territories | 100+ countries, strongest in specific remittance corridors |

| First Transfer Promotion | $0 fee on first transfer | Promotional rate on first transfer |

| Delivery Tracking | MTCN tracking system | SMS updates and in-app tracking |

Remitly typically offers lower fees and better exchange rates than Western Union for its supported corridors. However, Western Union provides broader global coverage and more pickup locations, making it advantageous for sending to remote or underserved regions.

Western Union vs. Other Competitors

| Competitor | Key Advantages vs. Western Union | Key Disadvantages vs. Western Union |

|---|---|---|

| MoneyGram | Sometimes lower fees, similar global reach | Fewer agent locations, less developed app |

| Xoom (PayPal) | PayPal integration, higher sending limits | Limited country coverage, higher fees for cash pickup |

| WorldRemit | Competitive fees for digital transfers | Limited cash pickup options, smaller global footprint |

| Revolut | Free transfers between users, multi-currency accounts | Limited countries, primarily digital-only service |

| OFX | Better rates for large transfers, no fixed fees | No cash options, slower transfers, higher minimums |

Who Should Choose Western Union?

Western Union remains the preferred option for:

- Sending money to remote or underserved regions where other services have limited presence

- Users who need the option of cash pickup for recipients without bank accounts

- Those requiring immediate or same-day transfers in emergency situations

- Senders who prefer the security of an established, regulated service provider

- People who value the flexibility of starting transfers digitally and paying in cash

User Reviews and Feedback

Western Union's app receives mixed reviews across platforms in 2025. Here's what users are saying:

"The app works BETTER and faster than the website! I've been using Western Union for years to send money to my family in Mexico, and the app has made the process so much more convenient. The instant notifications when money is picked up give me peace of mind."

"The fees are way too high compared to other services. I switched to Wise for sending money to Europe and save about 3% on each transfer. Western Union is convenient but expensive for regular transfers."

"I appreciate that I can send money to my home country where other services don't operate. The app is mostly reliable, though sometimes glitchy when uploading verification documents. Customer service could be better, but overall it works well for my needs."

"Transfer service offered is good, but the application has serious usability problems. The interface is slow and unstable. I've had multiple transfers stuck in 'processing' status for days with no explanation. Their customer service couldn't help resolve the issue."

"Best international transfer ever! With this Western Union app, it makes transferring of funds to other countries so easy and fast! It says it will take about 2 days but my recipient usually gets it within hours. The tracking feature is very useful too."

"The app is fine but I wish they would be more transparent about their exchange rates. They advertise low fees but then make their money on the exchange rate markup. I only use it because it's the only reliable option for sending money to my parents in rural areas."

Aggregate Ratings

- App Store: 4.8/5 (200,000+ reviews)

- Google Play Store: 4.6/5 (250,000+ reviews)

- Trustpilot: 3.9/5 (118,000+ reviews)

- Consumer Affairs: 3.5/5 (4,500+ reviews)

- Yelp: 1.5/5 (470+ reviews)

Common Complaints

- High fees and unfavorable exchange rates

- App performance issues during peak usage times

- Account verification delays for new users

- Inconsistent customer service quality

- Transfer delays to certain countries

Most Praised Features

- Global reach and availability in remote areas

- Speed of transfers with Express options

- Reliable tracking system

- Multiple payout options, especially cash pickup

- Ease of use when sending to saved recipients

2025 Updates and New Features

Western Union has introduced several noteworthy updates and features to its app in 2025:

Enhanced Security Framework

Improved multi-factor authentication, behavioral biometrics, and AI-powered fraud detection systems provide enhanced protection for users' accounts and transactions.

Streamlined Verification Process

Faster ID verification with improved document scanning technology reduces the time needed to verify accounts and approve transfers for new users.

Expanded Mobile Wallet Integrations

New partnerships with mobile wallet providers have increased the number of digital wallets that can receive Western Union transfers directly.

Improved Tracking Interface

More detailed transfer tracking with visual timeline, status notifications, and estimated delivery countdown for better transparency.

Enhanced Personalization

Customizable dashboard, saved preferences, and smart suggestions based on transfer history make repeat transfers faster and more convenient.

Expanded Payment Options

Integration with additional digital payment methods including more mobile wallets and regional payment services provides greater flexibility for funding transfers.

Business Strategy Updates

Western Union released its "Evolve 2025" strategy, focusing on several key business initiatives that impact app users:

- Digital Transformation: Continued investment in digital channels with a goal of digital transactions representing 50% of consumer business by the end of 2025

- Partnership Expansion: New collaborations with financial institutions, telecoms, and fintech companies to expand service reach

- Focus on High-Value Corridors: Strategic emphasis on key remittance markets with tailored features and potentially reduced fees

- Enhanced Cross-Border Payment Infrastructure: System improvements to increase processing efficiency and reduce transfer times

- Blockchain Exploration: Testing of blockchain technology for selected transfer corridors to improve efficiency and reduce costs

2025 Recognition

Western Union has been recognized as the "Best Money Transfer App 2025" by Expert Consumers, highlighting its unparalleled international reach, robust app features, and commitment to user security and convenience.

Improved Transfer Tracking Interface in 2025

Conclusion: Is Western Union App Worth It in 2025?

After thoroughly examining the Western Union app's features, fees, security, user experience, and competitive positioning in 2025, we can draw several conclusions about its value proposition:

Worth It For:

- Global Reach Needs: If you're sending money to remote or underserved regions, Western Union's unmatched global network makes it one of the few reliable options available.

- Cash Pickup Requirements: For recipients without bank accounts or those who prefer cash, Western Union's extensive agent network provides convenient access points worldwide.

- Urgent Transfers: When speed is critical, Western Union's near-instant delivery options to many destinations can be worth the premium fees.

- Hybrid Users: Those who value the flexibility to alternate between digital and cash-based services will appreciate Western Union's versatile model.

- Security-Conscious Users: With its established reputation and robust security infrastructure, Western Union offers peace of mind for high-value or critical transfers.

Consider Alternatives For:

- Cost-Conscious Regular Transfers: If you send money frequently, especially in popular corridors, services like Wise or Remitly typically offer better exchange rates and lower fees.

- Bank-to-Bank Only: Users who exclusively send money between bank accounts can find more cost-effective options with digital-first providers.

- Multi-Currency Needs: Those requiring the ability to hold multiple currencies should consider services like Wise or Revolut with their multi-currency account features.

- Large Transfers: For transferring significant sums, specialized services like OFX typically offer better rates and lower total costs.

- Tech-Forward Users: If you value cutting-edge technology and integration with other financial apps, newer fintech companies may provide more innovative features.

Final Verdict

The Western Union app in 2025 represents a solid option in the money transfer marketplace, particularly excelling in global reach, versatility of service, and established security. While not always the cheapest option, its unique combination of digital convenience and physical infrastructure creates a differentiated value proposition that remains relevant for many users' needs.

The app has shown meaningful improvements in user experience and features since previous years, but still faces challenges in fee transparency and competitive pricing in an increasingly crowded marketplace. For certain use cases—especially those involving cash pickup or transfers to remote regions—Western Union remains a market leader and often the most reliable choice.

Users should carefully evaluate their specific transfer needs, comparing Western Union's fees and exchange rates for their particular corridors against alternatives before deciding. The company's fee estimator tool makes this comparison straightforward by providing transparent cost breakdowns before committing to transfers.

Post a Comment