POWER of Financial PLANNING! | Money Matters 2025

The Power of Financial Planning: Building a ₹5+ Crore Retirement Corpus

How a 33-Year-Old Government Employee from West Bengal Created Massive Wealth on Just ₹30,000 Monthly Income

Important Disclaimer

This article is for informational purposes only and should not be considered as financial advice. The content is based on a case study from Ankur Warikoo's Money Matters series. Please consult with qualified financial professionals before making any investment decisions. Past performance does not guarantee future results.

The Inspiring Story of Arindam

In a world where many believe that building significant wealth requires a high income, Arindam's story proves otherwise. This 33-year-old medical technologist from Kalyani, West Bengal, earning just ₹30,000 per month, has successfully built an investment portfolio that's projected to grow into a retirement corpus of over ₹5 crores.

Featured in Ankur Warikoo's popular "Money Matters" series, Arindam's journey demonstrates the transformative power of disciplined financial planning, strategic investing, and long-term wealth building - regardless of your income level.

Key Achievement Highlights:

- • Built ₹9+ lakh investment portfolio in just 2-3 years

- • Saved ₹12 lakh for home down payment

- • Projected ₹5.37 crore retirement corpus by age 60

- • Complete family insurance coverage

Meet Arindam: The Middle-Class Wealth Builder

Personal Profile

Financial Challenges

Current Investment Portfolio Analysis

Portfolio Composition

• Flexi/Mid Cap: ₹1,500

• Small Cap: ₹500

• Child Education Fund: ₹1,000 (separate)

Current Portfolio Value

Total Investments: ₹9+ lakhs

Home Down Payment Fund: ₹10 lakhs (in liquid funds)

Investment Duration: 2-3 years

Monthly Savings Rate: ₹7,500+ (25% of income)

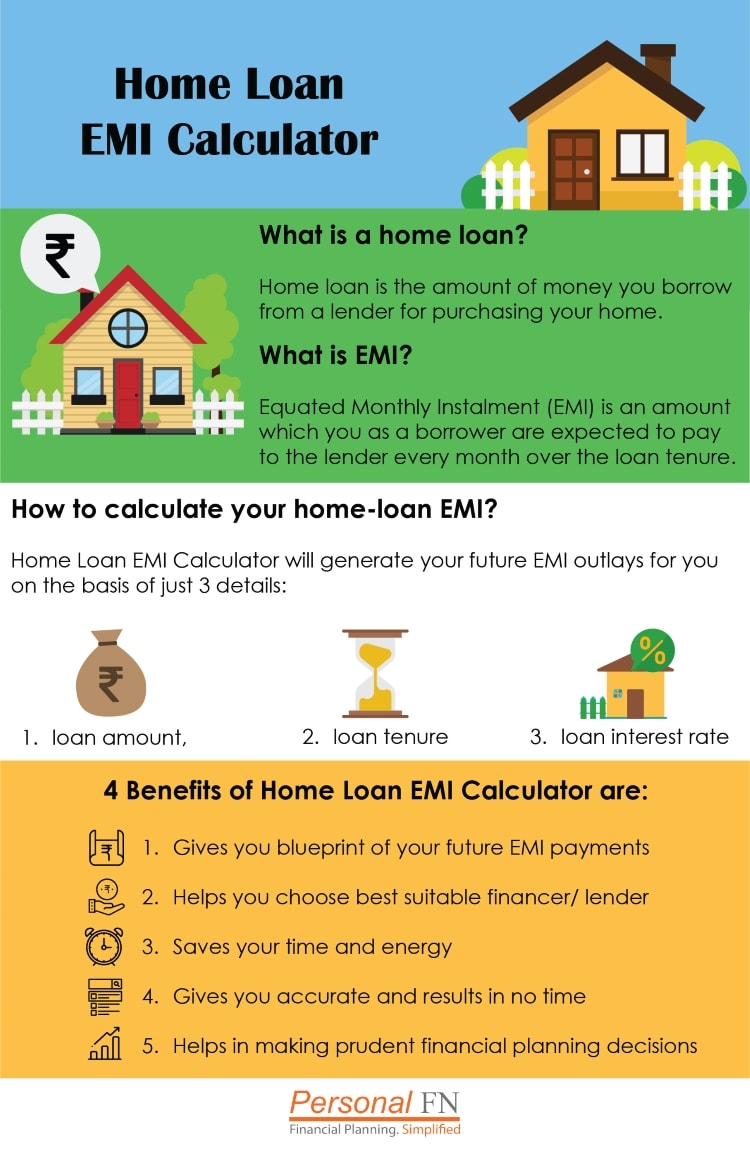

Strategic Home Loan Planning

Property Purchase Details

Property Value: ₹25 Lakhs

• Down Payment Paid: ₹2 lakhs ✓

• Additional Payment Arranged: ₹10 lakhs ✓

• Home Loan Required: ₹13 lakhs

• Expected Completion: 1.5-2 years

EMI Calculation

• Loan Amount: ₹13 lakhs

• Interest Rate: 8.5% annually

• Loan Tenure: 20 years

• Monthly EMI: ₹11,280

EMI Affordability Analysis

• Current Rent: ₹7,000/month

• Net Additional EMI: ₹4,280/month

• Current Monthly Savings: ₹7,500

• Easily Affordable! ✓

Smart Strategy Tips

- • Pay one extra EMI annually to reduce tenure

- • Increase EMI by 10% yearly if possible

- • With these strategies: 20-year loan becomes 9-10 years!

- • Rent savings (₹7,000) makes EMI very manageable

Retirement Corpus Projection: The ₹5+ Crore Journey

₹25.9 Lakhs

At Age 43 (10 years)

Early wealth accumulation

₹1.62 Crores

At Age 53 (20 years)

Crossing the crore mark

₹5.37 Crores

At Age 60 (27 years)

Retirement corpus target

Projection Breakdown by Asset Class:

Equity MFs (₹4,000 SIP)

₹5.37 crores at 60

NPS (₹500)

₹5.25 lakhs at 60

Gold (5g)

₹4.58 lakhs at 60

EPF

₹37.8 lakhs at 60

Key Success Strategies: What Made Arindam's Plan Work

1. Disciplined SIP Investing

Started with just ₹1,000/month and gradually increased to ₹4,000 with 10% annual step-up. Consistency over 2-3 years created substantial corpus.

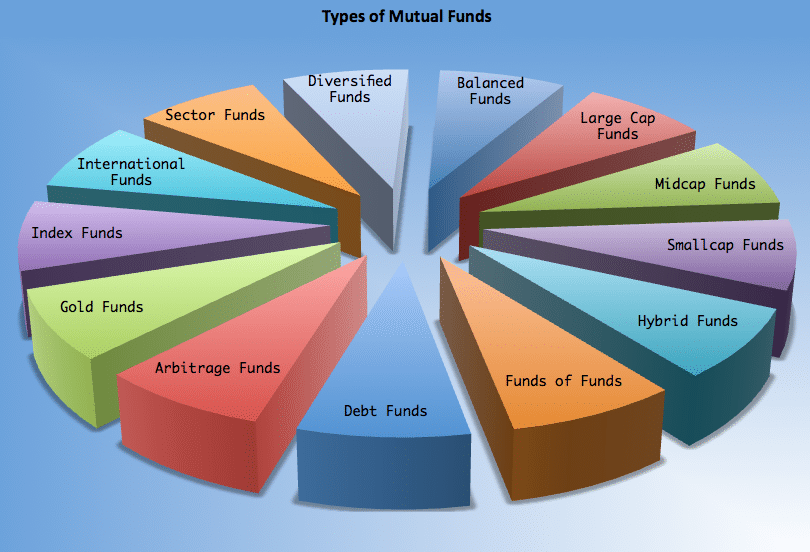

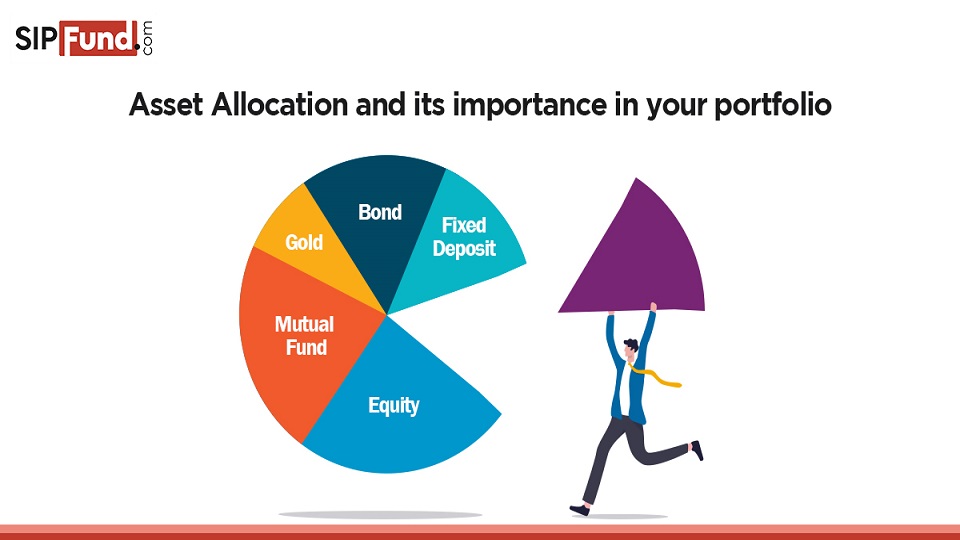

2. Smart Diversification

Balanced portfolio across Large Cap (₹2,000), Flexi Cap (₹1,500), and Small Cap (₹500) funds to optimize risk-return balance.

3. Goal-Based Planning

Separate funds for home purchase (liquid funds) and child's education, ensuring goals don't conflict with each other.

4. Comprehensive Protection

₹75 lakh term insurance until age 70, separate health insurance for family and mother, ensuring complete financial protection.

5. Strategic Home Buying

Planned home purchase with adequate down payment, ensuring EMI doesn't strain monthly budget after rent savings.

6. Continuous Learning

Followed financial education content consistently, applied learnings systematically without getting overwhelmed by complexity.

The Master Formula

- ✓ Start early, even with small amounts

- ✓ Increase investments by 10% annually

- ✓ Diversify across asset classes

- ✓ Stay consistent through market ups and downs

- ✓ Plan for specific goals separately

- ✓ Protect your wealth with adequate insurance

Practical Lessons for Middle-Class Families

Monthly Budget Breakdown

Implementation Roadmap

Month 1-6: Foundation

- • Start with ₹1,000 SIP in diversified equity fund

- • Open separate savings account for emergency fund

- • Get basic health and term insurance

Month 6-12: Expansion

- • Increase SIP to ₹2,000 across 2-3 funds

- • Start NPS with ₹500/month

- • Build 6-month emergency fund

Year 2+: Optimization

- • Increase SIP by 10% annually

- • Add goal-based investments

- • Review and rebalance portfolio yearly

Expert Financial Planning Tips

Start Small, Think Big

Don't wait for a perfect salary to start investing. Even ₹500/month can compound into lakhs over 20-25 years. The key is to begin today and increase gradually.

Diversify Wisely

Spread investments across Large Cap (stability), Mid Cap (growth), and Small Cap (high growth potential). This balanced approach reduces risk while maximizing returns.

Time Is Your Friend

The earlier you start, the more time your money has to compound. Starting at 30 vs 40 can mean the difference between ₹5 crores and ₹2 crores at retirement.

Arindam's Success Mantras

- "Small steps consistently taken lead to big results"

- "Don't let low salary become an excuse for not investing"

- "Educate yourself through reliable financial content"

- "Plan for specific goals separately"

- "Protection is as important as growth"

- "Stay disciplined through market volatility"

The Power of Financial Discipline

Arindam's story is a powerful reminder that wealth building is not about how much you earn, but how wisely you manage and invest what you have. His journey from a government employee earning ₹30,000 to building a projected ₹5+ crore retirement corpus demonstrates the extraordinary power of financial discipline and strategic planning.

The key takeaways from his success are clear: start early, stay consistent, diversify intelligently, and never underestimate the power of compound interest. Whether you earn ₹25,000 or ₹25 lakhs, the principles of successful financial planning remain the same.

Your Financial Journey Starts Today

Don't wait for the "perfect" time or the "perfect" salary. Start with what you have, where you are, and let time and discipline work their magic. Your future self will thank you for the steps you take today.

Post a Comment