How to Document Money Transfers to India for US Tax Compliance"

How to Document Money Transfers to India for US Tax Compliance

A comprehensive guide for NRIs, expatriates, and US citizens transferring money to India

Introduction: Understanding Tax Compliance for India-Bound Transfers

Sending money from the United States to India is common practice for many Non-Resident Indians (NRIs), expatriates, and US citizens with family or business ties to India. In 2023 alone, India received approximately $120 billion in remittances, with the USA being the second-largest contributor.

However, international money transfers come with significant tax and reporting obligations in both countries. Failing to properly document and report these transfers can result in severe penalties, including substantial fines and potential legal complications.

This comprehensive guide will help you understand the critical documentation requirements, reporting thresholds, tax implications, and compliance rules for transferring money from the US to India. By following these guidelines, you can ensure your transfers are fully compliant with both US and Indian regulations.

Table of Contents

Key US Tax Forms for Documenting Money Transfers to India

FBAR (FinCEN Form 114)

The Report of Foreign Bank and Financial Accounts (FBAR) is required if you have financial accounts outside the US that exceed $10,000 in aggregate value at any point during the calendar year.

Due Date: April 15, with automatic extension to October 15

Filing Method: Electronically through FinCEN's BSA E-Filing System (not with your tax return)

Form 8938 (FATCA)

Statement of Specified Foreign Financial Assets, required under the Foreign Account Tax Compliance Act if you have specified foreign financial assets exceeding certain thresholds.

Due Date: Filed with your annual income tax return

Filing Method: Attached to your Form 1040

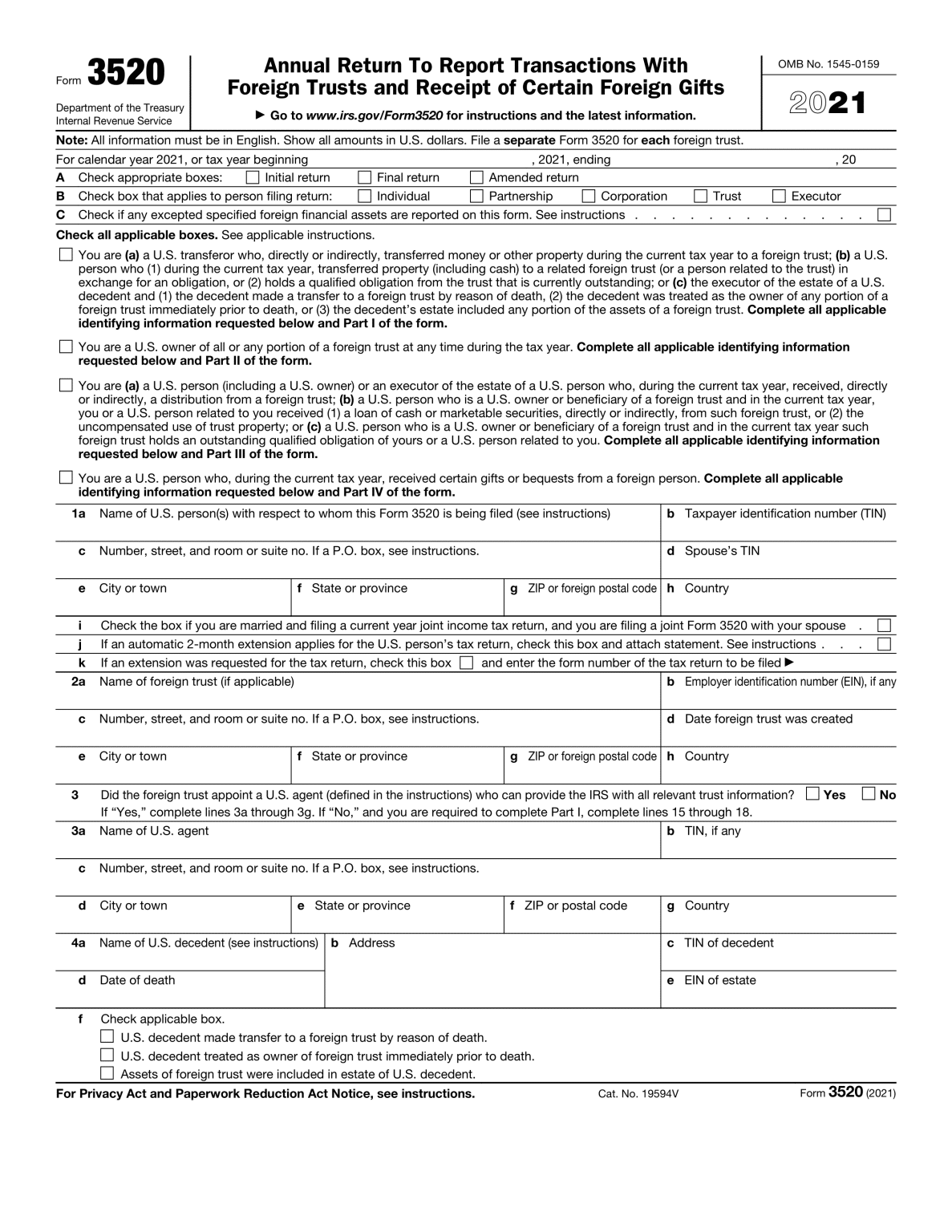

Form 3520

Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Required if you transfer money to foreign trusts or receive large gifts from foreign individuals.

Due Date: 15th day of the 4th month following the end of your tax year (can be extended)

Filing Method: Filed separately from your tax return

Gift Tax Return (Form 709)

Required when you give gifts exceeding the annual exclusion amount ($18,000 for 2024) to an individual, including money transfers to individuals in India.

Due Date: April 15 of the year following the gift transfer

Filing Method: Filed separately from your income tax return

Important Note

Many international money transfers require reporting on multiple forms. For example, large transfers to relatives in India might need to be reported on both Form 709 (for US gift tax purposes) and Form 3520 (if they exceed certain thresholds).

IRS Form 3520 - Required for reporting large gifts to foreign persons

Reporting Thresholds and Requirements

FBAR Reporting Thresholds

The FBAR filing requirement is triggered when your aggregate foreign financial accounts exceed $10,000 at any point during the calendar year. This is a cumulative threshold—if you have multiple accounts that together exceed $10,000, all accounts must be reported even if individually they are below this amount.

What Triggers FBAR Requirements for India Transfers?

- Having signature authority over accounts in Indian banks

- Maintaining NRE, NRO, or FCNR accounts in India

- Being named on a family member's account in India

- Holding investments through Indian financial institutions

Important: The $10,000 threshold applies to the combined value of all foreign accounts, not just those in India.

Form 8938 (FATCA) Reporting Thresholds

| Filing Status | Living in US | Living Abroad |

|---|---|---|

| Single or Married Filing Separately | $50,000 on last day of year or $75,000 at any time during the year | $200,000 on last day of year or $300,000 at any time during the year |

| Married Filing Jointly | $100,000 on last day of year or $150,000 at any time during the year | $400,000 on last day of year or $600,000 at any time during the year |

Form 3520 Reporting Thresholds

Form 3520 is required in several scenarios related to money transfers to India:

- If you transfer property to a foreign trust

- If you receive more than $100,000 as gifts from a foreign person (including family members in India) during the tax year

- If you receive more than the threshold amount (varies annually) from foreign corporations or partnerships

Gift Tax Reporting Thresholds

For 2024, gifts exceeding $18,000 to any individual in a calendar year (including money transfers to relatives in India) may require filing Form 709, even if no tax is due because of the lifetime gift tax exemption.

Documentation Best Practices

Essential Records to Maintain

- Transaction confirmations from your bank or money transfer service

- Purpose of each transfer (family support, gift, investment, etc.)

- Receipts showing the exchange rates applied

- Bank statements showing the transfers

- Communication with recipients about the transfers

- Foreign bank account statements (if applicable)

- Any agreements related to the transfers

Documentation Timeline

Keep thorough documentation for at least:

- 3 years - Standard IRS statute of limitations

- 6 years - If you underreport income by more than 25%

- Indefinitely - For transfers to foreign trusts or entities

- 5 years - For FBAR-related documentation

Note: The statute of limitations may be extended for foreign financial assets not properly reported.

Pro Tip: Create a Transfer Documentation System

Establish a systematic approach to documenting all international money transfers:

- Create a dedicated folder (physical or digital) for each calendar year

- For each transfer, complete a cover sheet noting the date, amount, purpose, recipient details, and which US tax forms will be required

- Attach all supporting documentation

- Maintain a master spreadsheet tracking all transfers and reporting requirements

- Review with a tax professional annually

Required Information for FBAR Reporting

For each foreign account, you must keep records with:

- Name on the account

- Account number

- Name and address of the foreign bank

- Type of account

- Maximum value during the year

Generally, these records must be kept for five years from the FBAR due date.

Compliance Requirements in Both Countries

US Compliance Requirements

IRS Requirements

- Report foreign accounts on FBAR if aggregate balance exceeds $10,000

- Disclose specified foreign financial assets on Form 8938

- Report large gifts to foreign individuals

- Document transfers to foreign trusts

- Report foreign income on US tax returns

Bank Secrecy Act Requirements

- Banks must report transactions over $10,000

- Multiple smaller transfers may also be reported if they appear structured to avoid reporting

Indian Compliance Requirements

RBI Guidelines

- Liberalised Remittance Scheme (LRS) allows resident individuals to receive up to $250,000 per financial year

- Non-resident Indians have no specific inward remittance limits

- Purpose of remittance must be documented

- Recipient needs to report significant transfers from non-relatives

Indian Tax Implications

- Gifts from relatives are tax-exempt in India

- Gifts from non-relatives exceeding ₹50,000 in a year are taxable

- Recipients may need to file appropriate tax declarations

Required Documentation from Both Sides

US Side Documentation

- Identity verification (passport, driver's license)

- Source of funds documentation

- Purpose of transfer declaration

- Recipient details

- Relationship to recipient (for gift transfers)

Indian Side Documentation

- Foreign Inward Remittance Certificate (FIRC) from beneficiary bank

- KYC documentation for the recipient

- Declaration of purpose for funds received

- Documentation showing relationship to sender (for gift purposes)

Documentation requirements for international money transfers

Penalties for Non-Compliance

Warning

The penalties for failing to properly document and report international money transfers can be severe and can accumulate quickly. Proactive compliance is always more cost-effective than addressing violations after the fact.

FBAR Non-Filing Penalties

| Violation Type | Penalty |

|---|---|

| Non-willful violation | Up to $10,000 per violation (adjusted for inflation) |

| Willful violation | Greater of $100,000 or 50% of account balance per violation (adjusted for inflation) |

| Criminal penalties | Up to $250,000 and/or imprisonment up to 5 years |

Form 8938 Non-Filing Penalties

- Initial penalty of $10,000 for failure to disclose

- Additional $10,000 for each 30 days of non-filing after IRS notification (maximum $50,000)

- 40% penalty on understatement of tax attributable to non-disclosed assets

- Extended statute of limitations for assessment

Form 3520 Non-Filing Penalties

- Greater of $10,000 or 35% of the gross value of property transferred to a foreign trust

- Greater of $10,000 or 35% of the gross value of distributions received from a foreign trust

- 5% of gross value of trust assets owned by a US person if required information isn't provided

- Additional penalties if non-compliance continues after IRS notification

Form 709 (Gift Tax) Non-Filing Penalties

- Failure to file penalties (5% per month, up to 25% of tax due)

- Accuracy-related penalties (20% of underpayment)

- Fraud penalties (75% of underpayment due to fraud)

- Interest on unpaid tax

Relief Options

The IRS offers various compliance programs for those who have failed to properly report foreign accounts or assets, including:

- Streamlined Filing Compliance Procedures

- Delinquent FBAR Submission Procedures

- Delinquent International Information Return Submission Procedures

These programs may provide penalty relief for those who can demonstrate their non-compliance was not willful.

The Proposed 5% Remittance Tax

What Is the Proposed Remittance Tax?

The "One Big Beautiful" Tax Act proposes a 5% tax on money transfers from the US to other countries, including India. This is a transaction-based tax that would apply each time money is sent abroad.

Implementation Timeline

If passed, the tax would be applicable from January 1, 2026, for all outbound transfers.

Who Would Be Affected?

The tax would primarily impact:

- NRIs on H1B, L1, F1, OPT or similar visas

- Green Card holders

- Non-citizen U.S. residents

Who Would Be Exempt?

- Verified U.S. citizens and nationals

- Transfers via certified remittance providers registered with the IRS that can verify sender's citizenship

Collection Method

The tax would be collected at the source—by the money transfer service, bank, app, or remittance provider at the time of transfer.

Planning Strategies (If Implemented)

- Track all foreign transfers systematically

- Review your visa and citizenship status

- Choose compliant and transparent remittance providers

- Stay updated on legislative changes

- Consult with a cross-border tax advisor

Frequently Asked Questions

Do I need to report money I send to my parents in India?

Yes, if the amount exceeds the annual gift tax exclusion threshold ($18,000 per recipient in 2024), you should file Form 709 to report the gift, even if no tax is due. Additionally, if total transfers exceed $100,000, Form 3520 may be required.

Are money transfers to India taxable in the US?

Generally, sending money to India is not taxable as income for the sender. However, if the amounts exceed certain thresholds, you may need to report these transfers even if no tax is due. Large gifts may be subject to gift tax reporting requirements.

Do I need to file an FBAR if I don't have a bank account in India but just send money there?

Simply sending money to India doesn't trigger FBAR requirements. FBAR is required only if you have financial interest in or signature authority over foreign financial accounts with aggregate value exceeding $10,000 at any time during the calendar year.

Is there a limit to how much money I can send to India?

The US doesn't impose specific limits on how much you can send abroad, but transfers over $10,000 must be reported by financial institutions to the government. In India, there's no specific limit for non-residents sending money to India, but documentation requirements increase with larger amounts.

How do I document the purpose of my money transfer to India?

Keep records of the transfer's purpose (e.g., family support, gift, property purchase), correspondence with recipients, and any related contracts or agreements. If using a money transfer service, they often have a field to declare the purpose which should match your documentation.

Are student transfers to parents in India subject to special rules?

Students on F1 visas sending money to parents in India follow the same reporting rules as others. For amounts like $3,000-$4,000, there are typically no significant legal hurdles, but ensure the transfer complies with Anti-Money Laundering (AML) laws by using reputable transfer services.

Will the 5% remittance tax affect all money transfers to India?

If implemented as proposed, the tax would apply to remittances sent by non-U.S. citizens. U.S. citizens would be exempt. The tax would be collected at the time of transfer by the financial service provider.

How long should I keep documentation of my transfers to India?

Keep records for at least 3 years (the standard IRS statute of limitations), but 6 years is safer. For foreign accounts reported on FBAR, keep records for 5 years from the filing date. For large transfers or complex situations, consider keeping records indefinitely.

What happens if I didn't report my transfers to India in previous years?

The IRS offers various compliance programs for those who failed to properly report. Depending on your situation, you might qualify for Streamlined Filing Compliance Procedures or other programs that provide penalty relief if non-compliance was non-willful.

Do I need to report money transfers to India on my US tax return?

Generally, money transfers themselves aren't reported directly on your Form 1040. However, depending on the amount and nature of the transfers, separate forms like Form 709 (Gift Tax Return), Form 8938 (FATCA), or Form 3520 may need to be filed alongside your tax return.

Expert Tips for Smooth Compliance

Use Consistent Transfer Methods

Select 1-2 reputable money transfer services for all your remittances to India. This creates a consistent paper trail and simplifies documentation. Banks and established money transfer services typically provide detailed transaction records that can be useful for tax documentation.

Time Your Transfers Strategically

Consider the tax implications of the timing of your transfers. Large transfers near year-end may trigger reporting requirements for that tax year. If you're planning substantial transfers, consider splitting them across tax years if that helps with compliance or tax planning.

Create a Tax Calendar

Develop an annual tax calendar that includes all filing deadlines related to international transfers and accounts. Include FBAR filing (April 15), Form 8938 (with tax return), Form 3520 deadlines, and any Indian reporting requirements.

Work with Specialized Tax Professionals

Engage tax professionals who specialize in cross-border taxation and US-India financial matters. They can provide tailored advice for your specific situation and help ensure complete compliance with all applicable regulations.

Advanced Compliance Strategy

Consider creating a comprehensive "International Transfer Compliance Folder" with:

- A master tracking spreadsheet of all transfers

- Documentation templates for consistent record-keeping

- A file organization system for physical and digital records

- Checklists for annual reporting requirements

- Contact information for financial institutions, tax professionals, and relevant government offices

This approach can significantly reduce the stress associated with tax compliance and minimize the risk of penalties.

Expert Reviews

"The most comprehensive guide I've seen on documenting US-India money transfers. Tax compliance in this area is complex and often overlooked, but this resource covers all the essential aspects that NRIs need to understand."

- Raj Sharma, CPA

US-India Tax Specialist

"As someone who specializes in FBAR compliance, this guide provides exceptional detail on the reporting requirements that many NRIs miss. The section on documentation practices is particularly valuable."

- Sarah Johnson

International Tax Attorney

Conclusion

Properly documenting money transfers from the US to India is essential for maintaining compliance with tax regulations in both countries. By understanding the reporting thresholds, keeping thorough documentation, and staying informed about changing requirements (like the proposed remittance tax), you can avoid costly penalties and ensure smooth financial transactions.

Remember that different forms have different filing requirements and deadlines. The FBAR must be filed electronically by April 15 (with automatic extension to October 15) if your foreign accounts exceed $10,000 at any time during the year. Form 8938 is filed with your tax return if your foreign financial assets exceed the applicable threshold. Form 3520 may be required for large gifts or transfers to foreign trusts.

While the documentation requirements may seem overwhelming, establishing a systematic approach to record-keeping from the beginning will make the process much more manageable. Consider working with tax professionals who specialize in US-India taxation to ensure full compliance and optimize your financial strategies.

As regulations continue to evolve, including the potential implementation of the 5% remittance tax, staying informed and maintaining comprehensive records will be your best protection against compliance issues.

Key Takeaways

- FBAR filing is required if foreign accounts exceed $10,000

- Form 8938 thresholds vary based on filing status and residence

- Gifts over $18,000 to individuals require Form 709

- Form 3520 is needed for large gifts from foreign persons

- Maintain thorough documentation for at least 3-6 years

- Penalties for non-compliance can be substantial

- A proposed 5% remittance tax may affect transfers starting 2026

Stay Compliant Checklist

- Track all international transfers systematically

- Document purpose and relationship for each transfer

- Keep records of transaction confirmations

- Report foreign accounts if over $10,000

- File gift tax returns for large transfers

- Consider timing of transfers for tax planning

- Consult a cross-border tax specialist annually

Important Deadlines

- FBAR Filing April 15

- FBAR Extension October 15

- Form 8938 Tax Return Due Date

- Form 3520 15th day of 4th month

- Gift Tax Return April 15

Common Pitfalls to Avoid

- Ignoring FBAR requirements for small accounts

- Assuming gifts to family don't need reporting

- Failing to document transfer purposes

- Using multiple small transfers to avoid reporting

- Forgetting about foreign investment accounts

- Missing extended deadlines for filing

Post a Comment