Mobile Money Transfer Apps That Support Multiple Indian Bank Accounts

Mobile Money Transfer Apps That Support Multiple Indian Bank Accounts

The ultimate guide to managing all your accounts in one place

In today's digital world, managing multiple bank accounts has become a common necessity for many Indians. Whether it's maintaining separate accounts for personal and business purposes, having accounts across different banks for specific benefits, or simply managing family finances, the need to switch between multiple banking apps can be frustrating and time-consuming.

Thankfully, several mobile money transfer apps in India now offer the ability to link multiple bank accounts, providing a centralized platform to manage all your finances. These apps not only simplify money transfers but also offer comprehensive insights into your spending patterns, help track expenses, and provide a unified view of your financial health.

What You'll Learn in This Guide:

- Top mobile apps that support multiple bank accounts in India

- Unique features of each app to help you choose the right one

- Security measures implemented by these apps

- How to efficiently manage multiple accounts

- Benefits of consolidating your banking experience

Benefits of Using Multi-Bank Account Apps

Unified Experience

Access all your bank accounts from a single app instead of switching between multiple banking applications.

Better Financial Insights

Get a complete overview of your finances across all accounts, helping you make better financial decisions.

Time-Saving

Save time by managing multiple accounts from a single interface without having to log in and out of different apps.

Enhanced Security

Modern multi-bank apps implement robust security measures to protect your data across all connected accounts.

Simplified Transfers

Transfer money between your accounts instantly without the hassle of adding beneficiaries or waiting periods.

Consolidated Notifications

Receive alerts and notifications for all your accounts in one place, ensuring you never miss important updates.

Top Money Transfer Apps Supporting Multiple Bank Accounts

PhonePe

Rating: 4.4/5PhonePe, introduced in 2015, is one of India's leading payment apps with millions of users. It offers seamless support for multiple bank accounts, allowing users to add and manage various accounts from different banks.

Key Features:

- Link and manage multiple bank accounts

- Easily switch between accounts for transactions

- Quick UPI payments and transfers

- Auto-categorization of transactions

- Bill payments, recharges, and utility services

- Secure biometric authentication

Google Pay

Rating: 4.3/5Google Pay (formerly Tez) launched in 2017 has quickly become one of the most popular UPI apps in India. It provides a seamless experience for managing multiple bank accounts with Google's robust security infrastructure.

Key Features:

- Support for multiple bank accounts in one app

- Simple account switching during transactions

- Integration with Google services

- Reward system with cashback and scratch cards

- Advanced security with Google's protection

- Clean, minimalist interface

Paytm

Rating: 4.2/5Paytm, launched in 2014, is one of the pioneers in India's digital payment ecosystem. It allows users to link multiple bank accounts for UPI transactions, as well as maintaining its own wallet system for additional convenience.

Key Features:

- Link multiple bank accounts without any limit

- Option to set a primary account for UPI transactions

- Paytm Wallet for additional convenience

- Wide range of services (shopping, travel bookings, investments)

- Regular cashback offers and discounts

- QR code scanning for merchants

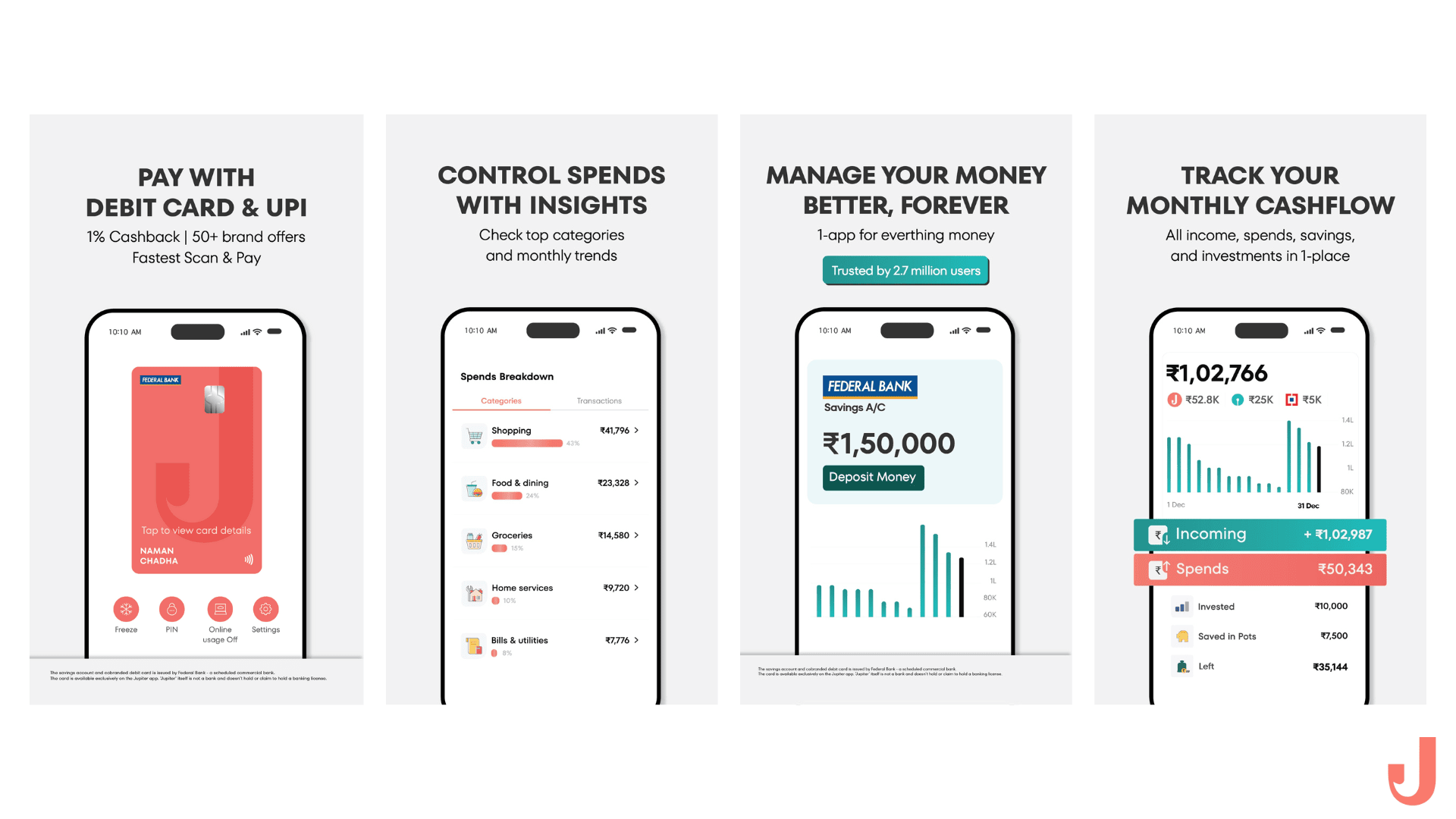

Fi Money

Rating: 4.5/5Fi Money is a neobanking platform that offers a revolutionary "Connected Accounts" feature, allowing users to sync multiple bank accounts from different banks on a single platform. It's designed specifically for millennials who typically maintain accounts across multiple banks.

Key Features:

- View balances and transactions from all linked bank accounts

- Fi's AI-powered financial assistant for smart insights

- Auto-categorization of expenses across accounts

- Consolidated financial dashboards

- Zero-fee banking with Federal Bank partnership

- Smart savings features and investment options

ICICI iFinance

Rating: 4.2/5ICICI Bank's iFinance is a game-changing feature that offers a consolidated view of all savings and current accounts held across different banks on a single platform. It's available on ICICI's iMobile Pay app and their internet banking platform.

Key Features:

- Track inflows and outflows across all linked accounts

- View top spending categories with analytical insights

- Download statements from all connected accounts

- 100% secured view of transactions with bank-level encryption

- Consolidated dashboard of savings and current accounts

- Smart financial insights and expense tracking

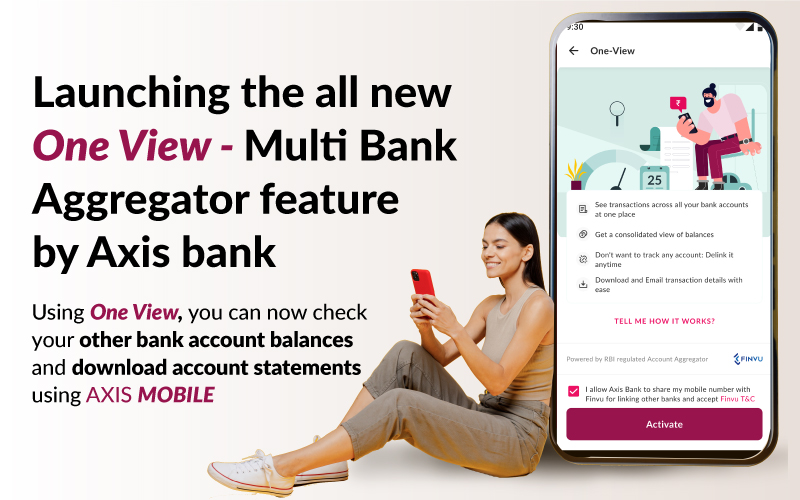

Axis Bank One View

Rating: 4.1/5Axis Bank's One View feature on their mobile app provides users with access to multiple bank accounts on a single platform. It utilizes the Account Aggregator ecosystem to provide a seamless experience for managing finances across different banks.

Key Features:

- Link and verify bank accounts with simple OTP verification

- Track transactions across multiple banks seamlessly

- View account balances from all linked accounts

- Secure integration through the Account Aggregator framework

- Simplified user interface for easy navigation

- Comprehensive financial overview in one place

BHIM UPI

Rating: 4.0/5BHIM (Bharat Interface for Money), developed by the National Payments Corporation of India (NPCI), is a UPI-based payment app that allows users to link multiple bank accounts and manage transactions with ease.

Key Features:

- Support for multiple bank accounts with easy switching

- Simple, clean interface with minimal distractions

- Direct government support and development

- Available in multiple Indian languages

- No ads or promotional content

- Reliable and secure transaction processing

Feature Comparison

| App | Multiple Bank Support | Financial Analytics | Security Features | Additional Services | Best For |

|---|---|---|---|---|---|

| PhonePe | Excellent | Good | Very Good | Extensive | Everyday users |

| Google Pay | Very Good | Basic | Excellent | Moderate | Security-focused users |

| Paytm | Excellent | Good | Very Good | Extensive | Super app enthusiasts |

| Fi Money | Excellent | Excellent | Very Good | Good | Millennials & tech-savvy |

| ICICI iFinance | Excellent | Excellent | Excellent | Very Good | ICICI customers & families |

| Axis One View | Very Good | Good | Excellent | Good | Axis customers |

| BHIM UPI | Good | Basic | Very Good | Limited | Minimalists |

Security Considerations

When using apps that connect to multiple bank accounts, security becomes even more crucial. Here's how these apps protect your data and what measures you should take:

How Multi-Bank Apps Keep Your Data Secure

End-to-End Encryption

Your financial data is encrypted during transmission and storage, making it unreadable to unauthorized parties.

Biometric Authentication

Fingerprint scanning and face recognition add an extra layer of security beyond passwords.

Account Aggregator Framework

Many apps use India's Account Aggregator framework, which ensures secure data sharing without storing your credentials.

Two-Factor Authentication

Additional verification beyond passwords helps prevent unauthorized access to your accounts.

Safety Tips

- Always download apps from official sources like Google Play Store or Apple App Store.

- Keep your app updated to the latest version to benefit from security patches.

- Enable additional security features like app locks and biometric authentication.

- Monitor your transactions regularly to spot any unauthorized activity.

- Use unique, strong passwords for each financial app.

- Be wary of phishing attempts asking for your banking credentials.

How to Choose the Right App for You

Selecting the right app for managing multiple bank accounts depends on your specific needs and preferences. Here are some factors to consider:

For Simple Money Transfers

If you primarily need to transfer money between accounts and pay bills, apps like Google Pay and BHIM UPI offer straightforward interfaces with minimal distractions.

Best options:

- Google Pay

- BHIM UPI

- PhonePe

For Financial Insights

If you want detailed analytics about your spending habits and financial health across accounts, consider apps with strong analytical features.

Best options:

- Fi Money

- ICICI iFinance

- Axis One View

For All-in-One Services

If you want a single app for banking, shopping, investments, and more, consider these comprehensive platforms.

Best options:

- Paytm

- PhonePe

- Fi Money

For Bank-Specific Features

If you already have accounts with specific banks and want enhanced features, consider their proprietary solutions.

Best options:

- ICICI iFinance (for ICICI customers)

- Axis One View (for Axis customers)

- SBI YONO (for SBI customers)

User Reviews & Experiences

I've been using PhonePe for managing my multiple bank accounts for over two years now. The interface is intuitive, and I love how easy it is to switch between accounts during transactions. Their customer service is also quite responsive.

Rohit Sharma

Business Owner, Mumbai

Fi Money has revolutionized how I track my finances. Being able to see all my accounts in one place with smart insights has helped me budget better and save more. The clean interface makes it a joy to use.

Ananya Patel

Software Developer, Bangalore

ICICI's iFinance feature has been a game-changer for me. I can now track all my family's accounts in one place, understand our spending patterns, and make better financial decisions together.

Rajesh Kumar

Financial Advisor, Delhi

As someone who values simplicity, BHIM UPI has been my preferred choice. I've linked all my accounts and can perform transactions without any clutter or distractions. It's straightforward and reliable for day-to-day use.

Sanjay Verma

Teacher, Chennai

Future Trends in Multi-Bank Account Management

The landscape of mobile payment apps is continuously evolving. Here are some emerging trends to watch for:

AI-Powered Financial Advice

Apps are increasingly incorporating AI to provide personalized financial advice based on spending patterns across all linked accounts.

Enhanced Security Measures

Future apps will incorporate advanced biometrics and behavioral analysis to further secure access to multiple accounts.

Cross-Account Analytics

Deeper insights spanning all accounts will help users optimize their finances across institutions and account types.

Conclusion

Managing multiple bank accounts in India has never been easier, thanks to the innovative mobile money transfer apps available today. Whether you prefer the simplicity of BHIM UPI, the comprehensive features of Paytm, the analytical insights of Fi Money, or the bank-specific advantages of ICICI iFinance or Axis One View, there's an app tailored to your needs.

These apps not only simplify money transfers but also provide valuable insights into your financial health across all your accounts, helping you make more informed decisions about your money. As technology continues to evolve, we can expect even more innovative features that will further enhance how we manage our finances.

The key is to choose an app that aligns with your specific requirements, offers robust security features, and provides a user experience that you find intuitive and enjoyable. By consolidating your banking experience through these apps, you'll save time, gain better financial insights, and enjoy a more streamlined approach to managing your money.

Final Recommendations

- For everyday users: PhonePe and Google Pay offer the best balance of features and simplicity.

- For financial analytics enthusiasts: Fi Money and ICICI iFinance provide the most comprehensive insights.

- For super-app experience: Paytm combines banking, shopping, and investments in one platform.

- For minimalists: BHIM UPI offers a clean, distraction-free experience focused on core functionality.

- For bank-specific customers: Explore your bank's dedicated solutions like Axis One View or ICICI iFinance.

Frequently Asked Questions

Yes, it's generally safe to link multiple bank accounts to reputable apps that use proper security measures. Look for apps that use end-to-end encryption, two-factor authentication, and the Account Aggregator framework. Most apps don't store your actual banking credentials but use secure tokens for access.

This varies by app. Some apps like Paytm and PhonePe allow you to link multiple bank accounts without any specific limit. Others might have restrictions. For example, Google Pay allows linking multiple accounts but might limit certain features for secondary accounts. Check the specific app's terms for details.

For UPI-based transactions, having the same phone number linked to all bank accounts makes the process smoother. However, many multi-bank aggregator apps like Fi Money or ICICI iFinance can link accounts with different registered phone numbers through alternative verification methods.

Most money transfer apps don't charge for linking multiple bank accounts or conducting basic transactions. However, some premium features or specialized services might come with fees. Always check the app's fee structure before conducting transactions.

If you lose your phone, immediately contact your bank to temporarily block your UPI accounts. Most apps require additional authentication like PINs, passwords, or biometrics to access your accounts, providing a layer of security. You can also remotely log out from these apps using their websites or customer service.

Many apps have restrictions for users outside India due to regulatory requirements. However, some banks offer NRI-specific mobile banking apps that allow account management from abroad. Check with your specific bank for NRI-compatible options.

Post a Comment