How to Send Emergency Money to India Quickly in 2025

How to Send Emergency Money to India Quickly: The Complete Guide

A comprehensive guide to fast, reliable, and affordable emergency money transfers to India

International money transfers are crucial during medical and family emergencies in India

Table of Contents

- Introduction

- Understanding Emergency Money Transfers to India

- Top Services for Emergency Money Transfers

- Comparison of Money Transfer Services

- Step-by-Step Guide: How to Send Money Quickly

- Understanding Fees and Exchange Rates

- How to Track Your Emergency Money Transfer

- Tips to Speed Up Your Money Transfer

- Customer Reviews and Experiences

- Frequently Asked Questions

Introduction

Life is unpredictable, and emergencies can occur when we least expect them. Whether it's a medical crisis, a family emergency, or an urgent financial need, being able to send money to India quickly can make all the difference in such situations. However, navigating the world of international money transfers during stressful times can be overwhelming.

In this comprehensive guide, I'll walk you through everything you need to know about sending emergency money to India quickly and efficiently. From comparing the best services to understanding fees and exchange rates, this article covers all aspects of emergency money transfers to ensure your funds reach India as fast as possible when it matters most.

Quick Takeaway:

In emergency situations, digital money transfer services like Wise, Xoom, Remitly, and Western Union offer the fastest way to send money to India, with funds typically available within minutes to 24 hours. Bank-to-bank transfers via SWIFT are more secure but slower (1-5 business days). UPI transfers are available through some services for instant delivery to Indian recipients with UPI IDs.

Understanding Emergency Money Transfers to India

Emergency money transfers differ significantly from regular remittances primarily in terms of speed and urgency. When sending money during an emergency, time is of the essence, and you'll likely prioritize speed over cost. However, this doesn't mean you should ignore fees or exchange rates entirely.

Key Considerations for Emergency Transfers

- Transfer speed (minutes vs. hours vs. days)

- Availability of funds during Indian business hours

- Service reliability and customer support

- Transfer limits for emergency situations

- Recipient's access to pickup locations or banking

- Documentation requirements

Common Emergency Transfer Methods

- Online money transfer services (fastest option)

- Bank wire transfers via SWIFT (more secure)

- UPI transfers (instant for Indian recipients)

- Cash pickup services (no bank account needed)

- Mobile wallet transfers

- Credit/debit card transfers

One important thing to understand about emergency transfers to India is that the receiving method matters just as much as the sending method. India has a robust digital payment infrastructure, including UPI (Unified Payments Interface), which enables instant money transfers when used with compatible services.

Various methods to transfer money to India during emergencies

Top Services for Emergency Money Transfers to India

Based on extensive research and customer reviews, here are the top services for sending emergency money to India:

1. Wise (formerly TransferWise)

Best for: Transparent fees and excellent exchange rates

Speed: 1-2 business days typically (not the fastest option)

Pros:

- Mid-market exchange rates with no markup

- Transparent fee structure

- Direct bank deposits

- UPI transfers available

- Highly rated mobile app

Cons:

- Not the fastest option for emergencies

- No cash pickup option

- Transfer limits may apply

2. Xoom (PayPal Service)

Best for: Speed and convenience

Speed: Minutes to 24 hours (depending on payment method)

Pros:

- Extremely fast transfers (minutes in some cases)

- UPI transfers supported

- Bank deposits and cash pickup options

- PayPal integration

- 24/7 customer support

Cons:

- Higher fees than some competitors

- Exchange rate markup

- Inconsistent delivery times during Indian holidays

3. Western Union

Best for: Widespread availability and cash pickup options

Speed: Minutes to 1-2 business days

Pros:

- Extensive network of agents in India

- Cash pickup available within minutes

- No recipient bank account required

- Multiple funding options

- High transfer limits

Cons:

- Higher fees for cash pickups

- Less favorable exchange rates (2-4% markup)

- Online transfers may be slower than advertised

4. Remitly

Best for: Competitive rates and fast delivery

Speed: Minutes to 3-5 business days (Express vs. Economy)

Pros:

- Express delivery option for emergencies

- Better exchange rates than Western Union

- First transfer promotion often available

- Bank deposits and cash pickup

- Delivery promise (or refund)

Cons:

- Higher fees for credit/debit card payments

- Exchange rate markup (1-2%)

- Limited customer service hours

5. MoneyGram

Best for: Wide network and cash pickup options

Speed: Minutes to 1-2 business days

Pros:

- Fast cash pickup option

- Extensive agent network in India

- No bank account required for receiver

- Multiple payment methods

Cons:

- Higher fees than digital-first providers

- Less competitive exchange rates

- Website and app less user-friendly

6. Bank SWIFT Transfers

Best for: Security and high-value transfers

Speed: 1-5 business days (not ideal for emergencies)

Pros:

- Most secure transfer method

- High or unlimited transfer amounts

- Direct bank-to-bank transfer

- Regulated and traceable

Cons:

- Slowest option (not ideal for emergencies)

- High fees ($25-$50 per transfer)

- Poor exchange rates

- May involve intermediary bank fees

Comparison of Money Transfer Services

When you need to send money to India during an emergency, comparing your options quickly is essential. The table below provides a side-by-side comparison of the most important factors to consider:

| Service | Speed (Fastest Option) | Fees | Exchange Rate Markup | Maximum Transfer | Delivery Methods | Best For |

|---|---|---|---|---|---|---|

| Wise | 1-2 days | $7-8 on $1,000 | None (mid-market) | $1,000,000+ | Bank deposit, UPI | Best rates, transparency |

| Xoom | Minutes to hours | $0-4.99 on $1,000 | 1-3% | $10,000/30 days | Bank deposit, cash pickup, UPI | Speed, convenience |

| Western Union | Minutes | $0-45 on $1,000 | 2-4% | $5,000/transfer | Bank deposit, cash pickup | Cash pickup, wide network |

| Remitly | Minutes (Express) | $0-3.99 on $1,000 | 1-2% | $10,000/day | Bank deposit, cash pickup, UPI | Balance of speed and cost |

| MoneyGram | Minutes | $0-30 on $1,000 | 2-3% | $10,000/transfer | Bank deposit, cash pickup | Cash pickup locations |

| SWIFT (Banks) | 1-5 days | $25-50 flat fee | 3-5% | Varies by bank | Bank deposit only | Security, large amounts |

Important Note:

Fees and exchange rates can change frequently. The information provided is based on research conducted in May 2025. Always verify the current rates and fees before initiating a transfer, especially for emergency situations.

Process flow of international wire transfers to India

Step-by-Step Guide: How to Send Money Quickly to India

Follow these detailed steps to ensure your emergency money transfer to India is completed as quickly and smoothly as possible:

Method 1: Using Online Money Transfer Services (Fastest Option)

Step 1: Choose the Right Service

For genuine emergencies requiring immediate funds, choose services offering instant or same-day transfers like Xoom, Western Union, or Remitly's Express service. Consider your recipient's location and access to banks or pickup points.

Step 2: Create an Account

Register on the service's website or mobile app. You'll need to provide:

- Valid email address and phone number

- Government-issued ID for verification

- Payment information (bank account, debit/credit card)

- Basic personal information

Tip: For faster verification, have your identification documents ready and ensure you have good lighting for any required selfies or document photos.

Step 3: Enter Transfer Details

Provide the following information:

- Amount to send (in USD or INR)

- Recipient's full legal name (exactly as it appears on their ID)

- For bank deposits: Complete bank details including IFSC code

- For UPI transfers: Recipient's UPI ID

- For cash pickup: Recipient's address and phone number

Step 4: Review and Pay

Before confirming:

- Double-check all recipient details

- Review the exchange rate and fees

- Note the estimated delivery time

- Choose your payment method (debit/credit card for fastest processing)

Note: Credit cards typically process faster than bank transfers but may incur higher fees.

Step 5: Complete Verification (if required)

For security reasons, especially for first-time users or large amounts, you may need to:

- Verify your identity through additional documentation

- Complete a brief security questionnaire

- Verify your payment method

Step 6: Track Your Transfer

After sending:

- Save your tracking/reference number

- Use the service's app or website to monitor progress

- Enable notifications for status updates

Step 7: Notify Your Recipient

Once the transfer is confirmed:

- Share the tracking number with your recipient

- For cash pickups: Inform them about required identification

- Advise on pickup location hours and procedures

Method 2: Bank-to-Bank SWIFT Transfer

Step 1: Gather Required Information

You'll need:

- Recipient's full name and address

- Recipient's bank name, branch address, and IFSC code

- Recipient's bank account number

- Bank's SWIFT/BIC code

- Purpose of transfer (medical emergency, family support, etc.)

Step 2: Contact Your Bank

Initiate the transfer through:

- Online banking (if available for international transfers)

- Mobile banking app

- Visiting a branch in person (fastest for verification)

- Calling your bank's international wire department

Step 3: Complete Wire Transfer Form

Fill out the international wire transfer form with all recipient details. Specify that this is an emergency transfer to potentially expedite processing.

Step 4: Pay Transfer Fees

Be prepared to pay:

- Sending bank fee ($25-$50 typically)

- Possible intermediary bank fees

- Recipient bank fees (can be deducted from the transfer amount)

Step 5: Keep Your Receipt and SWIFT Code

Save your receipt and the SWIFT confirmation code to track your transfer. Share this information with your recipient to help them monitor the incoming transfer.

Method 3: UPI Transfers (For Indian Recipients with UPI IDs)

Step 1: Choose a Service Supporting UPI

Select a service that supports UPI transfers to India, such as Wise or Xoom.

Step 2: Enter the Recipient's UPI ID

Enter your recipient's UPI ID (usually in the format username@bankname or phonenumber@upi).

Step 3: Send and Verify

Complete the transaction as normal. UPI transfers are typically processed very quickly, often within minutes.

Pro Tips for Emergency Transfers:

- Verify account details thoroughly - A single incorrect digit can delay or cancel your transfer

- Consider the time difference - Initiate transfers during Indian banking hours (9:30 AM to 3:30 PM IST) for faster processing

- Have a backup method ready - In case your first transfer option encounters issues

- Keep all verification documents handy - To avoid delays in security checks

- Use debit/credit cards for funding - They process faster than bank transfers

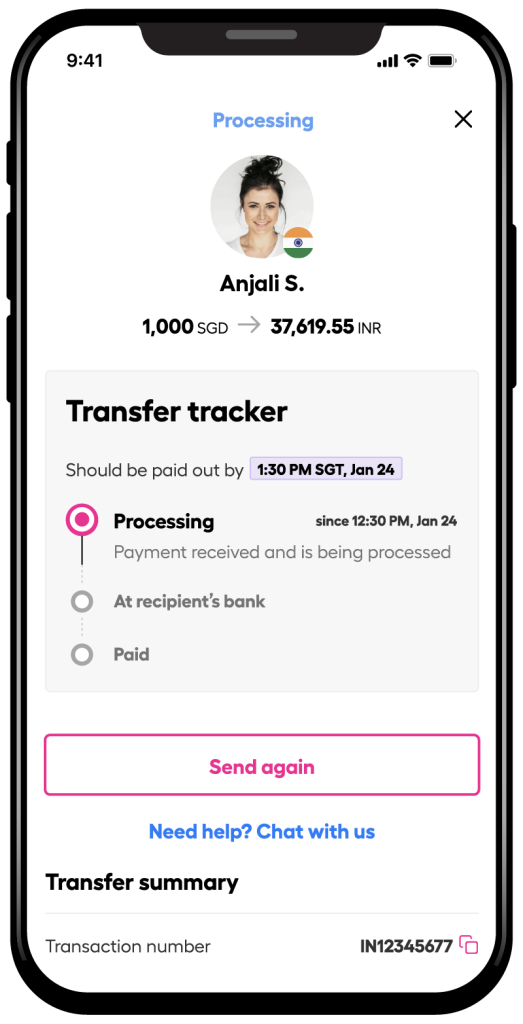

Most services allow tracking transfers through mobile apps

Understanding Fees and Exchange Rates

When sending emergency money to India, the total cost includes more than just the upfront fee. Understanding the full cost structure will help you make informed decisions during stressful situations:

Types of Fees

- Transfer fees: Flat fees or percentage-based charges for processing the transfer

- Payment method fees: Additional costs based on how you fund the transfer (credit cards typically cost more)

- Speed premium: Extra fees for express or instant transfers

- Recipient fees: Charges that may be deducted when funds arrive in India

- Intermediary bank fees: Additional charges from banks that help route your money (common with SWIFT transfers)

Exchange Rate Markups

The exchange rate markup is often the largest "hidden" cost in international transfers:

- Mid-market rate: The real exchange rate you see on Google or financial sites

- Provider rates: The adjusted rate offered by transfer services, typically including a markup

- Markup percentages: Range from 0% (Wise) to 5% (some banks)

- Impact example: On a $1,000 transfer, a 3% markup equals $30 in hidden costs

- Bank vs. specialized services: Banks typically have the highest markups (3-5%)

Real Cost Calculation Example:

For a $1,000 emergency transfer to India:

| Service | Transfer Fee | Exchange Rate Markup | Amount Received (INR) | Total Cost (USD) |

|---|---|---|---|---|

| Wise | $7.33 | $0 (0%) | ₹85,399 | $7.33 (0.73%) |

| Xoom (Economy) | $0 | $20 (2%) | ₹83,691 | $20 (2%) |

| Western Union | $0 (online) | $30 (3%) | ₹82,837 | $30 (3%) |

| Remitly (Express) | $3.99 | $15 (1.5%) | ₹84,118 | $18.99 (1.9%) |

| Bank SWIFT | $35 | $40 (4%) | ₹81,983 | $75 (7.5%) |

Note: Calculations based on a mid-market rate of 1 USD = 85.4 INR. Actual rates and fees may vary.

How to Track Your Emergency Money Transfer

During an emergency, knowing exactly when funds will arrive is critical. Here's how to effectively track your money transfer to India:

Tracking Methods by Service

- Wise: Real-time tracking via app or website dashboard

- Xoom: Status updates through app, email, and SMS notifications

- Western Union: MTCN tracking number for online or phone tracking

- Remitly: Real-time updates in app with delivery confirmations

- Bank SWIFT: Reference number tracking through your bank's system

Common Transfer Statuses

- Processing: Your payment is being verified

- Sending: Money has been deducted and is being transmitted

- In transit: Funds are moving through the banking system

- Available: Funds are ready for pickup or have been deposited

- Completed: Transaction has been successfully delivered

- On hold: Additional verification needed (requires action)

- Canceled/Failed: Transfer could not be completed

What to Do If Your Transfer Is Delayed:

- Check the status online using the tracking system

- Contact customer support through chat, phone, or email

- Verify recipient details are correct (name spelling, account numbers)

- Check for compliance holds that might require additional documentation

- Consider bank processing times in India (especially during weekends and holidays)

Example of a money transfer tracking interface

Tips to Speed Up Your Money Transfer

In emergency situations, every minute counts. Here are some proven strategies to expedite your money transfer to India:

Before Sending

- Verify and complete your account verification ahead of time

- Keep identification documents ready for quick uploading

- Pre-save recipient details if you send money regularly

- Check transfer limits and increase them if needed

- Understand Indian banking hours (9:30 AM-3:30 PM IST)

During the Transfer

- Use debit/credit cards instead of bank transfers for funding

- Pay for express or instant delivery options when available

- Double-check all recipient information for accuracy

- Choose UPI or mobile wallet options when possible

- Use cash pickup for recipients without bank accounts

After Sending

- Share tracking information with your recipient immediately

- Enable notifications for transfer status updates

- Be available to respond to any verification requests

- Contact customer support if any delays occur

- Confirm receipt with your recipient

Emergency Transfer Checklist:

- ✅ Valid government ID for sender verification

- ✅ Recipient's full legal name (as on their ID)

- ✅ Correct bank information and/or UPI ID

- ✅ IFSC code for Indian bank transfers

- ✅ Payment method with sufficient funds

- ✅ Phone access for verification codes

- ✅ Understanding of any daily/monthly transfer limits

- ✅ Knowledge of working hours for cash pickup locations

Customer Reviews and Experiences

Real experiences from people who have sent emergency money to India can provide valuable insights:

Raj P.

Sent $5,000 for medical emergency

"When my father needed emergency surgery in Mumbai, I used Remitly's Express service to send money from the US. I paid with my debit card around 9 PM EST, and the money was available in my father's HDFC account by the time he woke up (about 5 hours later). The exchange rate wasn't the absolute best, but the speed was worth it. Their customer service also helped me increase my sending limit immediately when I explained it was for a medical emergency."

Priya M.

Sent $1,200 for family emergency

"I've tried several services for sending money to India, and Xoom has been the most reliable for emergencies. When my sister needed immediate funds after a housing issue, I sent money at 2 AM using Xoom's UPI transfer option. The funds were available within 15 minutes! The fees were reasonable, and while their exchange rate includes a markup, the convenience and speed made it worthwhile. The only downside was the $10,000 monthly limit which was too low for my needs."

Vikram S.

Sent $3,500 for emergency home repairs

"I used Western Union to send money for emergency repairs after flooding damaged my parents' home in Chennai. The cash pickup option was crucial since my parents couldn't access their bank due to the floods. The transfer was processed within an hour, but they had issues at the pickup location due to high demand during the crisis. The fees were higher than online services, but having a physical pickup location during a natural disaster proved invaluable. Their exchange rate was quite poor though."

Anjali K.

Sent $2,000 for medical bills

"Wise has been my go-to service for sending money to India. When my mother needed funds for an unexpected medical procedure, I sent money using Wise on a Tuesday morning. While not instant (took about 19 hours to arrive), their exceptional exchange rate meant my family received significantly more rupees compared to other services. The transparent fee structure and tracking feature gave me peace of mind during a stressful time. I'd recommend completing their verification process before emergencies arise!"

Amar T.

Sent $8,000 for family emergency

"I tried using my bank's SWIFT transfer during a family emergency, and it was a frustrating experience. Despite paying a $45 fee and being told it would take 1-3 business days, the money took almost a week to reach my family in Delhi. There were also unexpected intermediary bank fees that reduced the amount received. For emergencies, I would strongly recommend avoiding traditional bank transfers and using specialized services instead. The only positive was being able to send a larger amount than most online services allow."

Frequently Asked Questions

For true emergencies requiring immediate funds, services like Xoom, Western Union, and Remitly's Express option can deliver money within minutes to a few hours. Paying with a debit or credit card (rather than a bank account) will further expedite the process. UPI transfers through services that support this feature are also extremely fast when sending to recipients with Indian bank accounts linked to UPI.

Some services offer limit increases for emergency situations, but you'll typically need to contact customer support directly and may need to provide documentation of the emergency (such as medical bills or official communications). Wise and traditional banks generally have the highest transfer limits. New customers may face lower initial limits until they build a transaction history with the service.

For most transfers to India, you'll need:

- Recipient's full legal name (exactly as it appears on their ID)

- For bank transfers: Complete bank information including account number, IFSC code, and bank name

- For UPI transfers: The recipient's UPI ID

- For cash pickup: Recipient's address and phone number

- Your own identification documents for verification

- The purpose of the transfer (especially for larger amounts)

Indian banks typically operate from 9:30 AM to 3:30 PM IST (Indian Standard Time) Monday through Friday, and some have limited Saturday hours. While online transfers may be processed 24/7, the final deposit into an Indian bank account often depends on these banking hours. Cash pickup locations and UPI transfers are generally less affected by banking hours. Consider the 9.5-13.5 hour time difference from the US when planning urgent transfers.

This depends on the transfer status. Most services allow cancellation if the transfer is still "in progress" and hasn't been picked up or deposited. Once the money has been delivered or claimed, cancellation is generally not possible. For modification, it's often easier to cancel the transfer entirely (if possible) and initiate a new one rather than trying to modify an existing transfer. Contact customer support immediately if you need to cancel or change a transfer.

For senders, gifts to family members generally don't incur gift tax unless they exceed annual or lifetime exclusion limits (for US senders, the 2025 annual exclusion is $18,000 per recipient). For recipients in India, foreign remittances from relatives are typically not taxable as income. However, large transfers may trigger reporting requirements in both countries. For medical emergencies specifically, there may be additional tax benefits for senders in some jurisdictions. Consult a tax professional for advice specific to your situation.

If your emergency transfer is delayed:

- Check the transfer status using the tracking number/reference

- Contact customer support through chat, phone, or email (mention it's an emergency)

- Verify all recipient details were entered correctly

- Ask if additional verification is needed from you

- If the service isn't responding adequately, consider initiating a second transfer through a different provider while the first one processes

Conclusion

When facing an emergency that requires sending money to India quickly, having the right information at your fingertips can make a significant difference. This guide has covered the most important aspects of emergency money transfers, from selecting the right service to understanding fees and tracking your transfer.

For true emergencies where speed is the top priority, services like Xoom, Western Union, and Remitly's Express option provide the fastest delivery, often within minutes to a few hours. If you have a bit more time and want to maximize the amount received, Wise offers the best exchange rates with reasonable delivery timeframes.

Remember to verify your accounts ahead of time, keep identification documents ready, and understand the requirements for both sending and receiving money in India. This preparation can save precious time during actual emergencies.

Finally, consider establishing accounts with multiple money transfer services before emergencies occur. This gives you options and flexibility when urgent situations arise, ensuring you can always get money to your loved ones in India when they need it most.

Last updated: May 16, 2025 | The information provided in this article is for general information purposes only and should not be construed as professional advice. Exchange rates, fees, and service offerings are subject to change. Always verify current rates and terms with the service providers before initiating any money transfer.

Post a Comment