Fastest Transfer Methods from Chicago to India

Fastest Transfer Methods from Chicago to India (2025)

A comprehensive guide to sending money quickly, securely, and cost-effectively from Chicago to India

Whether you're supporting family back home, investing in property, or handling business transactions, finding the fastest and most reliable way to transfer money from Chicago to India is crucial. This comprehensive guide compares the top money transfer services, focusing on speed, exchange rates, and fees to help you make the best choice.

In this article, you'll discover:

- The fastest digital payment platforms for Chicago to India transfers

- Real-time comparison of exchange rates and fees

- Traditional bank transfers vs. digital remittance services

- Regulatory considerations and compliance requirements

- User experiences and expert recommendations

Why Transfer Speed Matters

When sending money from Chicago to India, transfer speed can be crucial, especially during emergencies or time-sensitive situations. The good news is that technological advancements have significantly reduced transfer times over the past decade.

Today's digital platforms can deliver funds within minutes, compared to the several business days that traditional bank transfers typically require. This article explores the various options available, with a focus on the fastest and most reliable methods.

Key Factors That Affect Transfer Speed

Transfer Method

Digital platforms generally offer faster transfers than traditional banks, with some providing near-instant delivery.

Receiving Option

Bank deposits can take longer than cash pickups or mobile wallet transfers, especially with certain Indian banks.

Payment Method

Debit card and digital wallet payments typically process faster than bank account transfers or credit cards.

Fastest Digital Platforms for Chicago to India Transfers

Digital remittance services have revolutionized international money transfers, offering significantly faster delivery times than traditional methods. Here's a comparison of the top platforms for sending money from Chicago to India:

Remitly

Express delivery in minutes

Remitly offers two service options: Express and Economy. The Express option delivers funds to Indian bank accounts in as little as minutes, making it one of the fastest services available.

Key Features:

- Real-time tracking through SMS updates

- First-time sender promotions with better rates

- 24/7 customer service via phone, email, or chat

- Money-back guarantee if the transfer doesn't arrive on time

Xoom (PayPal)

Instant bank deposits to major banks

Xoom, owned by PayPal, offers near-instant deposits to majorIndian banks like HDFC, ICICI, and SBI. It also supports UPI transfers, which are typically processed within minutes.

Key Features:

- UPI transfers support for fast delivery

- Seamless integration with PayPal accounts

- Mobile app with transfer tracking

- Cash pickup options at thousands of locations in India

Wise (formerly TransferWise)

Best exchange rates with fast delivery

While not the absolute fastest option, Wise offers the best exchange rates with mid-market rates and transparent fees. Transfers typically arrive within 1-2 business days, with repeat transfers often being faster.

Key Features:

- Mid-market exchange rates without markups

- Transparent fee structure

- Support for both NRE and NRO accounts

- Multi-currency account options

Western Union

Extensive cash pickup network

Western Union offers nearly instant cash pickup options at thousands of agent locations across India. Bank transfers typically take 1-3 business days, but the extensive cash pickup network makes it convenient for emergency transfers.

Key Features:

- Largest agent network in India for cash pickups

- Option to send from physical locations in Chicago

- Real-time tracking with MTCN number

- Loyalty programs for frequent users

Afriex

New instant transfer service

A newer player in the market, Afriex has recently launched instant money transfers to India from the US. Their service leverages blockchain technology to provide instant transfers with competitive rates.

Key Features:

- Instant transfers using blockchain technology

- Competitive exchange rates

- Mobile app with simple interface

- Supports both bank deposits and UPI transfers

Ria Money Transfer

Affordable international transfers

Ria offers a good balance between speed and cost, with transfers typically arriving within 24 hours. Cash pickup options are available within minutes at partner locations across India.

Key Features:

- Lower fees compared to many competitors

- Cash pickup available at over 15,000 locations in India

- Bank deposit option for all major Indian banks

- Online tracking of transfers

Digital Transfer Methods Comparison

| Service | Fastest Option | Transfer Time | Fee Range | Exchange Rate | Best For |

|---|---|---|---|---|---|

| Remitly | Express | Minutes | $3.99 - $6.99 | 0.5% - 2% markup | Speed and reliability |

| Xoom | UPI Transfer | Minutes to hours | $4.99 - $8.99 | 1% - 3% markup | PayPal users, UPI transfers |

| Wise | Fast Transfer | 1-2 business days | $1.50 + 0.5% | Mid-market rate | Best exchange rates |

| Western Union | Cash Pickup | Minutes | $3.99 - $25 | 2% - 4% markup | Cash pickups, wide network |

| Afriex | Blockchain Transfer | Instant | $1.99 - $4.99 | 0.5% - 1.5% markup | Instant transfers |

| Ria | Cash Pickup | 3-24 hours | $0 - $3.95 | 1% - 3% markup | Budget-friendly transfers |

* Rates and fees may vary based on transfer amount, payment method, and promotions. Data current as of August 2025.

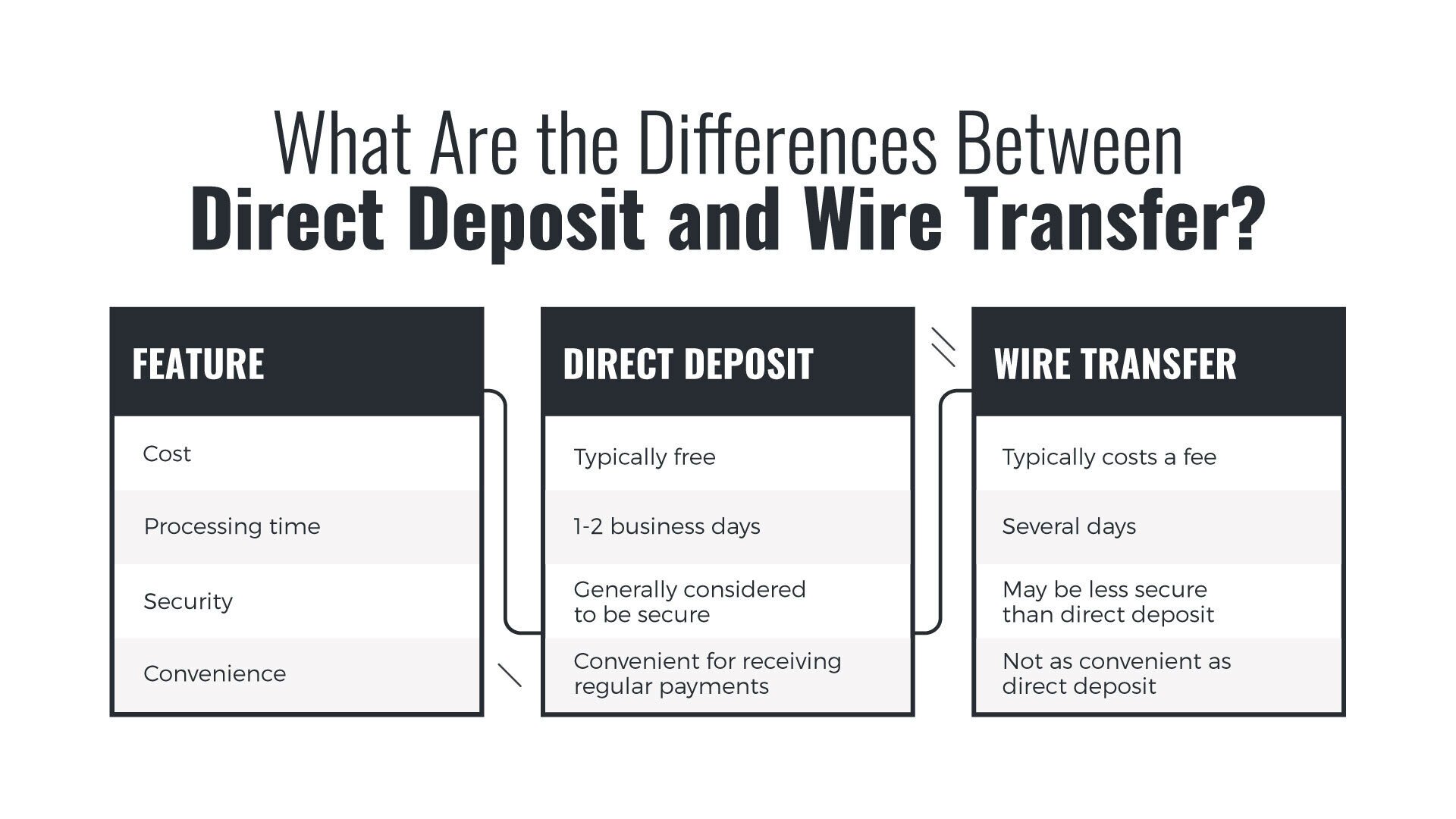

Traditional Bank Wire Transfers

While digital platforms typically offer faster transfers, traditional bank wire transfers remain a popular option for sending larger amounts from Chicago to India. Most major US banks like Chase, Bank of America, and Citibank offer international wire transfer services to India.

How Bank Wire Transfers Work

With a wire transfer, money is sent electronically from your Chicago bank to a corresponding bank in India, which then deposits the funds into the recipient's account. The process typically involves:

- Providing the recipient's bank details, including IFSC code and account number

- Completing a wire transfer form at your bank or through online banking

- Paying the transfer fee and exchange rate margin

- Waiting for the funds to be processed through the SWIFT network

- Final delivery to the recipient's account in India

Important Note:

Bank wire transfers typically take 2-5 business days to complete, making them significantly slower than many digital remittance services. However, they may be preferred for larger transfers due to higher transfer limits and established security protocols.

Wire transfer process flow from US to India

Bank Transfer Comparison

| Bank | Transfer Time | Wire Fee | Exchange Rate Markup | Online Initiation | Maximum Amount |

|---|---|---|---|---|---|

| Chase Bank | 3-5 business days | $40-$50 | 3-4% | Yes | $50,000/day |

| Bank of America | 2-5 business days | $45-$55 | 3-4% | Yes | $25,000/day |

| Citibank | 2-4 business days | $25-$35* | 2-3% | Yes | $50,000/day |

| HDFC (NRI Services) | 2-3 business days | $0-$15** | 2-3% | Yes | No set limit |

| ICICI Bank (Money2India) | 1-3 business days | $0-$15** | 2-3% | Yes | No set limit |

* Lower or waived fees may apply for premium account holders

** Indian banks with US operations often offer specialized remittance services with lower fees

Wire Transfer vs. Digital Platforms: Speed Comparison

Bank Wire Transfer Pros:

- Higher transfer limits for large amounts

- Established security protocols

- Direct bank-to-bank relationship

- No need to create new accounts on platforms

Bank Wire Transfer Cons:

- Significantly slower (2-5 business days)

- Higher fees ($25-$55 typically)

- Less favorable exchange rates

- More paperwork and documentation

UPI and Modern Digital Payment Solutions

India's Unified Payments Interface (UPI) has revolutionized domestic payments within the country, and it's now extending to cross-border transactions. Several remittance services have integrated UPI capabilities, allowing for faster transfers from Chicago to India.

How UPI Transfers Work

UPI transfers allow senders to directly deposit funds to a recipient's Indian bank account using just their UPI ID (similar to an email address). This eliminates the need for complex bank details like IFSC codes and account numbers.

Services Supporting UPI Transfers

- Xoom - Fully integrated UPI support with fast delivery

- Remitly - UPI transfers to major Indian banks

- Wise - Recently added UPI support for faster transfers

- Afriex - Blockchain-based UPI transfers

India's UPI system has revolutionized digital payments

Speed Advantage of UPI Transfers

Transfer Time Comparison

- UPI Transfers: Typically minutes to reach recipient

- Regular Bank Deposits: 1-24 hours with digital services

- Traditional Wire Transfers: 2-5 business days

UPI Advantage:

UPI transfers can be processed almost instantly as they utilize India's advanced domestic payment infrastructure, bypassing some of the traditional banking steps that cause delays in international transfers.

Limitations of UPI International Transfers

- May have lower transaction limits compared to wire transfers

- Not all US-based services support UPI transfers yet

- Requires the recipient to have UPI set up with their Indian bank

- May have additional verification steps for first-time users

Ideal For:

UPI transfers are ideal for sending smaller amounts quickly, especially in emergency situations when funds need to be available immediately. They're less suitable for very large transfers.

Exchange Rates and Fee Considerations

When sending money from Chicago to India, the total cost isn't just about the upfront fee—it's also heavily influenced by the exchange rate offered. Even a small difference in exchange rates can significantly impact the amount received, especially for larger transfers.

Understanding Exchange Rate Markups

Most transfer services make money in two ways: through upfront fees and by adding a markup to the exchange rate. This markup is the difference between the mid-market rate (the actual rate banks use to trade with each other) and the rate offered to customers.

Exchange Rate Comparison (USD to INR)

| Service | Exchange Rate* | Markup % | Upfront Fee** | Total Cost (on $1000) | INR Received (on $1000) |

|---|---|---|---|---|---|

| Mid-Market Rate | 85.50 | 0% | N/A | $0 | ₹85,500 |

| Wise | 85.50 | 0% | $6.50 | $6.50 (0.65%) | ₹84,944 |

| Remitly (Economy) | 84.80 | 0.82% | $0 | $8.20 (0.82%) | ₹84,800 |

| Remitly (Express) | 84.65 | 1.00% | $3.99 | $13.99 (1.40%) | ₹84,270 |

| Xoom | 84.60 | 1.05% | $4.99 | $15.49 (1.55%) | ₹84,185 |

| Western Union | 83.80 | 2.00% | $3.99 | $23.99 (2.40%) | ₹83,464 |

| Bank Wire (Avg) | 82.60 | 3.40% | $45.00 | $79.00 (7.90%) | ₹78,885 |

* Exchange rates are illustrative and based on typical markups as of August 2025. Actual rates may vary.

** Fees shown are typical for a $1000 transfer and may vary based on payment method and promotions.

Balancing Speed and Cost

When to Prioritize Speed

- Emergency situations - When funds are needed immediately for medical emergencies or urgent family needs

- Time-sensitive transactions - Paying for educational fees, housing deposits, or other deadline-driven payments

- Small to medium transfers - When the fee difference is minimal compared to the convenience of immediate availability

- Business-critical transfers - When delays could impact business operations or relationships

When to Prioritize Cost

- Larger transfers - When sending significant amounts where even small percentage differences result in substantial savings

- Regular, planned transfers - Recurring remittances that can be scheduled in advance

- Non-urgent transfers - When the recipient doesn't need the funds immediately

- Investment or property transactions - When maximizing the value transferred is the priority

Regulatory Considerations

International money transfers between Chicago and India are subject to regulatory requirements in both countries. Understanding these regulations is important to ensure smooth transfers and compliance with financial laws.

US Regulations

- Transfers exceeding $10,000 may trigger reporting requirements under the Bank Secrecy Act

- The sending institution may require detailed information about the purpose of the transfer

- Regular large transfers might require additional documentation or explanation

Indian Regulations (RBI Guidelines)

The Reserve Bank of India (RBI) regulates all inward remittances to India under the Foreign Exchange Management Act (FEMA):

- There is no upper limit on the amount that can be transferred to India

- Transfers over ₹10 lakhs (approximately $12,000) may require additional documentation for tax purposes

- Recipients may need to declare the source of funds for large transfers

- Different regulations apply to NRE, NRO, and regular savings accounts

LRS Guidelines for Indians

For residents of India sending money to the US, the Liberalised Remittance Scheme (LRS) applies:

- Annual limit of $250,000 for outward remittances

- Requires declaration of purpose

- May require income tax PAN information

Note:

These LRS restrictions don't apply to NRIs in Chicago sending money to India, but rather to residents of India sending money abroad.

KYC Requirements

Both US and Indian regulations require Know Your Customer (KYC) verification:

- Valid government-issued ID

- Proof of address

- Source of funds for large transfers

- Complete recipient information

Tax Implications

For Senders in Chicago

- Personal remittances to family members are generally not tax-deductible

- Business transfers may have different tax implications

- Gifts exceeding $15,000 per recipient per year may trigger gift tax filing requirements

- Regular large transfers may require additional documentation for IRS purposes

For Recipients in India

- Remittances from family members abroad are generally not taxable as income in India

- Large deposits may trigger tax inquiries about the source of funds

- Different tax rules apply depending on where the funds are deposited (NRE vs. NRO accounts)

- Interest earned on transferred funds may be taxable

Important: Tax laws and regulations change frequently. It's advisable to consult with a tax professional familiar with both US and Indian tax systems for personalized advice on your specific situation.

User Experiences and Reviews

We've gathered feedback from Chicago residents who regularly send money to India to provide real-world insights into the reliability, customer service, and overall experience with different transfer methods.

Remitly

"I've been using Remitly's Express service for two years to send money to my parents in Delhi. The funds typically arrive in 15-20 minutes, which is amazing. I once had an issue where a transfer was delayed, but their customer service resolved it quickly. The app is intuitive and I can easily track my transfers."

- Priya S., Rogers Park

Wise (TransferWise)

"When I'm sending larger amounts to India for property investments, Wise is my go-to service. Their exchange rates are unbeatable, and while not the fastest option, transfers typically complete within 1-2 days. The transparency in fees and the ability to see exactly what my recipient will get makes it worth the slightly longer wait."

- Rajesh M., Lincoln Park

Xoom (PayPal)

"I like Xoom because it integrates with my PayPal account, making transfers super convenient. Their UPI transfer option is great - I send money directly to my sister's UPI ID in Mumbai and it arrives in minutes. The fees are a bit higher than some competitors, but the convenience and speed make up for it."

- Anand K., West Loop

Bank Wire Transfer

"I used Chase Bank to wire funds for my daughter's college tuition in India. While the process was secure, it took nearly 4 days for the money to arrive and cost me $45 in fees. The exchange rate wasn't great either. I only use bank transfers now for very large amounts where the security is worth the extra cost and time."

- Vikram P., Oak Park

Western Union

"Western Union has been reliable for sending emergency funds to my family in a small town near Jaipur. While digital services are faster for bank deposits, the cash pickup option at Western Union is invaluable when my relatives need physical cash quickly. The exchange rates aren't competitive, but the extensive network in India is unmatched."

- Sonia G., Evanston

Ria Money Transfer

"Ria has been my preferred service for monthly remittances to my parents in Chennai. Their fees are consistently lower than most competitors, and while not the absolute fastest option, transfers typically arrive within 24 hours. Their customer service has been responsive the few times I've needed assistance."

- Deepak T., Naperville

Common User Concerns

Transfer Delays

Several users reported occasional delays with all services, particularly during Indian holidays, weekends, or when sending to smaller banks. To minimize delays:

- Be aware of banking hours in both countries

- Avoid initiating transfers on weekends or holidays

- Double-check all recipient information

- Consider paying for expedited options when time is critical

Exchange Rate Fluctuations

Users frequently mentioned concerns about exchange rate variations affecting the amount received. To manage this:

- Compare rates across multiple services before transferring

- Some services offer rate locks for a period of time

- Consider services that show the exact amount to be received

- For large transfers, consult with a financial advisor on timing

Recommendations for Different Scenarios

Emergency Transfers

When funds are needed immediately

When time is critical and money is needed urgently in India:

Best Options:

- Remitly Express - Funds arrive in minutes

- Xoom UPI Transfer - Near-instant delivery

- Western Union Cash Pickup - When cash is needed immediately

For true emergencies, consider calling the transfer service after initiating the transaction to ensure it's processed promptly and to address any potential issues immediately.

Regular Monthly Transfers

For ongoing support or payments

For recurring monthly transfers to family or for regular payments:

Best Options:

- Wise - Best exchange rates for consistent value

- Remitly Economy - Good balance of speed and cost

- Ria Money Transfer - Low fees for regular transfers

Consider services that offer scheduled transfers to automate the process and potentially qualify for loyalty discounts offered to regular customers.

Large Transfers

For property, investments, or major expenses

When sending large amounts for investments, property purchases, or major expenses:

Best Options:

- Wise - Best exchange rates for large amounts

- OFX - Specialized in larger transfers with no upper limits

- Bank Wire - For very large amounts where security is paramount

For transfers over $10,000, consider speaking with a foreign exchange specialist who might offer better rates for large amounts or splitting the transfer into smaller amounts to manage risk.

Transfer Strategy Tips

Maximizing Speed

- Initiate transfers during business hours in both Chicago and India

- Use debit cards or digital wallets for funding rather than bank accounts

- Send to major banks or via UPI for faster processing

- Complete verification processes for all services in advance

- Have all recipient information accurately prepared before starting

Minimizing Costs

- Compare exchange rates across multiple services before each transfer

- Consider slightly slower services that offer better rates for non-urgent transfers

- Look for promotional offers and first-time user bonuses

- Send larger amounts less frequently to reduce per-transaction fees

- Use services that offer fee waivers above certain transfer amounts

Conclusion: Choosing the Right Transfer Method

Selecting the fastest transfer method from Chicago to India depends on your specific needs, priorities, and circumstances. Our comprehensive guide has outlined the key factors to consider:

For Maximum Speed

When time is of the essence, digital remittance services like Remitly Express, Xoom UPI transfers, and Western Union cash pickup offer the fastest delivery, often within minutes. These options typically come with slightly higher fees or less favorable exchange rates, but the speed can be worth it in urgent situations.

For Best Value

When maximizing the amount received is your priority, services like Wise that offer mid-market exchange rates or Remitly Economy with minimal fees provide the best value. These options may take 1-2 days longer but can save significantly on larger transfers.

For Security and Compliance

For large transfers or situations requiring maximum security, traditional bank wire transfers or specialized foreign exchange services offer robust security protocols and compliance with all regulations, though at higher costs and with longer processing times.

The money transfer landscape is constantly evolving, with new technologies and services emerging regularly. UPI integration and blockchain-based transfers are making international remittances faster and more cost-effective than ever before.

Ultimately, the best approach may be to use a combination of services depending on your specific needs at different times. By understanding the tradeoffs between speed, cost, and convenience, you can make informed decisions that best serve your financial goals and the needs of your recipients in India.

Final Recommendations

- Fastest overall: Remitly Express or Xoom UPI transfers for near-instant delivery

- Best value: Wise for excellentexchange rates with reasonable speed

- Most reliable: Established services like Western Union with extensive global networks

- Best for large amounts: Wise or specialized forex providers like OFX

- Best all-around: Remitly, offering both Express and Economy options to balance speed and cost

Frequently Asked Questions

What is the absolute fastest way to send money from Chicago to India?

The fastest options are Remitly Express and Xoom UPI transfers, which can deliver funds within minutes to major Indian banks or UPI IDs. For cash pickup, Western Union offers near-instant availability at thousands of agent locations across India.

Are digital transfers safe compared to bank wires?

Yes, reputable digital transfer services employ strong encryption and security measures similar to banks. All legitimate services are regulated and must comply with anti-money laundering laws. The primary difference is in processing time and cost, not security.

How much can I send from Chicago to India?

There is no regulatory limit on how much you can send from the US to India. However, different services have their own maximum transfer amounts. Digital services typically limit transfers to $2,000-$10,000 per transaction, while banks may allow much larger transfers.

Do I need an NRI account to receive money in India?

No, transfers can be sent to regular Indian bank accounts as well as specialized NRE or NRO accounts. However, there may be tax implications depending on which type of account is used. NRE accounts offer tax benefits for foreign income.

Can I send money directly to an Indian mobile wallet?

Some services like Xoom and Wise now support transfers to UPI IDs, which can be linked to mobile wallets. This option is increasing in popularity and typically offers faster delivery than traditional bank deposits.

What documentation do I need to send money to India?

For most transfers, you'll need a government-issued ID (such as a driver's license or passport), the recipient's full name as it appears on their bank account, their bank details (including IFSC code for bank transfers) or UPI ID, and sometimes their address. For larger transfers, additional verification may be required.

About the Author

This comprehensive guide was written by a financial expert with over a decade of experience in international money transfers and remittances. The author has extensive knowledge of the US-India transfer corridor and stays current with the latest developments in digital payment technologies and regulatory changes.

The information in this article is regularly updated to reflect the most current exchange rates, fees, and service offerings. Last updated: August 2025.

Post a Comment