Guide to Sending Money via Western Union in 2025 Step-by-Step

Complete Step-by-Step Guide to Sending Money via Western Union (2025)

The most comprehensive guide to sending money safely and efficiently

Introduction to Western Union Money Transfers

Western Union is one of the world's largest money transfer services, enabling individuals to send money across the globe quickly and securely. Whether you need to send money to family members abroad, pay international bills, or send emergency funds, Western Union offers multiple ways to do so, including online transfers, mobile app services, and in-person transactions at over 500,000 agent locations worldwide.

In this comprehensive guide, we'll walk you through everything you need to know about sending money through Western Union, including step-by-step instructions, fees, security measures, and tips to make your transfers smooth and cost-effective.

Table of Contents

- Western Union Sending Options

- Sending Money Online (Website)

- Sending Money via Mobile App

- Sending Money In-Person

- Western Union Fees and Exchange Rates

- How to Receive Money via Western Union

- Tracking Your Money Transfer

- Security Tips and Fraud Prevention

- International Transfer Considerations

- Frequently Asked Questions

- User Reviews and Experiences

Western Union Sending Options

Western Union offers multiple ways to send money, giving you flexibility based on your preferences and needs:

Online Transfers

Send money directly from Western Union's website. Create an account, enter recipient details, and pay using your preferred payment method.

Mobile App

Use the Western Union mobile app for convenient transfers on the go. Available for both iOS and Android devices with user-friendly interfaces.

In-Person

Visit any of Western Union's 500,000+ agent locations worldwide to send money in person with cash or other payment methods.

Important: Before sending money, be aware of fees, exchange rates, and delivery times which vary depending on the sending method, destination country, and amount being sent.

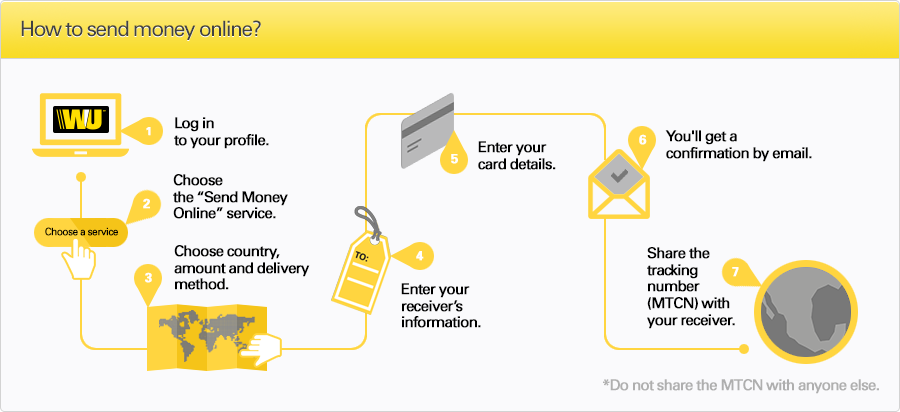

Sending Money Online (Website)

Sending money through Western Union's website is convenient and can be done from anywhere with internet access. Here's a step-by-step guide:

Step 1: Create an Account or Log In

Visit the Western Union website (westernunion.com) and create an account if you're a new user, or log in with your existing credentials. You'll need to provide personal information including your name, address, email, and phone number for verification purposes.

Step 2: Enter Transfer Details

Enter the amount you want to send and select the destination country. The website will show you available delivery methods for that country (bank deposit, cash pickup, or mobile wallet).

Step 3: Choose Payment Method

Select how you want to pay for the transfer. Options typically include:

- Bank account

- Credit card

- Debit card

Note that fees may vary depending on your chosen payment method.

Step 4: Enter Recipient Information

Enter your recipient's details, including:

- Full name (exactly as it appears on their ID)

- Location/address

- If sending to a bank account: bank name, account number, and other relevant banking details

Double-check all information for accuracy before proceeding.

Step 5: Review and Complete

Review all the transfer details, including:

- Transfer amount

- Exchange rate (if sending in a different currency)

- Fees

- Total cost

- Estimated delivery time

Confirm and complete your payment to finalize the transfer.

Step 6: Save Your MTCN

After successful payment, you'll receive a receipt with your Money Transfer Control Number (MTCN). This 10-digit number is essential for tracking your transfer and for your recipient to collect the money. Save it and share it with your recipient.

Pro Tips for Online Transfers:

- Sign up for Western Union Rewards to earn points on eligible transfers

- Save recipient information for faster future transfers

- Check for promotional offers or reduced fees on certain destinations

- Use bank transfers instead of credit cards to avoid higher fees

Sending Money via Mobile App

The Western Union mobile app offers all the functionality of the website with added convenience for on-the-go transfers. Available for both iOS and Android devices, here's how to use it:

Step 1: Download and Install the App

Download the "Western Union Send Money Now" app from the App Store or Google Play Store and install it on your device.

Step 2: Create an Account or Sign In

Launch the app and either create a new account or sign in with your existing Western Union credentials. If creating a new account, you'll need to verify your email address and provide personal information for identity verification.

Step 3: Set Up Your Transfer

Tap "Send Money" and enter the amount you want to send, select the destination country, and choose how your recipient should receive the money (cash pickup, bank account, or mobile wallet where available).

Step 4: Enter Recipient Information

Enter your recipient's details. You can select from your saved recipients or add a new one. Make sure all information is accurate and matches the recipient's identification documents.

Step 5: Select Payment Method

Choose how you want to pay for the transfer: bank account, debit card, credit card, or even start online and pay cash at a Western Union location. Add your payment details or select a saved payment method.

Step 6: Review and Complete

Review the transfer details, including the exchange rate, fees, and estimated delivery time. Confirm the transfer and make your payment.

Step 7: Share Transfer Details

Once your transfer is complete, you'll receive an MTCN (tracking number). You can share this and other transfer details directly from the app with your recipient via text message, email, or other messaging platforms.

App Features and Benefits:

- Real-time transfer tracking

- Biometric login (fingerprint or face recognition) for enhanced security

- Save and manage recipient information

- Set up repeat transfers

- Access to exclusive mobile-only promotions

- Find nearby Western Union locations with the agent locator

Sending Money In-Person

For those who prefer face-to-face transactions or need to pay in cash, Western Union offers in-person transfers at over 500,000 agent locations worldwide. Here's how to send money in person:

Step 1: Locate a Western Union Agent

Find your nearest Western Union agent location using the "Find Locations" feature on the Western Union website or mobile app. These locations may include banks, supermarkets, post offices, and dedicated Western Union offices.

Step 2: Bring Required Documentation

When visiting an agent location, bring:

- Valid government-issued photo ID (passport, driver's license, etc.)

- Cash or payment method accepted at that location

- Recipient's full name (as it appears on their ID)

- Destination country and city

- Amount you wish to send

Step 3: Complete the Send Money Form

Fill out the "Send Money" form provided at the agent location. You'll need to include:

- Your personal information

- Recipient's name and location

- Amount to send

- Preferred delivery method

Step 4: Review and Pay

Review the transaction details, including:

- Exchange rate (if applicable)

- Transfer fee

- Total amount due

Pay the agent the transfer amount plus fees.

Step 5: Get Your Receipt

After payment, you'll receive a receipt with your Money Transfer Control Number (MTCN). This is crucial for your recipient to collect the funds and for tracking the transfer.

Step 6: Share Transfer Information with Recipient

Share the following information with your recipient:

- MTCN (10-digit tracking number)

- Exact amount sent

- Your name as sender (exactly as you provided it)

- Originating country

Tips for In-Person Transfers:

- Agent operating hours vary, so check before visiting

- Some locations offer extended hours or weekend service

- Busy locations may have longer wait times during peak periods

- Some agents may offer additional services like bill payments

- Ask about any current promotions or discounts

Western Union Fees and Exchange Rates

Understanding Western Union's fee structure and exchange rates is essential to make informed decisions about your money transfers. Costs vary based on several factors:

Factors Affecting Fees

- Transfer amount: Larger transfers often have higher fees

- Destination country: Fees vary by country

- Delivery method: Bank deposits vs. cash pickup

- Payment method: Credit card, debit card, bank account

- Transfer speed: Express transfers cost more

- Transfer channel: Online, app, or in-person

Exchange Rate Considerations

- Margin: Western Union adds a margin to the mid-market rate

- Fluctuations: Rates change throughout the day

- Currency pairs: Some currency exchanges have better rates

- Transparency: Final exchange rate is shown before confirmation

- Rate lock: Rate is guaranteed once transfer is confirmed

Sample Fee Structure

While specific fees change regularly, here's a general overview of Western Union fees as of 2025:

| Transfer Amount | Online (Bank Account) | Online (Credit/Debit Card) | In-Person (Cash) |

|---|---|---|---|

| $1 - $100 | $0.99 - $3.99 | $4.99 - $9.99 | $5.00 - $15.00 |

| $101 - $300 | $3.99 - $8.99 | $9.99 - $14.99 | $15.00 - $22.00 |

| $301 - $500 | $8.99 - $12.99 | $14.99 - $19.99 | $22.00 - $30.00 |

| $501 - $1,000 | $12.99 - $20.99 | $19.99 - $29.99 | $30.00 - $45.00 |

| $1,001+ | $20.99+ or percentage | $29.99+ or percentage | $45.00+ or percentage |

Important Note: Always check the current fees and exchange rates on Western Union's website or app before initiating a transfer. Promotional rates or discounts may be available for certain destinations or first-time users.

Money-Saving Tips:

- Use bank account transfers instead of credit cards to reduce fees

- Compare the total cost (fees + exchange rate margin) before sending

- Check for promotional offers or fee discounts

- Consider sending larger amounts less frequently to minimize fee impact

- Use the Western Union price estimator tool before initiating transfers

- Join the Western Union rewards program for potential discounts

How to Receive Money via Western Union

If you're on the receiving end of a Western Union transfer, here's how to collect your money:

Cash Pickup

Step 1: Gather Required Information

Before visiting a Western Union location, make sure you have:

- Money Transfer Control Number (MTCN) from the sender

- Valid government-issued photo ID that matches the recipient name

- Sender's full name and originating country

- Approximate transfer amount

Step 2: Find a Western Union Location

Use the Western Union website or mobile app to find a nearby agent location for pickup. Note their opening hours.

Step 3: Complete the Receive Money Form

At the location, fill out a "Receive Money" form with your information, the sender's details, and the MTCN.

Step 4: Present Identification

Show your valid government-issued ID to the agent. The name on your ID must exactly match the recipient name provided by the sender.

Step 5: Verify and Receive Money

Answer any security questions if applicable. Once verified, you'll receive your money in the local currency.

Step 6: Check and Sign Receipt

Verify the amount received is correct, then sign the receipt to complete the transaction.

Bank Deposit

If the sender has chosen to send the money directly to your bank account:

- The money will be deposited automatically to the bank account provided by the sender

- No action is typically required from the receiver

- Funds are typically available within 1-5 business days, depending on the bank

- You may receive a notification once the funds are deposited

- Check your bank account balance to confirm receipt

Mobile Wallet

If receiving to a mobile wallet (where available):

- Ensure your mobile wallet is active and properly registered

- The funds will be credited directly to your mobile wallet

- You'll typically receive an SMS notification when the money arrives

- Check your mobile wallet balance to confirm receipt

- Transaction fees may apply when withdrawing from mobile wallet to cash

Important: Western Union transfers must be picked up in the country they were sent to, and typically within 90 days of being sent (though this may vary by country). After that period, the money may be returned to the sender.

Tracking Your Money Transfer

Western Union provides several ways to track your money transfer and confirm its status:

Online Tracking

Visit westernunion.com and use the "Track Transfer" feature. Enter your MTCN (10-digit tracking number) to see real-time status updates.

Mobile App

Use the Western Union mobile app to track transfers. Log in to your account to see all your recent transfers or enter the MTCN.

Phone Support

Call Western Union customer service and provide your MTCN, sender details, and amount to check transfer status.

Understanding Transfer Statuses

| Status | Description |

|---|---|

| In Progress | Your transfer has been initiated but is still being processed |

| Available for Pickup | Money has been processed and is ready for collection at the destination |

| Delivered | Money has been collected by your recipient or deposited into their account |

| Delayed | Transfer is experiencing a delay due to verification or other issues |

| Cancelled | Transfer has been cancelled (usually by the sender) |

| Refunded | Money has been returned to the sender |

What is an MTCN?

The Money Transfer Control Number (MTCN) is a unique 10-digit tracking number assigned to every Western Union transfer. It's provided to the sender upon completion of the transaction and is essential for both tracking and receiving the money. Always keep this number secure and share it only with your intended recipient.

Security Tips and Fraud Prevention

Western Union takes security seriously, but it's important to follow these best practices to protect yourself from potential fraud:

Warning Signs of Potential Scams

- Someone you've never met in person asks for money

- Online sellers requesting Western Union payment

- Emergency or urgent requests from "relatives" you can't verify

- Job offers requiring you to transfer money

- Lottery or prize winnings requiring a fee to claim

- Tax refund or government benefit claims

- Requests to send money to yourself in another country

Security Best Practices

- Only send money to people you know and trust

- Never share your MTCN publicly or with strangers

- Use strong, unique passwords for your Western Union account

- Enable two-factor authentication when available

- Verify recipient information before sending

- Keep your receipt until you confirm successful delivery

- Report suspicious activity immediately

Important Security Alert: Western Union will NEVER ask for your banking information, credit card details, or personal information via email or text message. If you receive such requests, they are fraudulent.

Western Union Security Measures

Western Union employs several security measures to protect your transfers:

- ID Verification: Recipients must provide valid identification that matches the name provided by the sender

- MTCN System: Unique tracking numbers for each transfer

- Fraud Monitoring: Advanced systems to detect suspicious patterns

- Encryption: Secure encryption of personal and financial information

- Multi-factor Authentication: Additional security layers for online accounts

- Security Questions: Optional security questions for added protection

If You Suspect Fraud:

- Contact Western Union's Fraud Hotline immediately at 1-800-448-1492 (US) or your country's equivalent

- Report suspicious emails to spoof@westernunion.com

- Change your Western Union account password

- Report the incident to local authorities

- Visit Western Union's Fraud Awareness Center for more information

International Transfer Considerations

When sending money internationally through Western Union, there are additional factors to consider:

Country-Specific Regulations

- Transfer Limits: Maximum amounts vary by country

- Documentation: Some countries require additional documentation

- Restricted Countries: Transfers to certain countries may be restricted

- Currency Restrictions: Some countries limit foreign currency transactions

- Reporting Requirements: Transfers above certain amounts may need reporting

Timing Considerations

- Time Zones: Consider business hours in the destination country

- Holidays: Local holidays can delay transfers

- Processing Times: Bank deposits take longer than cash pickup

- Weekends: Some services limited during weekends

Currency Exchange Factors

- Exchange Rate Timing: Rates fluctuate throughout the day

- Currency Availability: Not all currencies available at all locations

- Local Payout Currency: Some countries pay in local currency only

- Exchange Rate Margins: Higher for exotic currency pairs

- Dual Currency Options: Some destinations offer choice of currencies

ID Requirements

- Acceptable ID Types: Varies by country (passport, national ID, etc.)

- Secondary Verification: Some countries require multiple forms of ID

- Name Match: Names must match exactly as on ID

- Question/Answer: In some cases, test questions can be used

Important: Before sending an international transfer, check Western Union's country-specific information for your destination country to understand any special requirements or limitations.

Popular International Corridors

Western Union supports transfers to over 200 countries and territories. Some popular corridors include:

| From | To | Typical Delivery Speed | Special Considerations |

|---|---|---|---|

| United States | Mexico | Minutes for cash pickup | High number of pickup locations |

| United States | Philippines | Minutes to hours | Mobile wallet options available |

| United States | India | 1-2 business days | Bank deposit popular option |

| United Kingdom | Nigeria | Minutes to hours | Currency restrictions apply |

| Saudi Arabia | Pakistan | Minutes for cash pickup | ID verification important |

Frequently Asked Questions

Transfer times vary depending on the sending and receiving methods:

- Cash pickup: Available within minutes in most cases

- Bank deposit: 1-5 business days, depending on the receiving bank

- Mobile wallet: Usually within minutes to a few hours

Factors that can affect speed include verification processes, banking hours, weekends, and holidays.

Recipients typically need to provide:

- Government-issued photo ID (passport, driver's license, national ID card)

- Money Transfer Control Number (MTCN)

- Sender's name and originating country

- The expected amount

The name on the ID must exactly match the recipient name provided by the sender. Some countries may require additional forms of identification.

Yes, Western Union imposes sending limits that vary based on:

- Your sending history and profile

- The destination country

- Your sending method (online, app, or in-person)

- Regulatory requirements

For online transfers, new customers typically have lower limits that increase with usage history. For specific limit information, check the Western Union website or app for your country and destination.

Yes, you can request cancellation of a transfer if it has not yet been picked up or deposited. To cancel:

- Online: Log in to your account, locate the transfer, and select "Cancel"

- Mobile App: Find the transfer in your history and select the cancel option

- In-person: Return to a Western Union location with your receipt and ID

- Phone: Call customer service with your MTCN and details

Refunds typically take 3-10 business days to process, depending on your original payment method. If the money has already been picked up, it cannot be cancelled.

The recipient's name on the transfer must match their ID exactly. If there's a discrepancy:

- For minor misspellings: The agent may have discretion to release funds

- For significant differences: The sender may need to correct the name

If you discover a name error, contact Western Union customer service immediately to update the information. If the transfer has already been sent, you may need to cancel and resend with the correct spelling.

Yes, Western Union offers recurring transfer options for registered online users:

- Set up automatic transfers at regular intervals (weekly, bi-weekly, monthly)

- Specify amount, recipient, and payment method

- Manage and modify recurring transfers through your online account

- Cancel at any time without penalty

This feature is particularly useful for regular remittances to family members or recurring payments. Not all countries support recurring transfers, so check availability for your specific destination.

If a transfer isn't claimed by the recipient:

- It remains available for pickup typically for 90 days (varies by country)

- After the holding period expires, the money is returned to the sender

- Refund processing may take 7-10 business days

- Original fees are typically not refunded

You can check the status of unclaimed transfers through the tracking feature on the website or app, or by contacting customer service.

Western Union complies with international sanctions and regulations:

- Transfers to sanctioned countries may be restricted or prohibited

- Services to certain countries may be limited

- Additional verification may be required for certain destinations

- Regulations change, so check current status before sending

As of 2025, Western Union does not offer services to some countries due to sanctions or operational constraints. Check the Western Union website for the most current list of available countries.

User Reviews and Experiences

Here's what real users have to say about their Western Union money transfer experiences:

Sarah M. from Chicago

"I've been sending money to my family in Mexico monthly for over three years using Western Union's app. The process is straightforward, and the money is always available for pickup within minutes. The fees are reasonable, especially when I use my bank account instead of a credit card. The tracking feature gives me peace of mind."

James K. from London

"Western Union has been reliable for sending emergency funds to my daughter studying abroad. The first time was a bit confusing with all the verification steps, but now I can complete a transfer in just a few minutes. The exchange rates aren't the best in the market, but the convenience and speed make up for it."

Priya S. from Toronto

"I appreciate Western Union's global reach. I regularly send money to relatives in India, and there are multiple pickup locations near their home. The online process is efficient, and their customer service was very helpful when I had an issue with a transfer. I would recommend setting up an online profile to save recipient information for future transfers."

Miguel R. from Madrid

"Western Union is convenient for emergency transfers, but I find the fees a bit high for regular use. The exchange rates could be more competitive, especially for larger amounts. That said, their mobile app is well-designed and makes the process quick. I've used several money transfer services, and Western Union is the most widely available globally."

Common Themes from User Reviews

Positive Feedback

- Fast delivery for cash pickup options

- Wide global availability of agent locations

- Reliable service with consistent delivery

- User-friendly mobile app experience

- Good customer service for resolving issues

- Convenient tracking features

Areas for Improvement

- Higher fees compared to some competitors

- Exchange rates not always competitive

- Verification processes sometimes lengthy

- Bank deposit transfers can be slow

- Website occasionally experiences technical issues

- Initial setup can be complex for new users

Conclusion

Western Union remains one of the most established and widespread money transfer services globally, offering various options to send money across borders. While fees and exchange rates may not always be the lowest in the market, the company's extensive network, reliability, and multiple sending and receiving options make it a popular choice for international money transfers.

By following the step-by-step guides in this article and being mindful of security precautions, you can use Western Union confidently for your money transfer needs. Whether you're sending money to family abroad, helping a loved one in an emergency, or making international payments, Western Union provides a trusted service with a long history of connecting people financially across the globe.

Remember to compare fees and exchange rates before each transfer, as costs vary significantly based on destination, amount, and payment method. Most importantly, only send money to people you know and trust to avoid potential scams and fraud.

Post a Comment