Best Money Transfer Options from California to India

Best Money Transfer Options from California to India: The Ultimate 2025 Guide

Article Highlights

- Comprehensive comparison of top money transfer services from California to India

- Detailed breakdown of fees, exchange rates, and transfer speeds

- Tax implications and legal considerations for international remittances

- Step-by-step guides for each major provider

- Real user reviews and expert recommendations

Introduction: Navigating Money Transfers from California to India

Transferring money from California to India is a common need for many Indian expatriates, students, professionals, and businesses. Whether you're supporting family back home, investing in property, or conducting business transactions, finding the most efficient, affordable, and secure way to transfer money internationally is crucial.

With numerous options available today, from traditional bank transfers to modern digital platforms, choosing the right service can save you significant money on fees and exchange rates while ensuring your funds reach their destination quickly and securely.

This comprehensive guide compares the top money transfer services for California to India remittances in 2025, analyzing critical factors like:

- Transfer fees and hidden costs

- Exchange rates and currency conversion margins

- Transfer speed and delivery options

- Maximum and minimum transfer limits

- Security features and regulatory compliance

- User experience and customer service quality

- Tax implications and documentation requirements

By the end of this guide, you'll have all the information needed to choose the best money transfer service for your specific needs and circumstances.

Overview of Money Transfer Methods: California to India

Before diving into specific providers, let's explore the main categories of money transfer services available for sending funds from California to India:

Online Money Transfer Services

Examples: Wise, Remitly, Xoom

Best for: Competitive exchange rates, lower fees than banks, fast transfers

Typical Features: Mobile apps, tracking capabilities, multiple payment and delivery options

Traditional Money Transfer Operators

Examples: Western Union, MoneyGram

Best for: Cash pickup options, extensive global network, no recipient bank account required

Typical Features: In-person service, cash pickup locations, brand recognition

Banks and Credit Unions

Examples: Bank of America, Chase, Wells Fargo, SBI California

Best for: Security, existing account holders, large transfers

Typical Features: Wire transfers, branch services, integrated banking

Payment Platforms

Examples: PayPal, Skrill

Best for: Convenience, existing users of the platform

Typical Features: Digital wallet functionality, linked to multiple payment methods

The best choice depends on your specific needs, including how much you're sending, how quickly the recipient needs the money, your preferred payment method, and how the recipient prefers to receive funds.

Key Factors to Consider When Choosing a Provider

- Exchange Rates: Even small differences in exchange rates can significantly impact the amount received, especially for larger transfers.

- Fees: Look beyond the advertised fee and consider all costs involved, including hidden fees and markup on exchange rates.

- Transfer Speed: Delivery times vary from minutes to several business days depending on the service and method.

- Maximum and Minimum Limits: Services have different limits on how much you can transfer at once or within a given period.

- Payment and Delivery Options: Consider convenient ways to fund your transfer and how the recipient will access the funds.

- Security and Reliability: Choose services with strong encryption, regulatory compliance, and positive user reviews.

- Customer Support: Access to support in your preferred language and time zone can be crucial if issues arise.

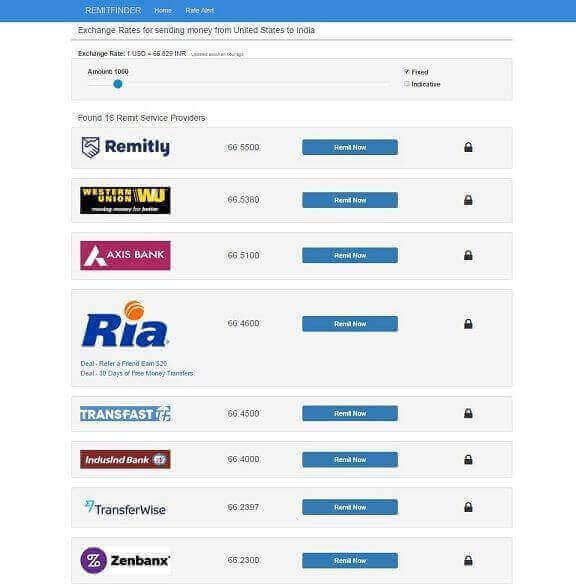

Top Money Transfer Providers: California to India Comparison

Let's examine the leading providers for sending money from California to India, comparing their key features, strengths, and limitations.

| Provider | Transfer Fee | Exchange Rate | Transfer Speed | Maximum Transfer | Delivery Options |

|---|---|---|---|---|---|

| Wise | $7.33 + 0.46% of amount | Mid-market rate | 1-2 business days | $1,000,000 | Bank deposit |

| Remitly | $3.99 (express), $0 for transfers over $1,000 | 1-1.5% margin | Minutes (express) or 3-5 days (economy) | $30,000/day | Bank deposit, cash pickup, mobile wallet, home delivery |

| Western Union | $0-$45 (varies by method) | 2-4% margin | Minutes to 5 business days | $50,000 | Bank deposit, cash pickup, mobile wallet |

| Xoom (PayPal) | $4.99-$30.99 (varies by amount) | 1-3% margin | Minutes to 2 business days | $25,000/180 days | Bank deposit, cash pickup, home delivery |

| SBI California | $0 for online/mobile transfers | 1-2% margin | Same day to 2 business days | $25,000/day (mobile), $50,000/month | Bank deposit |

| PayPal | 5% of amount ($0.99 min, $4.99 max) | 3-4% margin + 2.5% currency conversion fee | 1-3 business days | Varies by account | PayPal account, bank deposit |

Note: Exchange rate margins and fees are approximate and may vary. Always check current rates before making a transfer. Data accurate as of May 2025.

Wise (Formerly TransferWise): Detailed Review

Wise has established itself as a leader in transparent international money transfers with its commitment to using the mid-market exchange rate.

Pros

- Uses the real mid-market exchange rate with no markup

- Transparent fee structure

- User-friendly website and mobile app

- High transfer limits suitable for large transactions

- Regulated by financial authorities

- Multi-currency accounts available

Cons

- Bank deposit only (no cash pickup options)

- Not the fastest for urgent transfers

- Fee structure can make small transfers relatively expensive

- No physical branches for in-person assistance

Wise Fee Structure for California to India

As of May 2025, Wise charges:

- A fixed fee of $7.33 USD

- Plus a variable fee of 0.46% of the transfer amount

- No hidden markup on the exchange rate

Example Transfer: $1,000 USD to India

- Fixed fee: $7.33

- Variable fee: $4.60 (0.46% of $1,000)

- Total fees: $11.93

- Exchange rate: Mid-market rate (approximately ₹85.45 per USD as of May 2025)

- Amount received: ₹84,395.31 (minus any recipient bank charges)

Wise User Experience

Wise offers a streamlined transfer process through its website and mobile app. The interface is intuitive and provides clear information about fees, exchange rates, and estimated delivery times before you confirm your transfer.

"I've been using Wise for sending money to my parents in Mumbai for the past three years. The transparency in their fee structure and competitive exchange rates save me around $30-40 on each $1000 transfer compared to my previous bank transfers."

— Raj S., Software Engineer in San Francisco

How to Send Money with Wise

Create an account

Sign up on the Wise website or mobile app with your email address. You'll need to verify your identity with a government ID and proof of address.

Set up your transfer

Enter the amount you want to send, select USD as your sending currency and INR as the receiving currency.

Enter recipient details

Add your recipient's full name as it appears on their bank account, their bank details including IFSC code, and account number.

Verify recipient information

Double-check all banking details as mistakes can cause delays or failed transfers.

Choose your payment method

Select how you want to pay: bank transfer, debit card, or credit card (fees vary by method).

Review and confirm

Check all details, including the exchange rate and fees, before confirming your transfer.

Wise is ideal for those who prioritize getting the best possible exchange rate and appreciate transparency in fee structures. It's especially cost-effective for larger transfers where the percentage-based fee is offset by the excellent exchange rate.

Remitly: Detailed Review

Remitly has gained popularity among California residents sending money to India thanks to its competitive rates, speed options, and variety of delivery methods.

Pros

- Express option delivers funds in minutes

- Free transfers over $1,000 (economy option)

- Multiple delivery options including cash pickup

- First-time user promotions and better rates

- Dedicated customer support

- User-friendly mobile app

Cons

- Exchange rate includes a markup (1-1.5%)

- Economy delivery can take 3-5 business days

- Daily sending limits may be restrictive for some users

- Variable fees based on payment method

Remitly Fee Structure for California to India

As of May 2025, Remitly offers two service levels:

- Express: $3.99 fee for transfers under $1,000, delivery in minutes

- Economy: $0 fee for any amount, delivery in 3-5 business days

- Exchange rate: Includes a markup of approximately 1-1.5% from the mid-market rate

- Promotional rates: First-time users often receive better exchange rates

Example Transfer: $1,000 USD to India

- Express fee: $3.99

- Economy fee: $0

- Exchange rate: Approximately ₹84.45 per USD (with standard markup)

- Amount received (Express): ₹84,450 - delivered in minutes

- Amount received (Economy): ₹84,450 - delivered in 3-5 days

Remitly User Experience

Remitly offers a smooth, user-friendly experience with its mobile app, which is particularly convenient for tracking transfers. The service is known for its reliability and customer support.

"Remitly has been my go-to for sending money to my family in Delhi. Their Express option is a lifesaver during emergencies when my relatives need funds immediately. The tracking feature gives me peace of mind, and the rates are competitive enough."

— Priya K., Healthcare Professional in Los Angeles

How to Send Money with Remitly

Create an account

Sign up on the Remitly website or download their mobile app. You'll need to provide personal information and verify your identity.

Select India as the destination country

Choose how much you want to send and see the current exchange rate and fees.

Choose delivery method

Select bank deposit, cash pickup, or mobile wallet depending on your recipient's preference.

Enter recipient details

Add your recipient's information, including their full name and banking details if sending to a bank account.

Select transfer speed

Choose between Express (minutes) or Economy (3-5 days) delivery options.

Pay for your transfer

Enter your payment details using debit card, credit card, or bank account.

Track your transfer

Use the Remitly app to track the status of your transfer until it's completed.

Remitly is an excellent choice for those who need flexibility in delivery options and transfer speed. It's particularly valuable for urgent transfers where the recipient needs the money quickly.

Western Union: Detailed Review

Western Union is one of the oldest and most widely recognized money transfer services globally, with an extensive network of agent locations in both California and India.

Pros

- Extensive network of agent locations for in-person service

- Multiple ways to send: online, mobile app, or in-person

- Various delivery options, including cash pickup

- No bank account required for recipient (cash pickup)

- Reliable service with long-standing reputation

- High transfer limits for verified customers

Cons

- Higher fees compared to digital-first competitors

- Less favorable exchange rates (2-4% markup)

- Fee structure can be complex and varies by payment method

- Online transfers may require verification for larger amounts

Western Union Fee Structure for California to India

Fees vary widely depending on:

- How you pay (cash, debit card, credit card, bank account)

- How the recipient receives money (bank deposit or cash pickup)

- How much you're sending

- Transfer speed selected

Example Transfer: $1,000 USD to India

- Online bank transfer to bank account: $0-$5 fee

- Online debit/credit card to cash pickup: $10-$30 fee

- In-person cash to cash pickup: $15-$45 fee

- Exchange rate: Approximately ₹83.50 per USD (with 2-4% markup)

- Amount received: ₹83,500 (minus any applicable fees)

Western Union User Experience

Western Union offers multiple channels for sending money, catering to different user preferences. Their online and mobile platforms have improved significantly in recent years, while maintaining their traditional in-person service options.

"I've been using Western Union for years to send money to my elderly parents in a small town near Hyderabad. The cash pickup option is invaluable since banking is less accessible in their area. While the fees are higher than online services, the convenience for my parents is worth it."

— Venkat R., Business Owner in San Jose

How to Send Money with Western Union

Create an account (for online transfers)

Register on the Western Union website or mobile app with your personal information. For in-person transfers, visit a Western Union agent location.

Start your transfer

Select India as the destination country and enter the amount you want to send.

Choose delivery and payment methods

Select how you want to pay (bank account, card, cash) and how the recipient will receive the money (bank deposit or cash pickup).

Enter recipient details

Provide your recipient's information. For cash pickup, only basic information is required. For bank transfers, you'll need complete banking details.

Review and pay

Confirm all details, review fees and exchange rates, and complete your payment.

Share tracking information

For cash pickup, provide the tracking number (MTCN) to your recipient so they can collect the funds at an agent location.

Western Union remains a solid choice for those who prefer traditional methods or need to send money to recipients without bank accounts. Its extensive agent network makes it accessible in regions where digital banking infrastructure is limited.

Xoom (PayPal Service): Detailed Review

Xoom, acquired by PayPal in 2015, offers fast money transfers from California to India with multiple delivery options and integration with the PayPal ecosystem.

Pros

- Fast transfers - often within minutes for bank deposits

- Multiple delivery options including cash pickup

- Integration with PayPal accounts

- Strong mobile app experience

- High sending limits for verified users

- Ability to pay utility bills directly in India

Cons

- Exchange rates include markup (1-3%)

- Fees increase with transfer amount

- Verification process can be lengthy for new users

- Customer support response time can be slow

Xoom Fee Structure for California to India

As of May 2025, Xoom's fee structure for sending money to India:

- Bank account funding: $4.99 fee for any amount

- Debit/credit card funding: $4.99 for transfers up to $1,000, increasing for larger amounts

- PayPal balance: $4.99 for most transfers

- Exchange rate: Includes a markup of approximately 1-3% from the mid-market rate

Example Transfer: $1,000 USD to India

- Fee (bank account funding): $4.99

- Fee (debit/credit card): $4.99

- Exchange rate: Approximately ₹83.80 per USD (with markup)

- Amount received: ₹83,800 (minus any recipient bank charges)

- Delivery time: Within minutes to 24 hours for most bank deposits

Xoom User Experience

Xoom offers a streamlined user experience with its easy-to-navigate website and mobile app. Integration with PayPal makes it particularly convenient for existing PayPal users.

"I switched to Xoom after struggling with my bank's complicated wire transfer process. The speed is impressive – my mother in Chennai usually receives the money in her bank account within minutes of me completing the transaction. The tracking updates are also very helpful."

— Deepa M., IT Professional in San Diego

How to Send Money with Xoom

Create an account

Sign up on Xoom's website or mobile app. You can also use your existing PayPal credentials if you have a PayPal account.

Enter transfer details

Select India as the destination, choose your transfer amount, and see the applicable fees and exchange rate.

Choose delivery method

Select bank deposit, cash pickup, or home delivery depending on your recipient's preference.

Enter recipient information

Provide your recipient's details, including name, address, and bank information for bank deposits.

Select payment method

Choose to pay with your bank account, debit/credit card, or PayPal balance.

Review and send

Confirm all details, including fees and exchange rates, and complete your payment.

Track your transfer

Monitor the status of your transfer through the Xoom website or mobile app.

Xoom is well-suited for those who value speed and convenience, especially existing PayPal users. Its multiple delivery options make it flexible for various recipient needs across India.

SBI California: Detailed Review

State Bank of India California (SBIC) offers specialized remittance services for sending money to India, with the backing of India's largest public sector bank.

Pros

- Zero transfer fees for online and mobile transfers

- Direct integration with India's largest bank network

- Competitive exchange rates for a bank service

- Same-day to 2-day delivery for most transfers

- High level of security and regulatory compliance

- Physical branches in California for in-person assistance

Cons

- Requires SBIC account for best rates and features

- Limited delivery options (bank deposit only)

- Less intuitive online interface than digital-first competitors

- Monthly transfer limits may restrict large volume transfers

SBI California Fee Structure for Remittance to India

As of May 2025, SBI California offers these remittance options:

- Online/mobile app transfers: $0 transfer fee

- Branch-initiated transfers: May include nominal service charges

- Exchange rate: Includes a markup of approximately 1-2% from the mid-market rate

- Limits: $25,000 per day for mobile transfers, $50,000 monthly limit

Example Transfer: $1,000 USD to India

- Transfer fee: $0 (online/mobile)

- Exchange rate: Approximately ₹84.62 per USD (with bank markup)

- Amount received: ₹84,620

- Delivery time: Same day to 2 business days

SBI California User Experience

SBI California offers a more traditional banking experience compared to digital-first competitors. The service is particularly appealing to those who already bank with SBI or prefer dealing with established financial institutions.

"As an SBI account holder both in California and India, the seamless transfer between accounts is incredibly convenient. The zero transfer fee is a significant advantage, and my relatives in India receive the money directly to their SBI accounts usually by the next day."

— Arun P., Engineer in Sacramento

How to Send Money with SBI California

Open an SBI California account

For optimal service, open an account with SBI California either online or at a branch.

Register for remittance service

Complete a remittance registration form either online or at a branch to set up the service.

Provide recipient details

Add your recipient's bank account information, including IFSC code and account number.

Initiate transfer

Log in to SBIC Online Banking or the SBIC Mobile App and select "Send Money to India."

Enter transfer amount

Specify the amount you want to send and review the exchange rate offered.

Confirm and send

Review all details and confirm the transfer. You may need to authorize with a security code.

Track your transfer

Monitor the status of your transfer through the online banking portal or mobile app.

SBI California is particularly beneficial for those who already have SBI accounts or regularly send money to SBI account holders in India. The zero transfer fee makes it cost-effective for frequent remittances.

PayPal: Detailed Review

While PayPal is better known for online purchases and domestic transfers, it also offers international money transfer services to India.

Pros

- Familiar platform for existing PayPal users

- User-friendly interface

- Strong buyer and seller protections

- Multiple funding options (bank account, credit card, PayPal balance)

- Good security features

Cons

- Higher fees than specialized money transfer services

- Poor exchange rates (3-4% markup plus 2.5% currency conversion fee)

- Recipient needs a PayPal account (unless using Xoom)

- Withdrawal to Indian bank accounts can add extra steps and time

PayPal Fee Structure for California to India

As of May 2025, PayPal's fee structure for international transfers:

- International personal payments: 5% of the amount (minimum $0.99, maximum $4.99)

- Currency conversion fee: Additional 2.5% above the base exchange rate

- Funding source fees: May apply depending on payment method

- Recipient withdrawal fees: May apply when withdrawing to an Indian bank account

Example Transfer: $1,000 USD to India

- Transfer fee: $4.99 (maximum fee applies)

- Exchange rate: Approximately ₹82.00 per USD (after markups)

- Currency conversion fee: 2.5% of the transferred amount

- Amount received: Approximately ₹79,950 (after all fees)

- Delivery time: 1-3 business days to recipient's PayPal account, additional time for bank withdrawal

PayPal User Experience

PayPal offers a familiar and straightforward user experience, especially for those who already use the platform for other purposes. However, the overall experience for international transfers specifically to India can be less streamlined than specialized services.

"I occasionally use PayPal to send money to my freelance team in India. While it's convenient for me as I already use PayPal for business, the fees and exchange rates aren't competitive. It works for small amounts when convenience trumps cost, but I use alternatives for larger transfers."

— Michael T., Small Business Owner in Oakland

How to Send Money with PayPal

Create PayPal accounts

Both you and your recipient need PayPal accounts. Your recipient must have a verified Indian PayPal account.

Add funding source

Link your bank account, debit card, or credit card to your PayPal account if not already done.

Send money

Log into PayPal, click "Send & Request," enter your recipient's email or phone number, and enter the amount.

Select currency

Choose USD or INR for the transaction. If sending in USD, the recipient will handle the conversion.

Review and send

Check fees, exchange rate (if applicable), and other details before confirming the transfer.

Recipient withdrawal

Advise your recipient they'll need to transfer the funds from PayPal to their Indian bank account, which may take additional time.

PayPal is generally not the most cost-effective option for sending money to India due to its fee structure and exchange rate markups. However, it can be convenient for those who already use the platform extensively and for situations where both parties prefer the PayPal ecosystem.

Comprehensive Comparison: Finding Your Best Option

To help you select the most appropriate service for your specific needs, we've compiled this detailed comparison based on different transfer scenarios and priorities.

Best Options Based on Transfer Amount

| Transfer Amount | Best Option | Runner-up | Why |

|---|---|---|---|

| Under $200 | Remitly Economy | Xoom | Lower fixed fees make a significant difference for small transfers |

| $200-$1,000 | Remitly Economy | Wise | Balance of fees and competitive exchange rates |

| $1,000-$5,000 | SBI California (for account holders) | Wise | Zero transfer fees and competitive rates |

| Over $5,000 | Wise | SBI California | Mid-market exchange rate becomes more valuable for large amounts |

Best Options Based on Speed Priority

| Delivery Time Needed | Best Option | Average Cost Impact | Notes |

|---|---|---|---|

| Within minutes | Remitly Express | Higher by 3-5% | Instant transfers to major Indian banks |

| Same day | Xoom | Higher by 2-3% | Usually within hours to major banks |

| 1-2 business days | SBI California | Moderate | Reliable next-day delivery to SBI accounts |

| 3-5 business days | Wise | Lower by 1-2% | Best exchange rate but slower delivery |

Best Options Based on Recipient's Needs

| Recipient Situation | Recommended Service | Delivery Method |

|---|---|---|

| No bank account | Western Union | Cash pickup |

| Limited mobility/rural area | Xoom | Home delivery |

| SBI account holder | SBI California | Bank deposit |

| Tech-savvy with major bank | Remitly or Wise | Bank deposit |

| Emergency need | Remitly Express | Bank deposit/Cash pickup |

Key Recommendations Summary

- Best for lowest overall cost: Wise (especially for larger amounts)

- Best for speed: Remitly Express

- Best for flexible delivery options: Western Union

- Best for regular, small transfers: Remitly Economy

- Best for SBI account holders: SBI California

- Best user experience: Wise and Remitly (tie)

- Best for non-bank recipients: Western Union

Tax Implications and Legal Considerations

When transferring money from California to India, it's important to understand the potential tax implications and regulatory requirements in both countries.

U.S. Tax Considerations

- Gift Tax Exemption: As of 2025, you can transfer up to $19,000 per person annually without gift tax filing requirements. Amounts above this threshold may require filing a gift tax return (IRS Form 709), though actual tax is typically only due for very large lifetime gifts.

- Reporting Requirements: Financial institutions must report cash transactions exceeding $10,000 to the Financial Crimes Enforcement Network (FinCEN). This is automatic and doesn't typically affect legitimate transfers.

- FBAR Filing: If you have financial accounts in India totaling over $10,000 at any point during the year, you must file a Foreign Bank Account Report (FBAR).

- Source of Funds: Be prepared to verify the source of funds for large transfers as part of anti-money laundering compliance.

Indian Tax Considerations

- Gift Tax in India: Money received from relatives (as defined by Indian income tax laws) is exempt from tax. Gifts from non-relatives exceeding ₹50,000 in a financial year are taxable as "Income from Other Sources" for the recipient.

- Definition of "Relatives": Under Indian tax law, relatives include spouse, siblings, siblings of spouse, siblings of parents, any lineal ascendant or descendant, and spouses of these relatives.

- Foreign Remittance Declaration: For transfers above certain thresholds, recipients may need to provide a declaration about the source and purpose of funds.

- LIBERALISED REMITTANCE SCHEME (LRS): For transfers from India to the US, the RBI allows remittances up to $250,000 per financial year. This doesn't directly affect transfers into India but is relevant for Indian residents sending money abroad.

Documentation for Legal Compliance

To ensure smooth transfers and compliance with regulations, have these documents ready:

- Valid identification (passport, driver's license)

- Proof of address

- Recipient's complete banking information, including IFSC code for Indian banks

- Purpose of transfer documentation for larger amounts

- Source of funds documentation for larger transfers

Important: Tax laws and reporting requirements change frequently. This information is current as of May 2025, but we recommend consulting with a tax professional for advice specific to your situation, especially for large or regular transfers.

Security Considerations for International Money Transfers

Protecting your money and personal information during international transfers is paramount. Here are key security considerations when sending money from California to India:

Verify the Service Provider

- Ensure the money transfer service is properly licensed and regulated

- Check for U.S. registration with FinCEN

- Look for compliance with international security standards

- Research their reputation and customer reviews

Protect Your Account

- Use strong, unique passwords for transfer service accounts

- Enable two-factor authentication when available

- Never share OTPs or verification codes with anyone

- Log out completely after completing transactions

Secure Connection

- Only transact on websites with HTTPS (look for the padlock icon)

- Avoid using public Wi-Fi for financial transactions

- Use the official app from authorized app stores

- Keep your device's operating system and apps updated

Scam Prevention

- Be wary of offers with exchange rates that seem too good to be true

- Never send money to someone you don't know

- Verify recipient details before completing transfers

- Be suspicious of requests for unusual payment methods

Security Comparison of Major Providers

| Provider | Security Features | Regulatory Compliance | Fraud Protection |

|---|---|---|---|

| Wise | 2FA, activity monitoring, data encryption | Regulated by financial authorities in multiple countries | Transaction monitoring, verification steps |

| Remitly | 2FA, biometric login, encryption | Licensed as a money transmitter in 50 US states | Fraud detection system, verification process |

| Western Union | Secure PIN, verification questions | Globally regulated with extensive compliance team | Advanced fraud detection, secure MTCN system |

| Xoom/PayPal | 2FA, encryption, email confirmations | Operating under PayPal's extensive regulatory coverage | 24/7 transaction monitoring, buyer/seller protection |

| SBI California | Multi-factor authentication, encryption | Full banking regulatory compliance in US and India | Verification protocols, transaction limits |

Red Flags to Watch For

- Unsolicited emails or messages asking for account details

- Pressure to act quickly or claims of emergencies

- Requests to send "test transfers"

- Services with no clear physical address or customer support

- Significantly better exchange rates than market rates

- Requests to wire money to someone you haven't met in person

Tips for Getting the Best Rates and Service

Maximize the value of your money transfers from California to India with these practical tips:

Timing Your Transfers

- Monitor exchange rate trends using tools like XE.com

- Consider setting up rate alerts with services like Wise

- Avoid end-of-month transfers when rates often fluctuate

- For large transfers, consider splitting them across favorable rate days

- Weekday mornings (PST) often have better liquidity and rates

Saving on Fees

- Compare total cost, not just the advertised fee

- Look for first-time user promotions and discounts

- Consider economy options for non-urgent transfers

- Bank account funding usually has lower fees than cards

- Some services offer fee waivers for larger amounts

- Loyalty programs can reduce costs for regular transfers

Maximizing Recipient Value

- Verify if recipient's bank charges incoming fees

- Choose direct deposit to avoid intermediary bank fees

- Consider the total delivery time value for the recipient

- Pre-arranged transfers can sometimes access better rates

- Discuss with recipient which delivery method works best

Special Situations

- For recurring transfers, some services offer rate locks

- For very large amounts, contact services directly for better rates

- Emergency transfers may qualify for expedited processing

- Business transfers may have different rate structures

- Consider specialized NRI services for property purchases

The True Cost Calculator

To compare services accurately, calculate the true cost using this formula:

True Cost = Advertised Fee + Exchange Rate Margin + Recipient Bank Charges

Where Exchange Rate Margin = (Mid-market rate - Offered rate) × Transfer amount

Example calculation for a $1,000 transfer:

- Mid-market rate: 1 USD = 85.45 INR

- Service offered rate: 1 USD = 83.50 INR

- Advertised fee: $4.99

- Exchange rate margin: (85.45 - 83.50) × $1,000 = 1,950 INR ≈ $22.82

- Recipient bank fee: 100 INR ≈ $1.17

- True cost: $4.99 + $22.82 + $1.17 = $28.98 (2.9% of transfer amount)

User Reviews and Experiences

Real experiences from California residents who regularly transfer money to India provide valuable insights beyond technical comparisons. Here are some perspectives shared by users of different services:

Wise User - Sunita K., Tech Professional, San Francisco

"After trying several services, I've settled on Wise for monthly transfers to my parents in Bangalore. The transparency is unmatched - what you see is what you get. Their mid-market exchange rate saves me about $25-30 per month compared to my previous bank. The app is intuitive, and transfers typically complete within 24-48 hours. Worth the slightly higher upfront fee."

Remitly User - Vikram P., Healthcare Worker, Los Angeles

"Remitly has been reliable for sending money to my family in Chennai. The Express service is a lifesaver during emergencies - funds usually hit their account in minutes. The exchange rate isn't the absolute best, but the speed and ease of use make up for it. Customer service has been responsive when I needed help. One star off for occasional verification delays on larger transfers."

Western Union User - Anand J., Restaurant Owner, Sacramento

"I've been using Western Union for years to send money to relatives in a small town near Pune. While their rates and fees aren't the best, the cash pickup option is invaluable for my elderly relatives who aren't comfortable with banking. Their extensive network means there's always a pickup location nearby. Service is reliable but expensive compared to online options."

Xoom User - Meera T., Graduate Student, San Diego

"Xoom has been my go-to for sending money to my sister in Mumbai. The integration with my existing PayPal account made setup easy, and transfers typically arrive within hours. The tracking features give peace of mind, and their customer service has been helpful. The exchange rate could be better, but the convenience factor is high, especially for smaller, urgent transfers."

SBI California User - Rohit S., Engineer, San Jose

"As someone with accounts at both SBI California and SBI India, their remittance service is seamless. Zero transfer fees and next-day delivery to Indian SBI accounts are the main advantages. Their exchange rates are decent but not spectacular. The mobile app works well, though their online interface could use modernization. Perfect for regular transfers to family members with SBI accounts."

PayPal User - Divya M., Freelancer, Oakland

"I used PayPal initially for convenience since I receive client payments through it. While it works, it's definitely not optimized for India transfers. The fees are high, exchange rates poor, and the recipient has to go through extra steps to withdraw to their Indian bank. It works in a pinch but is expensive. I've since switched to specialized transfer services for better value."

Trustpilot Ratings Summary

As of May 2025, here are the Trustpilot ratings for the major money transfer services:

| Provider | Trustpilot Score | Positive Reviews | Common Praise | Common Complaints |

|---|---|---|---|---|

| Wise | 4.3/5 | 88% | Transparent pricing, excellent rates | Verification delays, limited support |

| Remitly | 4.6/5 | 88% | Speed, tracking, customer service | Account freezes, verification issues |

| Western Union | 3.9/5 | 74% | Reliability, global availability | High fees, exchange rates |

| Xoom | 4.2/5 | 82% | Speed, tracking, multiple delivery options | Exchange rates, account limitations |

| PayPal | 1.8/5 | 25% | Integration with existing accounts | High fees, poor support, account holds |

Frequently Asked Questions

What's the fastest way to send money from California to India in an emergency?

Remitly's Express service typically delivers funds to major Indian banks within minutes. Western Union and Xoom also offer rapid services, with funds often available within 1-2 hours. For these expedited transfers, using debit/credit cards as the funding method will provide the fastest processing times.

Are there any limits on how much money I can send to India?

Service providers have their own limits. Wise allows up to $1,000,000 per transfer, Remitly has a $30,000 daily limit, Western Union limits vary by service level (typically up to $50,000), Xoom allows up to $25,000 per 180 days, and SBI California permits $25,000 daily via mobile with a $50,000 monthly cap. There are no regulatory limits from the US side for sending money to India.

Do I need to pay taxes on money I send from California to India?

In the US, money transfers are not taxable events for the sender. However, if you send more than $19,000 (as of 2025) to an individual in a calendar year, you may need to file a gift tax return, though actual tax is rarely due. In India, recipients don't pay tax on gifts from relatives, but gifts exceeding ₹50,000 from non-relatives are taxable as income for the recipient.

What documents do I need to send money to India?

For most transfers, you'll need a government-issued ID (passport, driver's license), proof of address, and your recipient's full name and bank details (including IFSC code for bank transfers). For larger amounts, services may request additional documentation such as proof of funds source or the purpose of the transfer.

Which service offers the best exchange rates for transferring money to India?

Wise consistently offers the best exchange rates by using the mid-market rate without markup. Other services apply varying markups: SBI California (1-2%), Remitly (1-1.5%), Xoom (1-3%), Western Union (2-4%), and PayPal (3-4% plus 2.5% conversion fee). For large transfers, even small differences in exchange rates can significantly impact the amount received.

Can I send money to India without the recipient having a bank account?

Yes, several services offer cash pickup and home delivery options. Western Union has the most extensive cash pickup network in India. Xoom offers both cash pickup and home delivery services. Remitly also provides cash pickup options through partner locations. These services are particularly valuable for recipients in rural areas or those without easy access to banking services.

How long does it typically take for money to reach India?

Transfer times vary by service and method: Remitly Express delivers within minutes to major banks. Xoom typically delivers within hours for bank deposits. Western Union offers minutes to 1-2 days depending on method. SBI California takes 1-2 business days. Wise typically takes 1-2 business days. Economy options may take 3-5 business days but often offer lower fees.

Are there any special considerations for sending large amounts to India?

For transfers exceeding $10,000, financial institutions will automatically file reports with FinCEN, though this doesn't affect legitimate transfers. Consider splitting very large transfers across multiple days or using services like Wise or SBI California that specialize in larger transfers. Be prepared for additional verification requirements and consider contacting the service directly to potentially negotiate better rates for significant amounts.

Is it safer to use banks or specialized money transfer services?

Both regulated banks and licensed money transfer services offer secure transfers. Banks like SBI California offer the security of established financial institutions with full regulatory compliance. Specialized services like Wise and Remitly are also licensed and regulated money transmitters with strong security protocols. The choice often comes down to fees, exchange rates, and convenience rather than security differences.

Can I schedule recurring transfers to India?

Yes, most major services offer recurring transfer options. Wise allows scheduled recurring transfers with flexible frequency options. Remitly lets you save recipient details for easy repeat transfers. Xoom offers recurring payment features integrated with PayPal. SBI California has standing instruction options for account holders. These features are particularly useful for regular support payments to family or mortgage payments.

Conclusion and Recommendations

Choosing the right money transfer service for sending funds from California to India depends on your specific needs, priorities, and circumstances. After comprehensive analysis, here are our final recommendations:

Best Overall: Wise

With its combination of transparent fees, mid-market exchange rates, and reliable service, Wise offers the best value for most users, especially for transfers over $1,000. While not the fastest option, its 1-2 day delivery window is reasonable for most non-emergency situations.

Best for Speed: Remitly

When time is critical, Remitly's Express service delivers funds to major Indian banks within minutes. Combined with competitive rates and excellent tracking features, it's our top pick for urgent transfers.

Best for Banking Integration: SBI California

For those with accounts at SBI (or those sending to SBI account holders in India), SBI California offers zero-fee transfers with competitive rates and reliable next-day delivery. The banking relationship adds an extra layer of service and security.

Best for Flexible Pickup Options: Western Union

Despite higher fees, Western Union remains the leader for cash pickup services across India, making it invaluable for sending money to recipients without bank accounts or in remote areas.

Best for PayPal Users: Xoom

For those already in the PayPal ecosystem, Xoom offers a more competitive option than direct PayPal transfers, with faster delivery times and better rates, while maintaining integration with PayPal accounts.

Remember that the money transfer landscape is constantly evolving, with providers regularly updating their fee structures, exchange rates, and service offerings. It's worth periodically comparing services, especially before making large transfers, to ensure you're still getting the best deal.

Finally, beyond fees and rates, consider the entire experience—including ease of use, customer service quality, and reliability—when choosing a provider for your hard-earned money.

Post a Comment