Send money from USA to NRE account in 2025, Live Currency Conversion

Complete Guide: Send Money from USA to NRE Account in India

Everything you need to know about transferring money to your NRE account in 2024

Why This Guide Matters for NRIs

For millions of Non-Resident Indians (NRIs) living in the United States, sending money back to India is a regular necessity. Whether you're supporting family members, investing in property, or simply saving for the future, understanding how to efficiently transfer money to your NRE (Non-Resident External) account is crucial.

This comprehensive guide covers everything you need to know about transferring money from the USA to your NRE account in India, including the latest regulations, best transfer methods, hidden fees to avoid, and expert tips to save money on every transaction.

Did You Know? NRIs send over $100 billion annually to India, making it the world's largest recipient of remittances. Choosing the right transfer method can save you hundreds of dollars per year!

Understanding NRE Accounts: The Foundation

What is an NRE Account?

A Non-Resident External (NRE) account is a special type of bank account designed for NRIs to park their foreign earnings in India. It's denominated in Indian Rupees (INR) but can only receive funds from outside India.

Key Benefits

- Tax-free interest earnings

- Full repatriation rights

- No transfer limits

- Competitive interest rates

NRE vs NRO vs FCNR: Quick Comparison

| Feature | NRE Account | NRO Account | FCNR Account |

|---|---|---|---|

| Currency | Indian Rupees (INR) | Indian Rupees (INR) | Foreign Currency |

| Source of Funds | Foreign income only | Indian & foreign income | Foreign income only |

| Tax on Interest | Tax-free | Taxable | Tax-free |

| Repatriation | Fully repatriable | Up to $1M/year | Fully repatriable |

| Best For | Regular remittances | Local Indian income | Forex hedging |

Pro Tip

Most NRIs in the USA benefit from having both NRE and NRO accounts. Use your NRE account for transferring your US earnings and savings, while keeping an NRO account for any income generated within India (like rental income or dividends).

7 Ways to Send Money from USA to NRE Account

Online Money Transfer Services

Examples: Wise, Remitly, Western Union

Speed: Minutes to hours

Cost: Low to moderate fees

Best for: Regular transfers

Bank Wire Transfers

Examples: Chase, Bank of America, Wells Fargo

Speed: 1-5 business days

Cost: High fees ($15-50+)

Best for: Large amounts

Digital Wallets

Examples: PayPal, Skrill, Google Pay

Speed: Instant to hours

Cost: Variable fees

Best for: Small amounts

Indian Bank Services

Examples: ICICI Money2India, HDFC InstaReM

Speed: Same day to 24 hours

Cost: Competitive rates

Best for: Existing customers

Cryptocurrency

Examples: Coinbase, Binance (where legal)

Speed: Minutes to hours

Cost: Very low fees

Best for: Tech-savvy users

Demand Drafts/Checks

Examples: Foreign currency drafts

Speed: 7-15 business days

Cost: Moderate fees

Best for: One-time large transfers

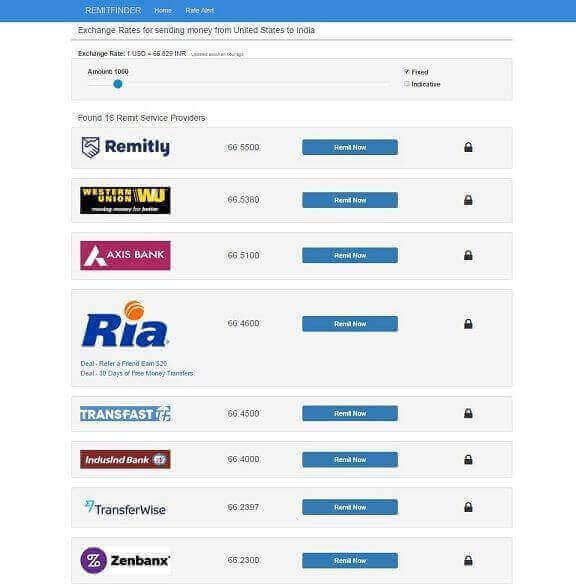

Image: Popular Money Transfer Services Comparison

Compare different money transfer services to find the best rates and fees

Step-by-Step Transfer Process

Method 1: Using Online Money Transfer Services (Recommended)

Choose Your Transfer Service

Research and compare popular services like Wise, Remitly, Western Union, or Xoom. Consider factors like exchange rates, fees, transfer speed, and user reviews.

Tip: Use comparison websites like CompareRemit or RemitFinder to find the best rates in real-time.

Create Account & Verify Identity

Sign up with your chosen service and complete KYC (Know Your Customer) verification. You'll need:

- Government-issued photo ID (Driver's License/Passport)

- Proof of US address (Utility bill/Bank statement)

- Social Security Number (for US residents)

Enter Transfer Details

Provide the following information:

Sender Information:

- • Full name and address

- • Purpose of transfer

- • Source of funds

Recipient Information:

- • Your full name in India

- • NRE account number

- • Bank name and IFSC code

- • Bank address

Review Exchange Rate & Fees

Carefully review the exchange rate, transfer fees, and total amount to be debited from your US account. The service should show you exactly how much your recipient will receive in INR.

Warning: Beware of services that advertise "no fees" but offer poor exchange rates. The real cost is often hidden in the exchange rate markup.

Choose Payment Method

Select how you want to pay for the transfer:

ACH Bank Transfer

Lowest fees, takes 1-3 days

Debit Card

Instant, moderate fees

Credit Card

Instant, highest fees

Submit Transfer & Track

Confirm all details and submit your transfer. You'll receive a confirmation email with a tracking number. Most services provide real-time updates via SMS or email.

Method 2: Bank Wire Transfer Process

Pros of Bank Wire Transfer

- High security and reliability

- No transfer limits

- Direct bank-to-bank transfer

- Established process

Cons of Bank Wire Transfer

- High fees ($15-50+ per transfer)

- Poor exchange rates

- Slower processing (1-5 days)

- Complex paperwork

Wire Transfer Steps:

- 1. Visit your bank branch or log into online banking

- 2. Request international wire transfer form

- 3. Provide recipient bank's SWIFT code and complete address

- 4. Include your NRE account details and Indian bank information

- 5. Pay the wire transfer fee (typically $15-50)

- 6. Receive confirmation and tracking reference

Comparison of different money transfer methods from USA to India

Complete Fees & Costs Comparison

Understanding the True Cost of Transfer

The total cost of your transfer includes both visible fees and hidden costs in exchange rates. Always compare the total amount your recipient receives, not just the advertised fees.

| Service | Transfer Fee | Exchange Rate Markup | Speed | Best For |

|---|---|---|---|---|

| Wise | $4.14 (on $1000) | 0.35-0.5% | 1-2 days | Regular transfers |

| Western Union | $5-15 | 2-4% | Minutes-hours | Urgent transfers |

| Remitly | $3.99-9.99 | 1-3% | Minutes-hours | First-time users |

| Xoom (PayPal) | $0-4.99 | 2-3% | Minutes-1 day | PayPal users |

| ICICI Money2India | $0-5 | 1-2% | Same day | ICICI customers |

| Bank Wire Transfer | $15-50+ | 3-5% | 1-5 days | Large amounts |

Cost Calculation Example

Transfer Amount: $1,000

Mid-market Rate: 1 USD = 83.50 INR

Expected Amount: ₹83,500

Money-Saving Tips

- Compare real-time rates before transferring

- Use ACH bank transfers instead of debit/credit cards

- Transfer larger amounts less frequently

- Look for first-time user promotions

- Set up rate alerts for favorable exchange rates

- Consider multi-currency accounts for better rates

Step-by-step process for transferring money from USA to India

Regulations & Compliance Requirements

US Regulations (FINCEN & IRS)

Bank Secrecy Act (BSA)

Transfers over $10,000 are automatically reported to FinCEN. Multiple smaller transfers that total $10,000+ may also trigger reporting.

FBAR Filing

US persons must file FBAR (Form 114) if foreign account balances exceed $10,000 at any time during the year.

Form 8938 (FATCA)

Report foreign accounts on your tax return if balances exceed specified thresholds ($50,000+ for single filers).

Indian Regulations (RBI & FEMA)

FEMA Compliance

All inward remittances must comply with Foreign Exchange Management Act regulations and specify purpose of transfer.

FIRC/FIRS Certificates

Banks issue Foreign Inward Remittance Certificates for tax filing and compliance purposes.

KYC Requirements

Indian banks must verify the identity of both sender and recipient for all international transfers.

Important Compliance Notes

- Purpose Declaration: Always specify the legitimate purpose of your transfer (family support, investment, etc.)

- Source of Funds: Be prepared to document that transferred funds come from legitimate sources

- Record Keeping: Maintain all transfer receipts and certificates for tax filing purposes

- Reporting Thresholds: Large transfers may require additional documentation and government reporting

Common Transfer Purposes (Select Appropriate Option)

Family Support

- • Medical expenses

- • Educational fees

- • Living expenses

- • Emergency support

Investment

- • Mutual funds

- • Fixed deposits

- • Stock investments

- • Real estate

Personal Savings

- • Retirement planning

- • Future expenses

- • Emergency fund

- • General savings

Expert Tips & Best Practices

Money-Saving Strategies

1. Time Your Transfers

Monitor USD-INR exchange rates and transfer when rates are favorable. Use rate alert tools to notify you of good exchange rates.

2. Consolidate Transfers

Make larger, less frequent transfers to reduce per-transaction costs. Most services have lower percentage fees for larger amounts.

For large transfers, consider forward contracts to lock in exchange rates for future transfers, protecting against currency volatility.

Security Best Practices

1. Verify Service Legitimacy

Only use licensed money transfer services. Check for regulatory compliance and customer reviews before sending money.

2. Double-Check Account Details

Verify recipient bank account number, IFSC code, and name spelling. Incorrect details can delay or misdirect transfers.

3. Keep Transfer Records

Save all confirmation emails, receipts, and reference numbers. You'll need these for tracking and tax purposes.

Expert's Top Recommendation

For Regular Transfers ($500-$5,000)

Use Wise (formerly TransferWise) for the best combination of low fees, competitive exchange rates, and reliability.

- • Real mid-market exchange rates

- • Transparent fee structure

- • Fast processing (1-2 days)

- • Excellent customer support

For Large Transfers ($10,000+)

Consider ICICI Money2India or negotiate rates with your US bank for bulk transfers.

- • Better rates for large amounts

- • Direct bank relationships

- • Specialized NRI services

- • Premium customer support

Monthly Transfer Planning Calculator

Small Regular

$500-1K

Monthly transfers

Best: Wise, Remitly

Medium Periodic

$2K-5K

Quarterly transfers

Best: ICICI M2I, Wise

Large Bulk

$10K+

Annual transfers

Best: Bank wire, M2I

Frequently Asked Questions

What is the maximum amount I can send to my NRE account?

There is no maximum limit for sending money to your NRE account from abroad. However, your transfer service or bank may have their own limits. Transfers over $10,000 are reported to FinCEN in the US for compliance purposes.

How long does it take for money to reach my NRE account?

Transfer times vary by method:

- • Online services: Minutes to 2 days

- • Bank wire transfers: 1-5 business days

- • Demand drafts: 7-15 business days

Do I need to pay taxes on money transferred to my NRE account?

In India, money deposited in NRE accounts from foreign sources is not taxable, and interest earned is also tax-free. However, you must comply with US tax obligations, including FBAR filing if your foreign account balances exceed $10,000.

Can I transfer money from my US checking account directly to NRE account?

Yes, you can transfer directly from your US bank account to your NRE account using various methods including online money transfer services, bank wire transfers, or your Indian bank's NRI services like ICICI Money2India.

What documents do I need for large transfers?

For transfers over $10,000, you may need:

- • Source of funds documentation

- • Purpose of transfer declaration

- • Tax clearance certificates (if required)

- • Enhanced KYC verification

Which is cheaper: wire transfer or online money transfer services?

Online money transfer services are typically much cheaper than bank wire transfers. While banks charge $15-50+ in fees plus poor exchange rates, services like Wise charge under $10 with competitive rates, potentially saving you hundreds of dollars per transfer.

Can I cancel a transfer after it's initiated?

Cancellation policies vary by service provider. Most online services allow cancellation within a short window (usually minutes to hours) before processing begins. Bank wire transfers are typically harder to cancel once initiated. Always check the specific cancellation policy before confirming your transfer.

What NRIs Are Saying

Raj Kumar

Software Engineer, California

"Switched from bank wires to Wise after reading this guide. Saving over $200 per month on transfer fees! The process is so much simpler and faster."

Priya Sharma

Doctor, Texas

"ICICI Money2India has been excellent for my large quarterly transfers. The rates are competitive and the NRI customer service is outstanding."

Arjun Mehta

Business Analyst, New York

"This comprehensive guide helped me understand all the regulations and choose the right transfer method. Very detailed and practical advice."

Take Action: Start Saving on Your Transfers Today

Now that you understand all the options for sending money from USA to your NRE account, it's time to put this knowledge into action. The right choice can save you thousands of dollars annually while ensuring your money reaches India safely and quickly.

Remember: The "best" transfer method depends on your specific needs - transfer amount, frequency, urgency, and fee tolerance. Use this guide as your reference and adjust your strategy as your circumstances change.

Make informed decisions for your international money transfers

Stay Updated with Exchange Rates & Transfer Tips

The world of international money transfers is constantly evolving. Stay informed about the latest rates, regulations, and money-saving opportunities.

Last Updated: January 2024 | Information subject to change based on regulatory updates

Always verify current rates and regulations with your chosen transfer service

Post a Comment