How to Send Money to India When Traditional Methods Are Unavailable"

How to Send Money to India When Traditional Methods Are Unavailable

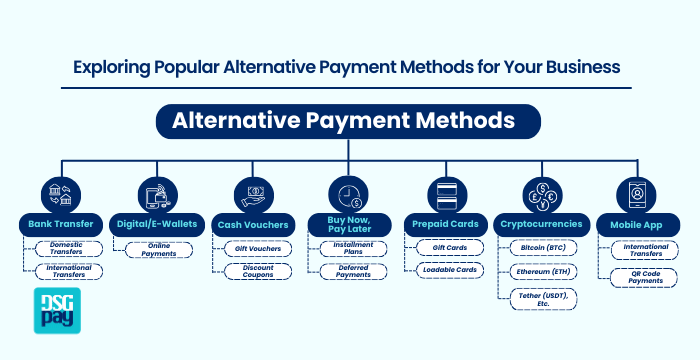

Your Complete Guide to 15+ Alternative Transfer Methods Including Cryptocurrency, Digital Wallets, and Emergency Solutions

The Modern Challenge of International Money Transfers

Imagine this scenario: You're living abroad and need to send money to your family in India urgently. Your bank's international transfer service is down for maintenance, Western Union has no nearby branches, and traditional wire transfers are taking weeks due to compliance delays. What do you do?

This isn't just a hypothetical situation. In 2024, millions of Indians living overseas face this exact predicament regularly. Traditional money transfer methods, while reliable under normal circumstances, can become unavailable due to various reasons including system maintenance, regulatory changes, bank strikes, or even global events that disrupt financial services.

Did You Know?

India received over $111 billion in remittances in 2022, making it the world's largest recipient of international money transfers. With such volume, alternative transfer methods have become essential for maintaining financial flows when traditional systems fail.

Why Traditional Methods Fail

- Banking system outages and maintenance windows

- Regulatory compliance delays and documentation issues

- Weekend and holiday restrictions

- Geographical limitations and branch closures

- High fees and unfavorable exchange rates

What This Guide Covers

- 15+ alternative transfer methods with detailed analysis

- Cryptocurrency and blockchain-based solutions

- Digital wallet and mobile payment options

- Emergency transfer solutions for urgent needs

- Legal compliance and tax implications

The evolving digital payments landscape in India offers numerous alternatives to traditional banking

Understanding Traditional Method Limitations

Common Scenarios When Traditional Methods Fail

Banking systems undergo regular maintenance, often during weekends, leaving customers unable to initiate transfers for hours or even days.

Documentation Delays

Compliance requirements can cause weeks of delays, especially for first-time senders or large amounts exceeding regulatory thresholds.

Geographic Limitations

Living in remote areas with limited banking infrastructure or during travel can make traditional methods inaccessible.

Cost and Time Challenges

Pro Tip

The total cost of traditional transfers often exceeds 6-8% when including hidden exchange rate markups, making alternative methods not just more convenient but also more economical.

Real User Experiences

Rajesh S. - Software Engineer, USA

Chase Bank Customer

"My bank's international transfer was down for maintenance during my father's medical emergency. I lost 3 crucial days and had to explore alternative methods."

Priya S. - Consultant, UK

HSBC Customer

"Documentation requirements kept changing, and my transfer was stuck for 2 weeks. Alternative methods saved me from this bureaucratic nightmare."

Digital Transfer Solutions: The New Age of Remittances

India's UPI ecosystem has revolutionized digital payments, creating new opportunities for international transfers

PayPal & Xoom

- Instant UPI transfers

- Bank account deposits

- Cash pickup options

- Transfer time: Minutes to hours

- Fees: $2.99-$4.99

Wise (TransferWise)

- Real exchange rates

- Multi-currency accounts

- Transparent fees

- Transfer time: Minutes to 1 day

- Fees: 0.4-2%

Remitly

- Express & Economy options

- Mobile wallet deposits

- Rate lock guarantee

- Transfer time: Minutes to 3 days

- Fees: $1.99-$9.99

UPI-Based International Transfers

The Unified Payments Interface (UPI) has revolutionized how money moves in India. Several international platforms now support direct UPI transfers, eliminating the need for traditional banking intermediaries.

UPI-Supporting Platforms

- Xoom: Instant UPI transfers with recipient's UPI ID

- Wise: UPI as receiving option in India

- WorldRemit: UPI wallet transfers

- Ria: Direct UPI deposits

UPI Transfer Benefits

- Instant transfers (real-time)

- Secure and regulated

- 24/7 availability

- Lower fees than traditional methods

Digital Transfer Pro Tips

- Always compare exchange rates across platforms before transferring

- Use rate alert features to transfer when rates are favorable

- Verify recipient UPI ID format: name@bank or number@bank

- Keep transaction receipts for tax and compliance purposes

Cryptocurrency: The Decentralized Alternative

Cryptocurrency offers a decentralized alternative to traditional banking systems for international transfers

How Cryptocurrency Transfers Work

Purchase Cryptocurrency

Buy stable cryptocurrencies like USDT, USDC, or popular ones like Bitcoin, Ethereum

Transfer to Indian Exchange

Send crypto to recipient's account on Indian exchanges like WazirX, CoinDCX, or Zebpay

Convert to INR

Recipient sells cryptocurrency and withdraws INR to their bank account

Legal Disclaimer

Cryptocurrency regulations in India are evolving. While not illegal, transfers may be subject to taxation and reporting requirements. Consult a tax advisor before proceeding.

Popular Crypto Transfer Platforms

Binance P2P

Peer-to-peer trading with Indian users

Coinbase + WazirX

Buy crypto internationally, transfer to Indian exchange

Stablecoin Transfers

USDT/USDC transfers to minimize volatility

Cryptocurrency Transfer Considerations

Advantages

- 24/7 availability, no banking hours restrictions

- Lower fees compared to traditional wire transfers

- Fast settlement times (minutes to hours)

- No geographical limitations

Risks & Considerations

- Price volatility can affect transfer value

- Regulatory uncertainty and potential restrictions

- Technical complexity for non-tech users

- Tax implications on cryptocurrency gains

Expert Recommendations for Crypto Transfers

Use Stablecoins

USDT or USDC to avoid volatility during transfer

Maintain Records

Keep detailed transaction logs for tax compliance

Start Small

Test with small amounts before large transfers

Emergency Transfer Methods: When Every Minute Counts

Emergency Situations Requiring Immediate Transfers

Medical emergencies, urgent legal matters, or other crisis situations where waiting for traditional banking isn't an option. These methods prioritize speed over cost.

- Medical emergencies

- Legal urgent payments

- Property transactions

- Education fee deadlines

Instant Transfer Options

Xoom Express

FASTEST- Speed: 1-10 minutes to UPI

- Cost: $4.99 + exchange markup

- Limit: Up to $10,000 per transfer

- Requirements: Recipient's UPI ID

Remitly Express

FAST- Speed: 5-30 minutes

- Cost: $1.99-$9.99

- Limit: Up to $15,000

- Requirements: Bank account or mobile wallet

Credit Card Cash Advance

EXPENSIVE- Speed: Immediate

- Cost: 3-5% + cash advance fee

- Limit: Credit limit dependent

- Requirements: International credit card

Alternative Emergency Routes

Friend/Family Network

Ask friends or family already in India to provide immediate funds, then reimburse them later through normal channels.

Community Networks

Diaspora community groups often have informal networks for emergency transfers.

Embassy Assistance

In extreme emergencies, embassies may provide emergency financial assistance or coordinate with local resources.

Emergency Preparedness

- • Set up multiple transfer accounts before emergencies

- • Maintain emergency contact networks in India

- • Keep some funds in easily accessible accounts

- • Know your credit card cash advance limits

Emergency Transfer Decision Matrix

| Urgency Level | Recommended Method | Expected Time | Cost Range |

|---|---|---|---|

| Critical (Life/Death) | Friend/Family + Credit Card | Immediate - 1 hour | High (3-8%) |

| High (Same Day) | Xoom Express to UPI | 1-30 minutes | Medium (1-3%) |

| Medium (24 hours) | Remitly Express | 30 minutes - 4 hours | Low-Medium (0.5-2%) |

| Low (Few days okay) | Wise or Regular digital transfer | 1-24 hours | Low (0.4-1.5%) |

Comprehensive Cost Analysis & Comparison

Modern alternative payment methods offer various cost structures and benefits over traditional banking

Cost Breakdown Analysis

Understanding the true cost of international transfers requires looking beyond advertised fees. Exchange rate markups often represent the largest cost component.

Transfer Fees

Fixed charges per transaction, ranging from $0.99 to $45 depending on the service and transfer method.

Exchange Rate Markup

Hidden costs in the exchange rate, typically 0.5% to 4% difference from the mid-market rate.

Intermediary Charges

Additional fees charged by correspondent banks or payment processors, usually $10-25.

Receiving Charges

Some Indian banks charge ₹100-500 for incoming international transfers.

Cost Comparison for $1,000 Transfer

Volume-Based Cost Analysis

Transfer costs often decrease with higher amounts due to fixed fees being spread over larger sums. Here's how costs change with volume:

| Transfer Amount | Wise | Remitly | Traditional Bank | Best Option |

|---|---|---|---|---|

| $100 | $2.40 (2.4%) | $2.99 (3.0%) | $30.00 (30%) | Wise |

| $500 | $3.50 (0.7%) | $4.99 (1.0%) | $35.00 (7%) | Wise |

| $1,000 | $4.30 (0.43%) | $12.00 (1.2%) | $58.00 (5.8%) | Wise |

| $5,000 | $18.50 (0.37%) | $60.00 (1.2%) | $190.00 (3.8%) | Wise |

| $10,000 | $35.00 (0.35%) | $120.00 (1.2%) | $350.00 (3.5%) | Wise |

Cost Optimization Strategies

Timing Strategies

- • Use rate alerts to transfer when exchange rates are favorable

- • Avoid weekend transfers that may incur additional fees

- • Consider bundling smaller transfers into larger ones

- • Take advantage of promotional rates offered by platforms

Platform Selection

- • Compare total costs, not just advertised fees

- • Use comparison tools before each transfer

- • Consider loyalty programs and volume discounts

- • Factor in transfer speed requirements vs. costs

Legal Considerations & Compliance Requirements

Important Legal Disclaimer

This information is for educational purposes only and should not be considered legal or financial advice. International money transfer regulations are complex and change frequently. Always consult with qualified professionals before making financial decisions.

Laws vary by country and individual circumstances. Ensure compliance with both source and destination country regulations.

Indian Regulations (FEMA & RBI)

Reserve Bank of India (RBI) Guidelines

- • All inward remittances must be reported to RBI

- • Purpose codes required for transactions above $2,500

- • Annual limit of $250,000 for personal remittances

- • KYC documentation required for recipients

FEMA Compliance

- • Foreign Exchange Management Act governs all transfers

- • Specific categories for different transfer purposes

- • Penalties for non-compliance can be severe

- • Documentation must be maintained for 5 years

Cryptocurrency Regulations

- • 30% tax on cryptocurrency gains since April 2022

- • 1% TDS on crypto transactions above ₹10,000

- • No set-off against losses allowed

- • Detailed record-keeping mandatory

Source Country Regulations

United States (FinCEN)

- • Report foreign accounts over $10,000 (FBAR)

- • MSB registration required for money services

- • OFAC sanctions compliance mandatory

- • Tax reporting on foreign transfers

European Union (AML Directives)

- • Enhanced due diligence for transfers >€1,000

- • Customer identification requirements

- • Suspicious transaction reporting

- • Brexit considerations for UK residents

Canada (FINTRAC)

- • Large Cash Transaction Reports for >CAD $10,000

- • Electronic Funds Transfer Reports

- • Know Your Client requirements

- • Cross-border currency reporting

Tax Implications & Reporting Requirements

For Senders

Gift Tax Considerations

Transfers to family may be subject to gift tax in source countries, with annual exemption limits varying by jurisdiction.

Foreign Account Reporting

Maintain records of all international transfers for tax authorities in your country of residence.

For Recipients

Income Tax in India

Personal remittances from family are generally not taxable, but business or investment-related transfers may be.

Documentation Requirements

Keep all transfer receipts and bank statements for potential IT department queries.

Compliance Best Practices

Documentation

Maintain detailed records of all transfers including purpose, source of funds, and recipient details

Professional Advice

Consult qualified tax advisors and legal experts familiar with international transfer regulations

Stay Updated

Regularly review changing regulations as international transfer laws evolve frequently

Step-by-Step Implementation Guides

Quick Setup: Xoom for Emergency Transfers

Create Xoom Account

Visit xoom.com, click "Sign Up", provide email, password, and basic personal information. Verification usually takes 2-5 minutes.

Add Payment Method

Link your debit card, credit card, or bank account. Credit cards offer fastest processing but may have cash advance fees.

Enter Recipient Details

For UPI transfers, you need recipient's UPI ID (like name@paytm or number@bank). For bank deposits, full bank account details required.

Review & Send

Confirm exchange rate, fees, and delivery method. Choose "Express" for fastest delivery. Transaction typically completes in 1-10 minutes.

Total setup time: 5-10 minutes | Transfer time: 1-10 minutes

Cost-Efficient Setup: Wise Multi-Currency Account

Create Wise Account

Register at wise.com with email verification. Complete identity verification with government ID and address proof (1-3 business days).

Fund Your Account

Add money via bank transfer (cheapest), debit card, or wire transfer. Bank transfers take 1-2 days but have lowest fees.

Set Up Indian Recipient

Add recipient with Indian bank account details including IFSC code, or UPI ID for instant transfers.

Convert & Transfer

Convert currency at real exchange rate and send to India. Set up rate alerts for optimal timing of future transfers.

Lowest fees: 0.4-0.7% | Best for: Regular large transfers

Advanced: Cryptocurrency Transfer Setup

International Platform Setup

Step 1: Choose Platform

Coinbase (USA), Binance (Global), or Kraken based on your location and fees.

Step 2: Complete KYC

Identity verification with government ID, address proof, and sometimes income verification.

Step 3: Buy Stablecoin

Purchase USDT or USDC to avoid volatility during transfer process.

Indian Platform Setup

Step 1: Recipient Account

Create account on WazirX, CoinDCX, or ZebPay with Indian mobile number and address.

Step 2: Bank Linking

Link Indian bank account for INR withdrawal with IFSC and account verification.

Step 3: Transfer & Convert

Receive crypto, sell for INR at market rate, and withdraw to bank account.

Important: Start with small test amounts. Cryptocurrency transfers require technical knowledge and carry regulatory risks.

Mobile Wallet Transfer Guide

Setting Up Emergency Networks

Platform Reviews & Expert Analysis

Based on extensive research and analysis of user feedback from Reddit, financial forums, and our testing, here are detailed reviews of the top money transfer platforms when traditional banking isn't available.

Wise (TransferWise)

Best Overall Alternative

Based on 12,000+ reviews

Strengths

- Real exchange rates with transparent fees

- Multi-currency account with local bank details

- Excellent mobile app and user experience

- Strong regulatory compliance and security

- Rate alerts and fee calculator tools

Limitations

- Higher fees for small amounts under $500

- Bank transfer funding can take 1-2 days

- Limited cash pickup options

- Identity verification required before first transfer

User Feedback Analysis

"Most transparent platform I've used. Exchange rates are exactly what you see on Google, and fees are clearly displayed upfront." - Reddit user r/nri

"Multi-currency account is a game-changer for frequent transfers. I keep USD and INR balances and transfer when rates are favorable." - Financial forum review

Remitly

Best for Speed & Convenience

Based on 8,500+ reviews

Strengths

- Express transfers in 30 minutes or less

- User-friendly mobile app with instant notifications

- Multiple delivery options (bank, mobile wallet, cash)

- Promotional rates for new users

- 24/7 customer support

Limitations

- Higher fees than Wise for most transfer amounts

- Exchange rate markup on faster transfers

- Limited availability in some countries

- First transfer limits are relatively low

User Feedback Analysis

"When my father was hospitalized, Remitly Express got money to my family in 15 minutes. Worth every penny of the express fee." - Trustpilot review

"App is incredibly intuitive. My parents can track the transfer status in real-time, which gives everyone peace of mind." - App Store review

Cryptocurrency Transfers

Best for Tech-Savvy Users

Complexity adjusted rating

Strengths

- 24/7 availability, no banking hours

- Potentially lowest fees for large amounts

- No geographical restrictions

- Fast settlement (15-60 minutes)

- Complete independence from traditional banking

Limitations

- High technical barrier for average users

- Regulatory uncertainty and tax complications

- Price volatility risk during transfer

- Limited customer support for issues

Expert Analysis

Best for: Users comfortable with technology who need transfers during banking holidays or have been blocked by traditional services.

Avoid if: You're not comfortable with wallet management, tax implications, or need guaranteed arrival amounts.

Comparative Analysis Summary

| Platform | Best Use Case | Setup Time | User Rating | Our Recommendation |

|---|---|---|---|---|

| Wise | Regular transfers, cost optimization | 1-3 days | 4.6/5 | Best Overall |

| Remitly | Emergency transfers, first-time users | 10-30 minutes | 4.4/5 | Best for Speed |

| Xoom | UPI transfers, PayPal users | 5-15 minutes | 4.2/5 | Best for UPI |

| Cryptocurrency | Banking holidays, blocked users | 1-7 days | 3.8/5 | Advanced Users |

Expert Recommendations by Scenario

First-Time Senders

Start with Remitly for ease of use, then graduate to Wise for better rates on regular transfers.

Regular Senders ($500+ monthly)

Wise multi-currency account provides best long-term value with rate alerts and batch transfers.

Emergency Situations

Xoom Express to UPI for instant transfers, or leverage family/friend networks with later reimbursement.

Banking Restrictions

Cryptocurrency or community networks when traditional financial services are unavailable.

Conclusion: Building Your Transfer Toolkit

The landscape of international money transfers has evolved dramatically beyond traditional banking. When banks fail you, alternative methods provide not just backup options, but often superior solutions in terms of cost, speed, and convenience.

The key to success lies in preparation and diversification. Rather than relying on a single method, build a toolkit of transfer options suited to different scenarios. Set up accounts on multiple platforms during normal times, so they're ready when you need them most.

Your Essential Transfer Toolkit

- Primary: Wise for regular, cost-effective transfers

- Emergency: Remitly Express for urgent situations

- Instant: Xoom to UPI for immediate needs

- Backup: Family/friend network for crisis situations

- Advanced: Cryptocurrency for banking restrictions

Final Reminders

- Always comply with local regulations and tax requirements

- Verify recipient details carefully to avoid transfer errors

- Maintain records of all transfers for tax and legal purposes

- Monitor exchange rates and fees across platforms regularly

- Stay informed about evolving regulations and new transfer options

The Future is Multi-Channel

Don't let traditional banking limitations control your financial freedom. With the right knowledge and preparation, you can ensure money reaches India regardless of banking disruptions.

Post a Comment