Digital Wallet Transfers vs. Traditional Bank Remittances: Complete 2025 Guide

Digital Wallet Transfers vs. Traditional Bank Remittances

Complete Guide for 2025

Image Source: Calibraint

Table of Contents

- Introduction to Digital Wallets and Traditional Banking

- Market Overview and 2025 Trends

- Cost and Fee Comparison

- Security Features and Protections

- Convenience and Accessibility

- Transfer Speed and Processing Times

- User Experience and Interface

- Global Adoption and Availability

- User Reviews and Testimonials

- Recommendations for Different User Types

- Conclusion and Future Outlook

- Frequently Asked Questions

Introduction to Digital Wallets and Traditional Banking

In today's rapidly evolving financial landscape, the way we transfer money internationally has undergone a significant transformation. The traditional bank-based remittance system that has dominated for decades is now facing fierce competition from digital wallet solutions that promise greater convenience, lower costs, and faster transfers.

As we navigate through 2025, the distinction between these two options has become increasingly important for consumers and businesses alike who need to send money across borders efficiently and securely.

What is a digital wallet?

A digital wallet is a specific type of application or software-based system that operates on a connected device. It can be used both online and in physical environments, storing various payment methods, loyalty cards, and even identification documents. Digital wallets like PayPal, Wise, Revolut, and Profee have become increasingly popular for international transfers.

What are traditional bank remittances?

Traditional bank remittances involve transferring money through established banking institutions, often requiring account numbers, branch codes, and various identification processes. This system has been the standard method for international transfers for decades, relying on networks like SWIFT to process cross-border transactions.

The adoption of digital wallets has been steadily growing over the past five years, with nearly 4.5 billion people now having one or more digital wallets - representing more than half of the global online population. This surge in popularity comes as no surprise given the numerous advantages they offer over traditional banking services.

This comprehensive guide will compare these two remittance options across various dimensions including costs, security, convenience, and market trends to help you make informed decisions about your international money transfers in 2025.

Market Overview and 2025 Trends

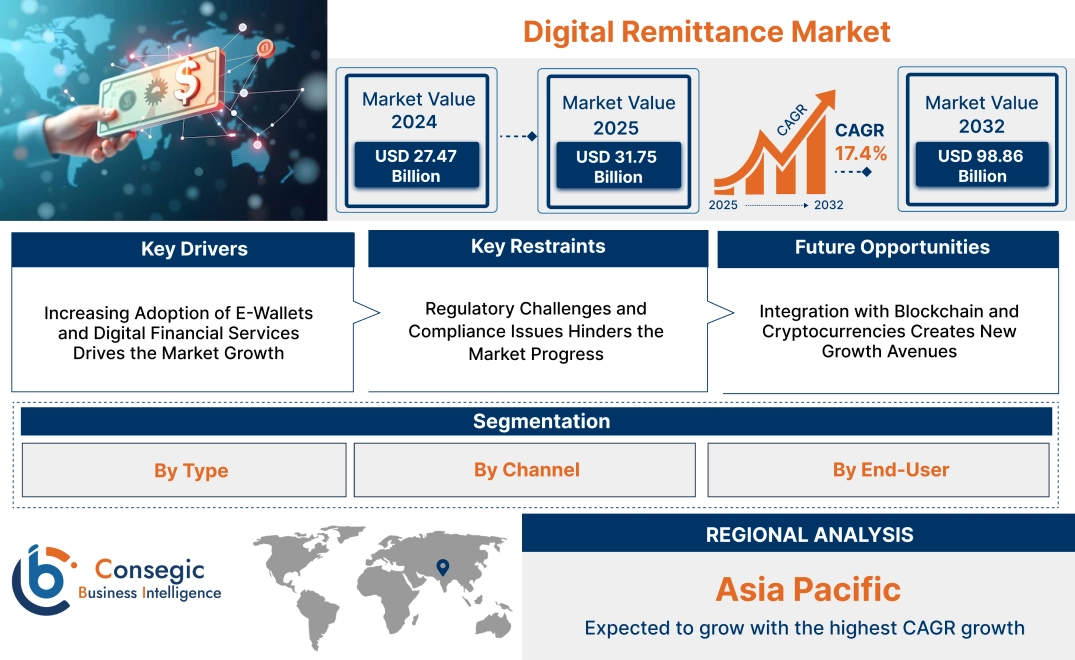

Image Source: Consegic Business Intelligence

The Growing Digital Remittance Market

The global digital remittance market has seen remarkable growth, reaching USD 22.1 billion in 2023 and projected to climb to USD 29.2 billion by the end of 2025. This impressive expansion represents a compound annual growth rate (CAGR) of approximately 15.0%, signaling a significant shift in how money is transferred internationally.

$29.2 Billion

Projected digital remittance market value by 2025

15.0%

Compound Annual Growth Rate (CAGR)

4.5 Billion

People using digital wallets globally

Shift from Traditional to Digital Remittances

The remittance landscape has witnessed a notable shift from traditional methods to digital channels. In Q1 2023, data shows that traditionally initiated remittances accounted for 52.62% of all transfers, while digitally initiated remittances made up 28.81% and digital end-to-end transactions represented 18.53%. This represents a dramatic change from just five years ago when traditional methods dominated with over 90% market share.

Image Source: Market.us Scoop

Key Players in the Digital Remittance Market

The competitive landscape is dominated by several key players, with Azimo Limited leading the market with a 19% share, followed by InstaReM Pvt. Ltd. with 17%, and Digital Wallet Corporation with 13%. Other significant players include TransferGo Ltd. (10%), MoneyGram (8%), TransferWise Ltd. (8%), PayPal Holdings, Inc. (7%), and Western Union Holdings, Inc. (6%).

Regional Analysis

North America leads the global digital remittance market with a 32.0% share, followed closely by Asia-Pacific (APAC) with 28.9% and Europe with 26.3%. The remaining market is divided between South America (9.1%) and the Middle East and Africa (3.7%).

This distribution reflects varying levels of digital adoption, banking infrastructure, and migration patterns across different regions, with North America and APAC showing particularly strong growth due to their technological advancement and large immigrant populations.

COVID-19 Impact

The COVID-19 pandemic significantly accelerated the adoption of digital financial technologies. In emerging markets and developing economies, 65% of the population reported increased use of digital payments and remittances, compared to 50% in advanced economies.

This shift was driven by lockdowns that limited access to physical banking locations and heightened awareness of the convenience and safety of digital transactions, permanently altering consumer preferences in the remittance market.

Cost and Fee Comparison

Digital Wallet Fee Structure

Digital wallets have disrupted the remittance industry primarily through their competitive fee structures. Fintech providers like Wise, Revolut, and Profee typically offer:

- Transfer fees of 0.5% to 1% of the transaction amount

- Transparent exchange rates close to the mid-market rate

- No hidden fees or markup on exchange rates

- Special promotional rates for first-time users

- Zero commission on transfers to selected destinations

- Lower fees for larger transfer amounts

Many digital wallet providers have implemented real-time rate monitoring systems to ensure competitive exchange rates at any given moment, providing customers with significant savings compared to traditional banks.

Traditional Bank Fee Structure

Traditional banks typically charge considerably higher fees for international remittances, including:

- Fixed transfer fees ranging from $25 to $50 per transaction

- Exchange rate markups of 3% to 7% above the mid-market rate

- Correspondent bank fees (intermediary charges) of $10-$20

- Receiving bank fees in some cases

- Additional charges for expedited transfers

- Monthly account maintenance fees

These combined fees can make traditional bank remittances significantly more expensive, especially for smaller transfer amounts where fixed fees represent a larger percentage of the total transaction.

Comparative Cost Analysis

| Transfer Method | Transfer Fee | Exchange Rate Markup | Additional Fees | Total Cost on $1,000 Transfer |

|---|---|---|---|---|

| Digital Wallets (Average) | 0.5-1% | 0-0.5% | Minimal to none | $5-15 (0.5-1.5%) |

| Traditional Banks (Average) | $25-50 flat fee | 3-7% | $10-20 correspondent fees | $65-140 (6.5-14%) |

| Wise | 0.4-0.7% | 0% | None | $4-7 (0.4-0.7%) |

| Revolut | 0.3-0.6% | 0-1% (weekend markup) | Monthly subscription for premium features | $3-16 (0.3-1.6%) |

| Profee | 0.5-1% | 0.3-0.5% | None | $8-15 (0.8-1.5%) |

| Bank of America | $45 flat fee | 3-5% | $10-20 correspondent fees | $85-115 (8.5-11.5%) |

| HSBC | $35 flat fee | 2.5-4.5% | $10-15 correspondent fees | $70-95 (7-9.5%) |

Note: Fees and rates are approximations based on 2025 market data and may vary based on specific corridors, amounts, and promotional offers.

Cost-Saving Insight

On a $1,000 international transfer, choosing a digital wallet over a traditional bank could save you between $50 to $125 in fees—equivalent to 5-12.5% of your transfer amount. These savings become even more pronounced for frequent remitters or businesses making regular international payments.

Security Features and Protections

Image Source: RNDpoint

Digital Wallet Security

Digital wallets employ cutting-edge security technologies to protect users' funds and personal information:

- Encryption: End-to-end encryption for all transactions and personal data

- Tokenization: Replacement of sensitive data with unique identification symbols

- Biometric Authentication: Fingerprint, facial recognition, and other biometric verification methods

- Two-Factor Authentication (2FA): Additional security layer beyond passwords

- Real-time Fraud Monitoring: AI-powered systems to detect suspicious activities

- Device Binding: Limiting access to specific registered devices

- Regulatory Compliance: Adherence to PSD2, GDPR, and other relevant regulations

While some still perceive traditional banks as more secure, digital wallet providers have invested heavily in security infrastructure, often implementing more advanced technological solutions than their banking counterparts. Many fintech companies now employ dedicated security teams and conduct regular penetration testing to maintain robust protection.

Traditional Bank Security

Traditional banks rely on established security protocols and physical infrastructure:

- Legacy Security Systems: Proven but sometimes outdated security protocols

- Physical Security Measures: Secure facilities and physical verification processes

- SWIFT Network Protection: Established international transfer security standards

- Fraud Departments: Dedicated teams monitoring for suspicious activities

- Consumer Protection Laws: Extensive legal frameworks for dispute resolution

- Transaction Limits: Caps on transfer amounts to minimize risk exposure

- Insurance and Guarantees: Government-backed deposit insurance in many countries

While traditional banks benefit from established reputations and long-standing security protocols, they often face challenges in implementing the latest security technologies due to complex legacy systems. This can sometimes result in vulnerabilities that more agile digital providers have already addressed.

Security Comparison: Digital Wallets vs. Traditional Banks

| Security Aspect | Digital Wallets | Traditional Banks | Advantage |

|---|---|---|---|

| Data Encryption | Advanced end-to-end encryption | Standard encryption, varies by institution | Digital Wallets |

| Authentication Methods | Biometrics, 2FA, PIN codes | Passwords, security questions, some 2FA | Digital Wallets |

| Fraud Detection | AI-powered real-time monitoring | Established protocols, sometimes slower response | Digital Wallets |

| Regulatory Oversight | Varies by provider, generally increasing | Comprehensive and well-established | Traditional Banks |

| Dispute Resolution | Improving but varies by provider | Well-established processes | Traditional Banks |

| System Downtime | Occasionally affected by technical issues | Less frequent but still occurs | Tie |

| Data Breach History | Fewer major incidents due to newer systems | Multiple high-profile breaches over decades | Digital Wallets |

Security Insight

In 2025, the security gap between digital wallets and traditional banks has narrowed significantly. While banks benefit from extensive regulatory oversight, digital wallet providers often implement more advanced authentication technologies. For the most secure experience, look for providers that offer biometric authentication, real-time notifications, and have a strong track record of protecting user data.

Convenience and Accessibility

The convenience and accessibility of financial services have become increasingly important factors in choosing between digital wallets and traditional banks for remittance needs. This is especially true in 2025 as users expect seamless, user-friendly experiences across all their digital interactions.

Digital Wallet Convenience

- 24/7 Accessibility: Transfers can be initiated at any time, regardless of banking hours or time zones

- Minimal Information Required: Often only needs recipient's email, phone number, or wallet ID

- Mobile-First Design: Optimized for smartphones with intuitive interfaces

- Quick Registration: Account setup typically takes minutes with basic information

- No Branch Visits: Entirely digital process from registration to transfers

- Lower Barriers to Entry: Available to individuals without traditional bank accounts

- Multi-Currency Support: Easy handling of multiple currencies in one application

- Integration with Other Services: Often works with various e-commerce platforms

Traditional Bank Accessibility

- Extensive Documentation: Requires detailed recipient information including bank codes

- Branch Visits: May require physical presence for certain transactions

- Banking Hours: Some services limited to business hours despite online options

- Complex Forms: Often requires filling multiple forms for international transfers

- Verification Steps: Multiple verification procedures for security purposes

- Account Requirements: Usually requires established banking relationship

- Less Intuitive Interfaces: Online banking platforms often have steeper learning curves

- Limited Cross-Border Features: Less optimized for frequent international transfers

Accessibility for Different User Groups

| User Group | Digital Wallet Accessibility | Traditional Bank Accessibility | Better Option |

|---|---|---|---|

| Unbanked Population | High - Minimal requirements to get started | Low - Significant barriers to entry | Digital Wallets |

| Tech-Savvy Users | High - Intuitive interfaces and mobile optimization | Medium - Improving but less streamlined | Digital Wallets |

| Older Adults | Medium - Simple interfaces but tech adoption barrier | Medium - Familiar but complex procedures | Tie (depends on individual) |

| Migrants/Expatriates | High - Designed with cross-border needs in mind | Low - Complex requirements for non-residents | Digital Wallets |

| Rural Communities | Medium - Requires internet but no physical presence | Low - Limited physical branch access | Digital Wallets |

| Small Businesses | High - Simple integration with business operations | Medium - More services but higher complexity | Digital Wallets |

Access Requirements Comparison

Image Source: RNDpoint

Digital Wallet Requirements

- Email address

- Phone number

- Basic personal information

- Device with internet connection

- ID verification for higher transaction limits

Some providers like Profee require minimal personal information during signup, with additional verification only needed for larger transfers.

Traditional Bank Requirements

- Proof of identity (government-issued ID)

- Proof of address (utility bills, lease agreements)

- Tax identification number

- Existing bank account in many cases

- Physical signature on multiple documents

- In-person branch visit often required

Requirements vary by country and institution, with international clients often facing stricter documentation demands.

Accessibility Insight

Digital wallets have democratized access to international remittance services, reaching previously underserved populations. In 2025, approximately 65% of adults in developing nations who previously lacked access to traditional banking services can now participate in the formal financial system through digital wallets, according to World Bank data.

Transfer Speed and Processing Times

In today's fast-paced world, the speed at which money transfers are completed has become a critical factor for many users. Digital wallets and traditional banks differ significantly in their processing times for international remittances.

Digital Wallet Transfer Speed

Digital wallet providers have revolutionized the remittance industry by dramatically reducing transfer times:

- Same-Currency Transfers: Often instant to a few minutes

- Cross-Currency Transfers: Typically within minutes to a few hours

- 24/7 Processing: Transfers processed on weekends and holidays

- Real-Time Tracking: Continuous visibility of transfer status

- Consistent Timeframes: More predictable delivery times

Services like Profee, Wise, and Revolut have optimized their systems to deliver funds to recipients within minutes, even for international transfers. This is achieved through pre-funded accounts in various countries, eliminating the need for traditional correspondent banking networks.

Traditional Bank Transfer Speed

Bank transfers typically operate on longer timeframes due to their established processes:

- Domestic Transfers: 1-3 business days

- International Transfers: 3-5 business days on average

- SWIFT Network Delays: Multiple intermediaries add processing time

- Business Hours Limitations: Many processes only occur during working hours

- Weekend and Holiday Delays: Processing often paused during non-business days

- Compliance Checks: Additional verification steps that extend processing

Traditional banks rely on the SWIFT network for international transfers, which involves multiple correspondent banks and clearing houses. Each intermediary adds time to the process, resulting in transfers that can take several business days to complete.

Transfer Speed Comparison by Destination (2025 Data)

| Transfer Route | Digital Wallet Average | Traditional Bank Average | Speed Difference |

|---|---|---|---|

| USA to Mexico | 10 minutes | 2-3 business days | 40-70x faster |

| UK to India | 20-30 minutes | 3-5 business days | 50-120x faster |

| Australia to Philippines | 15-45 minutes | 2-4 business days | 30-100x faster |

| UAE to Pakistan | 5-15 minutes | 2-3 business days | 60-150x faster |

| Germany to Turkey | 10-30 minutes | 2-4 business days | 40-120x faster |

| Canada to China | 30-60 minutes | 3-6 business days | 30-100x faster |

Note: Actual speeds may vary based on specific providers, amounts transferred, and regulatory requirements.

Minutes vs. Days

Digital wallets process transfers in minutes compared to days with traditional banks

24/7 Processing

Most digital wallets operate continuously, including weekends and holidays

50-100x Faster

Average speed improvement of digital wallets over traditional bank remittances

Speed Insight

The speed advantage of digital wallets is perhaps their most compelling feature for many users. In emergency situations or when time-sensitive payments are required, the difference between minutes and days can be crucial. This speed differential has been a key driver of the migration from traditional banking to digital wallet solutions for remittances in 2025.

User Experience and Interface

User Experience Design Principles

The way users interact with financial services has evolved dramatically, with digital wallets often leading the innovation in user experience design. Here's how the two options compare:

Digital Wallet User Experience

- Mobile-First Design: Optimized for smartphone use with intuitive gestures

- Simplified Workflows: Streamlined processes requiring minimal steps

- Visual Transaction Tracking: Graphical representations of transfer status

- Clear Fee Disclosure: Transparent presentation of costs before confirmation

- Recipient Management: Easy saving and organization of frequent recipients

- In-App Support: Chat and support features within the application

- Personalization: User preferences and customization options

- Multi-Language Support: Interface available in numerous languages

Digital wallets typically employ UX designers specifically focused on removing friction from the transfer process, resulting in significantly fewer steps to complete a transaction.

Traditional Bank User Experience

- Desktop-Oriented Interfaces: Often better optimized for computer use

- Multi-Step Processes: More screens and confirmations required

- Text-Heavy Information: Detailed terms and conditions displayed

- Complex Navigation: Multiple menus and sub-sections to navigate

- Form-Based Input: Numerous fields requiring manual entry

- Limited Customization: Fewer personalization options

- Traditional Support Channels: Phone and email support predominates

- Regulatory Disclosure Focus: Design prioritizes compliance over user flow

Traditional banks have improved their digital interfaces in recent years, but many still maintain legacy systems that prioritize comprehensive functionality over streamlined user experience.

Process Comparison: Sending $500 USD to Another Country

| Process Step | Digital Wallet (e.g., Wise, Profee) | Traditional Bank |

|---|---|---|

| Initial Navigation | 1-click access to "Send Money" from dashboard | Multiple menu selections to locate international transfer option |

| Recipient Information | Email/phone or select from saved contacts | Full name, address, bank name, SWIFT code, account number |

| Amount Entry | Single screen with real-time exchange rate display | Separate screens for amount and currency selection |

| Fee Disclosure | Transparent breakdown before confirmation | Often revealed after multiple steps or in fine print |

| Transfer Purpose | Simple dropdown or optional field | Mandatory detailed explanation often required |

| Verification | Quick fingerprint or facial recognition | Password, security questions, possibly SMS code |

| Confirmation | Instant with transfer tracking number | Reference number with little real-time tracking |

| Total Time Required | 1-3 minutes | 10-20 minutes |

| Total Steps | 4-6 steps | 10-15 steps |

Customer Support Comparison

Digital Wallet Support

- In-app chat support with quick response times

- AI-powered chatbots for immediate assistance

- Email support with typical response in hours

- Comprehensive knowledge bases and FAQs

- Community forums for peer assistance

- Limited phone support (varies by provider)

Traditional Bank Support

- Phone support with potential long wait times

- In-person support at physical branches

- Email support with typical response in 24-48 hours

- Basic online help sections

- Personal bankers for premium customers

- Limited chat support (improving but not universal)

UX Insight

The user experience gap between digital wallets and traditional banks continues to be significant in 2025. While many banks have invested in improving their digital interfaces, most digital wallet providers maintain a substantial lead in creating intuitive, frictionless experiences. This difference is particularly noticeable for international remittances, where digital wallets have specifically optimized their processes for cross-border transfers.

Global Adoption and Availability

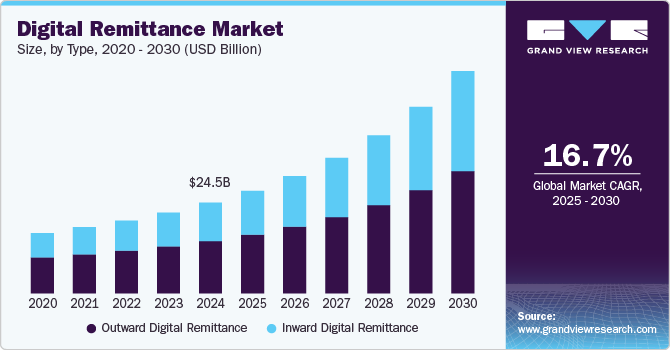

Image Source: Grand View Research

The global remittance landscape has transformed dramatically over the past decade, with digital wallets gaining significant ground across various regions. Understanding the regional variations in adoption can help users choose the most appropriate service for their specific needs.

Regional Adoption Patterns

North America

- Digital wallet adoption: 42% of remittance users

- Traditional bank use: 37% of remittance users

- Other methods: 21% of remittance users

Key corridors: USA to Mexico, USA to Philippines, USA to India

Europe

- Digital wallet adoption: 51% of remittance users

- Traditional bank use: 31% of remittance users

- Other methods: 18% of remittance users

Key corridors: UK to India, Germany to Turkey, France to North Africa

Asia-Pacific

- Digital wallet adoption: 57% of remittance users

- Traditional bank use: 22% of remittance users

- Other methods: 21% of remittance users

Key corridors: Saudi Arabia to India, UAE to Philippines, Singapore to Indonesia

Latin America

- Digital wallet adoption: 37% of remittance users

- Traditional bank use: 28% of remittance users

- Other methods: 35% of remittance users

Key corridors: USA to Mexico, USA to Colombia, Spain to Latin America

Africa

- Digital wallet adoption: 31% of remittance users

- Traditional bank use: 19% of remittance users

- Other methods: 50% of remittance users

Key corridors: Europe to Nigeria, USA to Ethiopia, UK to Kenya

Middle East

- Digital wallet adoption: 44% of remittance users

- Traditional bank use: 26% of remittance users

- Other methods: 30% of remittance users

Key corridors: UAE to India, Saudi Arabia to Pakistan, Qatar to Philippines

Top Digital Remittance Destinations and Volumes

The global remittance landscape sees significant flows to specific countries. Here are the top recipients of digital remittances in 2025:

| Recipient Country | Total Remittance Volume | Digital Wallet Share | Traditional Bank Share | Year-over-Year Growth |

|---|---|---|---|---|

| India | $95 billion | 47% | 33% | +7.2% |

| China | $63 billion | 52% | 37% | +3.5% |

| Mexico | $58 billion | 41% | 29% | +9.9% |

| Philippines | $42 billion | 56% | 24% | +8.3% |

| Egypt | $35 billion | 38% | 32% | +5.4% |

| Pakistan | $31 billion | 43% | 26% | +11.7% |

Source: Based on World Bank data and industry reports for 2025.

Availability Comparison

Digital Wallet Global Coverage

- Available in 150+ countries globally

- Support for 50-100+ currencies (varies by provider)

- Mobile penetration allows access in remote areas

- Services optimized for popular remittance corridors

- Some restrictions in countries with strict capital controls

- Continuous expansion into new markets

Traditional Bank Global Coverage

- Established presence in nearly all countries

- Support for major global currencies

- Limited access in remote areas without physical branches

- Correspondent banking relationships determine reach

- Comprehensive coverage for major financial centers

- Reduction in some correspondent banking relationships

Adoption Insight

Asia-Pacific leads in digital remittance adoption, with 57% of users preferring digital wallets over traditional methods. This high adoption rate is driven by technological advancements, favorable regulatory environments, and high smartphone penetration. Europe follows closely at 51%, while Africa shows the lowest adoption rate at 31%, primarily due to infrastructure limitations in certain regions.

User Reviews and Testimonials

Real-world experiences from users provide valuable insights into the practical advantages and disadvantages of both remittance options. Here's what users are saying in 2025:

Digital Wallet User Experiences

"I used to spend $45 per transfer plus wait 3-4 days when sending money to my family in the Philippines through my bank. With Wise, I pay less than $10 and the money arrives in minutes. The difference is life-changing for emergencies."

- Maria L., Healthcare Worker in USA

"As a digital nomad working across Southeast Asia, I rely completely on Revolut to manage currencies and send money internationally. The multi-currency feature saves me thousands annually in conversion fees that banks would charge."

- James T., Remote Software Developer

"Profee has the most straightforward interface I've used for sending money to Eastern Europe. The transparent fee structure means no surprises, and the special rates for first-time users convinced me to switch from my bank permanently."

- Andrei K., Business Owner in Germany

Traditional Bank User Experiences

"I still use my bank for larger transfers to India because I feel more secure with the established relationship. Yes, I pay more in fees, but the peace of mind is worth it for transfers over $10,000 for my property investments."

- Raj P., Physician in Canada

"The bank's customer service team helped resolve an issue with an international wire that was delayed. Having a physical branch to visit made a difference in getting the problem fixed quickly, which might not have happened with an online-only service."

- Emma S., Entrepreneur in Australia

"For business transactions, I prefer using my bank despite higher fees. The ability to speak with a dedicated business banker who understands my company's international payment needs provides value that digital wallets haven't matched yet."

- Carlos M., Import/Export Business Owner

Common User Complaints

Digital Wallet Complaints

- Account Verification Delays: Occasional lengthy ID verification processes

- Limited Customer Support: Difficulties reaching human agents for complex issues

- Transfer Limits: Restrictions on larger transfer amounts

- Regional Restrictions: Some services unavailable in certain countries

- App Glitches: Technical issues during updates or high-traffic periods

Traditional Bank Complaints

- High Fees: Excessive charges for international transfers

- Hidden Costs: Undisclosed exchange rate markups

- Slow Processing: Extended wait times for fund delivery

- Complex Requirements: Excessive paperwork and information needed

- Limited Tracking: Insufficient visibility into transfer status

User Satisfaction Ratings

| Aspect | Digital Wallet Average Rating | Traditional Bank Average Rating | Rating Difference |

|---|---|---|---|

| Overall Satisfaction | 4.3/5 | 3.4/5 | +0.9 |

| Fee Transparency | 4.6/5 | 2.8/5 | +1.8 |

| Transfer Speed | 4.7/5 | 2.9/5 | +1.8 |

| Ease of Use | 4.5/5 | 3.2/5 | +1.3 |

| Customer Support | 3.8/5 | 3.7/5 | +0.1 |

| Security Perception | 4.1/5 | 4.3/5 | -0.2 |

Source: Aggregated from major review platforms and customer satisfaction surveys as of 2025.

User Insight

While digital wallets outperform traditional banks in most satisfaction categories, banks still maintain a slight edge in perceived security and are preferred by some users for very large transfers. The most significant differentiators for digital wallet users are speed, cost savings, and ease of use—aspects where traditional banks continue to lag despite improvements.

Recommendations for Different User Types

The ideal remittance solution varies based on individual needs and circumstances. Here's a breakdown of recommendations for different user profiles:

Frequent Remitters

Individuals regularly sending money to family abroad

- Lower per-transaction fees save significant amounts over time

- Quick delivery ensures timely support for recipients

- Saved recipient details streamline repeat transfers

Recommended providers: Wise, Revolut, Profee

Business Users

Companies making international supplier or contractor payments

- Digital wallets for frequent smaller payments

- Business banking relationships for very large transfers

- Multi-user access features for team coordination

Recommended providers: Wise Business, Revolut Business, traditional bank with fintech partnerships

Expatriates & Digital Nomads

Individuals living or working abroad who manage multiple currencies

- Multi-currency accounts for currency management

- Linked debit cards for local spending

- Favorable currency exchange rates

Recommended providers: Revolut, Wise, N26

Large Sum Transferrers

People making significant one-time transfers (e.g., property purchase)

- Currency specialists for optimized exchange rates

- Higher transfer limits than standard services

- Personalized guidance and support

Recommended providers: OFX, Currencies Direct, premium banking services

Unbanked Individuals

People without traditional bank accounts seeking financial inclusion

- Low barriers to entry with minimal documentation

- Cash-in and cash-out options through local agents

- Mobile phone-based accounts for accessibility

Recommended providers: M-PESA, Airtel Money, Western Union Digital

Emergency Remitters

Those needing to send money quickly in urgent situations

- Near-instant delivery to recipient

- Mobile notification systems for confirmation

- 24/7 processing regardless of banking hours

Recommended providers: Profee, Wise, WorldRemit

Decision Framework

Use this simple framework to determine which remittance option might best suit your needs:

| If You Prioritize... | Choose... | Example Providers |

|---|---|---|

| Lowest Fees | Digital Wallets | Wise, Revolut, Profee |

| Fastest Delivery | Digital Wallets | Wise, Profee, WorldRemit |

| Comprehensive Service | Traditional Banks | HSBC, Citibank, JP Morgan Chase |

| Established Reputation | Traditional Banks | Major national banks in your country |

| User-Friendly Experience | Digital Wallets | Revolut, Wise, Profee |

| Multi-Currency Management | Digital Wallets | Revolut, Wise, N26 |

| Very Large Transfers | Specialized FX Providers | OFX, Currencies Direct, XE |

| Personal Relationship | Traditional Banks | Local or national banks with relationship managers |

Strategic Recommendation

Most users in 2025 benefit from employing a hybrid approach—using digital wallets for regular, smaller remittances where speed and cost efficiency matter most, while maintaining a relationship with a traditional bank for complex financial needs or very large transfers. This strategy allows you to leverage the strengths of both systems while minimizing their respective weaknesses.

Conclusion and Future Outlook

Key Takeaways

Digital Wallets Lead in:

- Cost Efficiency: Significantly lower fees and better exchange rates

- Speed: Transfers completed in minutes rather than days

- User Experience: Intuitive interfaces requiring fewer steps

- Accessibility: Lower barriers to entry for diverse users

- Innovation: Advanced security features and continuous improvement

- Transparency: Clear fee structures and real-time tracking

Traditional Banks Lead in:

- Established Trust: Longstanding reputations and regulatory oversight

- Service Range: Comprehensive financial offerings beyond remittances

- Personal Relationships: Face-to-face service and dedicated advisors

- Large Transfer Capabilities: Higher limits for significant transactions

- Global Network: Established presence in nearly all countries

- Integration: Connection with other banking products and services

The Evolving Landscape

The remittance industry continues to evolve rapidly in 2025, with several key trends shaping the future:

Bank-Fintech Partnerships

Traditional banks are increasingly partnering with fintech companies to offer digital wallet features while maintaining their established customer base. These hybrid solutions aim to combine the best of both worlds—the trust and comprehensive services of banks with the speed and efficiency of digital platforms.

Technology Integration

Blockchain and distributed ledger technologies are being adopted by both digital wallets and forward-thinking banks to further improve transaction speeds and reduce costs. Meanwhile, AI-driven systems are enhancing fraud detection, customer support, and personalization across all platforms.

Regulatory Evolution

Regulatory frameworks are adapting to accommodate digital innovation while maintaining consumer protection. Open banking initiatives continue to expand globally, fostering competition and innovation while also enabling better integration between traditional and digital financial services.

Future Predictions for 2026-2030

- Digital Dominance: By 2027, digital channels are expected to handle over 65% of global remittance volumes, with traditional banking's share continuing to decline.

- Fee Compression: Increased competition will likely drive average remittance costs below 3% by 2028, approaching the United Nations Sustainable Development Goal target.

- Real-Time Cross-Border Payments: Near-instant international transfers will become the standard rather than the exception across most major corridors.

- Banking Transformation: Traditional banks will either transform their remittance offerings or focus on other financial services where they maintain competitive advantages.

- Embedded Finance: Remittance capabilities will increasingly be integrated directly into various apps and platforms beyond dedicated financial services.

- Universal Access: Financial inclusion initiatives will extend digital remittance access to currently underserved populations, particularly in Africa and parts of Asia.

Final Verdict

For the majority of users in 2025, digital wallets offer the most compelling remittance solution, with advantages in cost, speed, and convenience that outweigh the diminishing benefits of traditional banking for cross-border transfers. However, the optimal strategy for many will continue to involve using both systems strategically based on specific transaction needs and personal preferences.

As the financial ecosystem continues to evolve, consumers stand to benefit from increasing competition, technological innovation, and regulatory improvements that make international money transfers more affordable, accessible, and efficient than ever before.

Frequently Asked Questions

Are digital wallets safe for international transfers?

Yes, reputable digital wallet providers employ advanced security measures including end-to-end encryption, biometric authentication, and real-time monitoring systems. Many digital wallets now offer security that matches or exceeds traditional banking standards. To ensure safety, choose well-established providers that are regulated in major jurisdictions and have strong user reviews regarding security and reliability.

What documentation do I need to send money through a digital wallet vs. a traditional bank?

Digital wallets typically require basic personal information (name, email, phone number) for registration, with additional verification (ID, proof of address) only needed for higher transfer amounts. Traditional banks generally require comprehensive documentation including government ID, proof of address, and sometimes source of funds documentation, particularly for international transfers. Digital wallets streamline this process significantly, especially for routine transfers.

What are the transaction limits for digital wallets compared to banks?

Transaction limits vary by provider. Digital wallets typically have tiered limits based on verification level, with basic verified accounts often capped at $10,000-$15,000 per transaction and higher verification levels allowing up to $50,000 or more. Traditional banks generally offer higher limits for established customers, sometimes allowing transactions of $100,000 or more, though these come with extensive documentation requirements and potentially higher fees.

How do I choose between different digital wallet providers?

When comparing digital wallet providers, consider: 1) Fee structure and exchange rates for your specific transfer corridor, 2) Transfer speed to your recipient's country, 3) Available payout methods for your recipient, 4) Security features and regulatory compliance, 5) User interface and ease of use, and 6) Customer service options. Testing a provider with a small transfer before committing to larger amounts is often advisable.

Can recipients without bank accounts receive digital wallet transfers?

Yes, many digital wallet providers offer multiple payout options for recipients without traditional bank accounts. These include cash pickup locations, mobile money accounts (like M-PESA in Africa), delivery to the recipient's digital wallet, or home delivery in some markets. This flexibility is a significant advantage over traditional banks, which typically require recipients to have a bank account for receiving international transfers.

What happens if something goes wrong with my transfer?

Digital wallets typically offer in-app support, email assistance, and sometimes chat or phone support for resolving issues. Most provide transaction tracking so you can see the status of your transfer. Traditional banks offer branch support, phone banking, and formal dispute resolution processes for transfer problems. Digital wallets have significantly improved their customer service in recent years, though banks may still have an edge for complex issues requiring extensive investigation.

Are there tax implications to consider when using digital wallets vs. bank transfers?

The tax implications are generally similar for both methods as they relate to the purpose of the transfer rather than the channel used. However, digital wallets may make it easier to track and categorize transactions for tax purposes through their digital interfaces. For large transfers, regulatory reporting requirements exist regardless of the method used. Consult with a tax professional regarding specific reporting requirements in your jurisdiction.

How has COVID-19 affected the remittance landscape?

The COVID-19 pandemic accelerated the shift from traditional to digital remittance channels as lockdowns limited access to physical branches and heightened awareness of contactless solutions. By 2025, this shift has become permanent for many users, with digital wallet adoption growing from approximately 28% pre-pandemic to over 45% globally. Traditional banks have responded by improving their digital offerings, though many still lag behind dedicated digital providers in user experience and cost efficiency.

About the Author

Ayesha Patel

Ayesha is a fintech analyst specializing in cross-border payments and digital financial services. With over a decade of experience in the international remittance industry, she has consulted for both traditional financial institutions and emerging fintech companies. Her research focuses on financial inclusion, digital transformation, and the evolving regulatory landscape for international money transfers.

Last updated: May 20, 2025

Ready to Save on Your International Transfers?

Compare digital wallet providers and traditional bank options to find the best solution for your unique remittance needs.

Post a Comment