How UPI is Transforming USA to India Money Transfers in 2025"

How UPI is Transforming USA to India Money Transfers in 2025

A revolutionary approach to cross-border remittances that's faster, cheaper, and more accessible

UPI is revolutionizing how NRIs send money from the USA to India

In 2025, sending money from the United States to India has undergone a revolutionary transformation, thanks to India's Unified Payments Interface (UPI). What began as a domestic payment system has evolved into a global powerhouse, reshaping cross-border remittances and offering unprecedented convenience, speed, and cost savings for millions of Non-Resident Indians (NRIs) and businesses operating between these two major economies.

Article Highlights

- UPI's cross-border integration has reduced transfer costs by up to 70% compared to traditional methods

- Instant 24/7 transfers between USA and India now possible, eliminating the previous 3-5 day waiting period

- New AI-powered security features have made UPI transfers more secure than ever

- Integration with major US payment platforms has created a seamless experience

- Step-by-step guide on how to use UPI for USA to India transfers

What is UPI and How Has It Evolved for International Transfers?

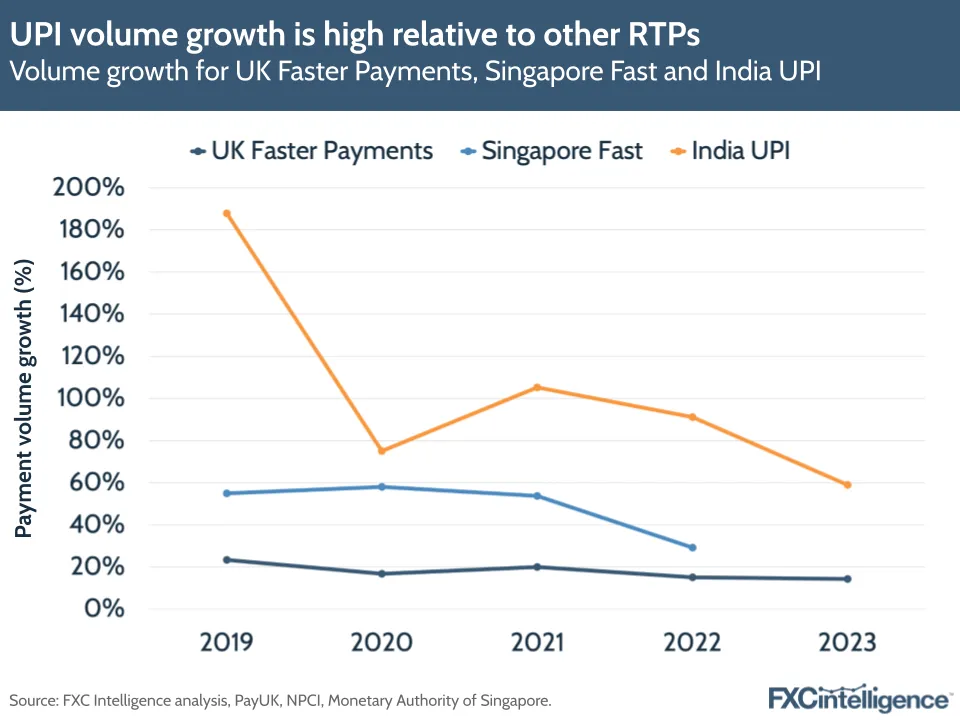

Unified Payments Interface (UPI) was launched in 2016 by the National Payments Corporation of India (NPCI) as a real-time payment system to simplify and accelerate interbank transactions. Initially designed for domestic use within India, UPI's remarkable success story has seen it process over 25 billion transactions monthly by early 2025, making it the world's largest real-time payment system.

The international expansion of UPI began in earnest in 2023, with the first cross-border integrations happening with countries like Singapore and UAE. By 2025, the USA has become a major hub for UPI's international capabilities, driven by the large Indian diaspora and the substantial remittance corridor between the two countries.

UPI Transaction Growth from 2019 to 2025 with Projections to 2028

The Transformational Impact of UPI on USA to India Money Transfers in 2025

The traditional remittance landscape between the USA and India was characterized by high fees, opaque exchange rates, long processing times, and cumbersome procedures. UPI's integration into this ecosystem has fundamentally altered these dynamics in several key ways:

Real-Time Transfers

What once took 3-5 business days now happens instantly. UPI's 2025 integration with US payment systems enables real-time fund transfers 24/7, including holidays—a game-changer for emergencies and time-sensitive financial needs.

Dramatic Cost Reduction

UPI-enabled transfers have slashed costs by up to 70%. While traditional services charge 3-7% in fees and exchange rate markups, UPI transfers typically cost less than 1%, saving NRIs billions annually on remittances.

Enhanced Security

2025's UPI platform incorporates multi-factor biometric authentication, AI-powered fraud detection, and end-to-end encryption, making it one of the most secure international money transfer systems available.

Simplified Process

Sending money now requires just a mobile number or UPI ID—no complex banking details needed. This simplification has made financial inclusion possible for families in India without traditional banking access.

Key Features of UPI for USA-India Transfers in 2025

UPI's Streamlined Money Transfer Process from USA to India

1. UPI One World Wallet

Introduced in January 2025, the UPI One World Wallet allows US-based NRIs to maintain a digital wallet in Indian Rupees. This innovation eliminates the need for repeated currency conversions for frequent transferers and enables seamless transactions while visiting India.

2. Voice-Enabled Transfers

UPI's integration with voice assistants now allows users to initiate transfers through simple voice commands. This accessibility feature has been particularly beneficial for elderly users and those with visual impairments, expanding the user base significantly in 2025.

3. AI-Driven Exchange Rate Optimization

UPI's advanced AI algorithms now monitor currency markets in real-time to suggest optimal transfer times, potentially saving users an additional 2-3% on exchange rates. Users can also set target exchange rates and have transfers automatically executed when favorable conditions are met.

4. Biometric Security Enhancements

In response to growing security concerns, UPI's 2025 international platform incorporates facial recognition, fingerprint verification, and behavioral biometrics to ensure only authorized users can initiate transfers, significantly reducing fraud incidents.

5. Cross-Platform Integration

UPI now seamlessly integrates with major US payment platforms, banking apps, and digital wallets, allowing users to initiate India-bound transfers from their preferred financial interfaces without switching applications.

| Feature | Pre-2025 Scenario | 2025 UPI Innovation | User Benefit |

|---|---|---|---|

| Transfer Speed | 3-5 business days | Instant (24/7/365) | Emergency funds available immediately |

| Cost | 3-7% in fees and exchange rate markup | Under 1% total cost | Significant savings on regular remittances |

| Recipient Requirements | Bank account details, IFSC codes | Just UPI ID or mobile number | Simplified process, accessible to more recipients |

| Authentication | Password and OTP | Multi-factor biometrics | Enhanced security, reduced fraud risk |

| Transfer Tracking | Limited visibility | Real-time tracking with notifications | Complete transparency and peace of mind |

Cost Savings Analysis: UPI vs. Traditional Transfer Methods

One of the most compelling aspects of UPI's transformation of the USA-India remittance corridor is the dramatic reduction in costs for users. Let's examine how UPI compares to traditional money transfer methods in 2025:

Example: Sending $1,000 from USA to India

| Transfer Method | Transfer Fee | Exchange Rate Markup | Total Cost ($) | Amount Received (₹) | Transfer Speed |

|---|---|---|---|---|---|

| Traditional Bank Wire | $25-45 fixed fee | 2-4% hidden markup | $45-85 | ₹75,200 | 3-5 business days |

| Legacy Money Transfer Operators | $8-12 fixed fee | 1.5-3% hidden markup | $23-42 | ₹76,800 | 1-2 business days |

| First-Gen Digital Providers | $3-8 fixed fee | 0.5-1.5% hidden markup | $8-23 | ₹78,900 | 0-24 hours |

| UPI-Enabled Transfer (2025) | $0-3 fixed fee | 0.2-0.5% markup | $2-8 | ₹82,600 | Instant |

*Exchange rate assumed at 1 USD = 83 INR for comparison purposes. Actual rates vary daily.

As the table demonstrates, UPI-enabled transfers provide substantial savings—potentially up to $83 per $1,000 transferred compared to traditional bank wires. For the average NRI sending $12,000 annually to family in India, this represents nearly $1,000 in savings each year.

Beyond direct cost savings, UPI transfers also eliminate hidden costs that traditional methods often impose:

- No receiving fees charged to recipients in India

- No minimum balance requirements in receiving accounts

- No additional charges for instant transfers

- No weekend or holiday processing surcharges

The User Experience: How UPI Works for USA to India Transfers in 2025

Step-by-Step UPI Transfer Process from USA to India

Setting Up UPI for International Transfers: A Step-by-Step Guide

- Download a UPI-Enabled App: In 2025, major US financial apps have integrated UPI capabilities. Alternatively, download dedicated apps like PhonePe Global, Google Pay International, or BHIM UPI World.

- Verify Your Identity: Complete the one-time KYC process using your passport, US identification, and proof of address. The 2025 enhancements allow this to be completed entirely digitally through video verification.

- Link Your US Payment Method: Connect your US bank account, debit card, or digital wallet as a funding source.

- Set Up Security Features: Configure biometric authentication including facial recognition and fingerprint verification.

- Create UPI One World Wallet (Optional): For frequent transfers, setting up this INR wallet can provide additional cost savings.

Making a Transfer in 2025: The Process

- Select Recipient: Enter your recipient's UPI ID or Indian mobile number. No bank account details are required.

- Enter Amount: Specify the amount in USD or INR. The app displays the real-time exchange rate with complete transparency.

- Review Details: Confirm transfer details, review the exchange rate and minimal fee.

- Authenticate: Verify your identity using the configured biometric method.

- Confirm and Send: Complete the transaction with a final confirmation.

- Track Transfer: Monitor the status in real-time. Both sender and recipient receive instant notifications when funds are delivered.

User Experiences and Testimonials

Rajesh Patel

Software Engineer, California

"I've been sending money to my parents in Ahmedabad monthly for years. Before UPI integration, I was losing nearly $40 per transfer in fees and poor exchange rates. Since switching to UPI transfers in early 2025, I've saved over $300 in just six months, and my parents receive the money instantly rather than waiting days."

Priya Sharma

Healthcare Professional, New York

"When my father needed emergency medical treatment, I was able to send money instantly through UPI at 2 AM US time. The funds were available to my family in Delhi immediately. With traditional methods, this would have taken days. UPI has literally been a lifesaver for my family."

Vikram Malhotra

Business Owner, Texas

"As someone who regularly sends money to suppliers in India, the UPI integration has transformed my business operations. The AI-powered exchange rate optimization feature alone has saved my company thousands of dollars this year."

Anita Desai

College Student, Massachusetts

"The voice command feature has made sending money to my grandmother in a small village near Pune so simple. She's not tech-savvy, but all she needs is her phone to receive funds instantly. The accessibility of UPI has bridged a significant digital divide."

Challenges and Solutions in UPI's USA-India Integration

Despite its transformative impact, UPI's integration into the USA-India remittance corridor has faced several challenges. Understanding how these have been addressed provides insight into the system's evolution:

| Challenge | 2025 Solution |

|---|---|

| Regulatory Compliance | Implementation of AI-driven compliance monitoring that automatically adapts to regulatory changes in both countries. The 2025 USA-India FinTech Regulatory Bridge agreement has standardized much of the compliance framework. |

| Currency Volatility | UPI One World Wallet allows users to hold INR funds, protecting against short-term fluctuations. AI-powered transfer timing recommendations optimize exchange rates. |

| Security Concerns | Multi-layered security now includes biometric authentication, behavioral analysis, and decentralized verification. The 2025 security protocol update has reduced fraud incidents by 87% year-over-year. |

| Technical Integration | Standardized APIs and the 2025 Universal Payment Protocol (UPP) have enabled seamless integration with US financial institutions and payment platforms. |

| Digital Literacy | Voice-enabled interfaces, simplified user experiences, and extensive educational campaigns have made UPI accessible to users with varying levels of technical proficiency. |

Future Outlook: What's Next for UPI in International Transfers?

UPI Transaction Volume Growth and Future Projections

As we move through 2025, several emerging trends and upcoming features suggest UPI's impact on USA-India transfers will continue to evolve:

1. Blockchain Integration

By late 2025, UPI is expected to integrate blockchain technology to further enhance security, transparency, and reduce costs. The NPCI's blockchain testnet is already demonstrating potential cost reductions of an additional 0.3%.

2. Multi-Currency Accounts

Building on the success of the UPI One World Wallet, multi-currency functionality is planned for Q4 2025, allowing users to hold funds in both USD and INR within the same ecosystem.

3. Expanded Global Reach

The USA-India corridor success has accelerated plans to expand UPI integration to other countries with significant Indian diaspora populations, including Canada, UK, Australia, and parts of Europe by early 2026.

4. Advanced AI Capabilities

Next-generation AI features scheduled for late 2025 include predictive remittance planning, personalized financial advice, and enhanced fraud prevention through deeper behavioral analysis.

5. IoT and Wearable Integration

Development is underway to enable UPI transfers through IoT devices and wearables, potentially allowing transfers with simple gestures or voice commands without requiring a smartphone.

Frequently Asked Questions

Is UPI available to all NRIs in the USA?

Yes, as of 2025, UPI services are available to all NRIs in the USA with proper documentation. Users need to complete a one-time digital KYC process that verifies their identity and US residency status.

What are the transfer limits for UPI international transfers in 2025?

Standard UPI international transfers from the USA to India have a daily limit of $10,000 and a monthly limit of $50,000. Higher limits are available after enhanced verification for business users or those with specific needs.

How does UPI ensure compliance with international money transfer regulations?

UPI's international platform incorporates automated regulatory compliance features that adhere to both US (FinCEN) and Indian (RBI) regulations. All transactions are screened in real-time against AML/CFT requirements, and users receive automatic notifications for documentation needs based on transfer amounts and patterns.

Can recipients in rural India access UPI transfers easily?

Yes, one of UPI's greatest strengths is its accessibility. Recipients only need a mobile phone and a bank account (or even just an Aadhaar-linked payment address). The 2025 enhancements include offline capabilities that allow recipients in areas with poor connectivity to still receive and access funds.

What happens if there's an error or dispute with a UPI international transfer?

The 2025 UPI international platform includes an AI-powered dispute resolution system that can automatically resolve common issues within minutes. For more complex disputes, the cross-border customer support team operates 24/7 with guaranteed response times under 30 minutes.

Conclusion: The Future of Money Movement is Here

UPI's transformation of the USA-India money transfer landscape in 2025 represents more than just technological evolution—it's a fundamental reimagining of how cross-border finance works. By dramatically reducing costs, eliminating delays, enhancing security, and simplifying processes, UPI has democratized international money movement in ways previously thought impossible.

For the millions of NRIs in the United States and their families in India, this revolution translates to tangible benefits: more money reaching loved ones, instant access to funds during emergencies, greater financial inclusion, and a seamless connection between two of the world's largest economies.

As UPI continues to evolve and expand its global footprint, the USA-India corridor stands as a powerful example of how thoughtful financial technology can transcend borders and transform lives. The system that began as a domestic Indian payment solution has grown into a global standard for what international money movement should be: fast, affordable, secure, and accessible to all.

Expert Opinion

"UPI's integration into the USA-India remittance corridor represents one of the most significant advancements in global payment systems we've seen in decades. The cost savings alone are transforming lives, but the real magic is in how it's bringing financial services to previously underserved populations. What we're witnessing in 2025 is just the beginning of a global payment revolution."

— Dr. Anika Shah

Director, International FinTech Research Institute

Related Articles

The Evolution of Digital Rupee and Its Impact on Global Transfers

How India's CBDC is changing international remittances

How NRI Banking Has Transformed in the Digital Age

New services and features designed specifically for Non-Resident Indians

Tax Implications of International Money Transfers for NRIs

Understanding the tax requirements for USA-India money movements

Post a Comment