How to Avoid Currency Conversion Losses When Transferring Money to India

How to Avoid Currency Conversion Losses When Transferring Money to India: The Ultimate Guide

A comprehensive strategy to maximize your remittance value and minimize hidden costs

Table of Contents

- 1. Introduction: The Hidden Cost of International Money Transfers

- 2. Understanding Currency Conversion Losses

- 3. Comparing Money Transfer Services

- 4. Strategic Timing of Your Transfers

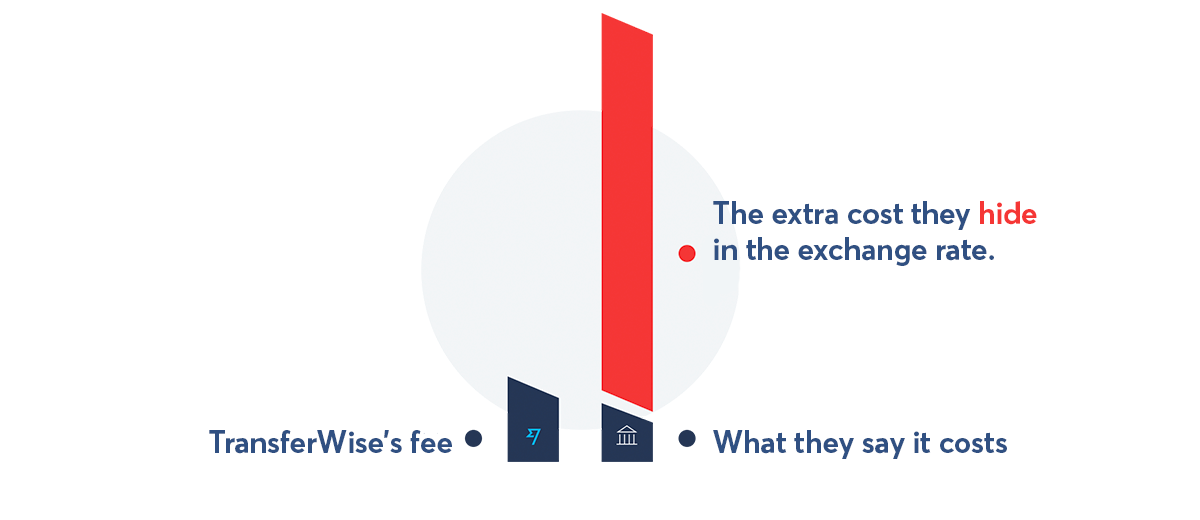

- 5. Identifying and Avoiding Hidden Fees

- 6. Hedging Strategies and Forward Contracts

- 7. Digital Tools and Apps for Better Transfers

- 8. Tax Implications and FEMA Regulations

- 9. Real User Experiences and Reviews

- 10. Conclusion and Action Plan

1. Introduction: The Hidden Cost of International Money Transfers

When sending money to India, most people focus only on the advertised transfer fee—but this is just the tip of the iceberg. The real cost often lies hidden in unfavorable exchange rates and undisclosed markups that can significantly reduce the amount your recipients actually receive.

According to a recent study, Indians paid over ₹263 billion (approximately $3.5 billion) on foreign exchange fees in 2020 alone, with roughly ₹97 billion hidden as exchange rate markups on currency conversions. This means that for every ₹100 sent to India, a significant portion never reaches the intended recipient due to these hidden costs.

The Real Impact:

If you're regularly sending money to India—whether to support family, invest in property, or for business purposes—these hidden costs can add up to thousands of dollars annually.

This comprehensive guide will equip you with strategies to identify these hidden costs, compare money transfer services effectively, time your transfers strategically, understand tax implications, and leverage digital tools to maximize every rupee that reaches your Indian bank account.

2. Understanding Currency Conversion Losses

Before diving into strategies, it's crucial to understand exactly how and where you lose money during currency conversion. International money transfers incur losses through multiple channels:

2.1. Exchange Rate Margins

Exchange rate margins represent the biggest source of hidden costs. When a provider offers an exchange rate, they typically use a rate that's less favorable than the mid-market rate (the real exchange rate you see on Google or financial news sites). The difference between these two rates is their profit margin.

Example:

If the actual mid-market rate is 1 USD = 85.5 INR, a transfer provider might offer you 1 USD = 83.5 INR. On a $1,000 transfer, this 2% margin means the recipient receives ₹2,000 less than they would at the true rate.

2.2. Fixed Transfer Fees

These are the most visible fees, typically ranging from $0-50 depending on the service. While some services advertise "zero fees," they often compensate by offering poorer exchange rates.

2.3. Receiving Bank Charges

Indian banks may charge a fee for receiving international transfers, typically ranging from ₹100-1,500 depending on the bank and transfer method. These fees are often overlooked in calculations.

2.4. Intermediary Bank Fees

For transfers using the SWIFT network, multiple intermediary banks may process the transaction, each potentially deducting their own fee from the transfer amount. These fees are unpredictable and can range from $10-30 per intermediary.

Pro Tip:

When comparing services, calculate the total amount that will be received in India after ALL fees and exchange rate differences—not just the advertised transfer fee.

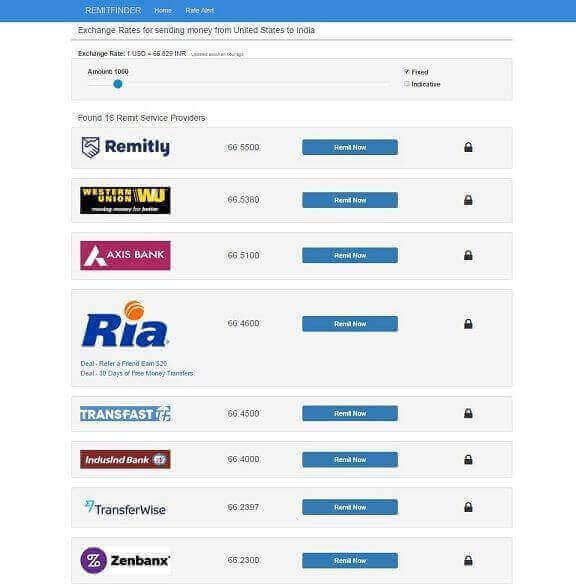

3. Comparing Money Transfer Services

Not all money transfer services are created equal. Here's a comparative analysis of the most popular options for sending money to India:

| Service | Typical Exchange Rate Margin | Transfer Fees | Speed | Best For |

|---|---|---|---|---|

| Wise (formerly TransferWise) | 0.4-0.5% | $1-4 | 1-2 business days | Transparency, competitive rates |

| Remitly | 0.8-2% | $0-3.99 | Minutes (express) to 3-5 days (economy) | Speed, first-time user promotions |

| Xoom (PayPal) | 1-3% | $0-4.99 | Minutes to 1-2 business days | Convenience for PayPal users |

| Western Union | 2-4% | $0-5 | Minutes to 1-2 business days | Cash pickup options |

| Bank Transfers | 3-5% | $20-50 | 3-7 business days | Familiarity, established relationships |

| InstaRem | 0.6-1% | $0-4 | 1-2 business days | Regular transfers, loyalty program |

3.1. How to Compare Effectively

To truly compare services, follow this process for each transfer:

- Check the mid-market rate on Google or XE.com first

- Input the same send amount on multiple services

- Note the final INR amount the recipient will get (after all fees)

- Compare this final amount, not just the transfer fee

- Consider speed requirements and convenience factors

Pro Tip:

Use comparison tools like Monito, RemitFinder, or CompareRemit to get real-time comparisons across multiple providers in one place.

3.2. Service Selection Strategy

Different services excel in different scenarios:

For Regular Small Transfers (Under $1,000)

Services like Wise, Remitly, and InstaRem typically offer the best value due to their low fixed fees and competitive exchange rates.

For Larger Transfers (Over $5,000)

Consider specialist services like OFX or even negotiating rates directly with your bank for premium exchange rates. Some services also offer better rates for larger transfers.

For Emergency/Urgent Transfers

Remitly's Express service, Western Union, or Xoom offer near-instant transfers to India, though typically at a higher cost.

For Absolute Best Rates

Wise consistently offers rates closest to the mid-market rate. Skydo is another emerging option with competitive rates for India transfers specifically.

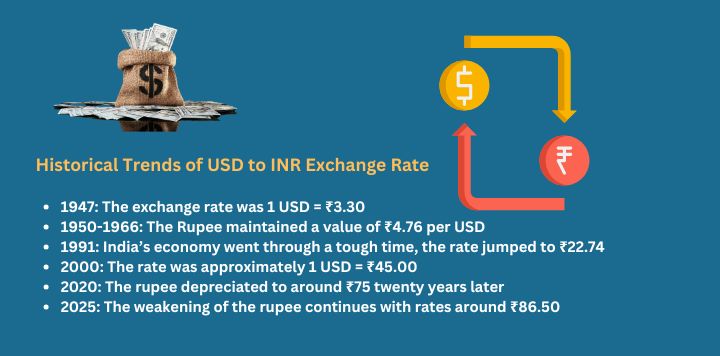

4. Strategic Timing of Your Transfers

Timing your transfers strategically can save you significant money, especially for larger amounts. Currency values fluctuate constantly due to economic data releases, geopolitical events, and market sentiment.

4.1. Best Days and Times

- Mid-week transfers (Tuesday to Thursday) often offer better rates than weekends.

- Morning hours in the US (when Indian markets are closed) can sometimes offer better rates.

- Avoid transfers during major Indian holidays when banking systems may be slower.

- The first half of the month typically sees more stable exchange rates than month-end.

"Mondays often experience the lowest number of trading in foreign exchange market. Therefore, you may expect the least fluctuation in price." - WorldRemit Research

4.2. Monitoring Exchange Rate Trends

For larger transfers, it's worth monitoring exchange rate trends over a period of time:

- Follow economic indicators like US Federal Reserve announcements, which often impact USD/INR rates.

- Major Indian economic data releases (inflation figures, GDP growth) can cause short-term fluctuations.

- Political stability or instability in either country can impact exchange rates significantly.

- For transfers over $10,000, consider tracking rates for 2-4 weeks to identify favorable trends.

Pro Tip:

Set up exchange rate alerts on apps like XE, Wise, or dedicated currency tracking apps. These will notify you when your desired rate is reached, helping you time your transfer optimally.

6. Hedging Strategies and Forward Contracts

:max_bytes(150000):strip_icc()/Currencyforward_sketch_final-21be21f0d5584ecd962f071201b921e1.png)

For larger transfers or regular remittances, hedging strategies can protect you from currency fluctuations and secure favorable rates in advance.

6.1. Forward Contracts Explained

A forward contract allows you to lock in today's exchange rate for a future transfer, protecting you from unfavorable currency movements.

How Forward Contracts Work:

You agree to exchange a specific amount of currency at a predetermined exchange rate on a future date. This guarantees your exchange rate regardless of market fluctuations.

6.2. Who Should Use Forward Contracts

Forward contracts are particularly valuable for:

- NRIs planning to send large sums (over $10,000) for property purchases

- Business owners making regular payments to Indian suppliers

- People with fixed payment obligations in India (like loan repayments)

- Situations where budget certainty is more important than potentially getting a better rate

6.3. Services Offering Forward Contracts

Not all transfer services offer forward contracts. Those that do include:

OFX

Offers forward contracts for 12 months, minimum transfer amount of $10,000.

Wise

Offers rate alerts and the ability to lock in rates for 24-48 hours, but not long-term forward contracts.

WorldFirst

Offers forward contracts up to 12 months for businesses and high-value transfers.

Major Banks

Most international banks offer forward contracts, though typically with less favorable rates than specialist services.

Important Consideration:

Forward contracts typically require a deposit (usually 5-10% of the total amount). You'll also be obligated to complete the transfer at the agreed rate, even if market rates become more favorable in the meantime.

7. Digital Tools and Apps for Better Transfers

Technology has made it easier than ever to minimize your currency conversion losses. Here are essential tools to help you get the best deals:

7.1. Rate Monitoring and Alert Apps

XE Currency App

Provides real-time exchange rates, historical charts, and rate alerts. You can set notifications for when USD/INR reaches your target rate.

Wise Rate Alerts

Notifies you when the exchange rate hits your specified target, helping you time your transfers optimally.

Currency Converter Plus

Offers detailed historical charts to identify trends and set multiple rate alerts.

Bloomberg App

For more serious currency watchers, provides financial news and detailed market analysis that may impact exchange rates.

7.2. Comparison Tools

Monito

Compares dozens of transfer services in real-time, showing the exact amount that will be received in India after all fees and exchange rate margins.

RemitFinder

Specializes in India remittances, comparing major providers and showing historical rate trends.

CompareRemit

Focused on Indian remittances with detailed provider reviews and promotional offers.

CurrencyShop

Provides side-by-side comparisons with detailed fee breakdowns and delivery time estimates.

Pro Tip:

Use these comparison tools even if you have a preferred service. Many providers offer promotional rates to new customers, so occasionally switching services can save you money.

8. Tax Implications and FEMA Regulations

Understanding the tax and regulatory framework is crucial for smooth, compliant transfers to India.

8.1. Tax Implications for the Receiver in India

Good News:

According to the Foreign Exchange Management Act (FEMA), taxes are not applicable if you send money to your children, spouse, parents, siblings, linear descendants or ascendants, and siblings of your spouse. These transfers are considered gifts and are tax-exempt.

However, there are important exceptions:

- If the recipient is not a relative as defined above, amounts exceeding ₹50,000 in a financial year may be taxable as "Income from Other Sources"

- Regular transfers for specific services rendered may be considered income and could be taxable

- Investment-related transfers (for stocks, property) have their own tax implications based on the asset type

8.2. Tax Implications for the Sender

For those sending money from outside India:

- Most countries don't impose tax on money sent abroad from already-taxed income

- US residents may need to complete Form 3520 if sending gifts exceeding $100,000 annually (reporting requirement only, not taxation)

- Some countries have currency control regulations limiting how much can be sent abroad

8.3. FEMA Regulations and Compliance

The Foreign Exchange Management Act (FEMA) governs foreign currency transactions in India:

- There is no upper limit on the amount of money that can be sent to India

- For transactions over certain thresholds, banks may request purpose codes and additional documentation

- NRI transfers to NRE accounts are fully repatriable (can be converted back to foreign currency)

- Transfers to NRO accounts have repatriation limits and may require tax clearance for reconversion

Important Note:

While inward remittances to India have favorable tax treatment, outward remittances from India are subject to TCS (Tax Collected at Source) at 5-20% depending on the amount and purpose.

9. Real User Experiences and Reviews

Learning from others' experiences can help you avoid pitfalls. Here are some insights from real users who regularly transfer money to India:

"Remitly is solid, no issues, have been using it for last 5ish years. Their express option gets the money in your Indian bank account in under 5 minutes."

- Reddit user from r/nri

"You can try Skydo. It just charges a flat fee and you don't have to pay forex markup. Your money will get converted with live exchange rates."

- Reddit user from r/nri

"I wanted to share my experience with Unplex for money transfers. It's the best service I've found, especially for transferring money to my India account."

- Review from CompareRemit

"I've been using Wise for over 2 years. Their rates are consistently better than banks by at least 2-3%. The app is straightforward, and transfers usually arrive within 1-2 business days."

- Personal experience shared online

9.1. Common Pitfalls to Avoid

Based on user experiences, here are common mistakes to avoid:

- Not verifying recipient details thoroughly (account numbers, IFSC codes)

- Assuming the service with the lowest transfer fee is cheapest overall

- Failing to check if there are promotional rates for first-time users

- Not considering the total delivery time, especially for time-sensitive transfers

- Using credit cards to fund transfers (high fees and potential cash advance charges)

- Transferring large amounts without comparing multiple services first

10. Conclusion and Action Plan

Minimizing currency conversion losses when transferring money to India requires awareness, comparison, and strategic timing. By implementing the strategies outlined in this guide, you could save 3-5% on each transfer—potentially thousands of dollars annually for regular or large transfers.

10.1. Your Money Transfer Checklist

Before Every Transfer:

- Check the current mid-market exchange rate on Google or XE.com

- Compare the total INR amount received across 2-3 services using comparison tools

- Consider transfer timing based on market conditions and urgency

- Verify recipient bank details and IFSC codes

- Choose bank transfer/ACH funding when possible to minimize fees

- Check for any promotional rates or first-time user bonuses

- For large transfers, explore forward contract options

10.2. For Regular Transfers

If you send money to India regularly, consider these additional strategies:

- Set up rate alerts on multiple platforms and transfer when rates are favorable

- Look into services offering loyalty programs or reduced fees for regular users

- Consider sending larger amounts less frequently to minimize per-transaction fees

- Explore NRE/NRO account options at Indian banks that offer preferential rates for account holders

10.3. Final Thoughts

The landscape of international money transfers is constantly evolving, with new services and technologies emerging regularly. By staying informed, comparing services routinely, and implementing the strategies in this guide, you can ensure more of your hard-earned money reaches its destination in India.

Remember:

The cheapest provider today might not be the cheapest tomorrow. Make comparison a habit, especially for larger transfers, and you'll consistently get the best value for your money.

Last Updated: May 24, 2025

Disclaimer: Exchange rates and service offerings mentioned in this article are subject to change. Always verify current rates and terms directly with the providers before making any financial decisions.

Post a Comment