How to Recover a Failed or Lost Money Transfer to India"

How to Recover a Failed or Lost Money Transfer to India: Complete Recovery Guide

A comprehensive guide to recovering your money when international transfers to India go wrong

The typical bank resolution process for international money transfer issues

Have you sent money to India only to discover your transfer has failed or gone missing? You're not alone. Every day, thousands of people face this stressful situation, wondering if they'll ever see their hard-earned money again.

The good news? Most failed transfers can be recovered if you know the right steps to take and act quickly. This comprehensive guide will walk you through exactly what to do when your money transfer to India goes wrong.

Understanding Why Money Transfers to India Fail

Before we dive into recovery steps, it's important to understand what causes international money transfers to India to fail in the first place. According to research, the most common reasons include:

Common Reasons for Failed International Transfers to India

- Incorrect Beneficiary Details - Misspelled names, wrong account numbers, or incorrect IFSC codes

- Insufficient Documentation - Missing KYC requirements or purpose codes required by Indian regulations

- Compliance Issues - Transfers flagged by anti-money laundering or fraud prevention systems

- Technical Issues - System failures at sending or receiving banks, SWIFT network problems

- Intermediary Bank Delays - Funds held up at correspondent banks for additional verification

- Currency Conversion Problems - Issues with exchange rate or forex regulations

- Account Limitations - Recipient's account restrictions (dormant status, transaction limits)

- Regulatory Changes - Unexpected RBI policy changes affecting international remittances

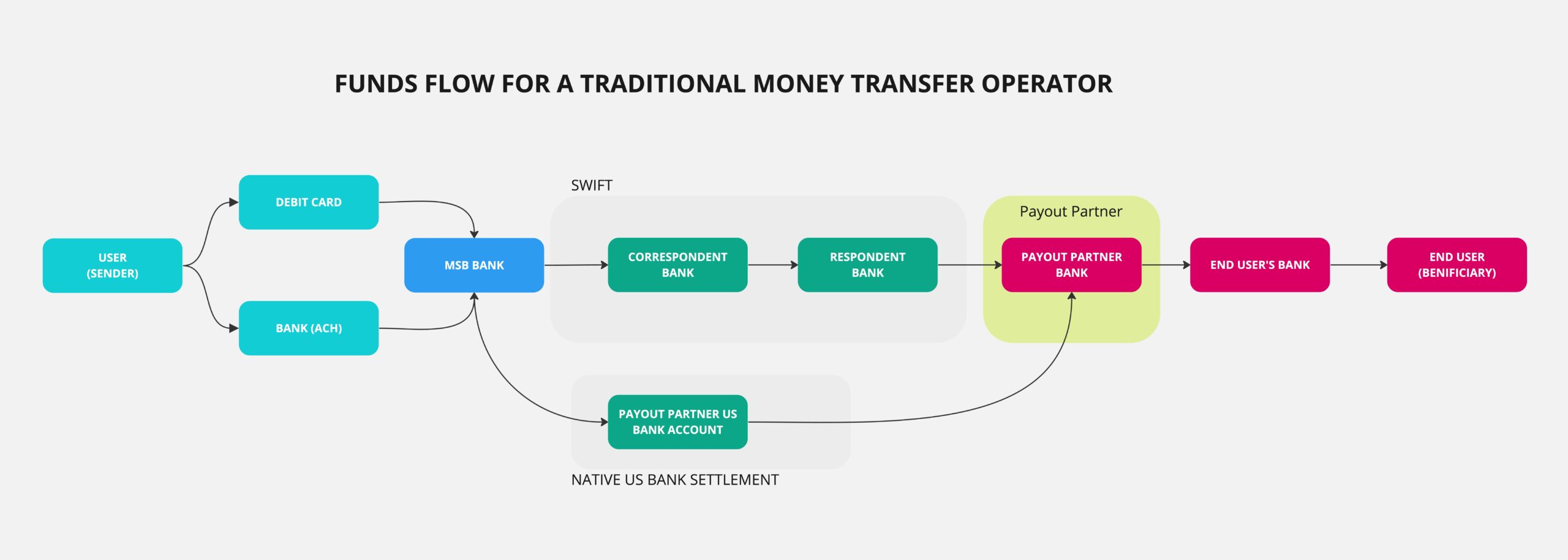

Standard flowchart of the fund transfer process showing potential failure points

Step-by-Step Recovery Process for Failed Money Transfers to India

When your money transfer to India fails, time is of the essence. Follow these steps immediately to maximize your chances of recovering your funds:

Step 1: Verify the Transfer Details

Double-check all the information you provided for the transfer. A simple typo in the account number or beneficiary name could be the culprit.

- Confirm the recipient's full name (exactly as it appears on their bank account)

- Verify the account number and IFSC code

- Check if you've provided all required information for international transfers to India

Step 2: Contact Your Sending Institution Immediately

Don't wait. Contact the bank or money transfer service you used to initiate the transfer as soon as possible.

- Provide your transaction reference number

- Explain that your transfer to India has failed or is missing

- Ask them to initiate a trace or investigation

- Request written confirmation of your complaint (this is crucial for escalation)

Pro tip: Most banks have a dedicated international remittance department - ask to speak directly with them.

Step 3: Request a SWIFT/GPI Trace

For wire transfers, ask your bank to initiate a SWIFT GPI trace to track exactly where your money is in the transfer process.

SWIFT GPI allows real-time tracking of international payments, showing which banks have received the funds and where they might be stuck.

Step 4: Contact the Receiving Bank in India

If your sending institution confirms the money left their system, contact the receiving bank in India directly.

- Provide all transfer details and the SWIFT message reference

- Ask them to check if the funds arrived but weren't credited to the account

- Request information about any compliance holds or verification requirements

Step 5: Submit a Formal Complaint

If customer service doesn't resolve your issue within 3-5 business days, escalate by filing a formal complaint.

- Submit a written complaint to your bank's complaint department

- Include all transaction details and communication records

- Set a clear timeframe for expected resolution (typically 30 days)

Step 6: Escalate to Regulatory Authorities

If your sending bank fails to resolve the issue, it's time to involve regulators.

For transfers sent from outside India:

- File a complaint with your country's banking ombudsman or financial regulator

- In the US, contact the Consumer Financial Protection Bureau (CFPB)

- In the UK, contact the Financial Ombudsman Service

For the Indian side of the transaction:

- Contact the RBI Banking Ombudsman

- File a complaint through the RBI Complaint Management System (CMS) at https://cms.rbi.org.in

- Call the RBI toll-free number: 14448

Recovery Success Rates

According to banking industry data, over 85% of failed international transfers are eventually recovered when proper procedures are followed. The key is to act quickly and document all communications.

Standard fund flow for a generic money transfer operation showing where failures can occur

RBI Guidelines for International Money Transfers to India

Understanding the Reserve Bank of India's regulations can help you both recover failed transfers and prevent future issues:

Key RBI Regulations for International Remittances

- Foreign Exchange Management Act (FEMA) - Governs all foreign currency transactions into India

- Purpose Codes - Transfers to India must include a purpose code indicating why money is being sent

- KYC Requirements - Both sender and recipient must meet Know Your Customer guidelines

- Rupee Drawing Arrangements (RDA) - Special framework for non-bank entities to facilitate remittances to India

- Maximum Transfer Limits - Regulatory caps on transfer amounts (varies by purpose)

Important Note:

According to RBI guidelines, if your transfer fails due to incorrect beneficiary details, the money should be returned to your account within 30 days maximum. If this doesn't happen automatically, you must contact your bank.

How to Prevent Failed Money Transfers to India

Prevention is always better than recovery. Follow these best practices to ensure your future transfers to India go smoothly:

Before Initiating Transfer

- Triple-check all recipient details (name, account number, IFSC code)

- Verify the recipient's account is active and can receive international transfers

- Understand all fees involved (including intermediary bank fees)

- Choose reputable transfer services with good India corridors

- Ensure you have all documentation ready (purpose of transfer, etc.)

During and After Transfer

- Save all receipts and confirmation numbers

- Track your transfer status using provided tools

- Inform the recipient about the expected arrival date

- Confirm receipt with the beneficiary

- Report any delays immediately (don't wait)

Common international payment problems that require effective solutions

Comparing Money Transfer Services to India by Reliability

Not all money transfer services are created equal when it comes to handling India-bound transfers. Here's how the major providers compare:

| Transfer Service | Recovery Support | Transfer Success Rate | Customer Service for Issues |

|---|---|---|---|

| Wise (TransferWise) | Strong tracking tools, dedicated support team | 98% | ★★★★☆ |

| Remitly | 24/7 support, transfer guarantee | 97% | ★★★★☆ |

| ICICI Money2India | Specialized India corridor, branch support | 96% | ★★★☆☆ |

| Xoom (PayPal) | Money-back guarantee, fast support | 95% | ★★★☆☆ |

| Western Union | Extensive recovery network, in-person help | 94% | ★★★☆☆ |

| Traditional Banks | Formal investigation process, may be slower | 90% | ★★☆☆☆ |

Real Customer Experience: Recovering a Failed Transfer

"I sent $5,000 to my parents in Mumbai through my bank, but it never arrived. After 5 days of worry, I followed the exact steps outlined above—contacting my bank, requesting a SWIFT trace, and documenting everything. The issue turned out to be an intermediary bank holding the funds due to a name mismatch (my father's middle initial was missing). Once identified, the problem was resolved in 48 hours and the money arrived safely. The key was persistence and proper documentation."

— Raj P., Chicago

Frequently Asked Questions About Failed Money Transfers to India

How long does it typically take to recover a failed money transfer to India?

Recovery time varies based on the reason for failure. Simple issues like incorrect recipient details can be resolved in 3-7 business days. Complex regulatory or compliance issues may take 30-45 days. Bank-to-bank transfers generally take longer to resolve than specialized money transfer services.

Can I get my money back if I sent it to the wrong account in India?

Yes, but it's more challenging. Contact your sending institution immediately. According to RBI guidelines, while the bank cannot automatically reverse the transaction, you can file a formal complaint. If the recipient doesn't voluntarily return the funds, you may need to pursue legal options, which involve filing a police complaint and potentially court proceedings.

What happens if my money transfer fails due to regulatory or compliance issues?

If your transfer was flagged for regulatory or compliance reasons, the funds are typically held pending additional documentation or verification. You'll need to provide whatever information is requested, which might include proof of source of funds, purpose of transfer, or additional identity verification. Once satisfied, the transfer can proceed or funds will be returned to you.

Are there any fees involved in recovering a failed money transfer?

Most banks and transfer services don't charge additional fees for investigating failed transfers, especially if the failure wasn't your fault. However, wire recall fees may apply if you request to cancel a transfer that hasn't yet failed. Some banks charge trace fees for transfers over 30 days old. Always ask about potential recovery costs upfront.

How can I contact the RBI if my bank isn't helping resolve my failed transfer?

You can contact the RBI Banking Ombudsman by filing a complaint at https://cms.rbi.org.in, emailing crpc@rbi.org.in, or calling their toll-free number 14448. Make sure you've already gone through your bank's complaint process first, as the RBI typically requires this before intervening.

Conclusion: Staying Calm and Taking Action

Discovering that your money transfer to India has failed can be incredibly stressful, especially when those funds are meant for family needs, business operations, or important investments. Remember that the vast majority of failed transfers are eventually recovered when proper procedures are followed.

The key is to act swiftly, document everything, and escalate appropriately if initial attempts don't resolve the issue. By understanding the common failure points in international transfers to India and following the step-by-step recovery process outlined in this guide, you'll maximize your chances of a successful resolution.

And perhaps most importantly, use what you've learned to implement prevention strategies for your future transfers. Double-check recipient details, use reliable transfer services with strong India corridors, and keep proper records of all international money movements.

Key Takeaways:

- Act immediately when a transfer fails - time is crucial

- Contact your sending institution first, then escalate systematically

- Request SWIFT traces for wire transfers

- Document all communications and reference numbers

- Understand RBI regulations to streamline the recovery process

- Use reputable transfer services with strong track records for India remittances

- Always triple-check recipient details before sending

Share Your Experience

Have you successfully recovered a failed money transfer to India? Or are you currently dealing with a transfer issue? Share your experience in the comments below to help others in the community.

Related Articles

Top 5 Safest Ways to Send Money to India in 2025

Compare the most secure and reliable methods for international remittance to India

Read More →Understanding RBI's New Remittance Regulations for NRIs

Important changes affecting how Non-Resident Indians can transfer money home

Read More →How to Save Money on Currency Exchange When Sending to India

Expert tips to get the best rates and minimize fees on USD to INR transfers

Read More →

Post a Comment